This version of the form is not currently in use and is provided for reference only. Download this version of

Form IA100F (41-160)

for the current year.

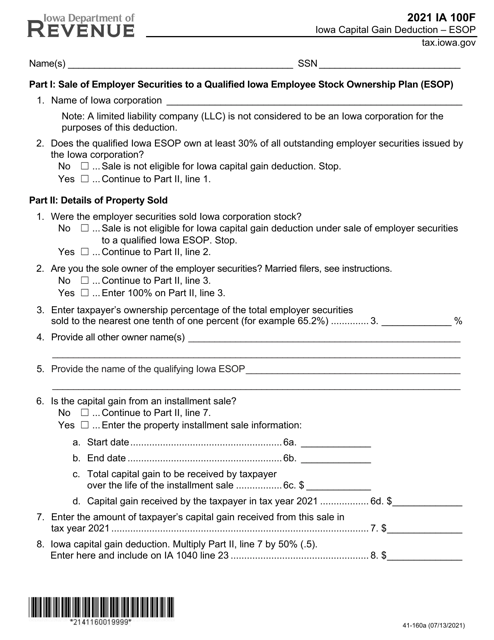

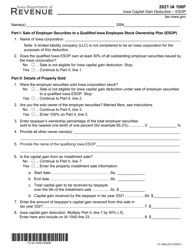

Form IA100F (41-160) Iowa Capital Gain Deduction - Esop - Iowa

What Is Form IA100F (41-160)?

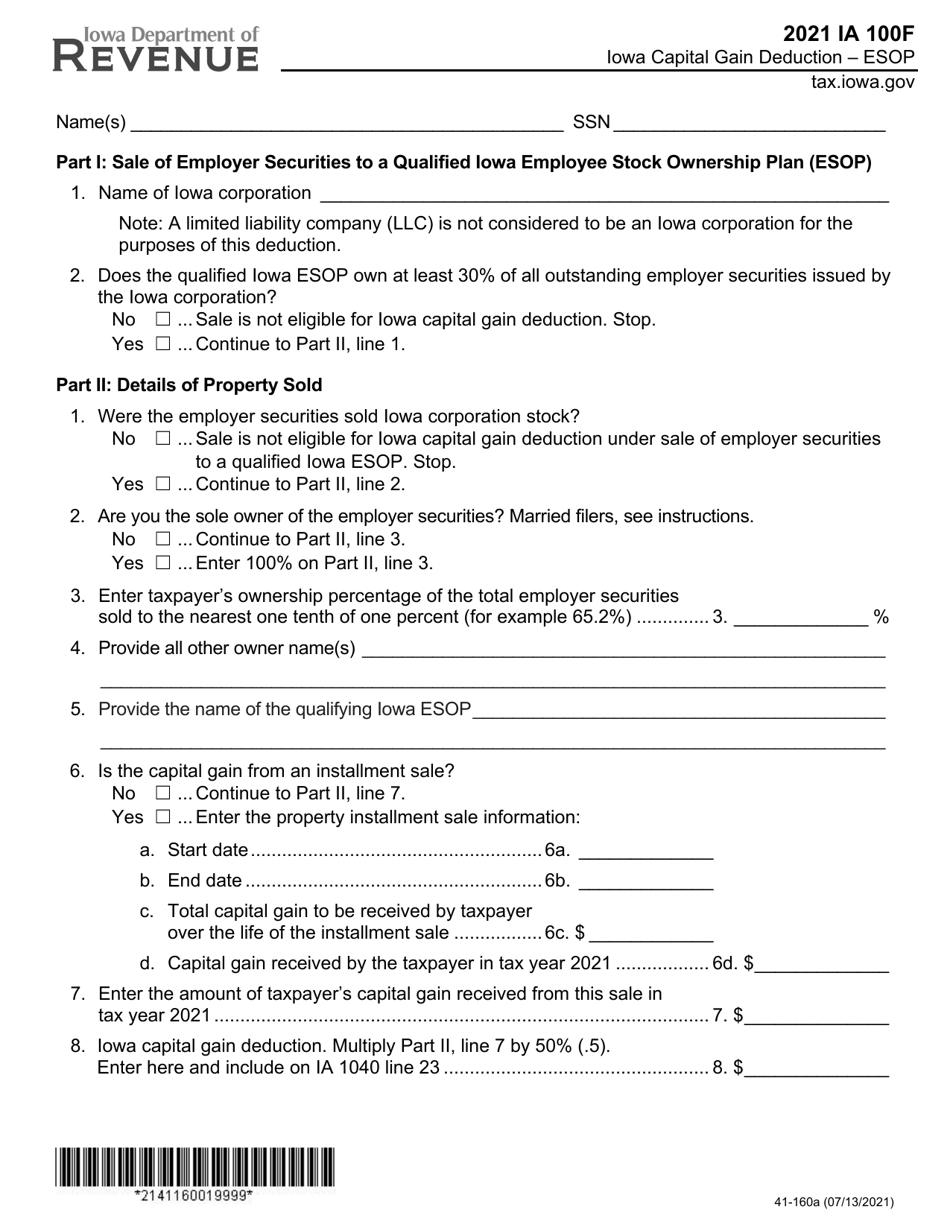

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA100F (41-160)?

A: Form IA100F (41-160) is the Iowa Capital Gain Deduction - Esop - Iowa form.

Q: What is the purpose of Form IA100F?

A: Form IA100F is used to claim the Iowa Capital Gain Deduction for Employee Stock Ownership Plans (ESOPs) in Iowa.

Q: What is the Iowa Capital Gain Deduction?

A: The Iowa Capital Gain Deduction allows taxpayers in Iowa to deduct a portion of the capital gains they have realized from the sale or exchange of qualified stock in an ESOP.

Q: Who can claim the Iowa Capital Gain Deduction?

A: Taxpayers in Iowa who have realized capital gains from the sale or exchange of qualified stock in an ESOP can claim the Iowa Capital Gain Deduction.

Q: What is an ESOP?

A: An Employee Stock Ownership Plan (ESOP) is a type of retirement plan in which the company contributes its own stock or money to buy stock on behalf of its employees.

Q: How much can be deducted with the Iowa Capital Gain Deduction?

A: Taxpayers can deduct 50% of their eligible capital gains on qualified ESOP stock.

Q: Are there any limitations or requirements for claiming the Iowa Capital Gain Deduction?

A: Yes, there are certain limitations and requirements that must be met in order to claim the Iowa Capital Gain Deduction. Taxpayers should refer to the instructions on Form IA100F for more information.

Q: When is the deadline to file Form IA100F?

A: Form IA100F must be filed by the deadline for filing Iowa income tax returns, which is usually April 30th of the following year.

Form Details:

- Released on July 13, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA100F (41-160) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.