This version of the form is not currently in use and is provided for reference only. Download this version of

Form IA147 (41-147)

for the current year.

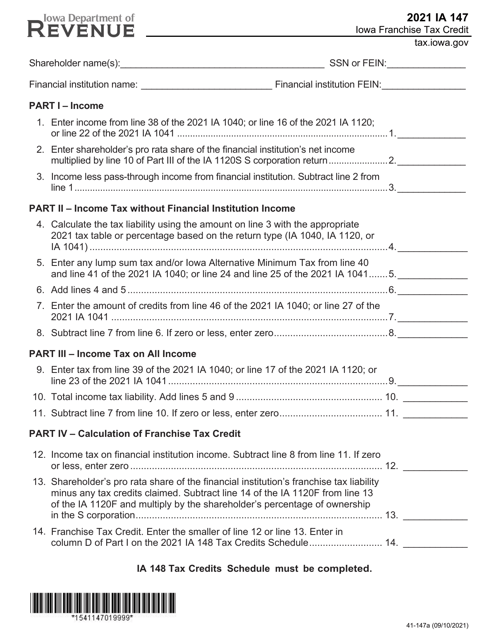

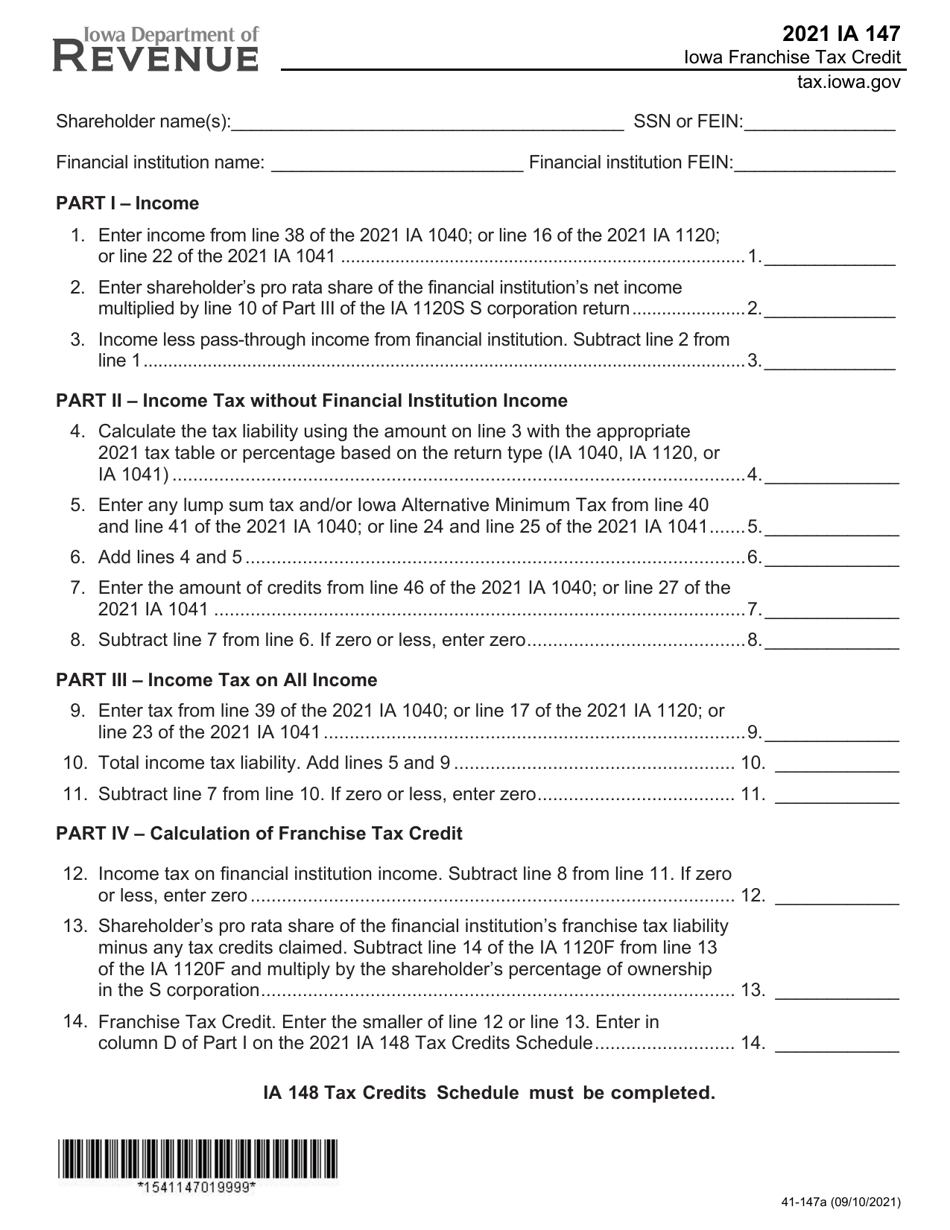

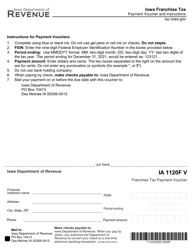

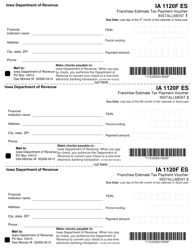

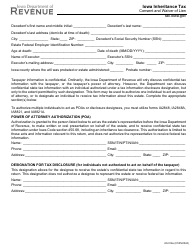

Form IA147 (41-147) Iowa Franchise Tax Credit - Iowa

What Is Form IA147 (41-147)?

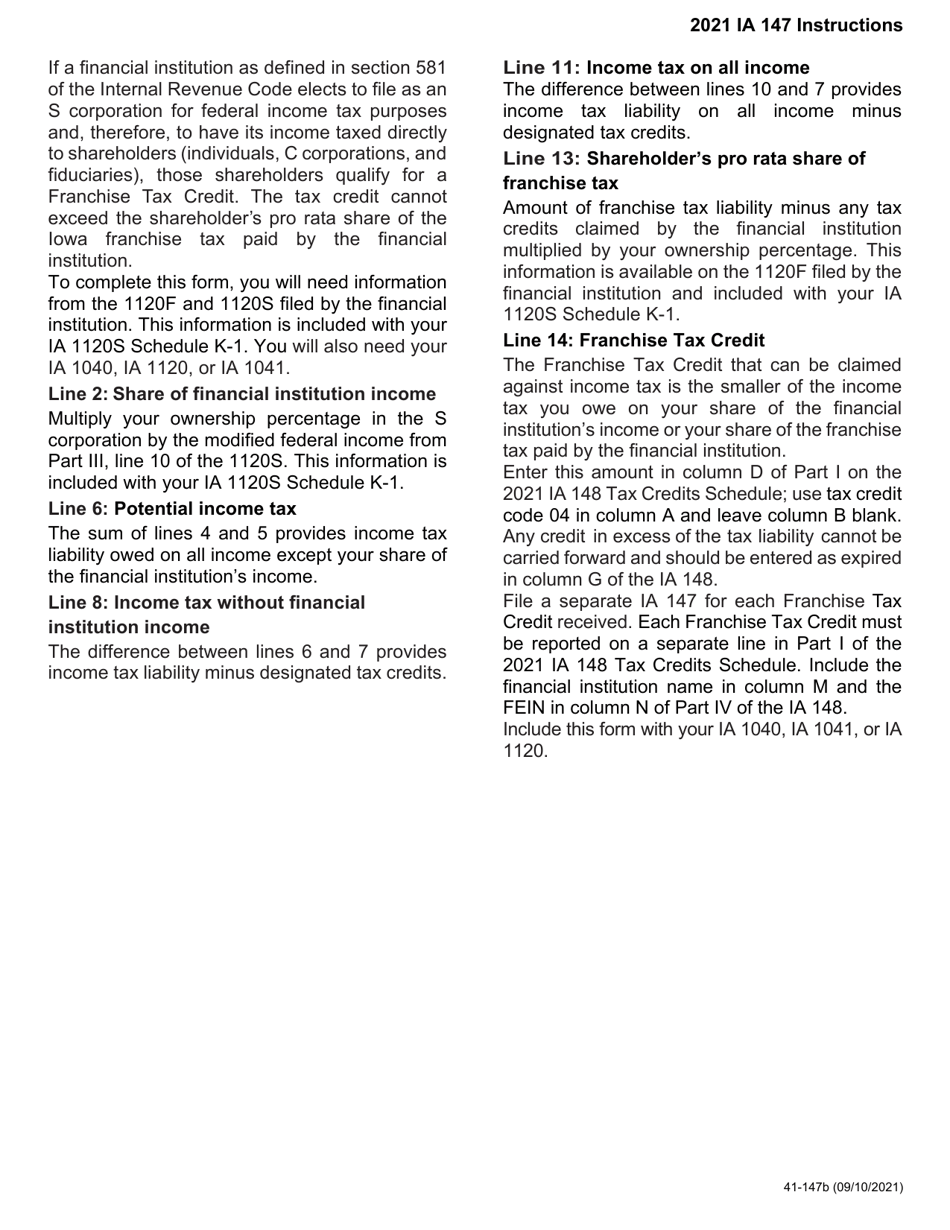

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA147?

A: Form IA147 is a tax form used in Iowa to claim the Iowa Franchise Tax Credit.

Q: Who is eligible to claim the Iowa Franchise Tax Credit?

A: Eligible taxpayers who paid Iowa franchise tax and meet certain criteria can claim the Iowa Franchise Tax Credit.

Q: What information is required to complete Form IA147?

A: You will need to provide information about your Iowa franchise tax payments and other relevant details to complete the form.

Q: Can I claim the Iowa Franchise Tax Credit if I didn't pay Iowa franchise tax?

A: No, the Iowa Franchise Tax Credit is specifically for taxpayers who have paid Iowa franchise tax.

Q: Is there a deadline to submit Form IA147?

A: Yes, the deadline to submit Form IA147 is generally the same as the deadline for filing your Iowa income tax return.

Q: How much is the Iowa Franchise Tax Credit worth?

A: The value of the Iowa Franchise Tax Credit depends on various factors and will be calculated based on the information provided on the form.

Form Details:

- Released on September 10, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA147 (41-147) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.