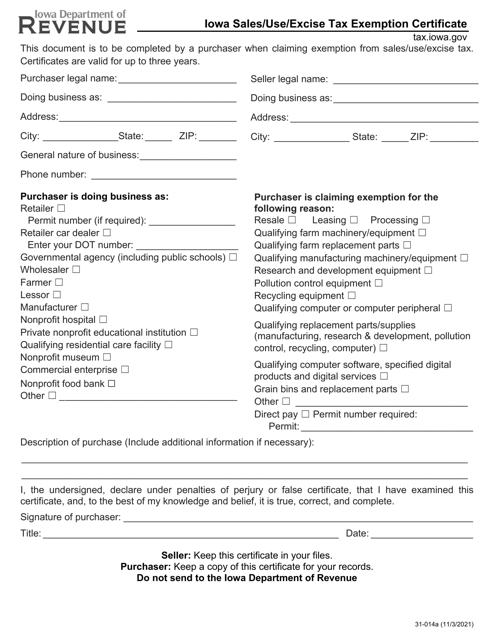

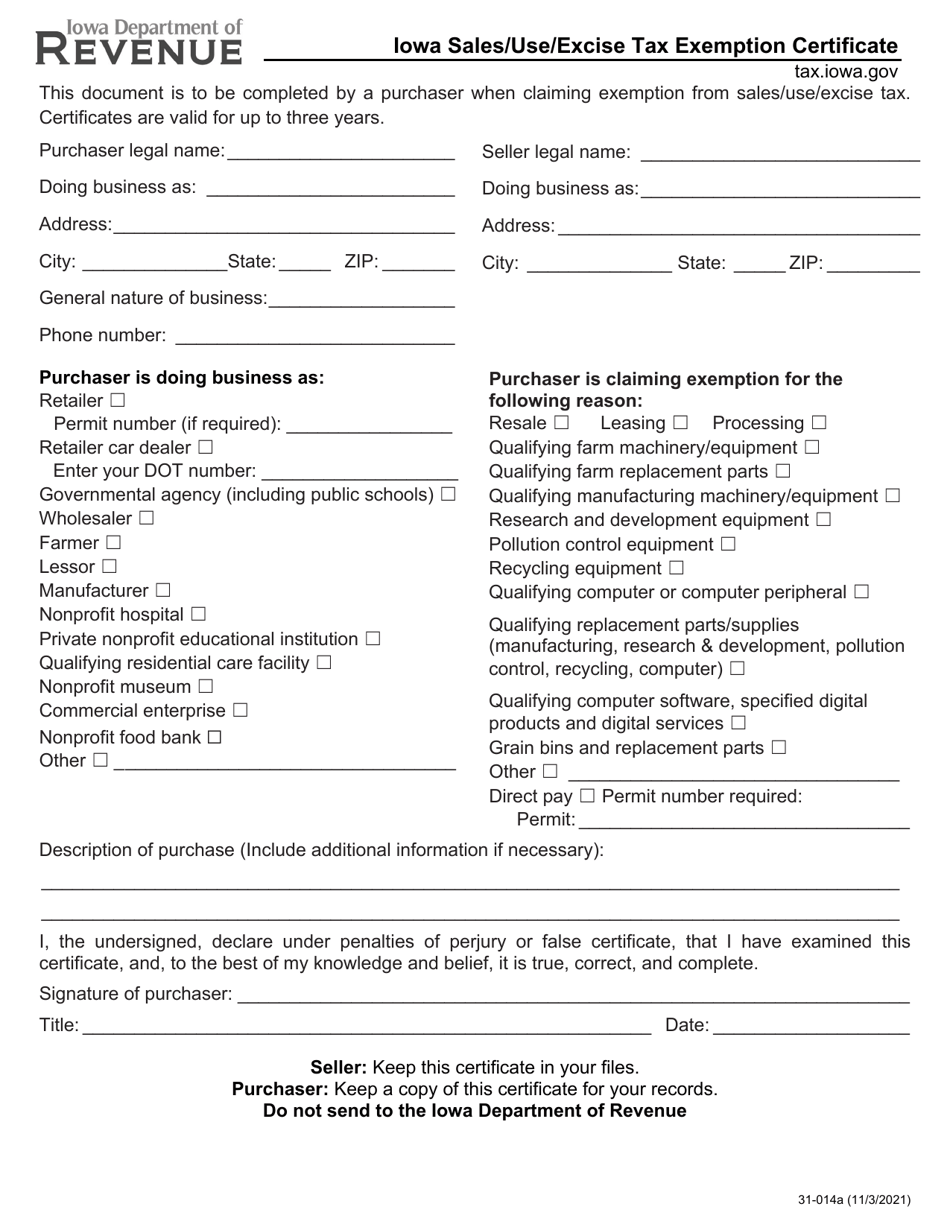

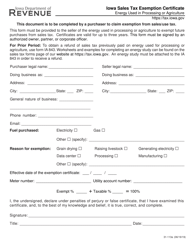

Form 31-014A Iowa Sales / Use / Excise Tax Exemption Certificate - Iowa

What Is Form 31-014A?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 31-014A?

A: Form 31-014A is the Iowa Sales/Use/Excise Tax Exemption Certificate.

Q: What is the purpose of Form 31-014A?

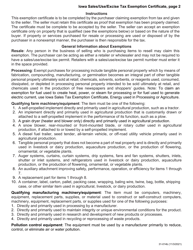

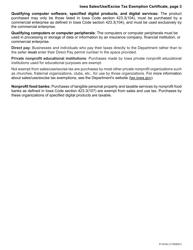

A: The purpose of Form 31-014A is to claim an exemption from sales, use, or excise tax in Iowa.

Q: Who should use Form 31-014A?

A: Any individual or business who wants to claim a tax exemption in Iowa should use Form 31-014A.

Q: Do I need to fill out Form 31-014A for every purchase?

A: Yes, you need to fill out Form 31-014A for each purchase in Iowa for which you want to claim a tax exemption.

Q: Can I use Form 31-014A to claim a tax exemption in other states?

A: No, Form 31-014A is specific to claiming tax exemptions in Iowa only.

Q: What information do I need to provide on Form 31-014A?

A: You need to provide your name, address, business name (if applicable), and the reason for claiming the tax exemption.

Q: Do I need to submit any supporting documents with Form 31-014A?

A: Depending on the reason for claiming the tax exemption, you may need to submit supporting documents such as a resale certificate or proof of nonprofit status.

Q: Can I make changes to Form 31-014A after submitting it?

A: No, you cannot make changes to Form 31-014A after submitting it. Make sure to review the form carefully before sending it to the Iowa Department of Revenue.

Form Details:

- Released on November 3, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 31-014A by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.