This version of the form is not currently in use and is provided for reference only. Download this version of

Form IA100E (41-159)

for the current year.

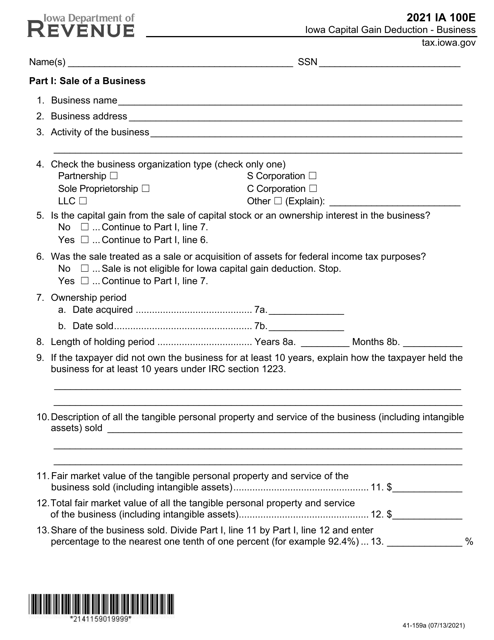

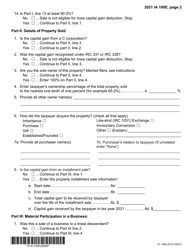

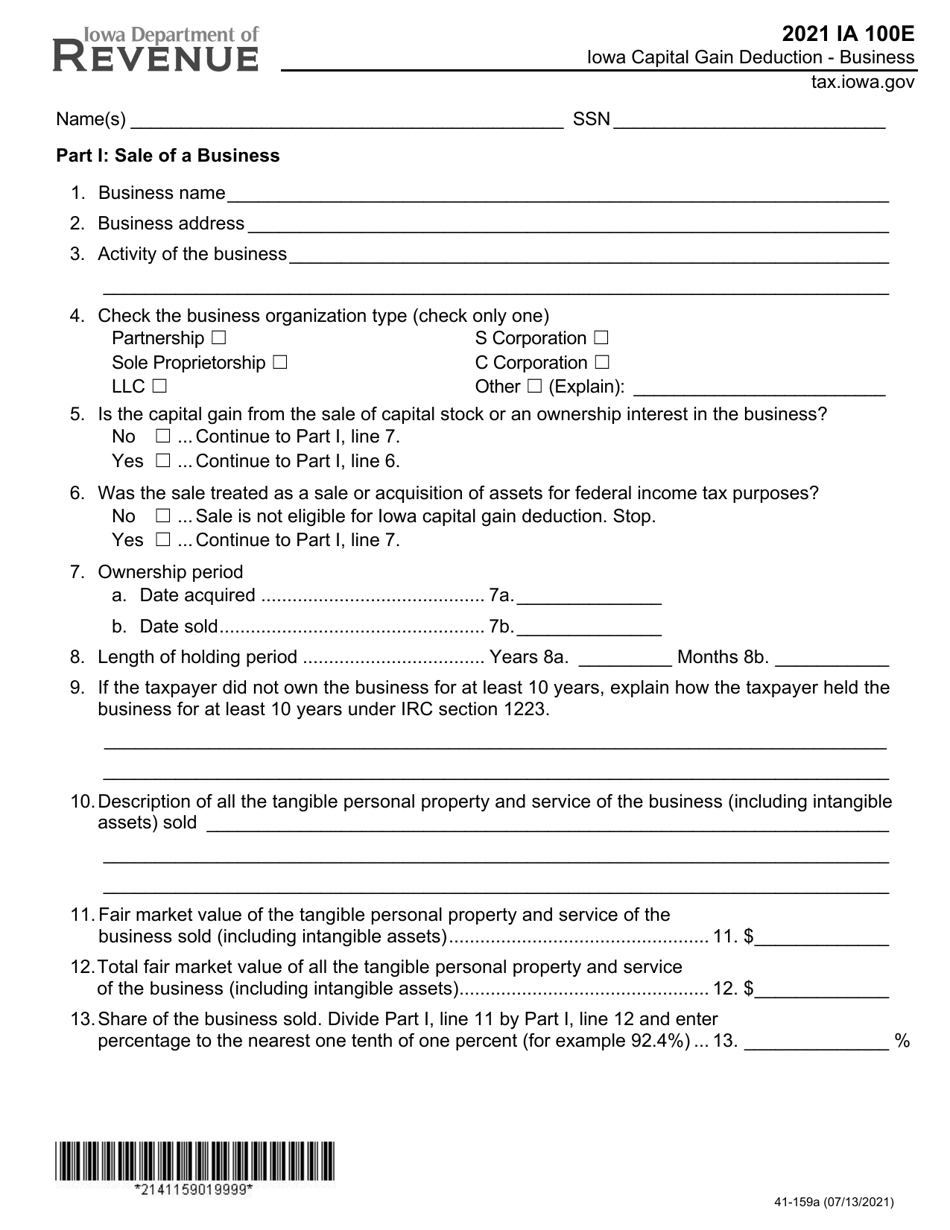

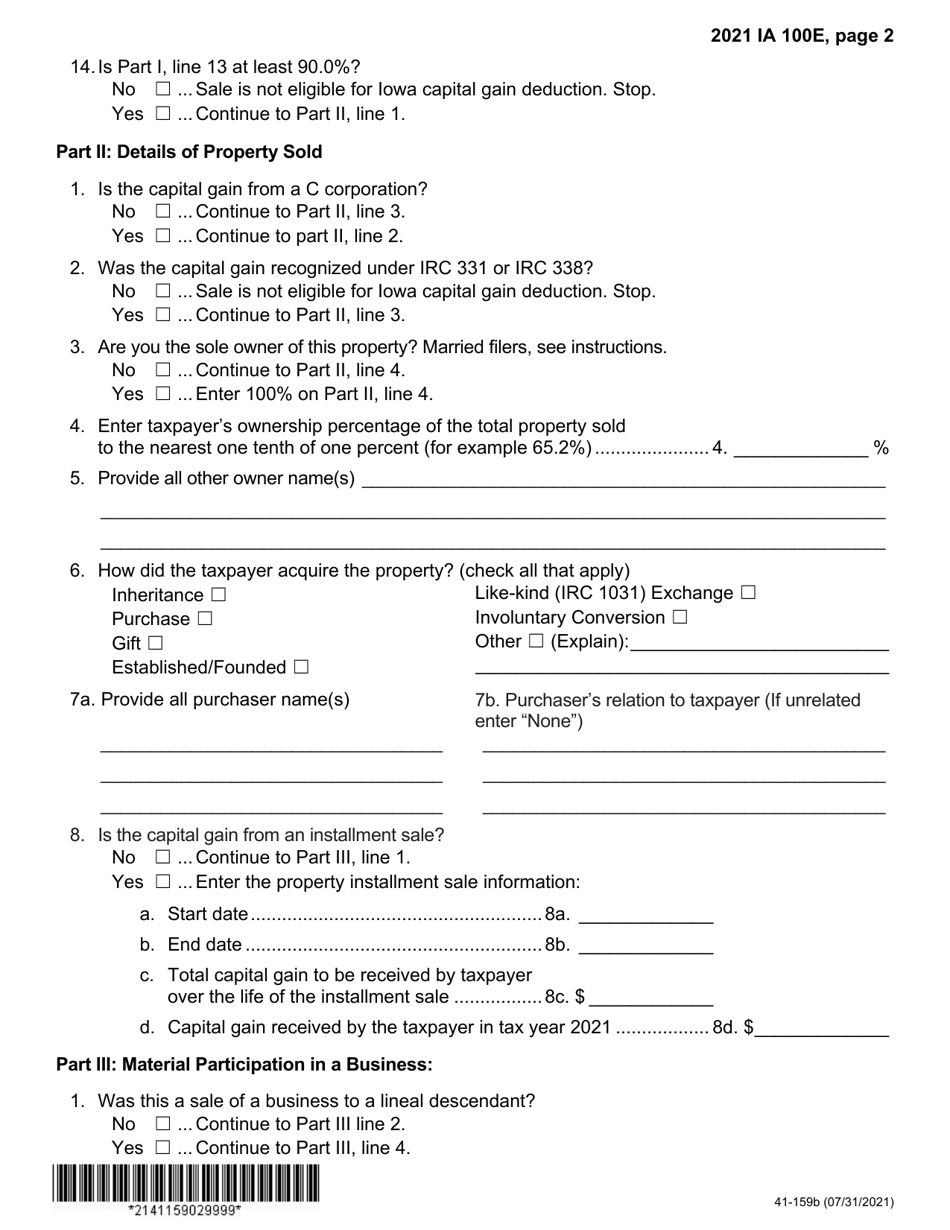

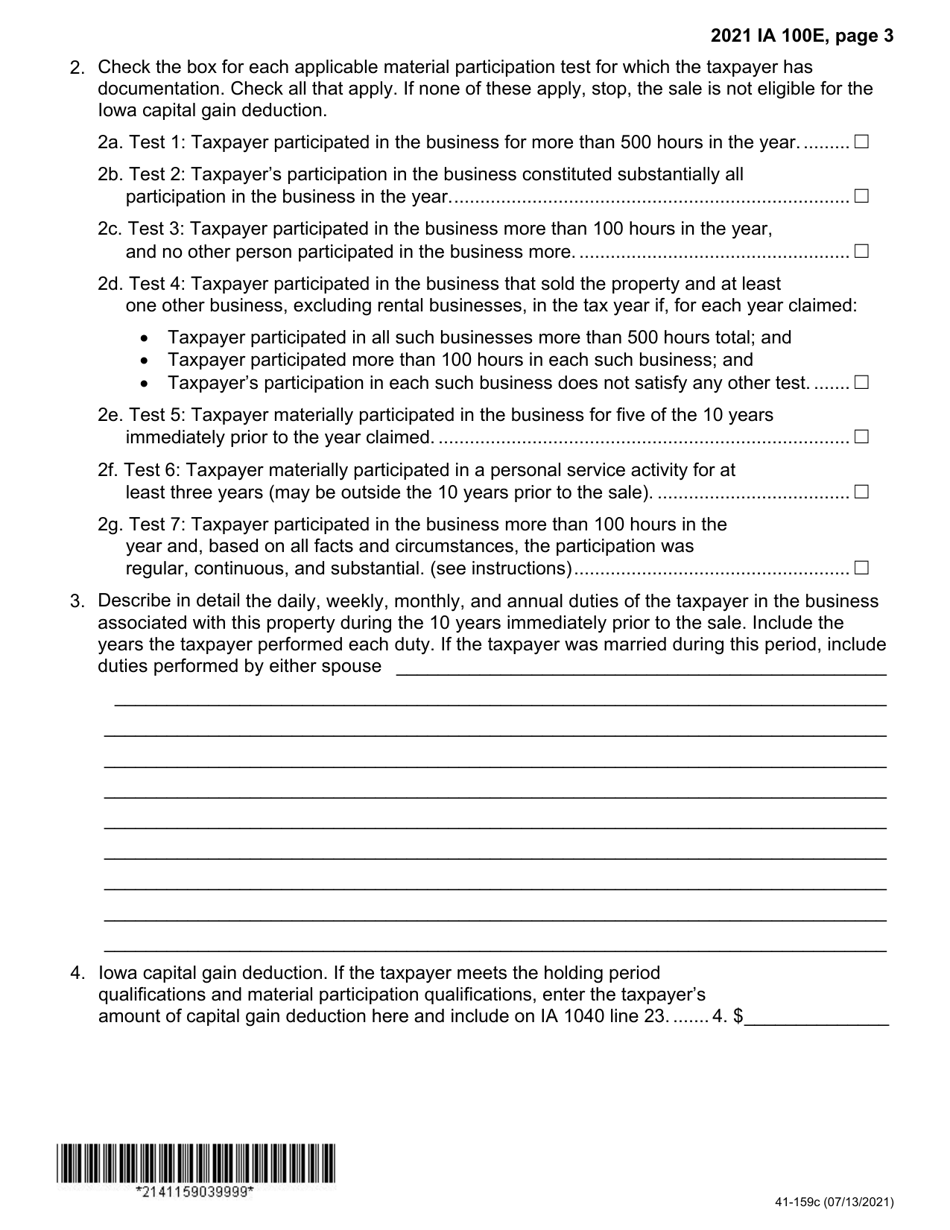

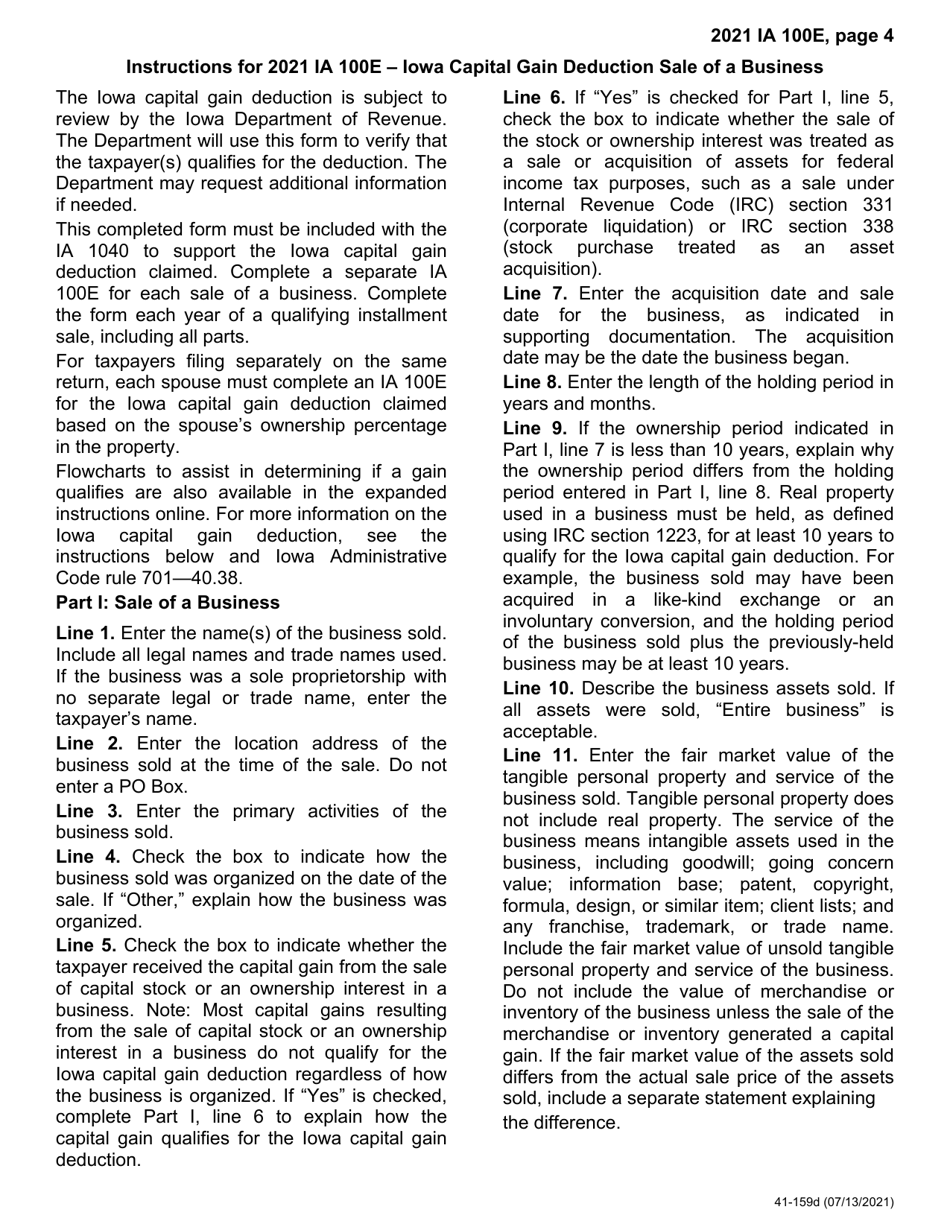

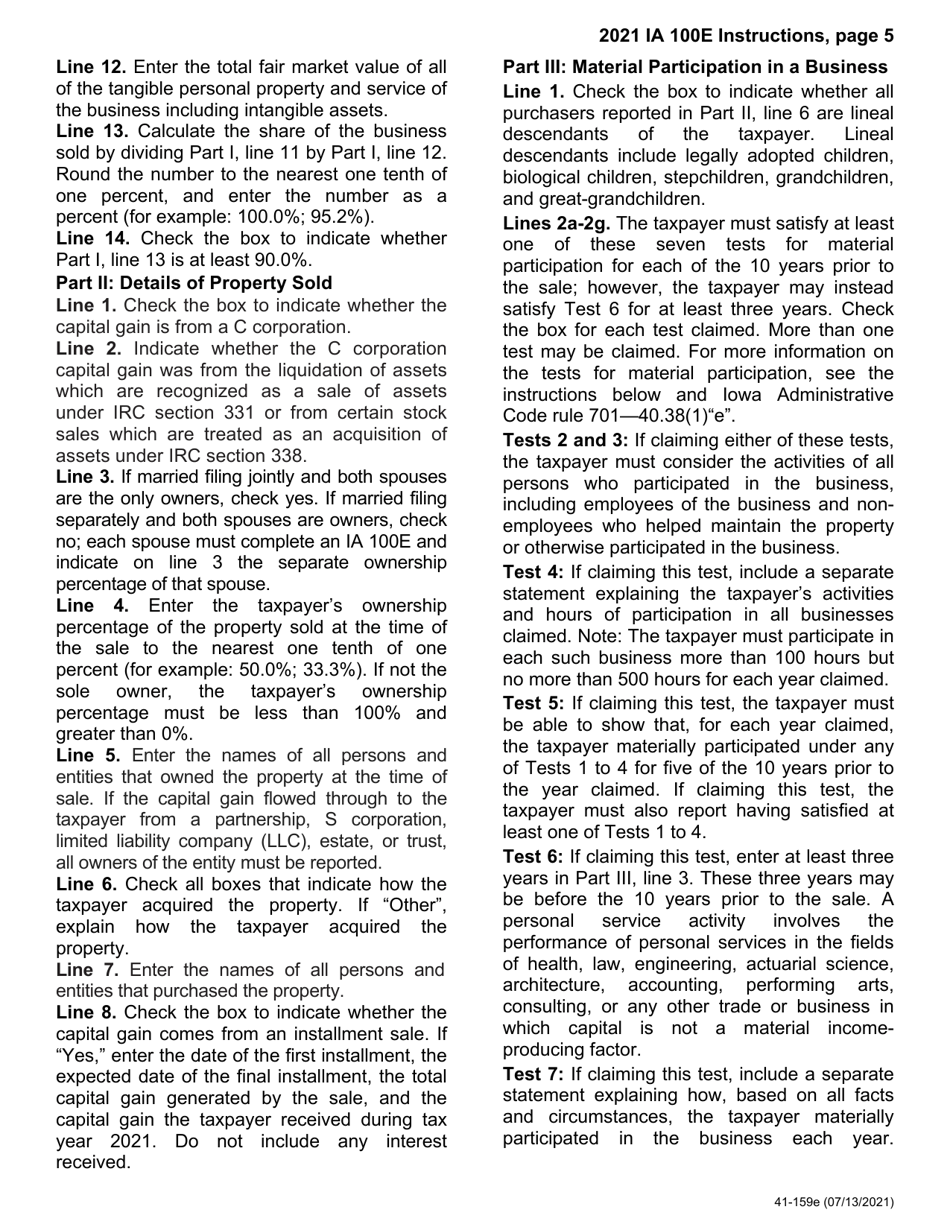

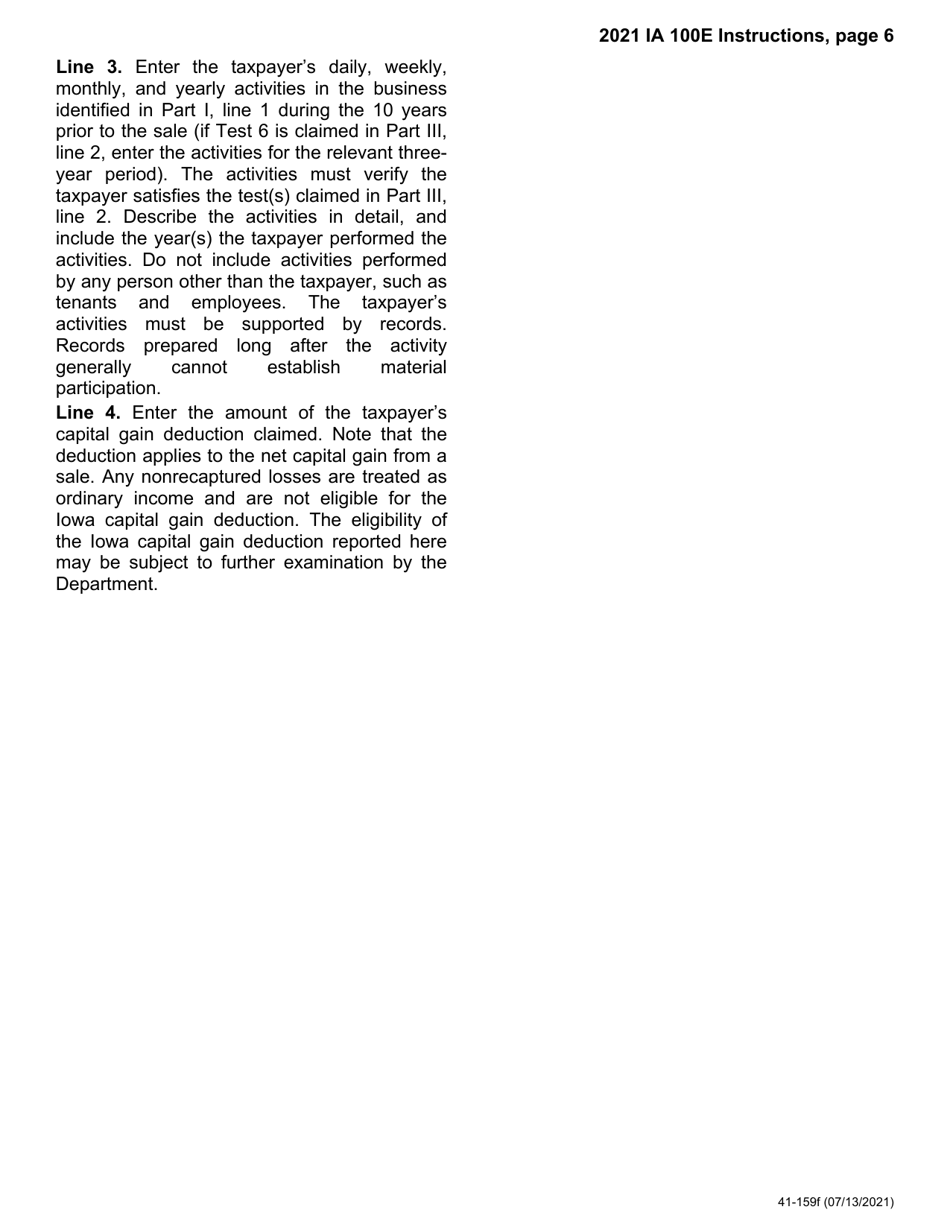

Form IA100E (41-159) Iowa Capital Gain Deduction - Business - Iowa

What Is Form IA100E (41-159)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA100E?

A: Form IA100E is a tax form used in the state of Iowa.

Q: What is the purpose of Form IA100E?

A: Form IA100E is used to claim the Iowa Capital Gain Deduction - Business in Iowa.

Q: What does the Iowa Capital Gain Deduction - Business refer to?

A: The Iowa Capital Gain Deduction - Business refers to a deduction that can be claimed on capital gains from qualifying business investments in Iowa.

Q: Who is eligible to claim the Iowa Capital Gain Deduction - Business?

A: Individuals, estates, and trusts that have realized qualifying capital gains from certain business investments in Iowa may be eligible to claim the deduction.

Q: What types of business investments qualify for the deduction?

A: Specific types of business investments that may qualify for the deduction include stocks, bonds, mutual funds, and ownership interests in Iowa businesses.

Q: Are there any limitations or restrictions to claiming the deduction?

A: Yes, there may be limitations and restrictions that apply. It is recommended to review the instructions for Form IA100E or consult with a tax professional for guidance.

Q: When is the deadline to file Form IA100E?

A: The deadline to file Form IA100E is typically the same as the deadline for filing your Iowa income tax return, which is April 30th of each year.

Form Details:

- Released on July 13, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA100E (41-159) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.