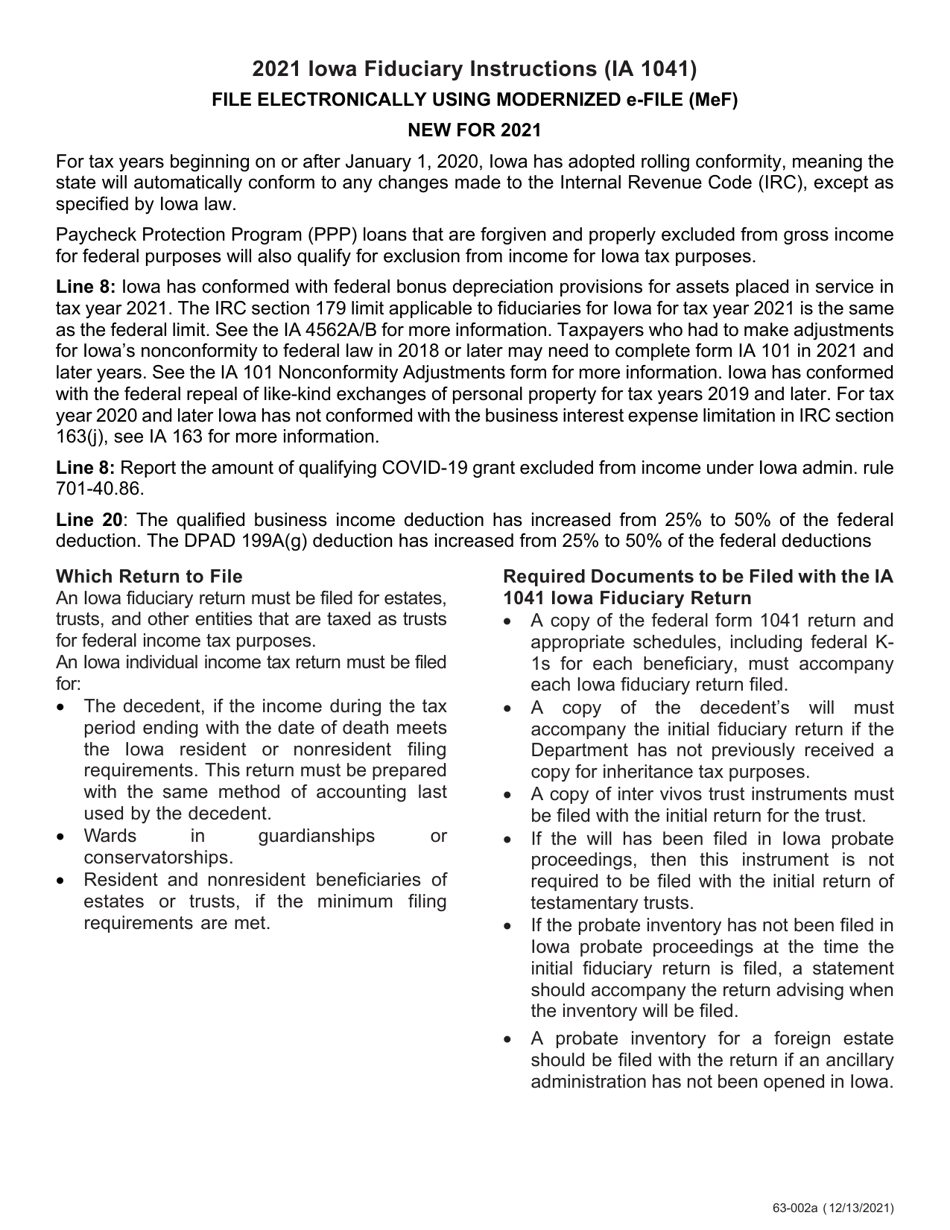

This version of the form is not currently in use and is provided for reference only. Download this version of

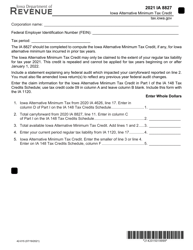

Instructions for Form IA1041, 63-001

for the current year.

Instructions for Form IA1041, 63-001 Iowa Fiduciary Return - Iowa

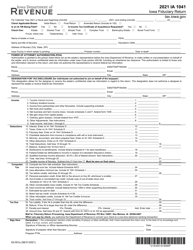

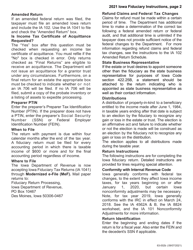

This document contains official instructions for Form IA1041 , and Form 63-001 . Both forms are released and collected by the Iowa Department of Revenue. An up-to-date fillable Form IA1041 (63-001) is available for download through this link.

FAQ

Q: What is Form IA1041?

A: Form IA1041 is the Iowa Fiduciary Return for Iowa.

Q: Who needs to file Form IA1041?

A: Any fiduciary (executor or administrator) of an estate or trust that is subject to Iowa income tax must file Form IA1041.

Q: What is the deadline for filing Form IA1041?

A: Form IA1041 must be filed by the 15th day of the fourth month following the close of the tax year.

Q: Are there any filing requirements if the estate or trust did not generate any income?

A: Yes, a Form IA1041 must still be filed even if the estate or trust did not generate any income, in order to report any deductions or credits.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing. It is important to file Form IA1041 by the deadline to avoid penalties and interest charges.

Instruction Details:

- This 7-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Iowa Department of Revenue.