This version of the form is not currently in use and is provided for reference only. Download this version of

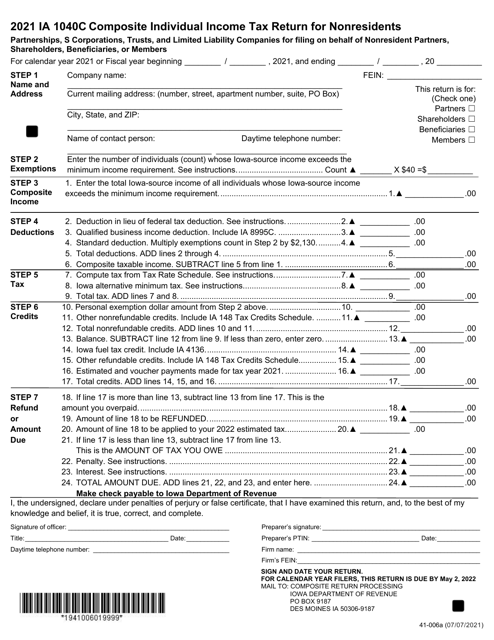

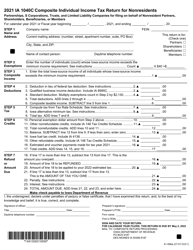

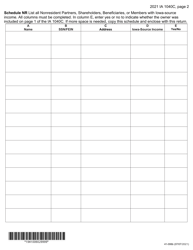

Form IA1040C (41-006)

for the current year.

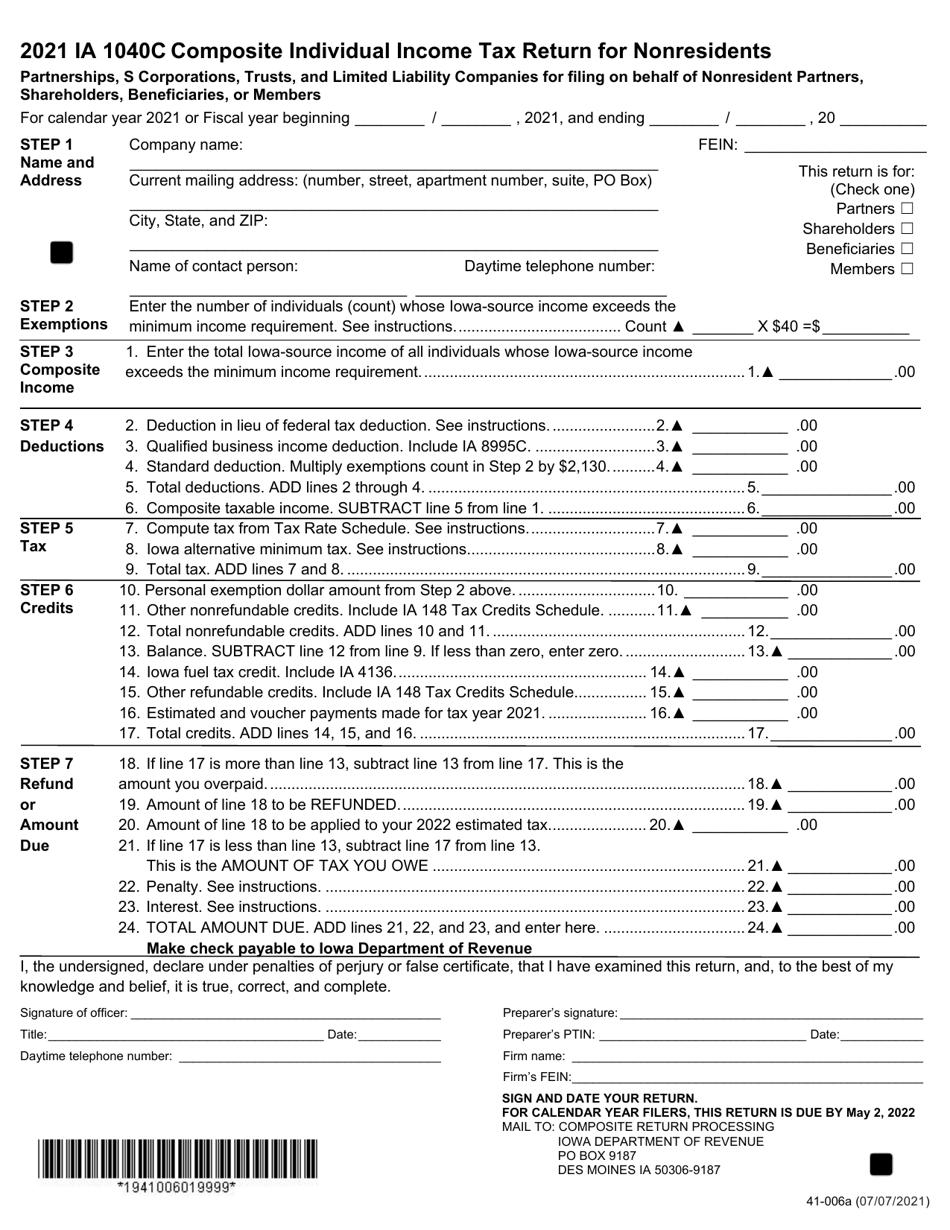

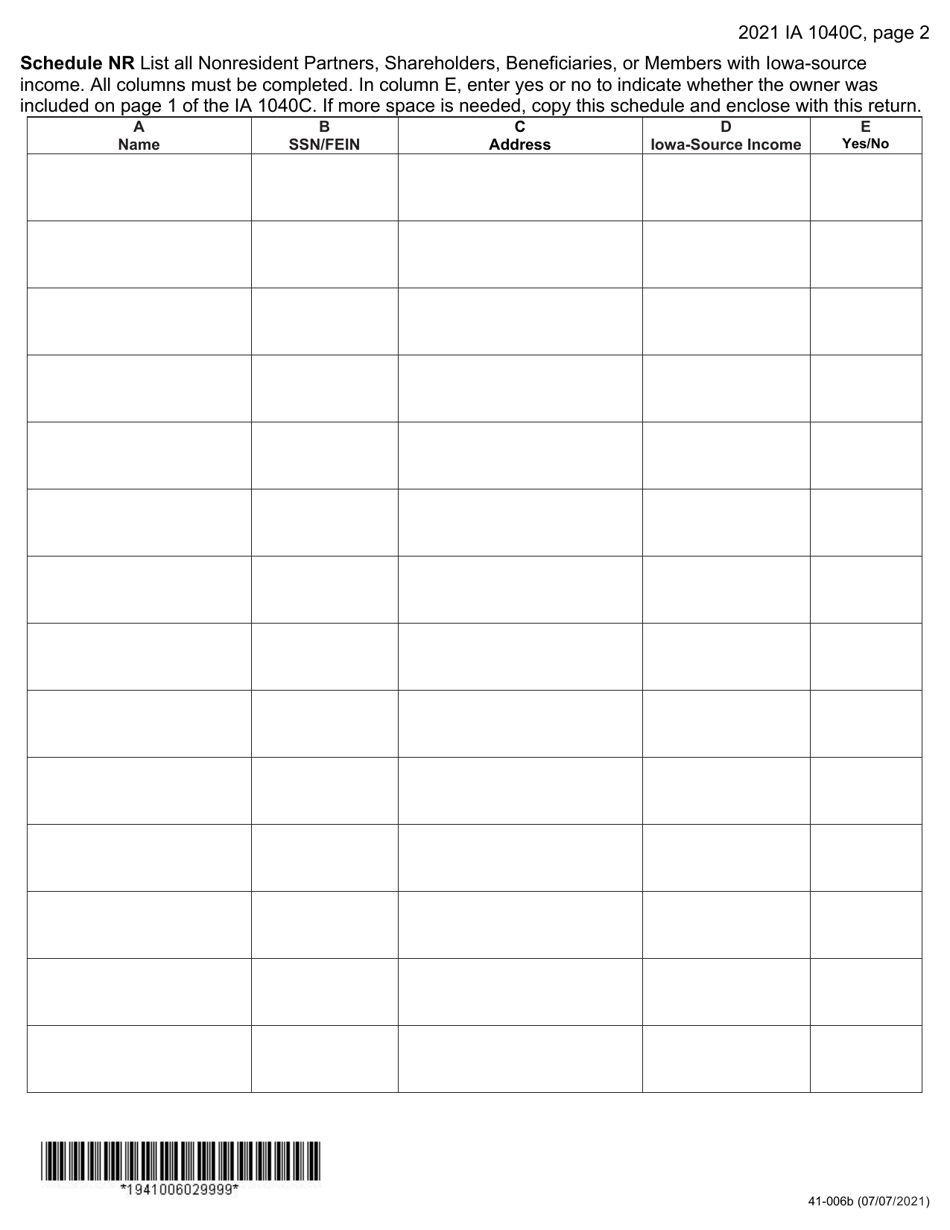

Form IA1040C (41-006) Composite Individual Income Tax Return for Nonresidents - Iowa

What Is Form IA1040C (41-006)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: Who needs to file the IA1040C form?

A: Nonresident individuals who have Iowa-source income and are part of a composite return.

Q: What is a composite return?

A: It is a tax return filed on behalf of nonresident individuals by a designated composite return filer.

Q: What income should be reported on the IA1040C form?

A: Only income earned from Iowa sources should be reported on this form.

Q: How do I select a composite return filer?

A: Each eligible nonresident individual must choose a composite return filer to handle their tax obligations.

Q: Are nonresident individuals required to make estimated tax payments?

A: Yes, nonresident individuals are required to make estimated tax payments if they expect to owe tax in Iowa.

Q: When is the IA1040C form due?

A: The IA1040C form is due on or before the 15th day of the fourth month following the close of the tax year.

Q: Can married couples file a joint composite return?

A: No, married couples filing as nonresidents must file separate IA1040C forms.

Form Details:

- Released on July 7, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA1040C (41-006) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.