This version of the form is not currently in use and is provided for reference only. Download this version of

Form IA6251 (41-131)

for the current year.

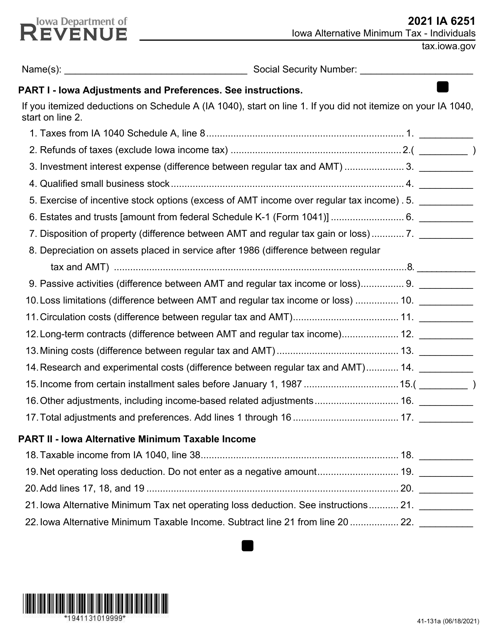

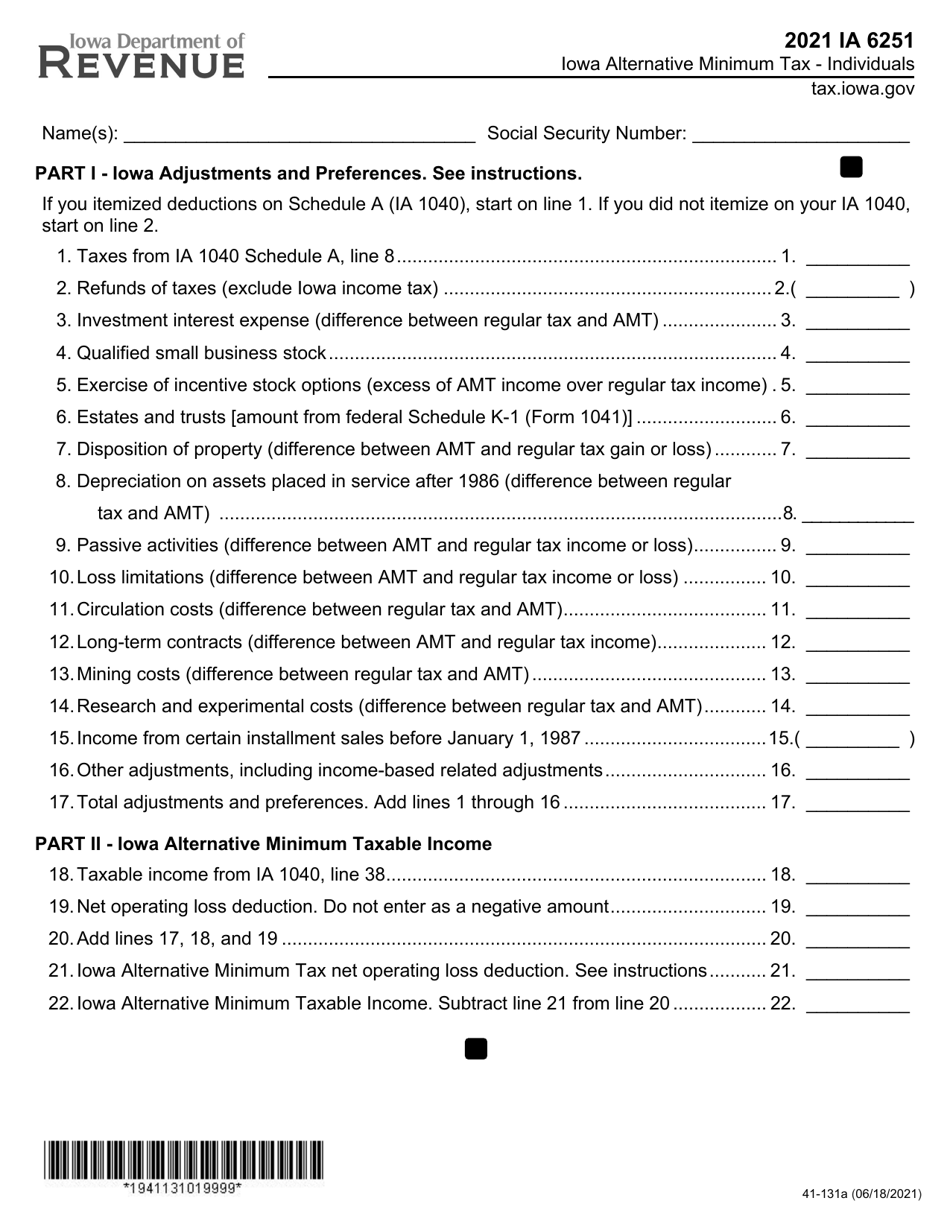

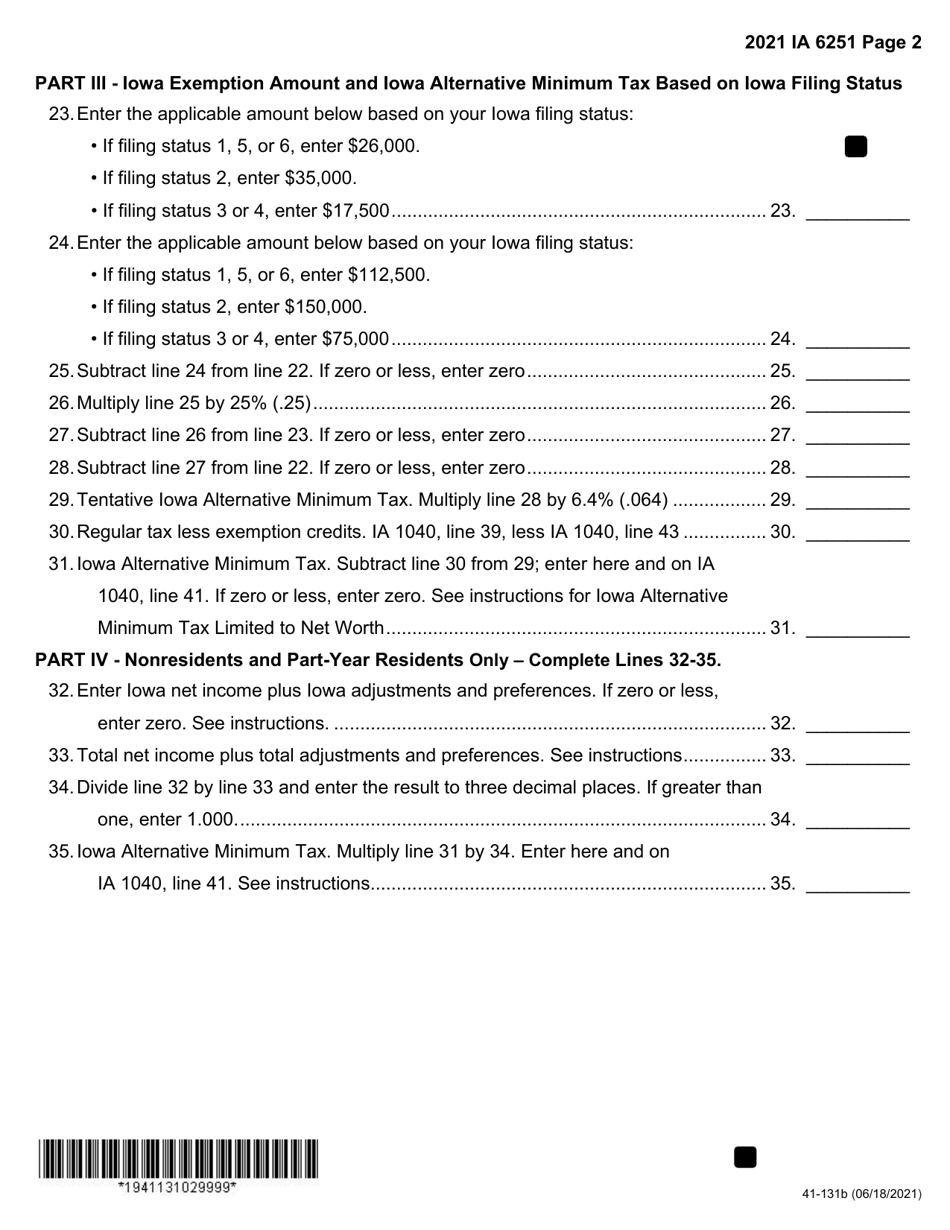

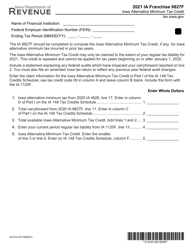

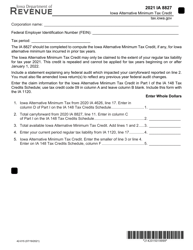

Form IA6251 (41-131) Iowa Alternative Minimum Tax - Individuals - Iowa

What Is Form IA6251 (41-131)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA6251?

A: Form IA6251 is the Iowa Alternative Minimum Tax (AMT) form for individuals in Iowa.

Q: Who needs to file Form IA6251?

A: Individuals in Iowa who are subject to the Alternative Minimum Tax need to file Form IA6251.

Q: What is the Alternative Minimum Tax?

A: The Alternative Minimum Tax (AMT) is a separate tax calculation that limits certain deductions and credits to ensure individuals with high income still pay some tax.

Q: What is the purpose of Form IA6251?

A: Form IA6251 is used to calculate and report the Iowa Alternative Minimum Tax (AMT) liability.

Form Details:

- Released on June 18, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA6251 (41-131) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.