This version of the form is not currently in use and is provided for reference only. Download this version of

Form IA126 (41-126)

for the current year.

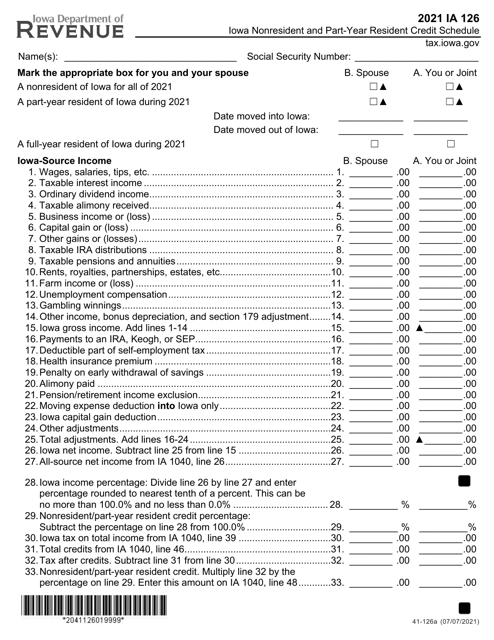

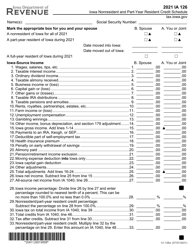

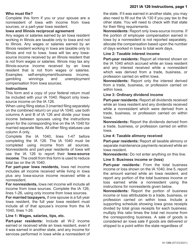

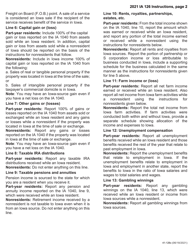

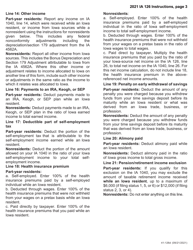

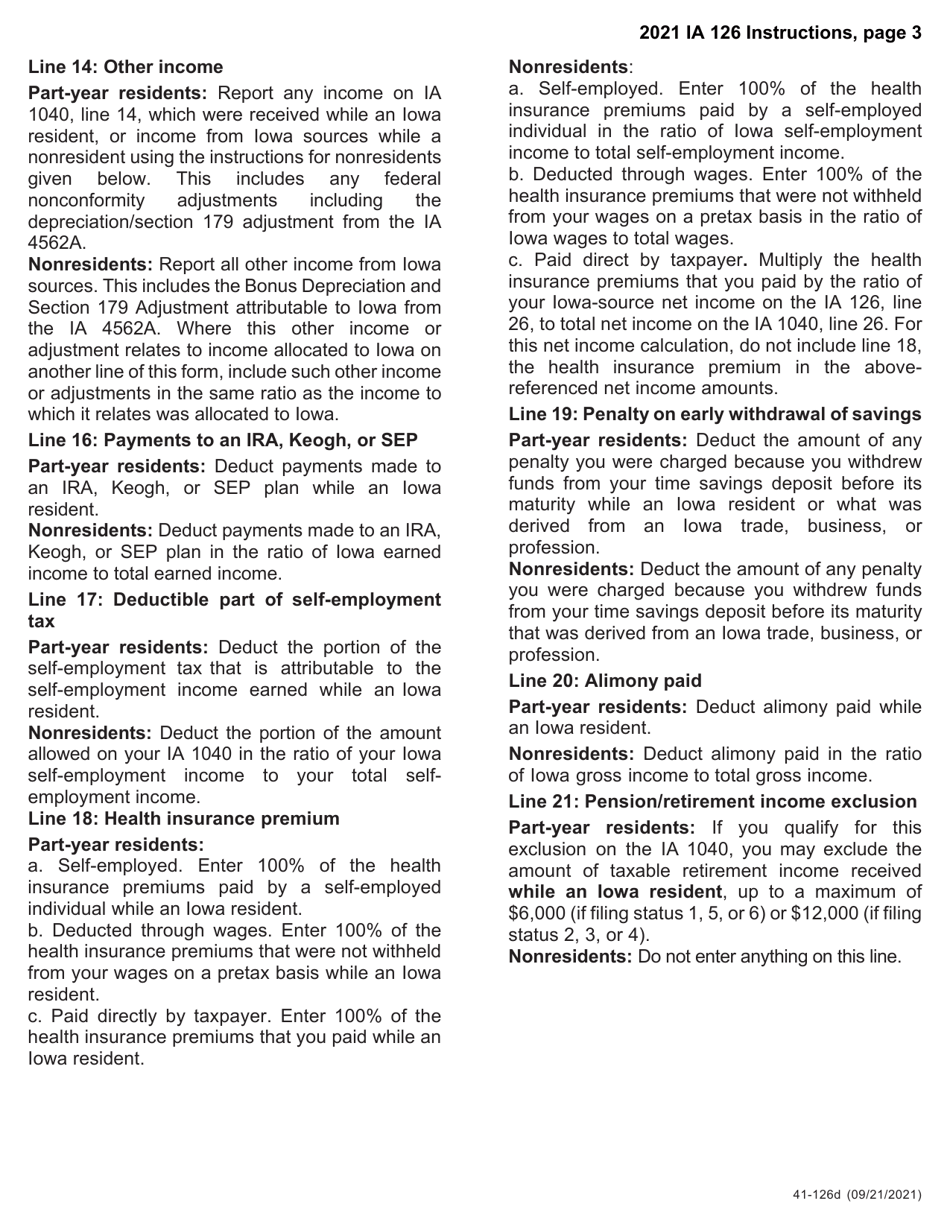

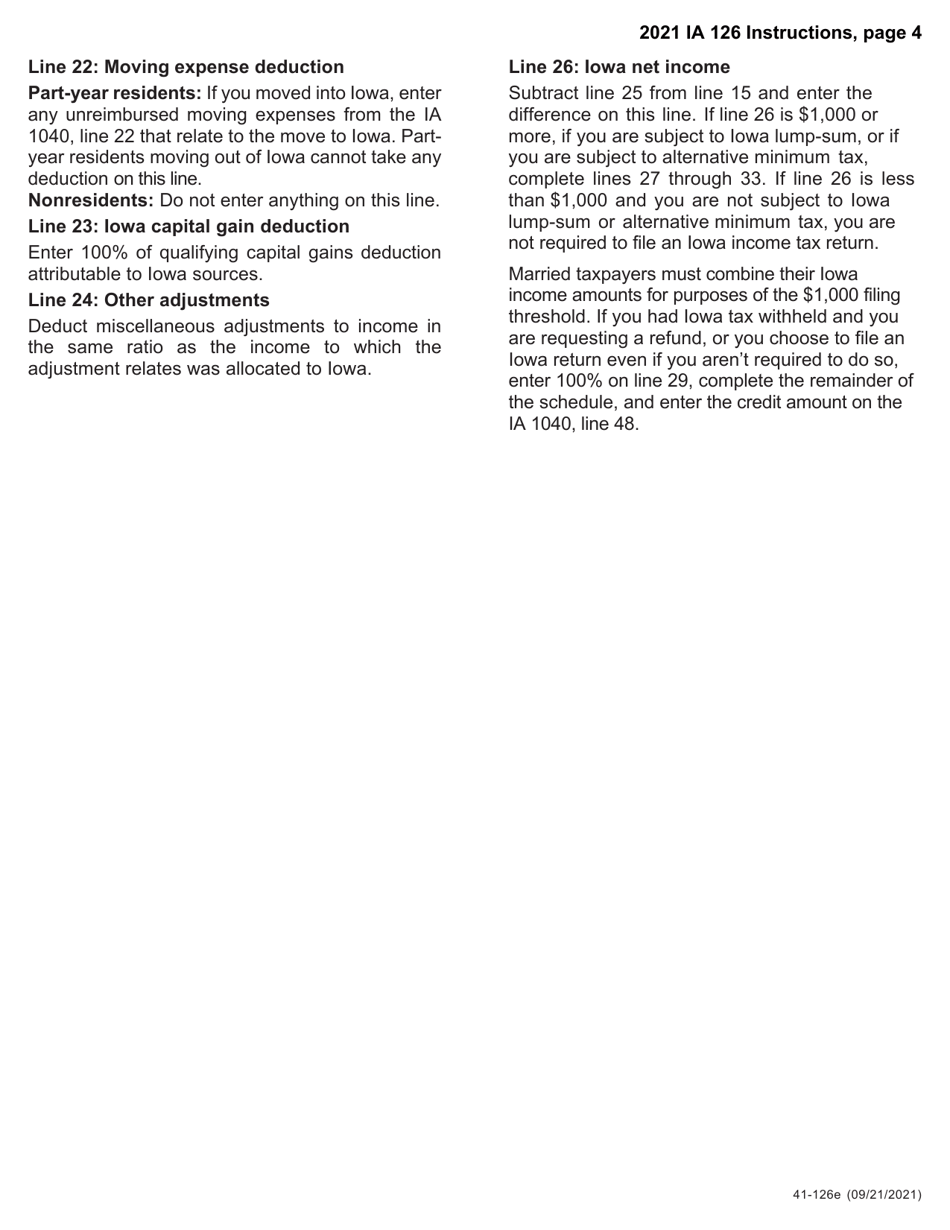

Form IA126 (41-126) Iowa Nonresident and Part-Year Resident Credit Schedule - Iowa

What Is Form IA126 (41-126)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA126?

A: Form IA126 is the Iowa Nonresident and Part-Year Resident Credit Schedule.

Q: Who should use Form IA126?

A: Form IA126 should be used by individuals who are nonresidents or part-year residents of Iowa.

Q: What is the purpose of Form IA126?

A: The purpose of Form IA126 is to calculate the nonresident and part-year resident tax credit for Iowa.

Q: What information is required to complete Form IA126?

A: To complete Form IA126, you will need information about your income earned in Iowa and your income earned in other states.

Q: When is Form IA126 due?

A: Form IA126 is due on the same date as your Iowa tax return, which is usually April 30th.

Q: Is there a fee to file Form IA126?

A: No, there is no fee to file Form IA126.

Q: What should I do if I have questions about Form IA126?

A: If you have questions about Form IA126, you can contact the Iowa Department of Revenue for assistance.

Form Details:

- Released on July 7, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA126 (41-126) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.