This version of the form is not currently in use and is provided for reference only. Download this version of

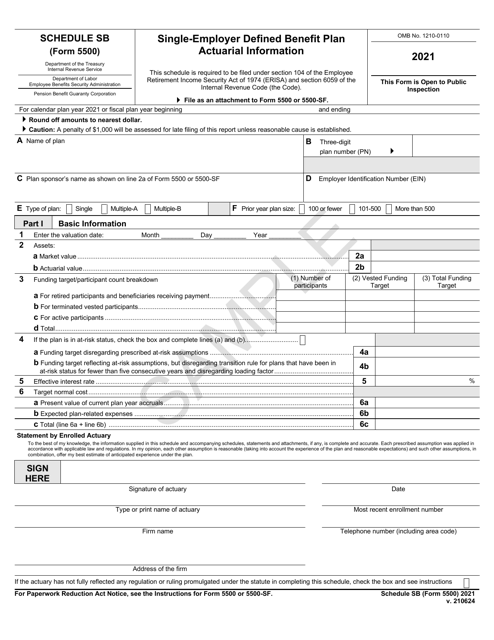

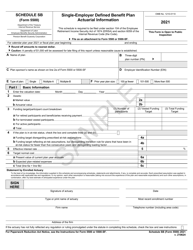

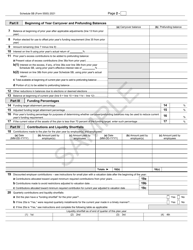

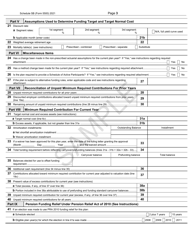

Form 5500 Schedule SB

for the current year.

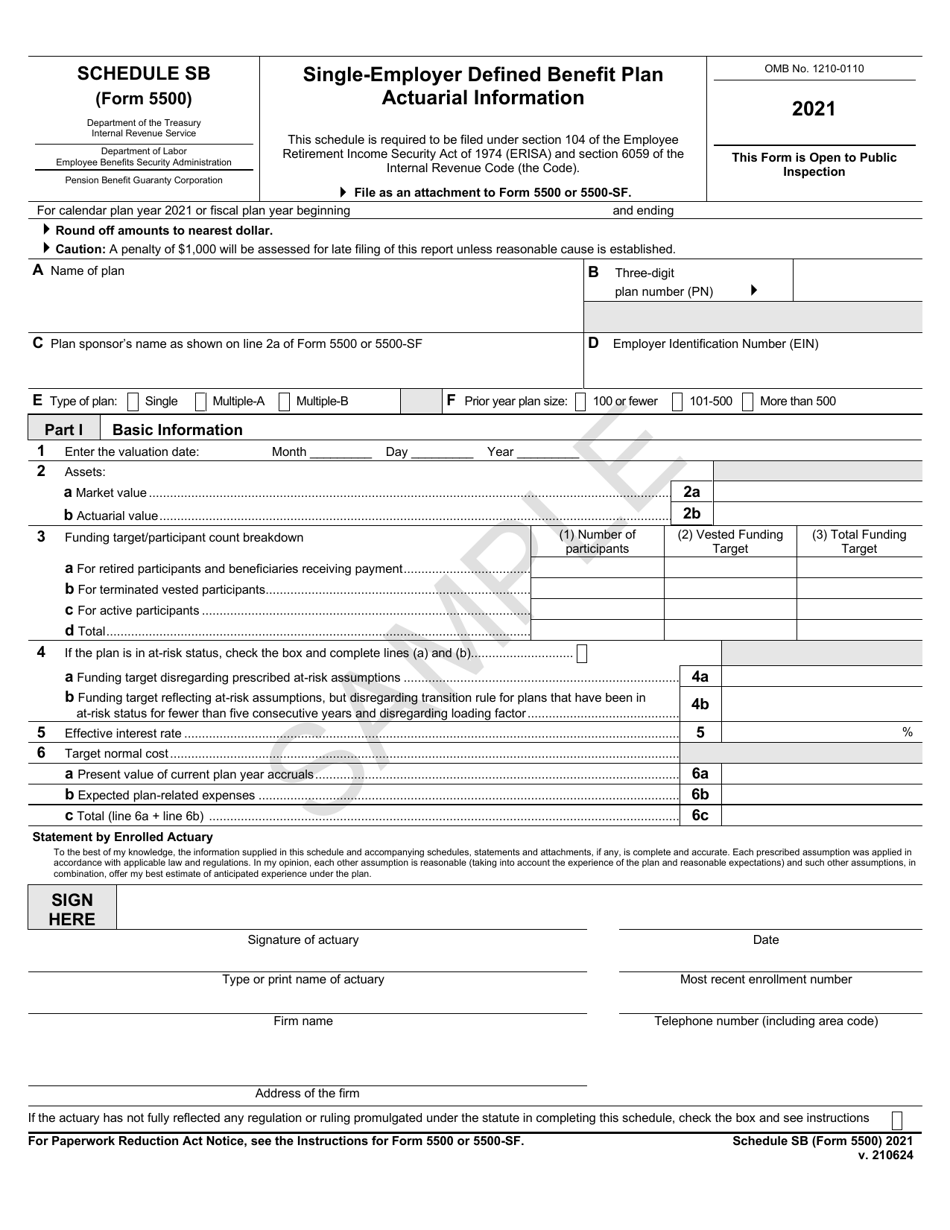

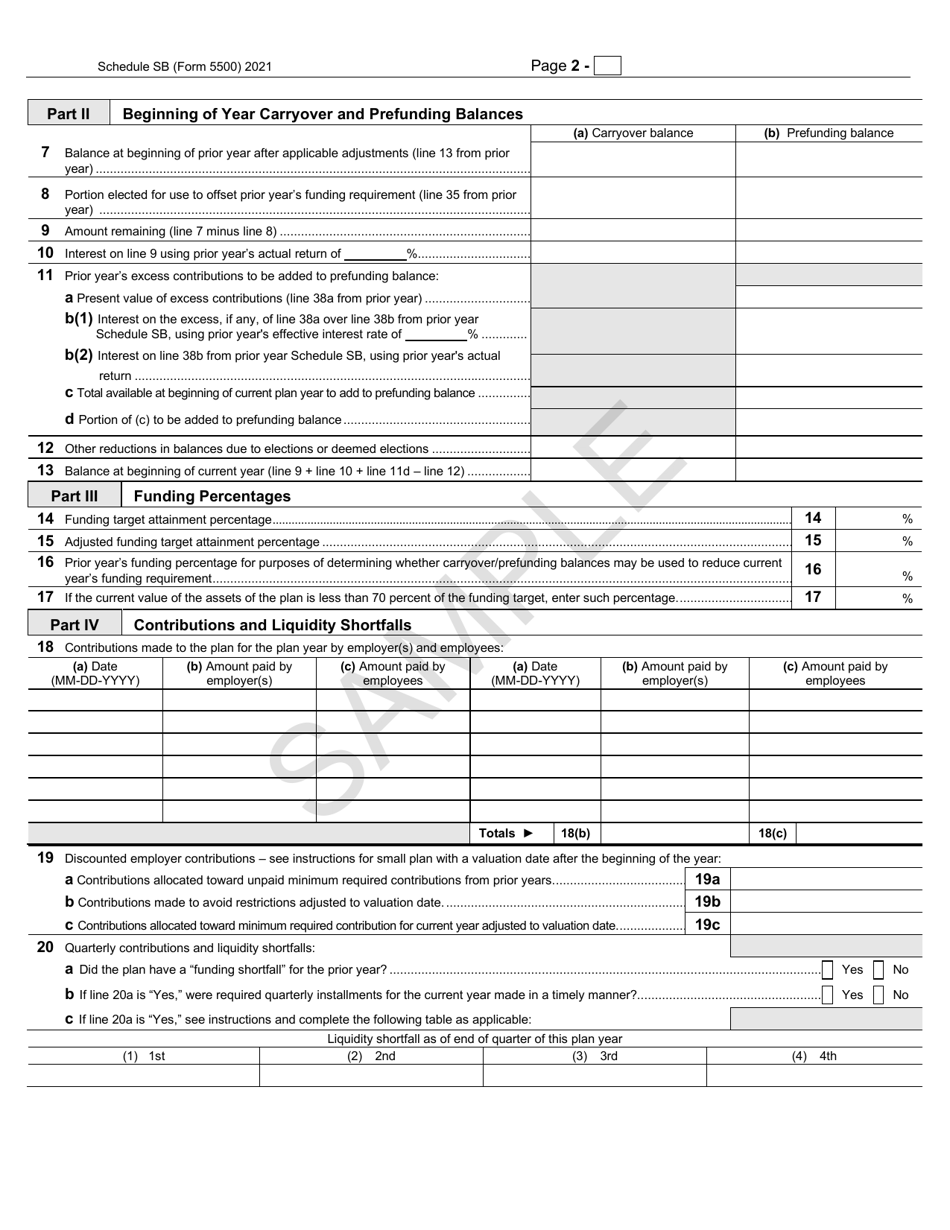

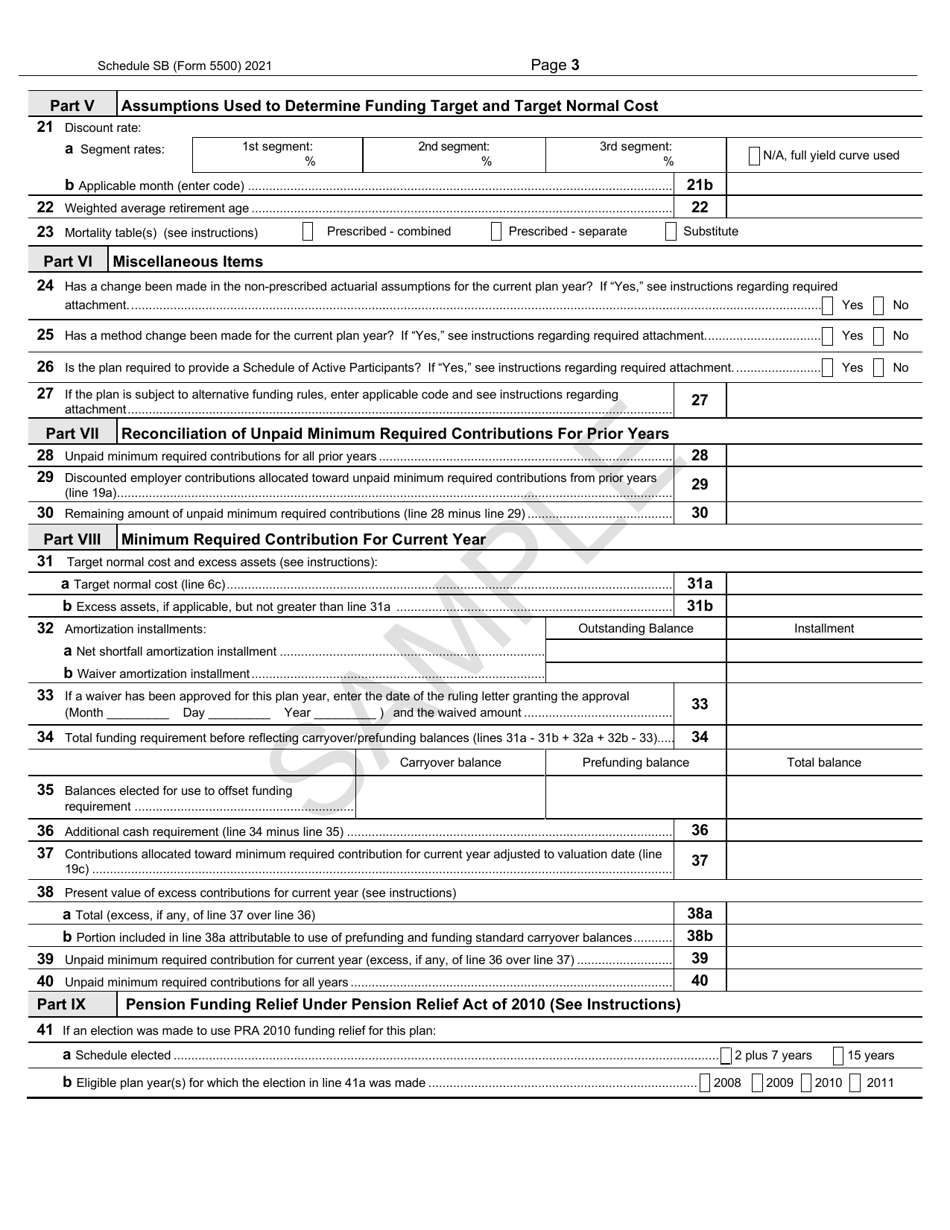

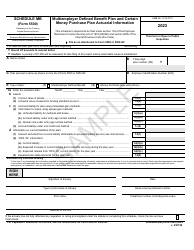

Form 5500 Schedule SB Single-Employer Defined Benefit Plan Actuarial Information - Sample

What Is Form 5500 Schedule SB?

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration and used country-wide. The document is a supplement to Form 5500, Annual Return/Report of Employee Benefit Plan - Sample. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 5500 Schedule SB?

A: The Form 5500 Schedule SB is a document used to report actuarial information for single-employer defined benefit plans.

Q: What is a single-employer defined benefit plan?

A: A single-employer defined benefit plan is a type of retirement plan where an employer promises to pay a specific benefit to employees upon retirement based on a formula.

Q: What type of actuarial information is reported in the Form 5500 Schedule SB?

A: The Form 5500 Schedule SB reports information such as the plan's funding status, contributions made by the employer, and the actuarial present value of vested benefits.

Q: Why is actuarial information important for defined benefit plans?

A: Actuarial information is important for defined benefit plans as it helps determine the funding status of the plan and ensures that there are enough assets to meet future benefit payments.

Q: Who is required to file the Form 5500 Schedule SB?

A: Employers that maintain single-employer defined benefit plans are generally required to file the Form 5500 Schedule SB.

Q: Is the Form 5500 Schedule SB filed with the IRS or the Department of Labor?

A: The Form 5500 Schedule SB is filed with the Department of Labor, specifically with the Employee Benefits Security Administration (EBSA).

Form Details:

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5500 Schedule SB by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.