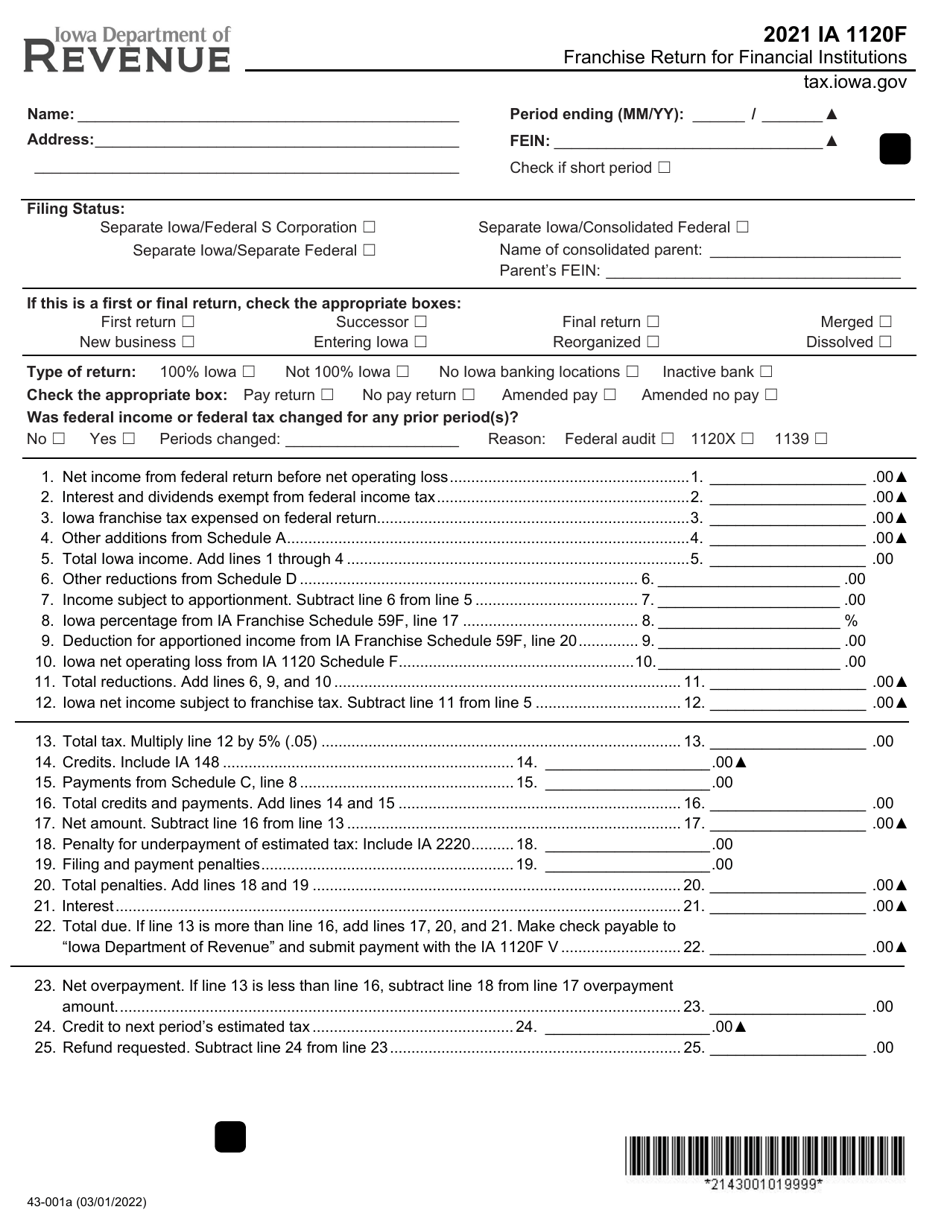

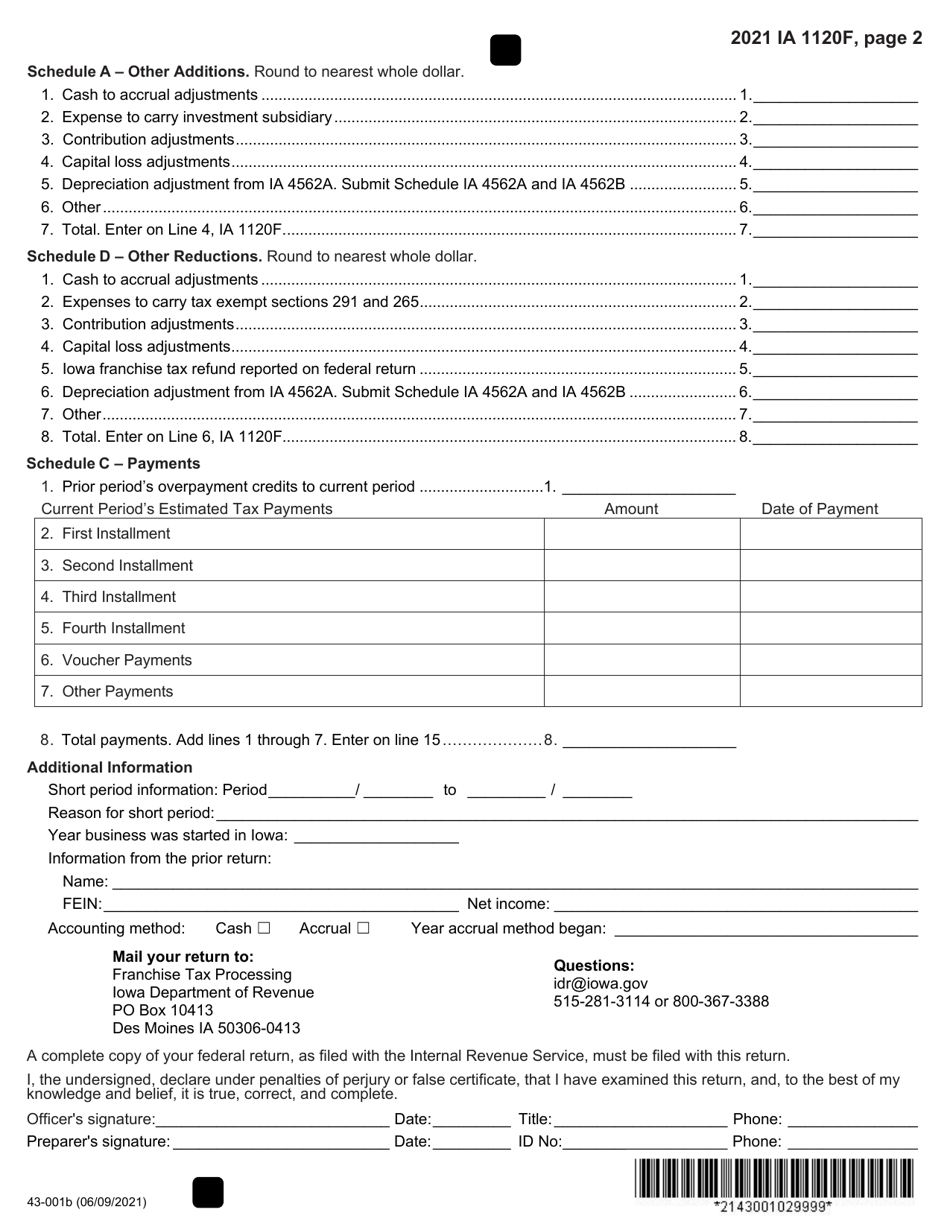

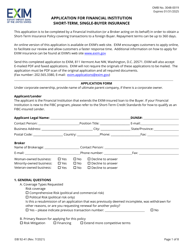

This version of the form is not currently in use and is provided for reference only. Download this version of

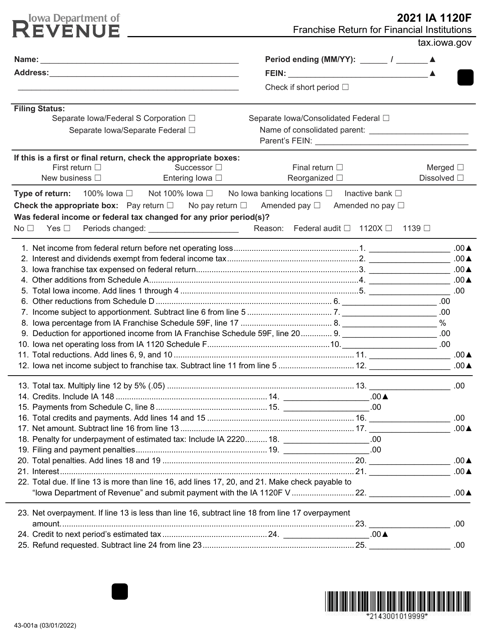

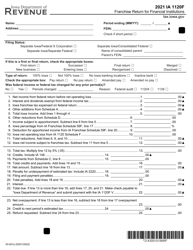

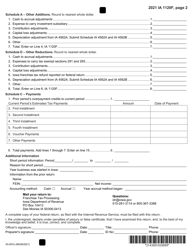

Form IA1120F (43-001)

for the current year.

Form IA1120F (43-001) Franchise Return for Financial Institutions - Iowa

What Is Form IA1120F (43-001)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IA1120F?

A: Form IA1120F is the Franchise Return for Financial Institutions in Iowa.

Q: Who needs to file Form IA1120F?

A: Financial institutions operating in Iowa need to file Form IA1120F.

Q: What is the purpose of Form IA1120F?

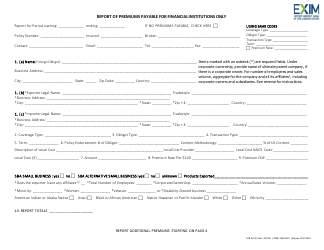

A: Form IA1120F is used to report the income, deductions, and tax liability of financial institutions in Iowa.

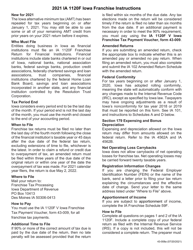

Q: Are there any specific requirements for filing Form IA1120F?

A: Yes, financial institutions need to meet the requirements set by the Iowa Department of Revenue for filing Form IA1120F.

Q: What is the deadline for filing Form IA1120F?

A: The deadline for filing Form IA1120F is determined by the Iowa Department of Revenue and may vary each year.

Q: Are there any penalties for late filing of Form IA1120F?

A: Yes, there may be penalties for late filing of Form IA1120F. It is important to file on time to avoid any penalties.

Q: Can I file Form IA1120F electronically?

A: Yes, the Iowa Department of Revenue allows electronic filing of Form IA1120F.

Q: Is there any additional documentation required with Form IA1120F?

A: Depending on the specific circumstances, additional documentation may be required with Form IA1120F. It is important to review the instructions provided with the form.

Form Details:

- Released on March 1, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IA1120F (43-001) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.