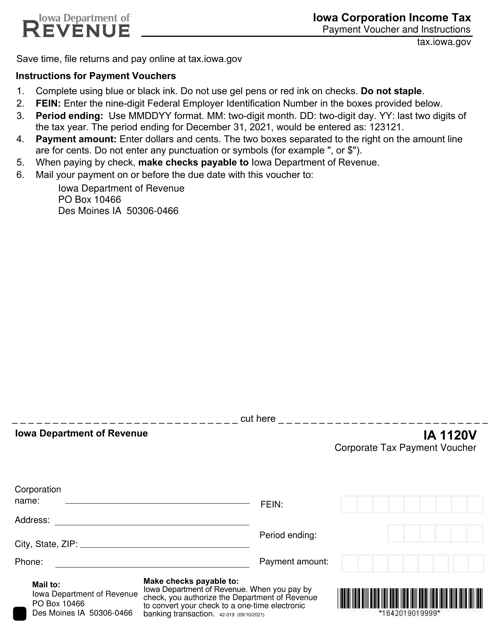

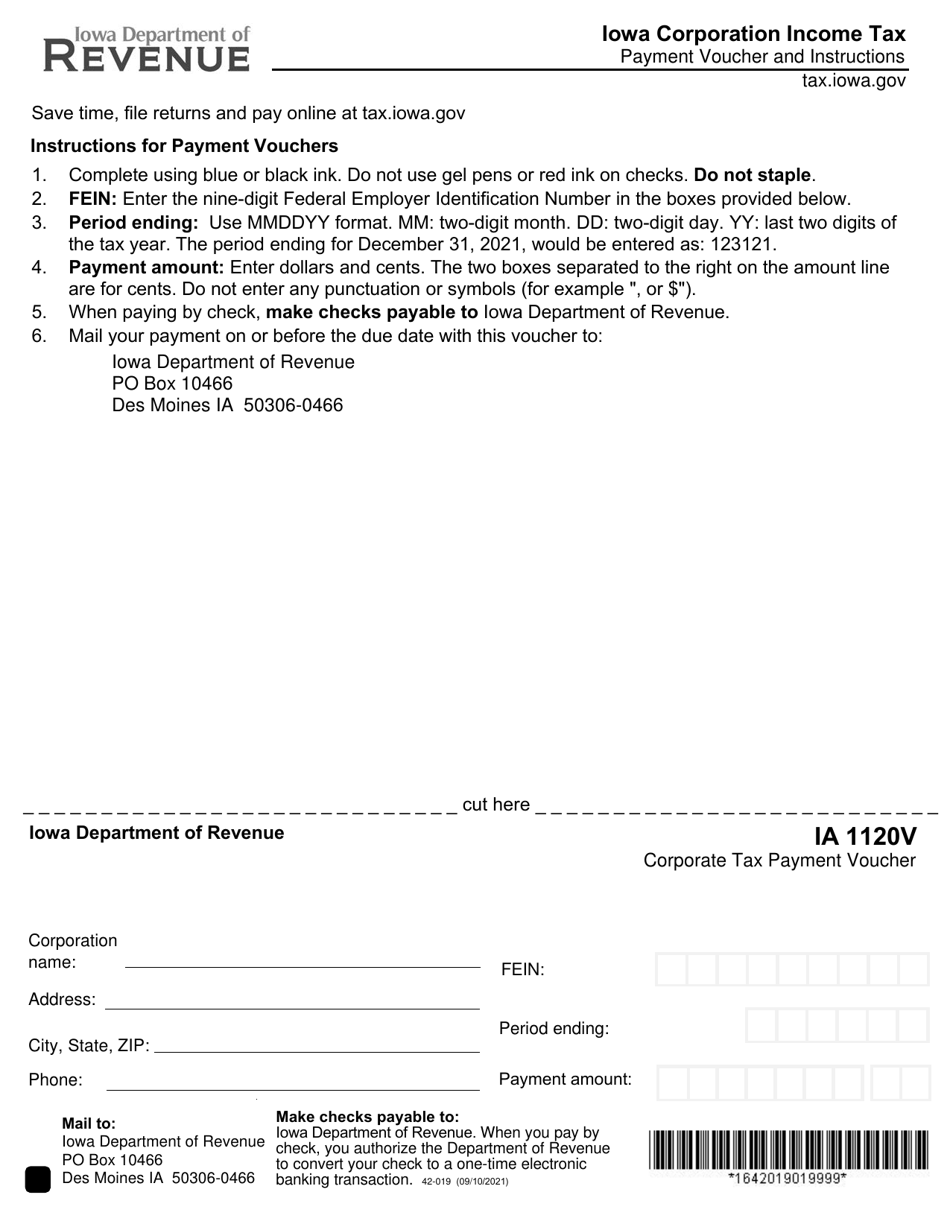

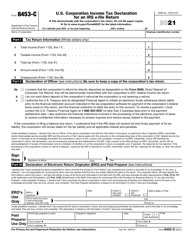

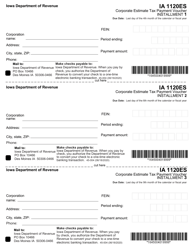

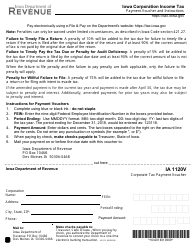

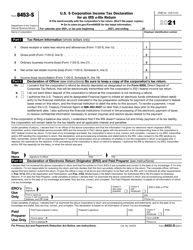

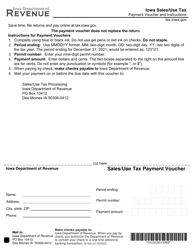

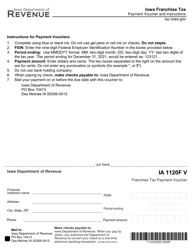

Form IA1120V (42-019) Corporation Income Tax Payment Voucher - Iowa

What Is Form IA1120V (42-019)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA1120V?

A: Form IA1120V is the Corporation Income Tax Payment Voucher specific to Iowa.

Q: What is the purpose of Form IA1120V?

A: The purpose of Form IA1120V is to submit payment for corporation incometax owed to the state of Iowa.

Q: Who needs to use Form IA1120V?

A: Corporations that owe income tax to the state of Iowa need to use Form IA1120V to submit their payment.

Q: Is Form IA1120V applicable only to Iowa residents?

A: No, Form IA1120V is applicable to corporations that owe income tax to the state of Iowa, regardless of their residency.

Form Details:

- Released on September 10, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA1120V (42-019) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.