This version of the form is not currently in use and is provided for reference only. Download this version of

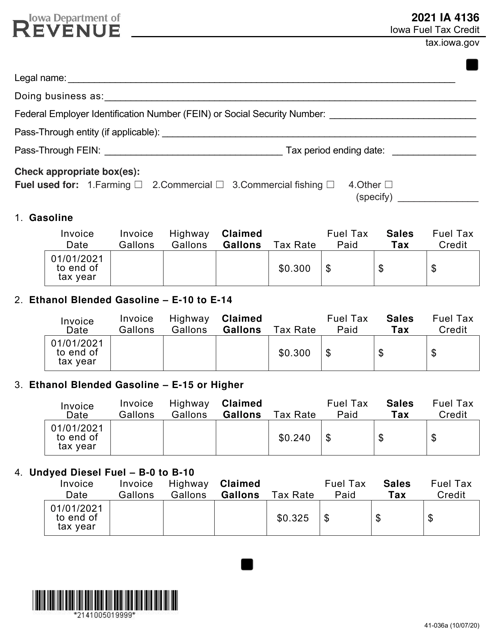

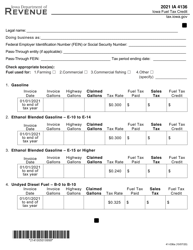

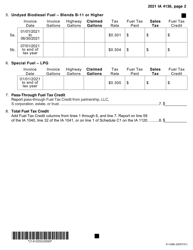

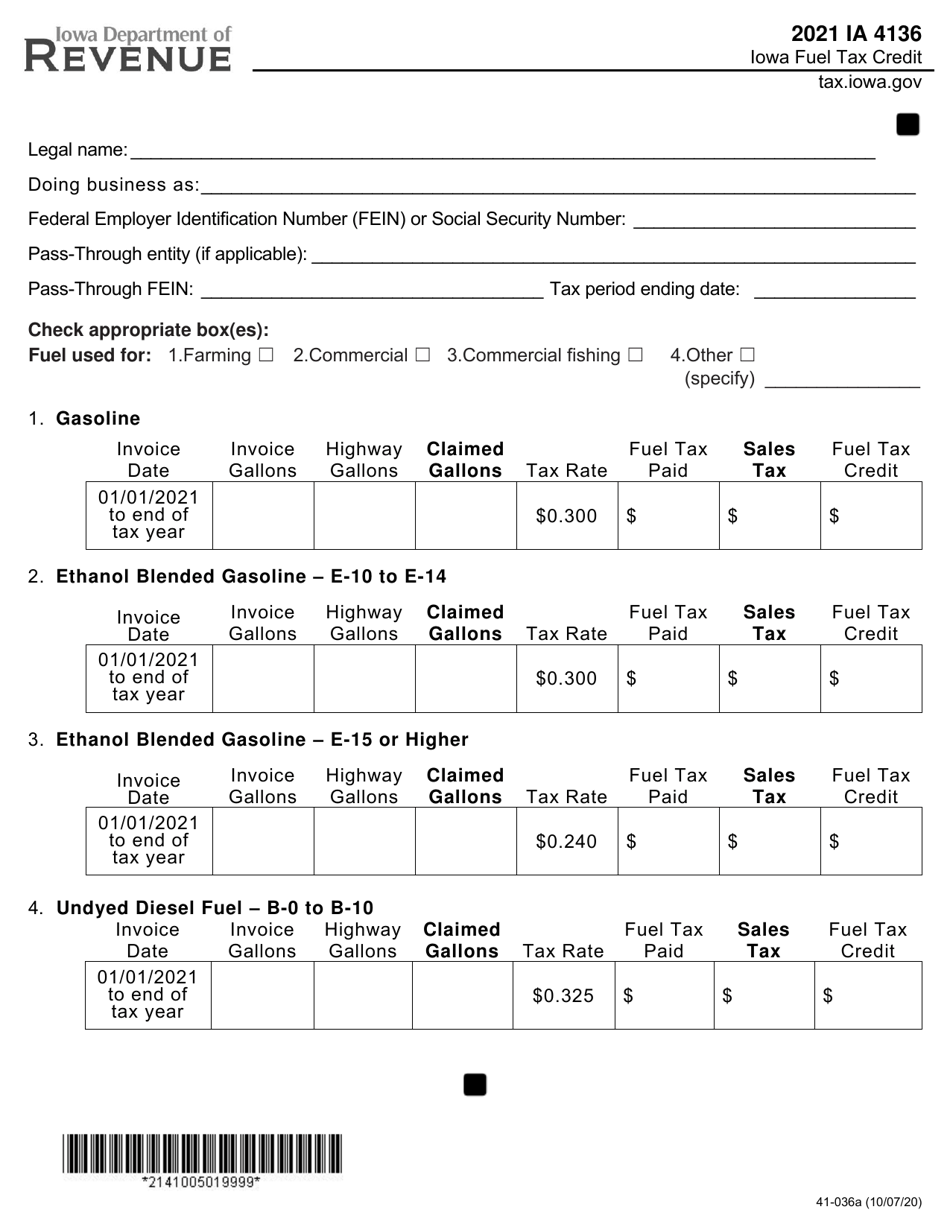

Form IA4136 (41-036)

for the current year.

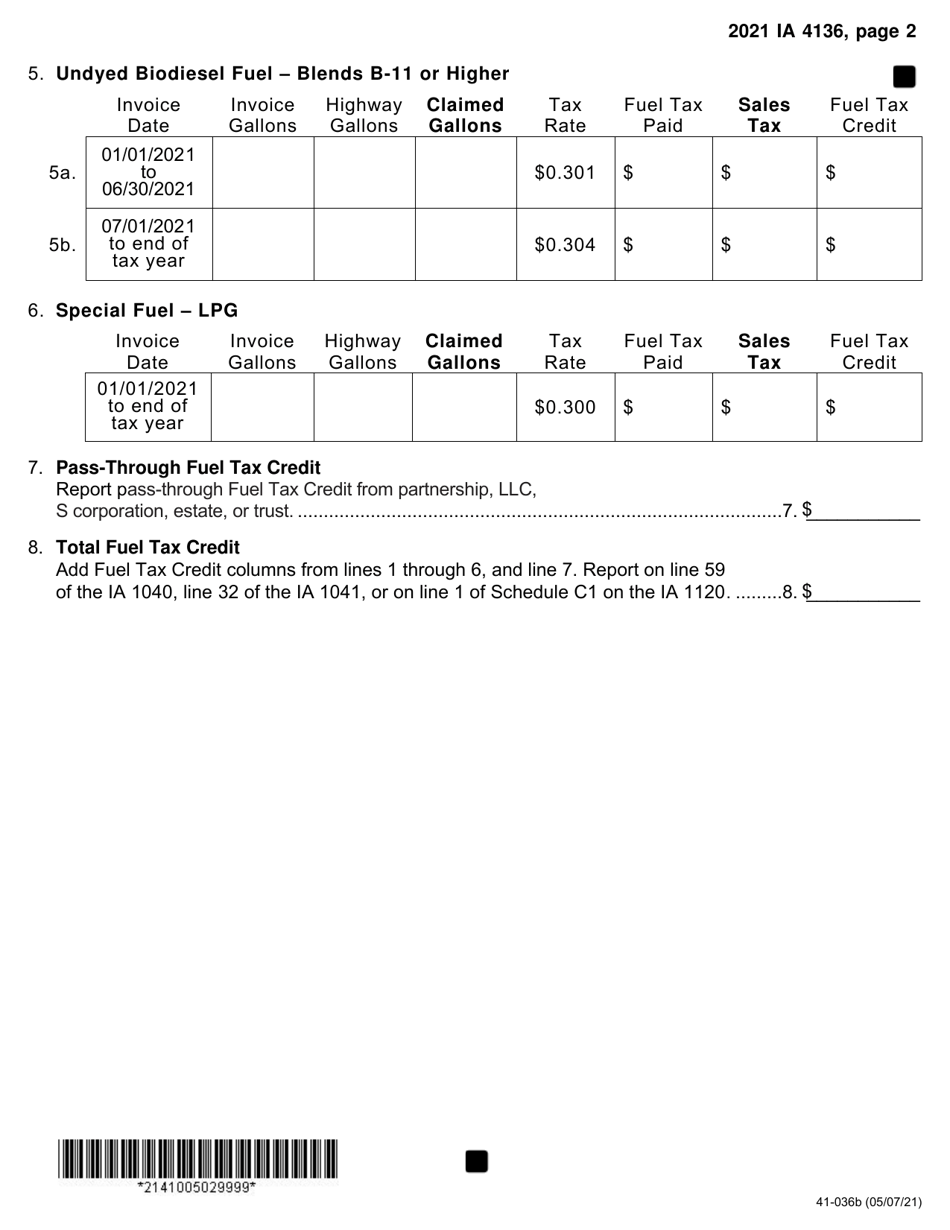

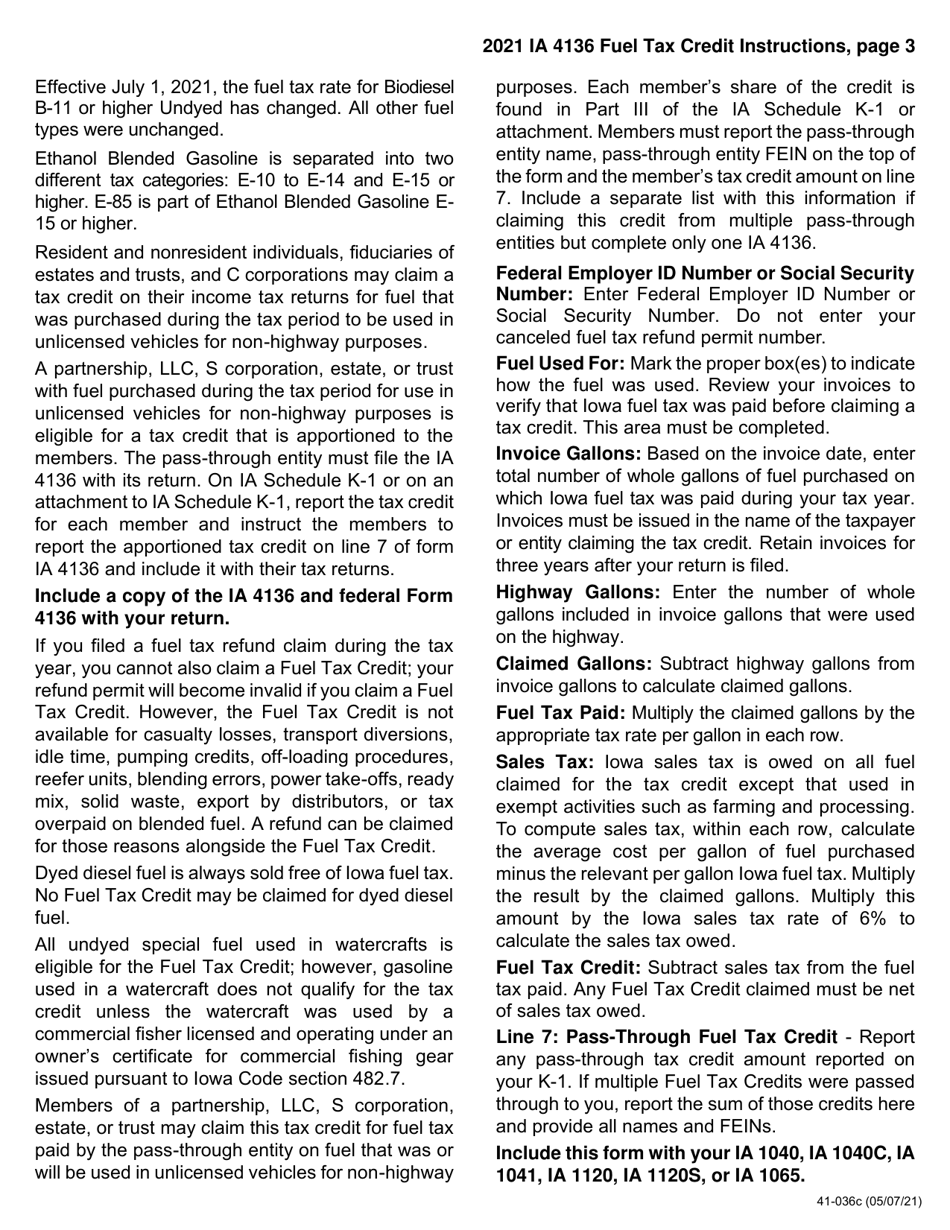

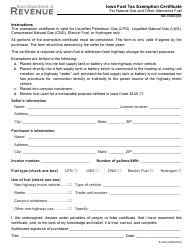

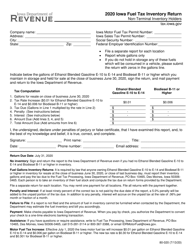

Form IA4136 (41-036) Iowa Fuel Tax Credit - Iowa

What Is Form IA4136 (41-036)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA4136?

A: Form IA4136 is the Iowa Fuel Tax Credit form.

Q: What is the purpose of Form IA4136?

A: The purpose of Form IA4136 is to claim the Iowa Fuel Tax Credit.

Q: Who can file Form IA4136?

A: Any individual or business who paid fuel taxes in Iowa can file Form IA4136.

Q: When should Form IA4136 be filed?

A: Form IA4136 should be filed annually with your Iowa income tax return.

Q: What are the requirements for claiming the Iowa Fuel Tax Credit?

A: To claim the Iowa Fuel Tax Credit, you must have paid fuel taxes in Iowa and meet certain eligibility criteria.

Q: Is there a deadline to file Form IA4136?

A: Yes, Form IA4136 must be filed by the deadline for filing your Iowa income tax return.

Q: Can I claim the Iowa Fuel Tax Credit if I didn't pay fuel taxes in Iowa?

A: No, the Iowa Fuel Tax Credit is only available to those who have paid fuel taxes in Iowa.

Q: What documentation do I need to include with Form IA4136?

A: You may need to include receipts or other documentation to support your claim for the Iowa Fuel Tax Credit.

Q: Are there any limitations or restrictions on the Iowa Fuel Tax Credit?

A: Yes, there are certain limitations and restrictions on the Iowa Fuel Tax Credit. It is recommended to review the instructions for Form IA4136 for more information.

Form Details:

- Released on May 7, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA4136 (41-036) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.