This version of the form is not currently in use and is provided for reference only. Download this version of

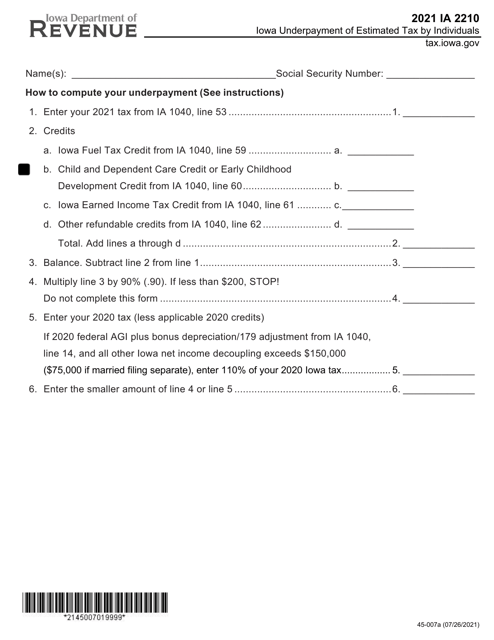

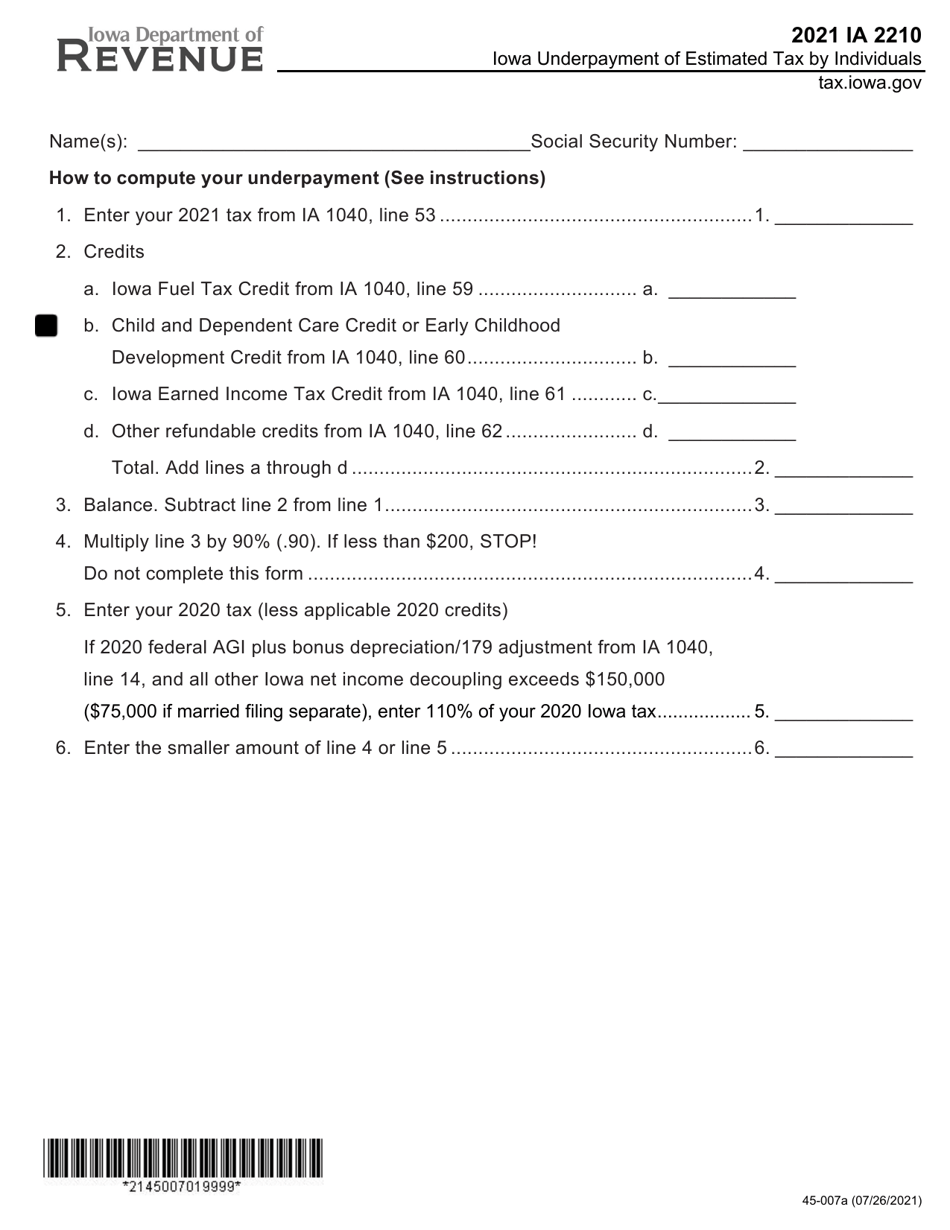

Form IA2210 (45-007)

for the current year.

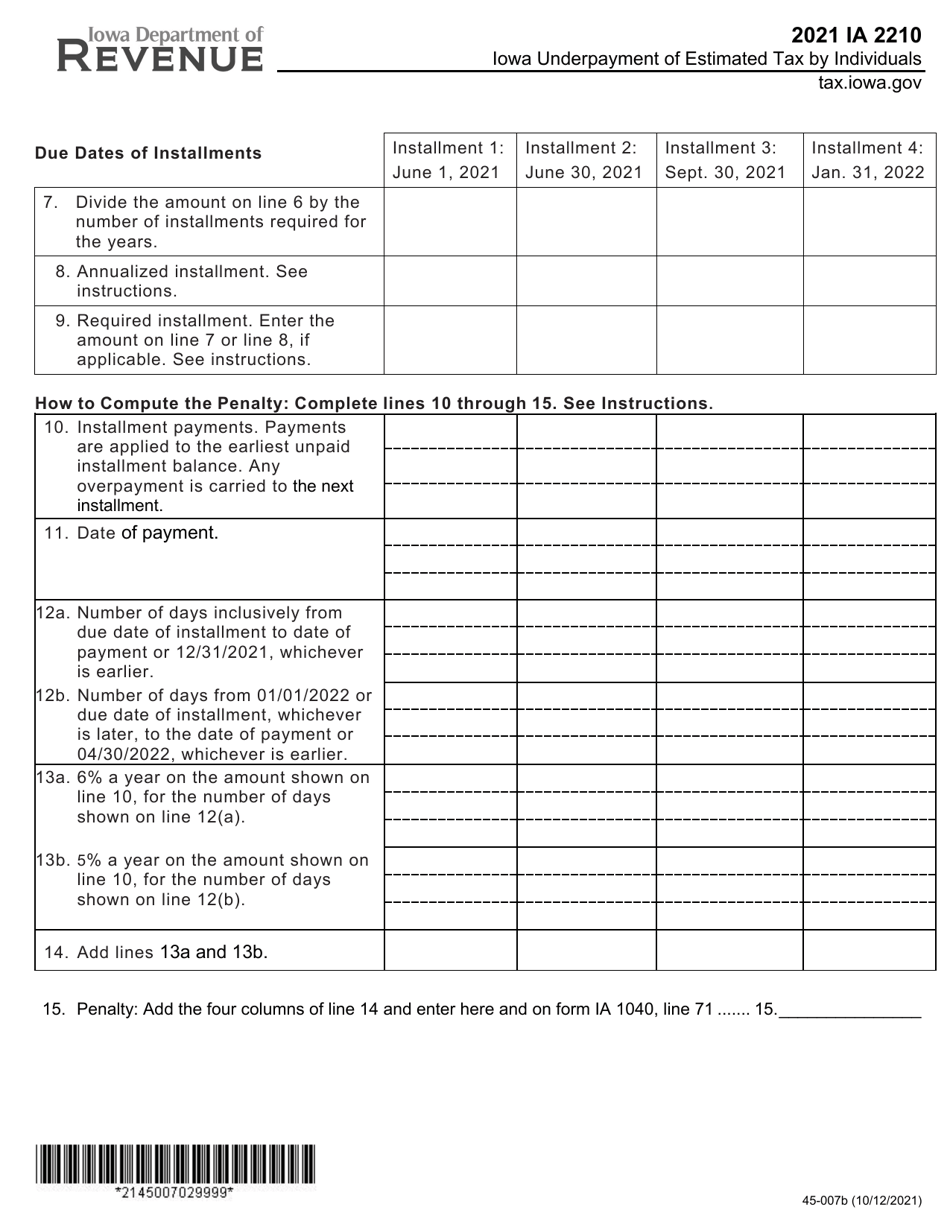

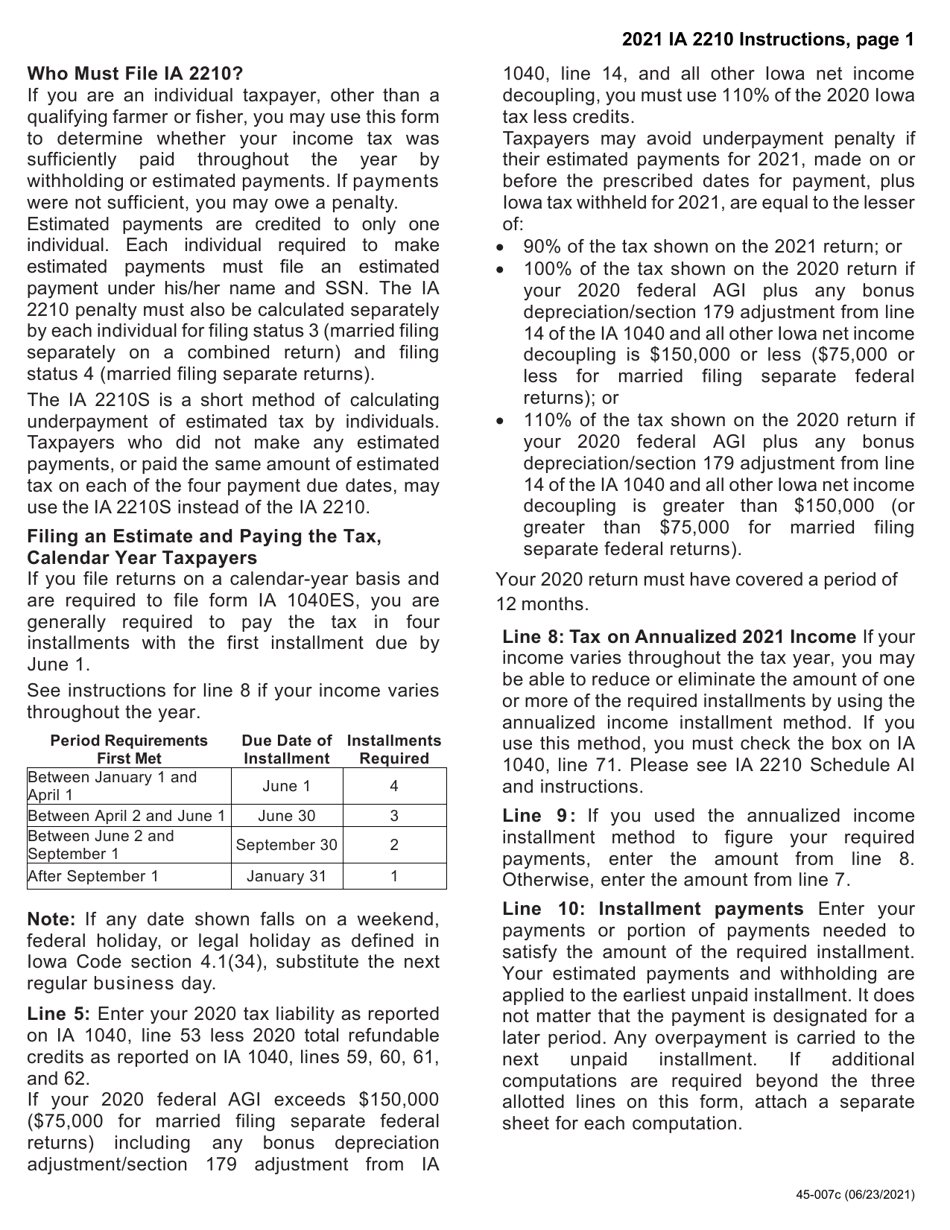

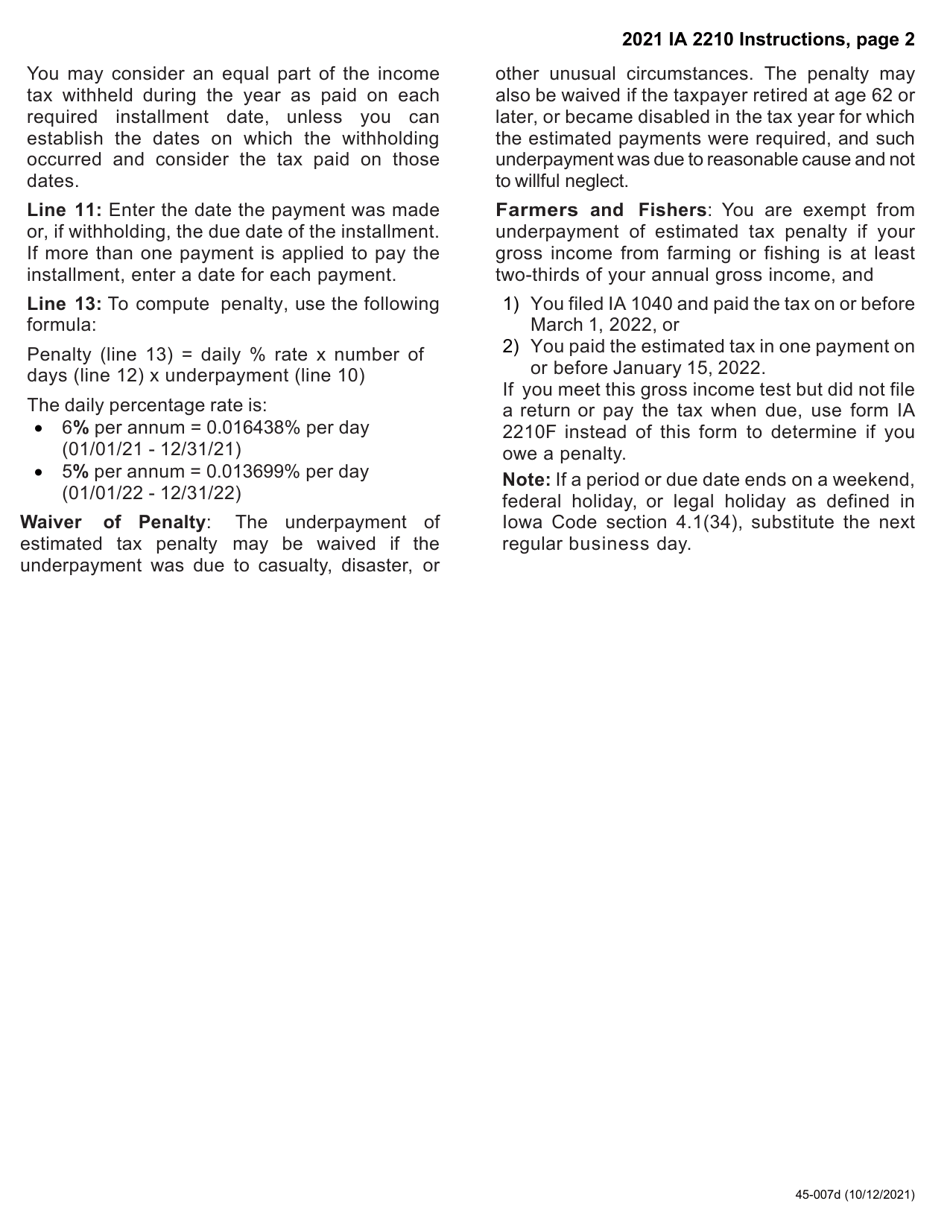

Form IA2210 (45-007) Iowa Underpayment of Estimated Tax by Individuals - Iowa

What Is Form IA2210 (45-007)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA2210?

A: Form IA2210 is a form used by individuals in Iowa to calculate and report any underpayment of estimated tax.

Q: Who needs to file Form IA2210?

A: Individuals in Iowa who have underpaid their estimated tax for the tax year need to file Form IA2210.

Q: How do I use Form IA2210?

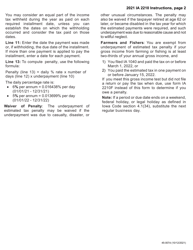

A: You will need to complete Form IA2210 to calculate the amount of underpayment of estimated tax. The form includes instructions on how to fill it out.

Q: When is Form IA2210 due?

A: Form IA2210 is due on the same date as your Iowa individual income tax return, which is typically April 30th.

Q: What happens if I don't file Form IA2210?

A: If you have underpaid your estimated tax and fail to file Form IA2210, you may be subject to penalties and interest.

Q: Can Form IA2210 be filed electronically?

A: Yes, Form IA2210 can be filed electronically if you are e-filing your Iowa individual income tax return.

Form Details:

- Released on July 26, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA2210 (45-007) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.