This version of the form is not currently in use and is provided for reference only. Download this version of

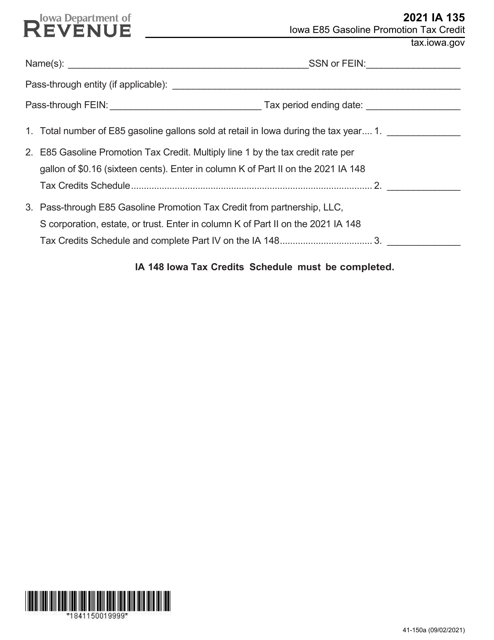

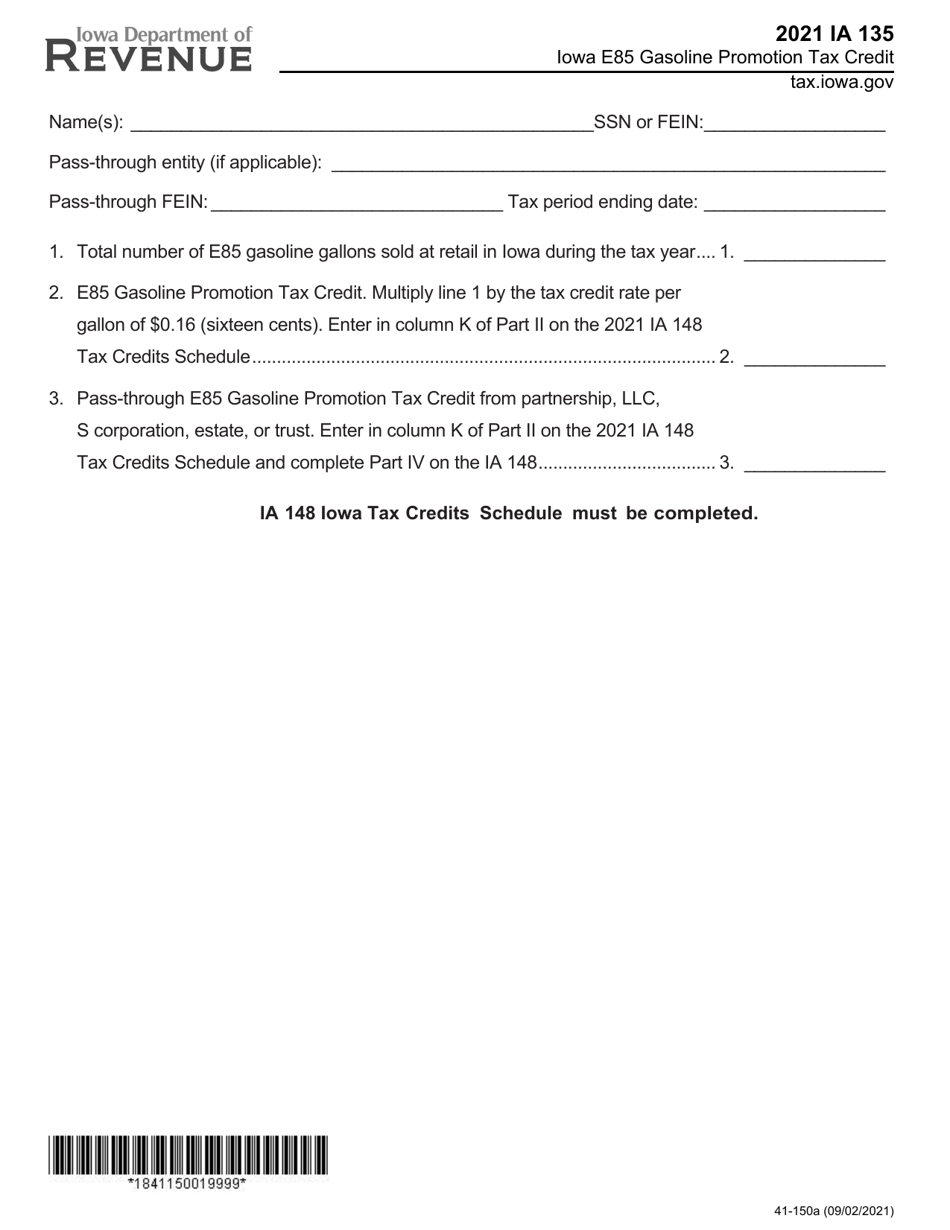

Form IA135 (41-150)

for the current year.

Form IA135 (41-150) Iowa E85 Gasoline Promotion Tax Credit - Iowa

What Is Form IA135 (41-150)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

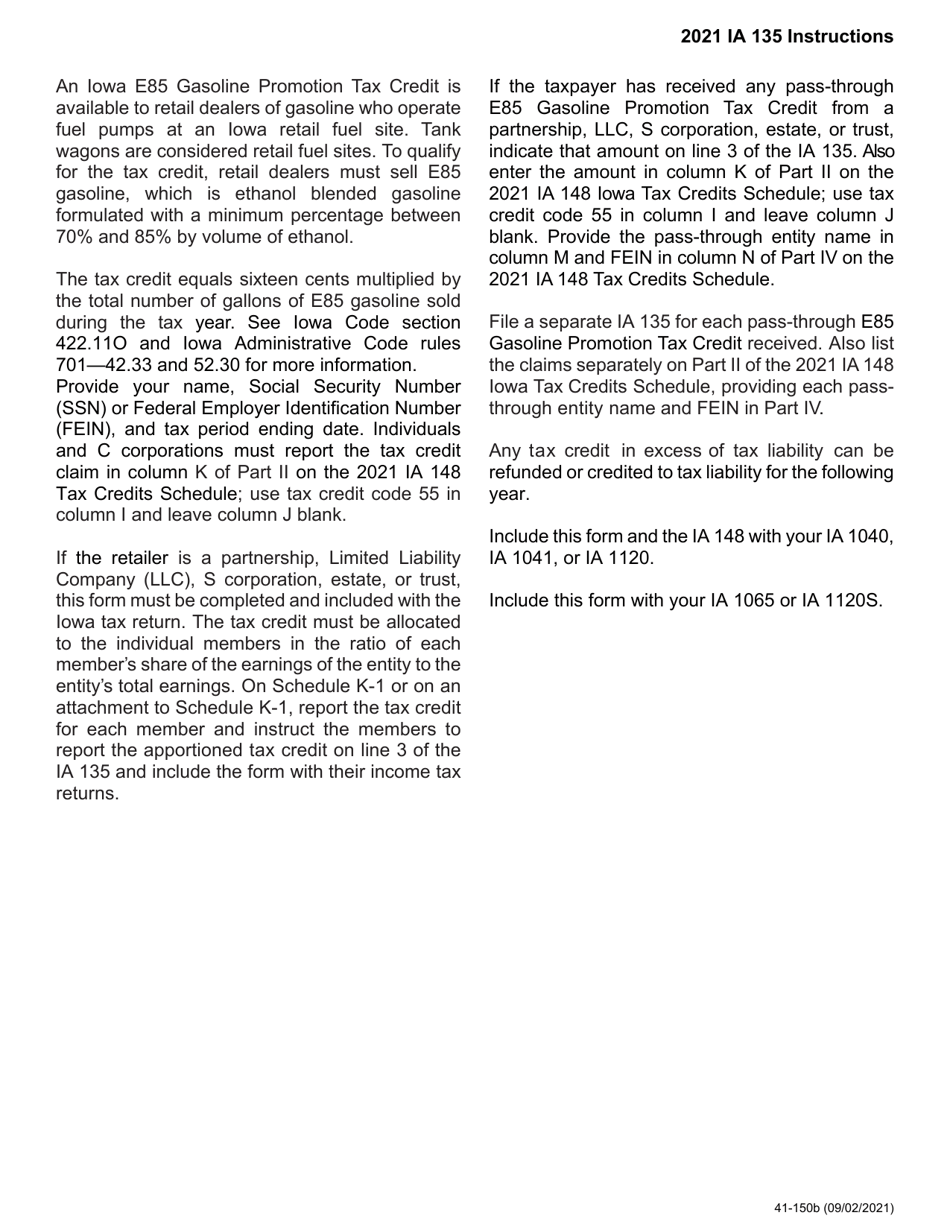

Q: What is Form IA135?

A: Form IA135 is a tax form used in the state of Iowa.

Q: What is the purpose of Form IA135?

A: Form IA135 is used to claim the E85 Gasoline Promotion Tax Credit in Iowa.

Q: What is the E85 Gasoline Promotion Tax Credit?

A: The E85 Gasoline Promotion Tax Credit is a tax credit aimed at promoting the use of E85 fuel in Iowa.

Q: Who is eligible to claim the E85 Gasoline Promotion Tax Credit?

A: Any individual, partnership, or corporation in Iowa that is selling or using E85 fuel is eligible to claim the tax credit.

Q: When is the deadline to file Form IA135?

A: The deadline to file Form IA135 is typically April 30th of each year.

Q: Are there any other requirements or documentation needed to claim the E85 Gasoline Promotion Tax Credit?

A: Yes, in addition to Form IA135, you may be required to submit supporting documentation such as fuel purchase receipts or other relevant records.

Q: How much is the E85 Gasoline Promotion Tax Credit?

A: The amount of the tax credit is determined by the gallons of E85 fuel sold or used during the tax year, and the credit is equal to 2 cents per gallon.

Q: Can the E85 Gasoline Promotion Tax Credit be carried forward or transferred?

A: No, the tax credit cannot be carried forward to future years or transferred to another individual or entity.

Q: Is there a limit on the amount of the E85 Gasoline Promotion Tax Credit that can be claimed?

A: Yes, there is a cap on the total amount of credits that can be claimed each year. The cap is determined by the Iowa Department of Revenue and may vary.

Q: Can I claim the E85 Gasoline Promotion Tax Credit if I don't live or operate in Iowa?

A: No, the tax credit is specific to Iowa and is only available to individuals, partnerships, or corporations that are selling or using E85 fuel in the state.

Form Details:

- Released on September 2, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA135 (41-150) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.