This version of the form is not currently in use and is provided for reference only. Download this version of

Form IA134 (41-134)

for the current year.

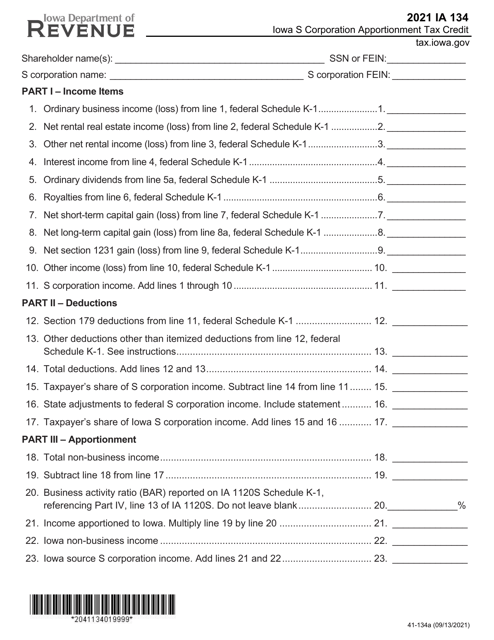

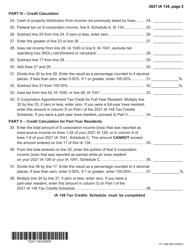

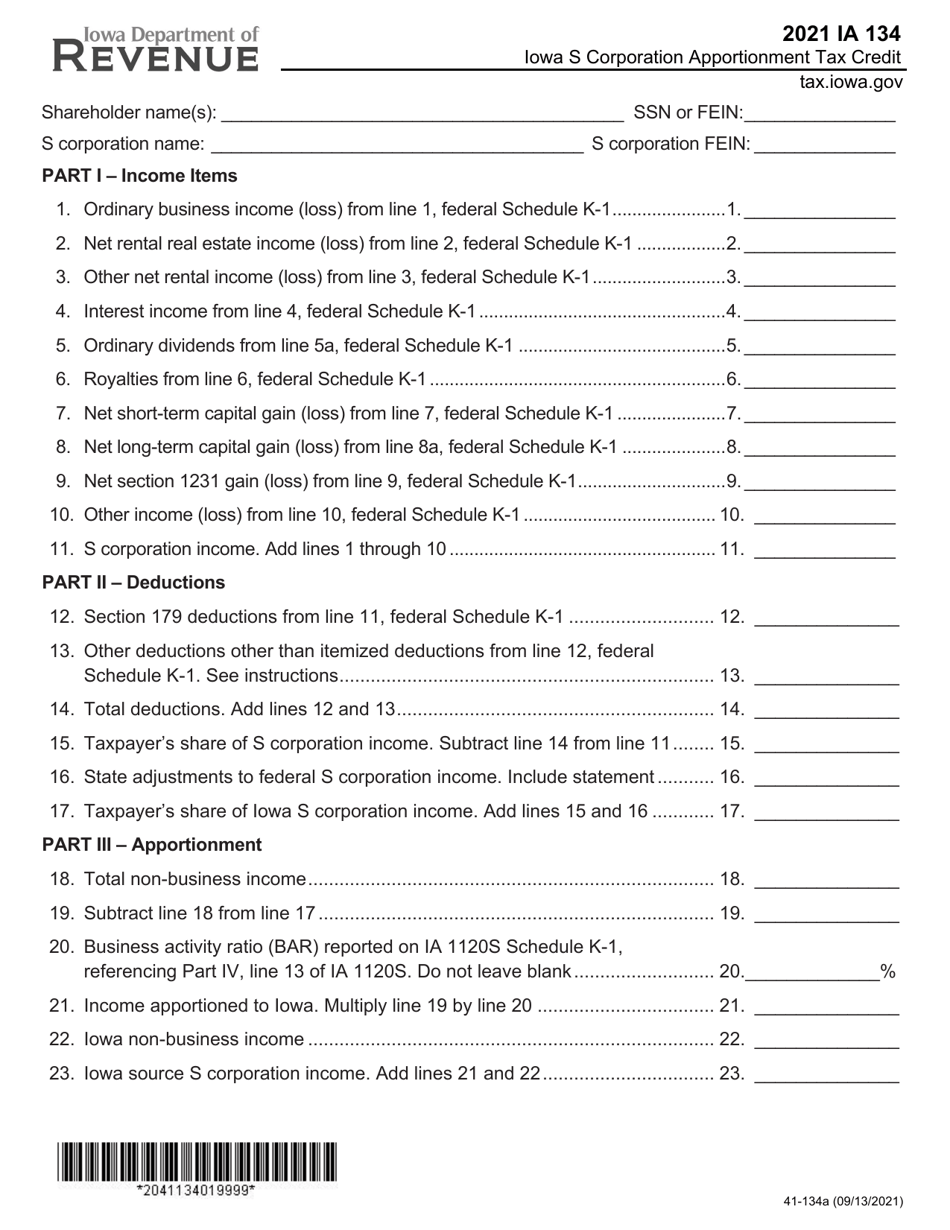

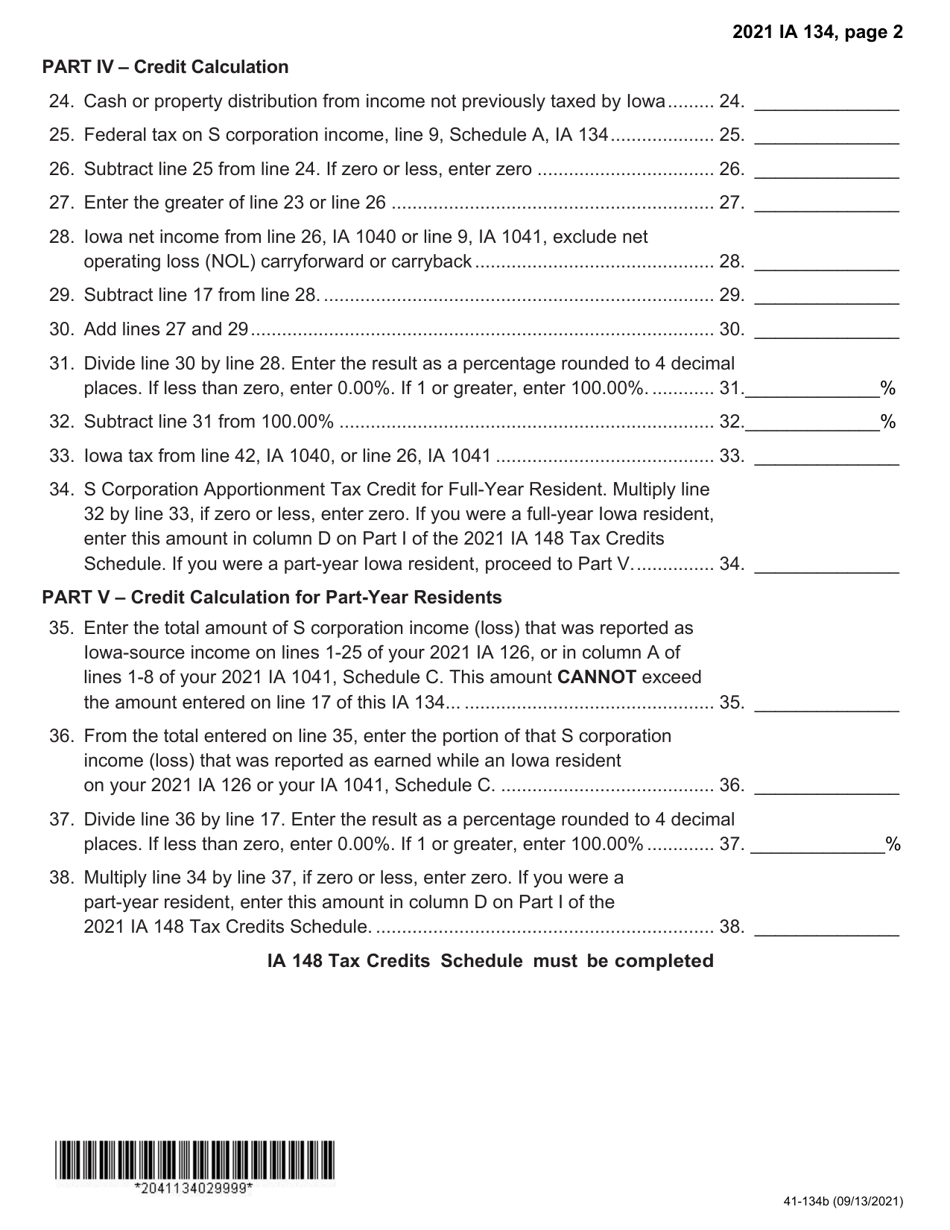

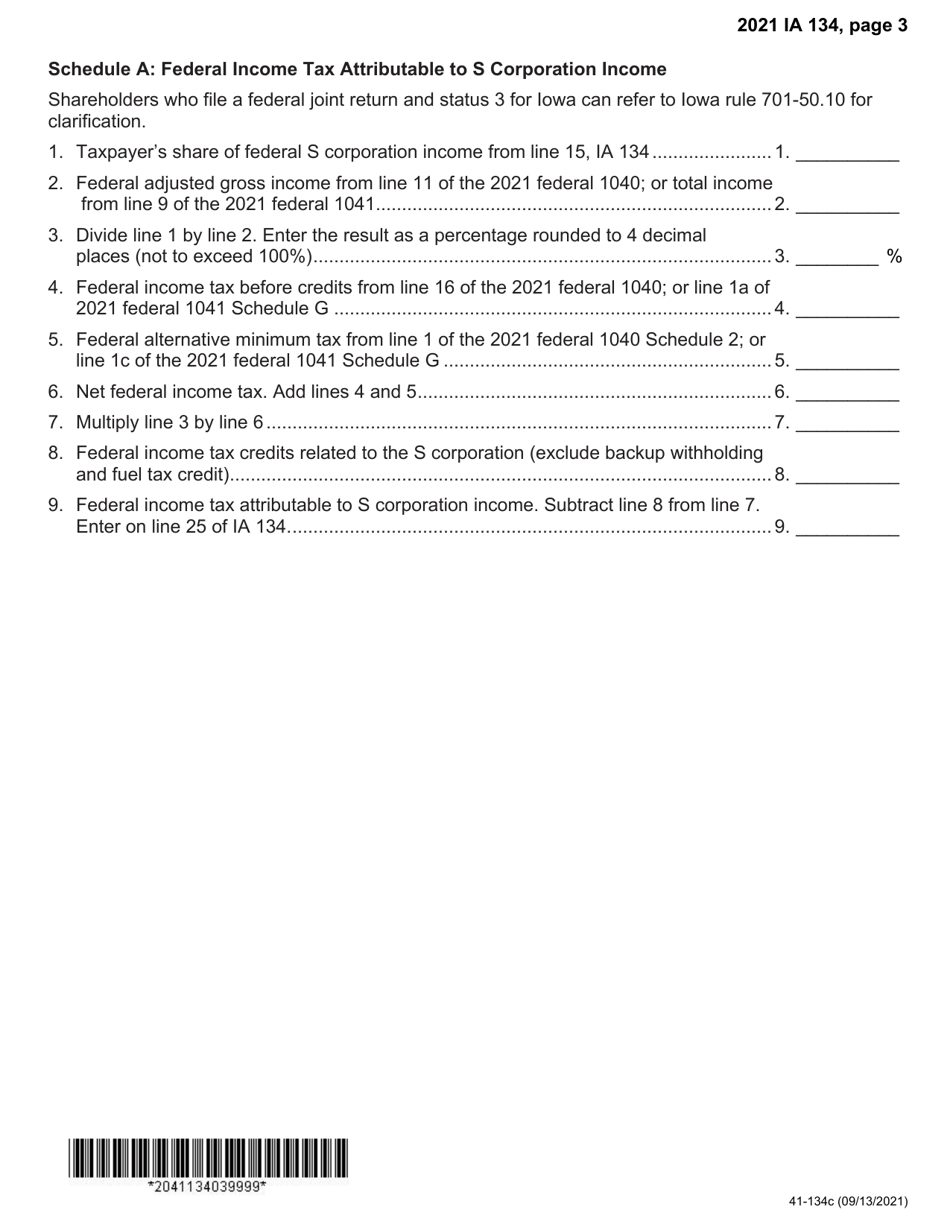

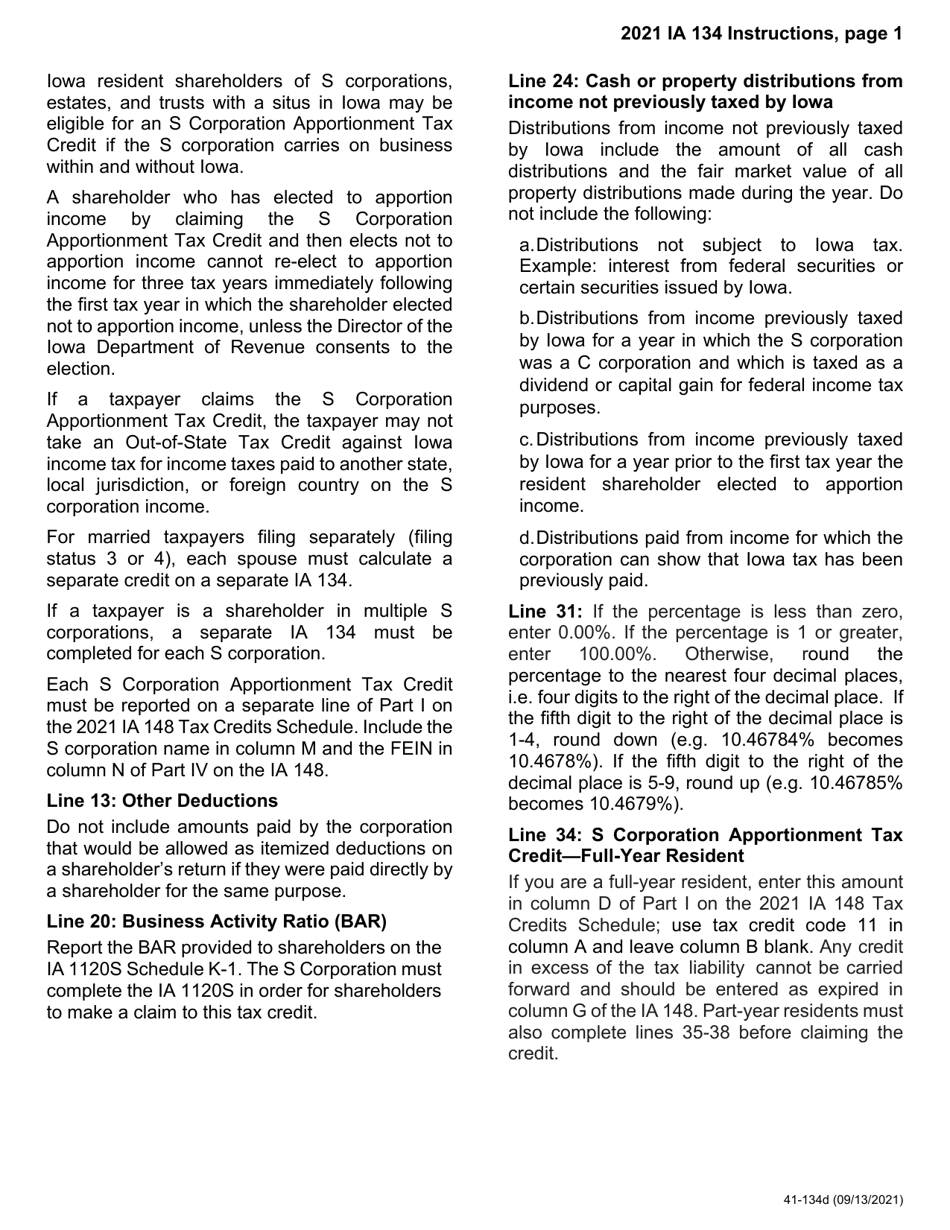

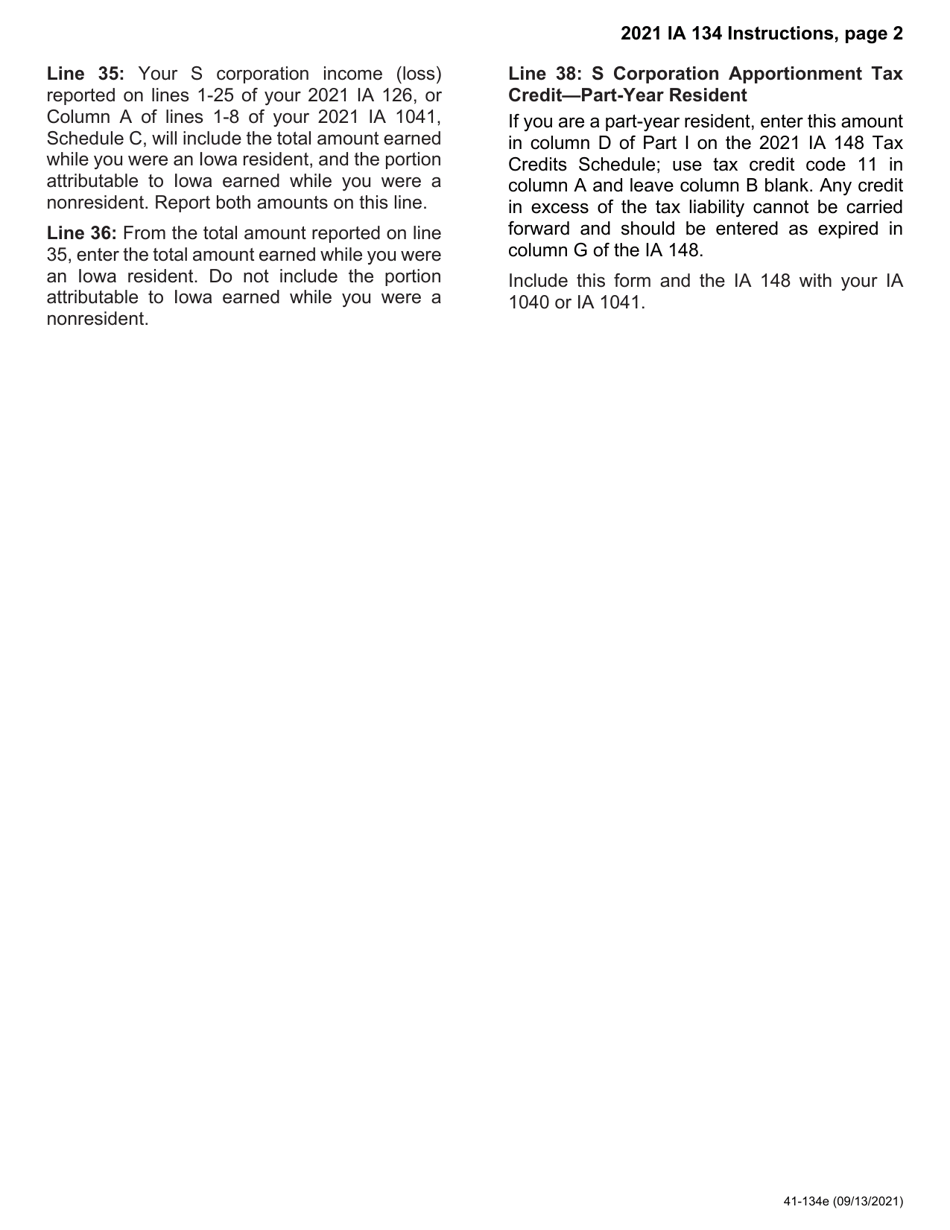

Form IA134 (41-134) Iowa S Corporation Apportionment Tax Credit - Iowa

What Is Form IA134 (41-134)?

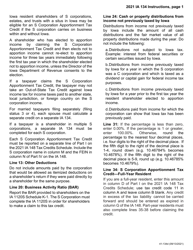

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA134?

A: Form IA134 is a tax form used in Iowa for claiming the S Corporation Apportionment Tax Credit.

Q: What is the purpose of Form IA134?

A: The purpose of Form IA134 is to claim the S Corporation Apportionment Tax Credit.

Q: Who needs to file Form IA134?

A: S Corporations in Iowa that qualify for the apportionment tax credit need to file Form IA134.

Q: What is the S Corporation Apportionment Tax Credit?

A: The S Corporation Apportionment Tax Credit is a tax credit available to S Corporations in Iowa for income apportioned to other states.

Q: How do I fill out Form IA134?

A: You need to provide information about your S Corporation and the apportioned income in other states.

Q: When is the deadline to file Form IA134?

A: The deadline to file Form IA134 is the same as the Iowa income tax return deadline, which is usually April 30th.

Q: Is there a fee to file Form IA134?

A: No, there is no fee to file Form IA134.

Q: Can I e-file Form IA134?

A: Yes, you can e-file Form IA134 if you are filing your Iowa income tax return electronically.

Q: What should I do if I make a mistake on Form IA134?

A: If you make a mistake on Form IA134, you may need to file an amended form or contact the Iowa Department of Revenue for guidance.

Form Details:

- Released on September 13, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA134 (41-134) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.