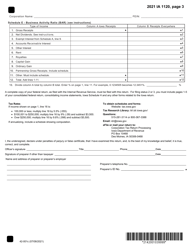

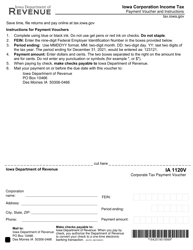

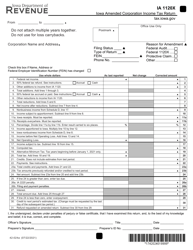

This version of the form is not currently in use and is provided for reference only. Download this version of

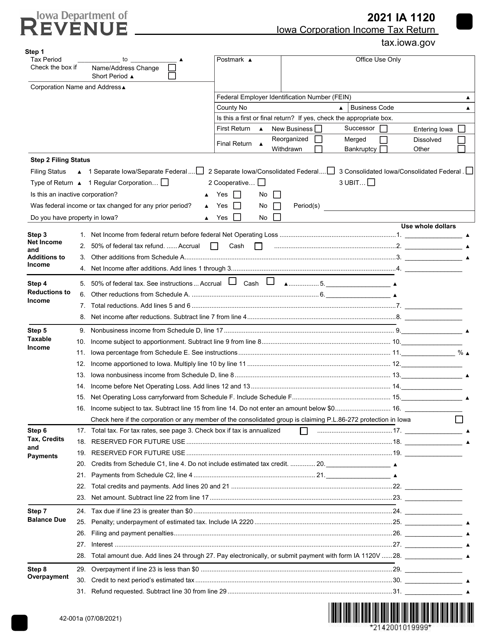

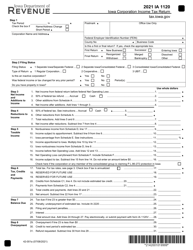

Form IA1120 (42-001)

for the current year.

Form IA1120 (42-001) Iowa Corporation Income Tax Return - Iowa

What Is Form IA1120 (42-001)?

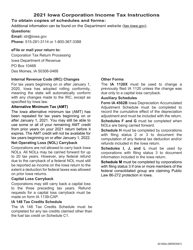

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. Check the official instructions before completing and submitting the form.

FAQ

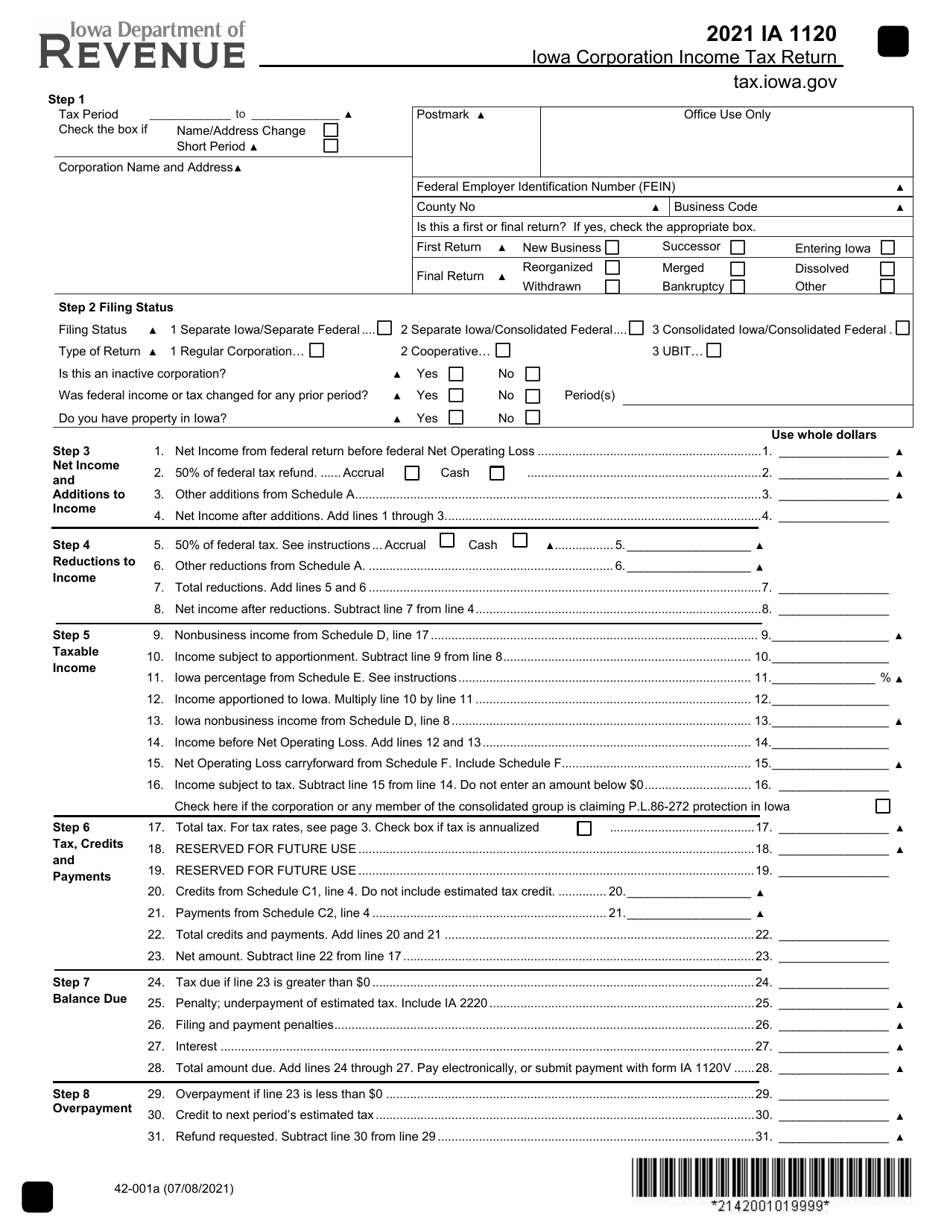

Q: What is Form IA1120?

A: Form IA1120 is the Iowa Corporation Income Tax Return for Iowa.

Q: Who needs to file Form IA1120?

A: Corporations operating in Iowa need to file Form IA1120.

Q: What is the purpose of Form IA1120?

A: Form IA1120 is used to report and pay state income taxes on corporate earnings in Iowa.

Q: When is the deadline to file Form IA1120?

A: The deadline to file Form IA1120 is typically the same as the federal corporate tax deadline, which is March 15th.

Q: Are there any penalties for late filing or non-filing of Form IA1120?

A: Yes, there are penalties for late filing or non-filing of Form IA1120. It is important to file the return and pay any taxes owed on time to avoid penalties and interest.

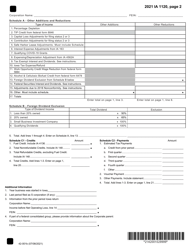

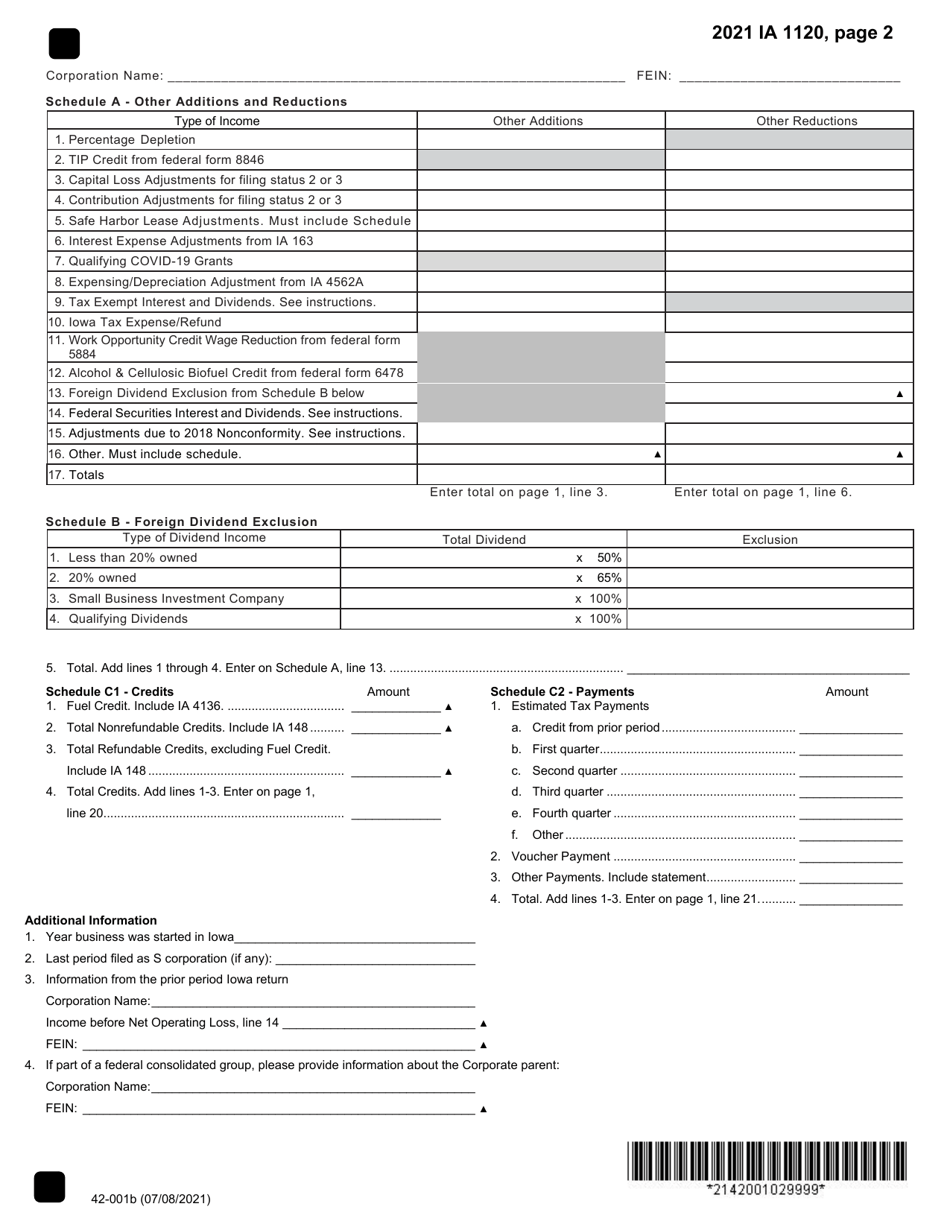

Q: What supporting documents should be attached to Form IA1120?

A: You may be required to attach supporting schedules and forms to Form IA1120, such as Schedule B and Schedule IA1120.

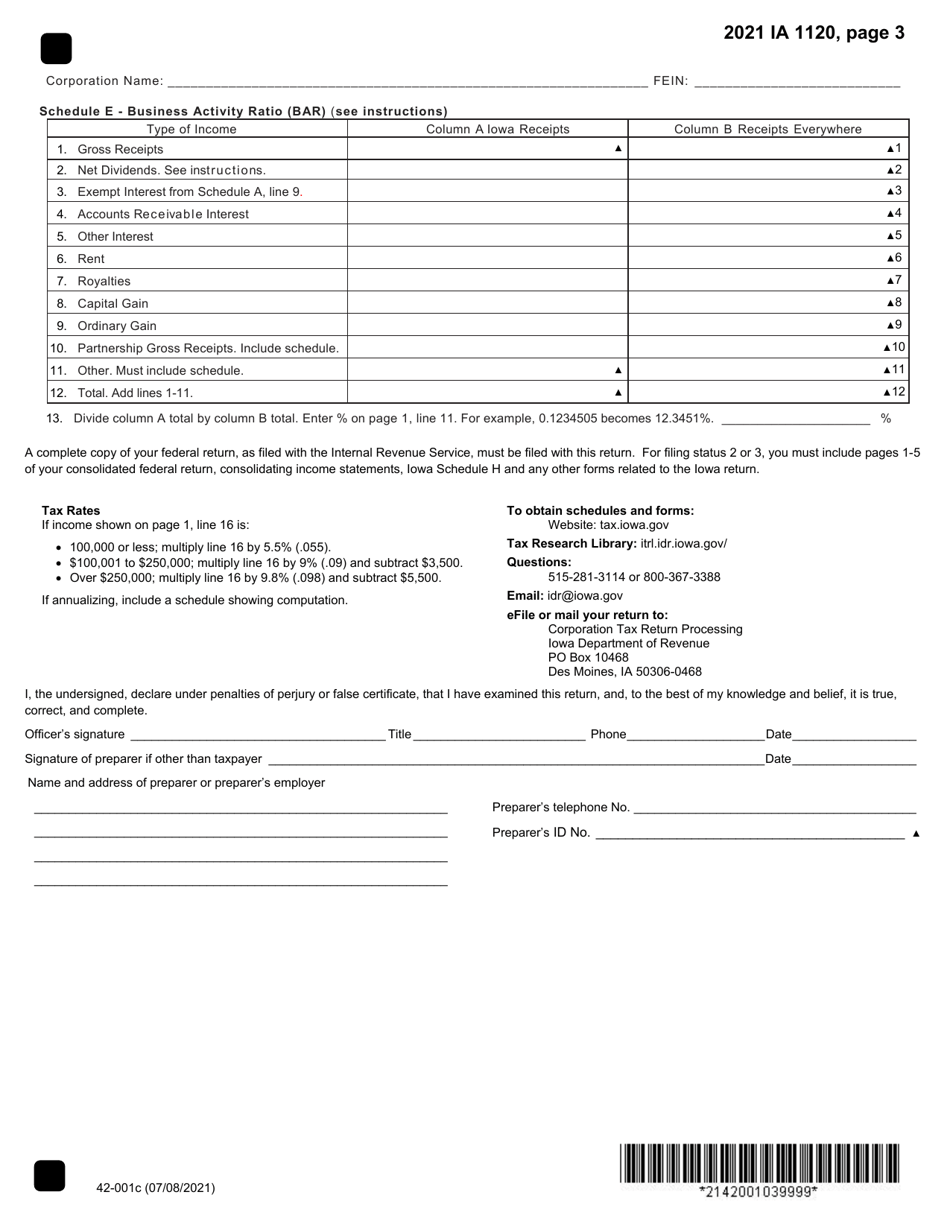

Q: What is the tax rate for Iowa corporation income tax?

A: The tax rate for Iowa corporation income tax varies depending on the level of taxable income. The rates range from 6% to 12%.

Q: Can I e-file Form IA1120?

A: Yes, Iowa provides the option to e-file Form IA1120.

Q: Are there any credits or deductions available for Iowa corporation income tax?

A: Yes, Iowa offers various credits and deductions that corporations may be eligible for when calculating their income tax liability.

Form Details:

- Released on July 8, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA1120 (42-001) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.