This version of the form is not currently in use and is provided for reference only. Download this version of

Form 57-150

for the current year.

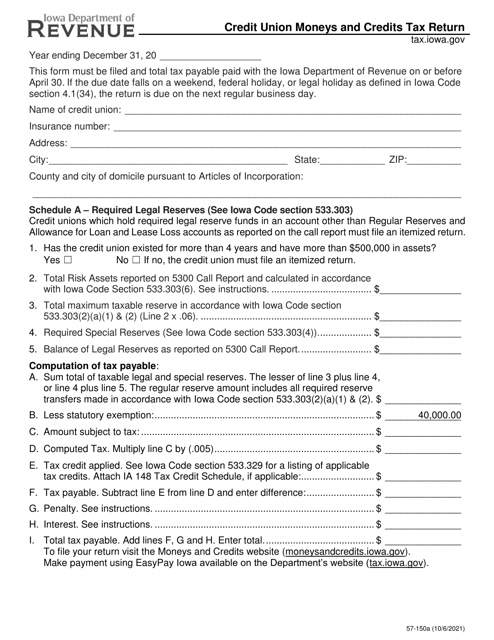

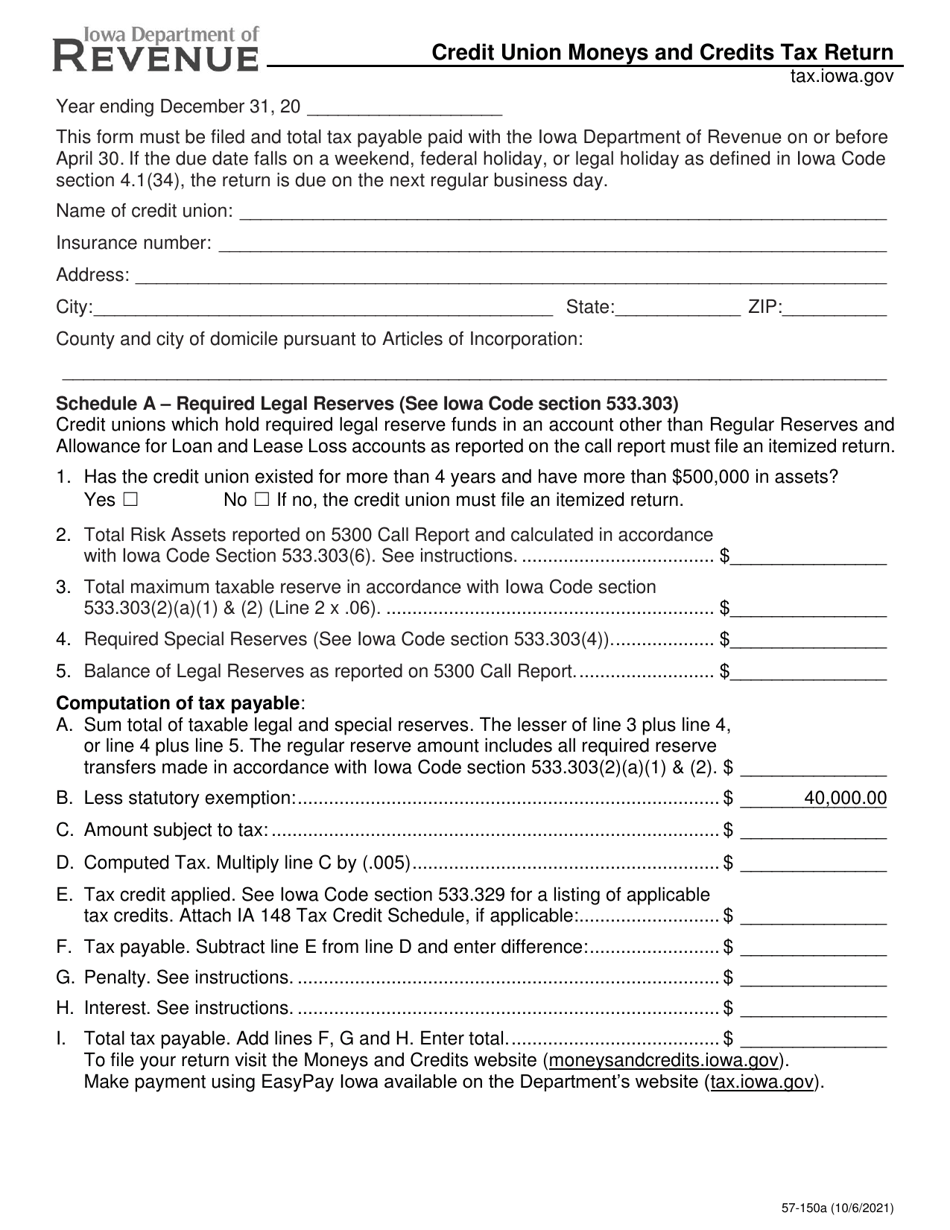

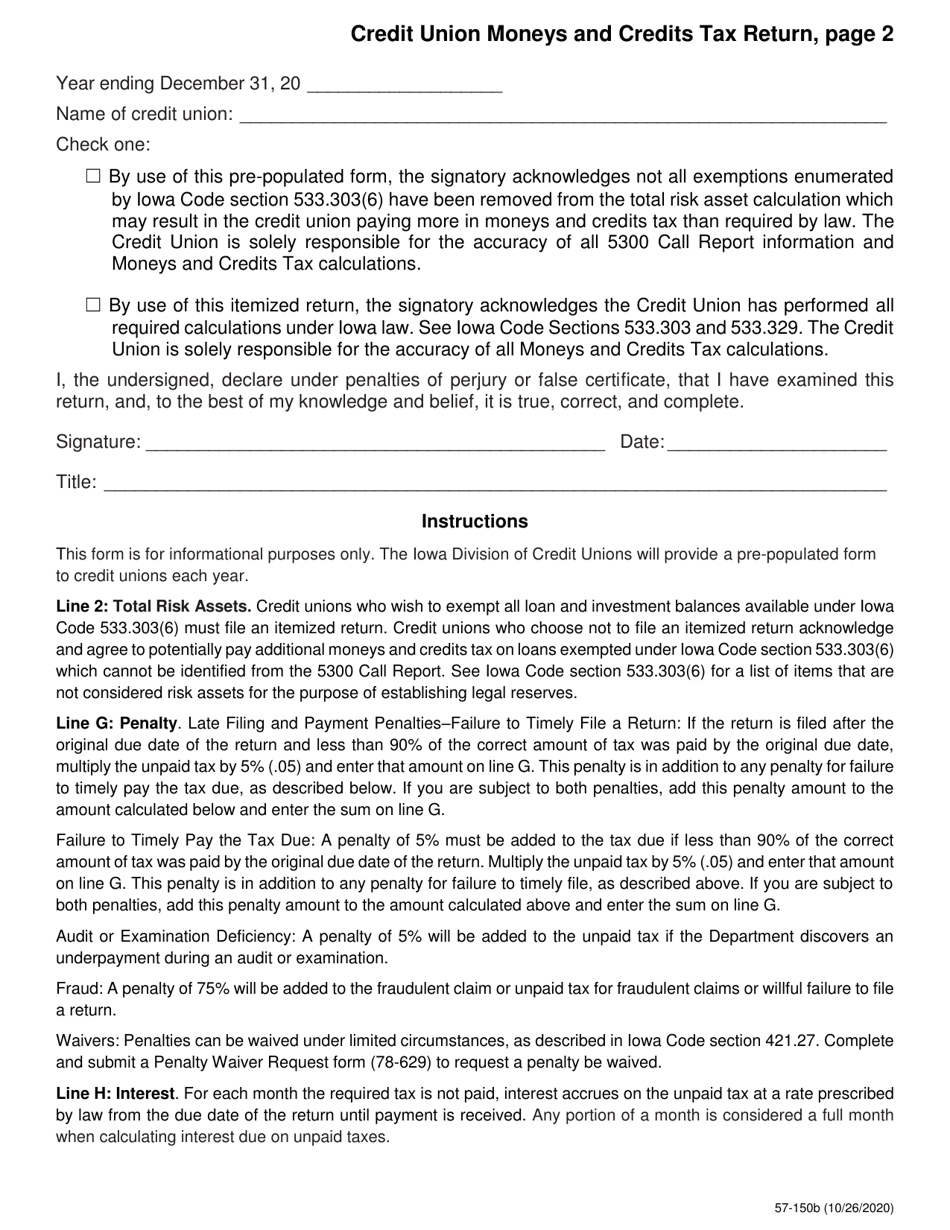

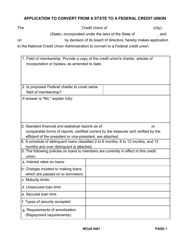

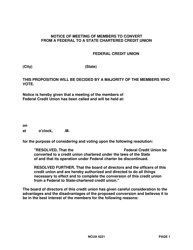

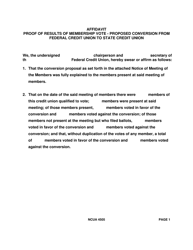

Form 57-150 Credit Union Moneys and Credits Tax Return - Iowa

What Is Form 57-150?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 57-150?

A: Form 57-150 is the Credit Union Moneys and Credits Tax Return for Iowa.

Q: Who needs to file Form 57-150?

A: Credit unions in Iowa must file Form 57-150.

Q: What is the purpose of Form 57-150?

A: Form 57-150 is used to report the amount of money and credits held by credit unions in Iowa.

Q: When is Form 57-150 due?

A: Form 57-150 is due on or before the last day of the fourth month following the close of the tax year.

Form Details:

- Released on October 6, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 57-150 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.