This version of the form is not currently in use and is provided for reference only. Download this version of

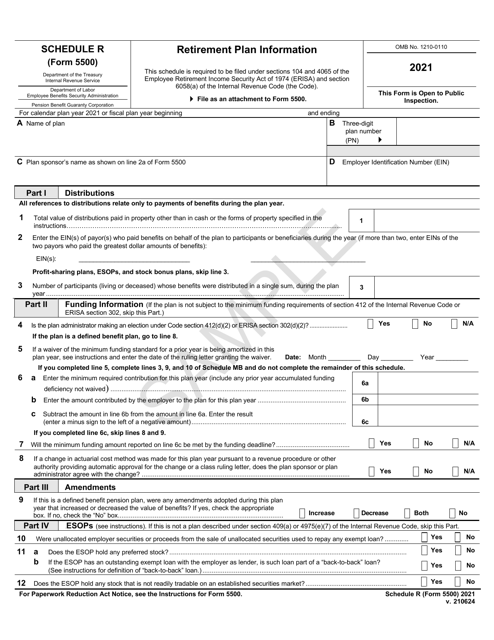

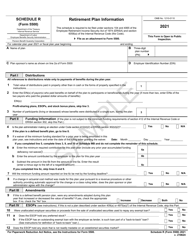

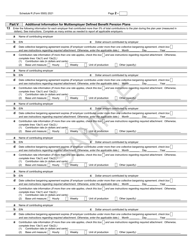

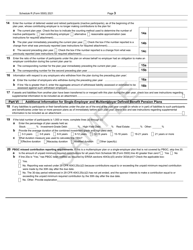

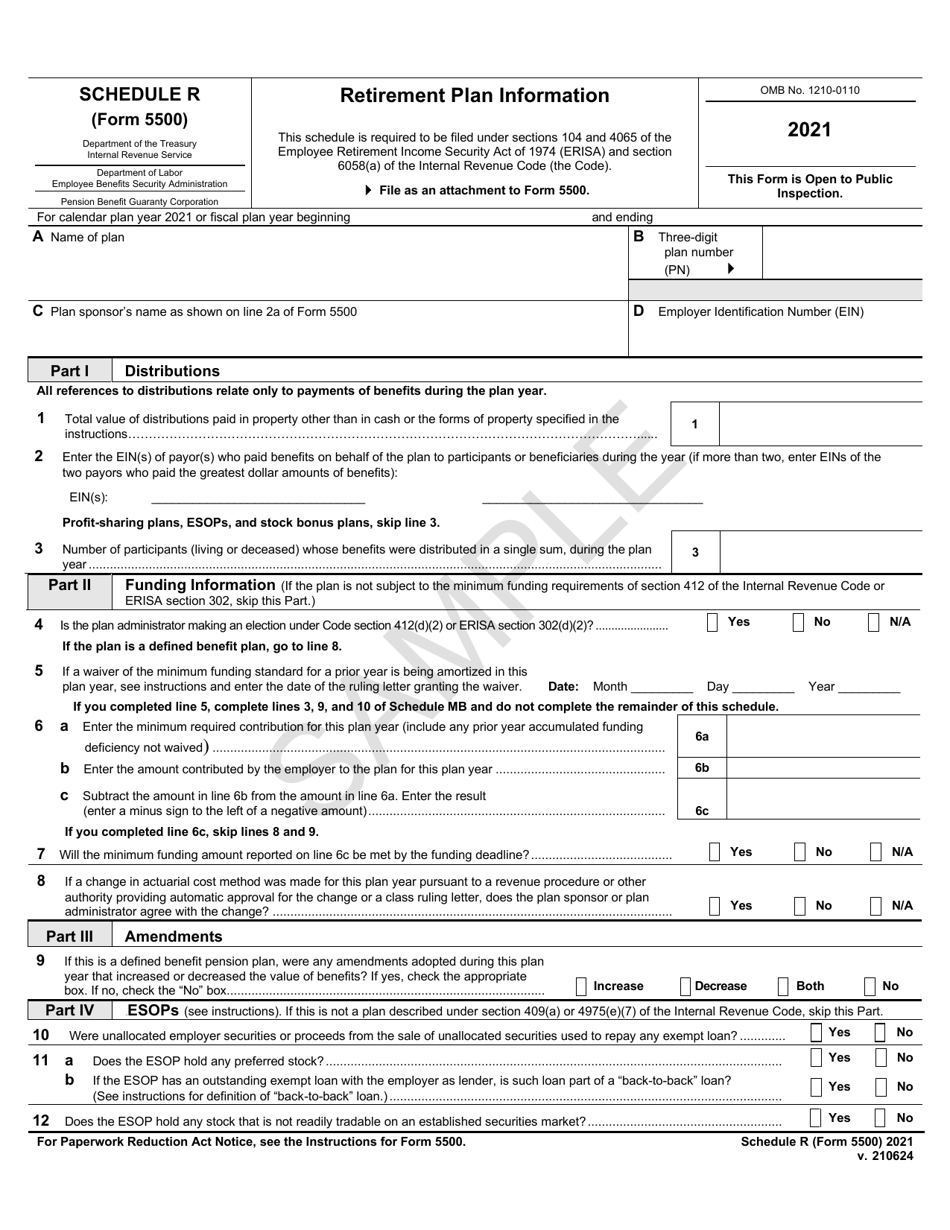

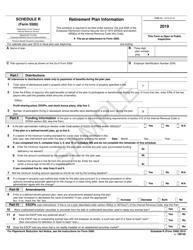

Form 5500 Schedule R

for the current year.

Form 5500 Schedule R Retirement Plan Information - Sample

What Is Form 5500 Schedule R?

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration on June 24, 2021 and used country-wide. The document is a supplement to Form 5500, Annual Return/Report of Employee Benefit Plan - Sample. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5500 Schedule R?

A: Form 5500 Schedule R is a form used to report information about retirement plans.

Q: Who needs to file Form 5500 Schedule R?

A: Employers who sponsor retirement plans and plan administrators must file Form 5500 Schedule R.

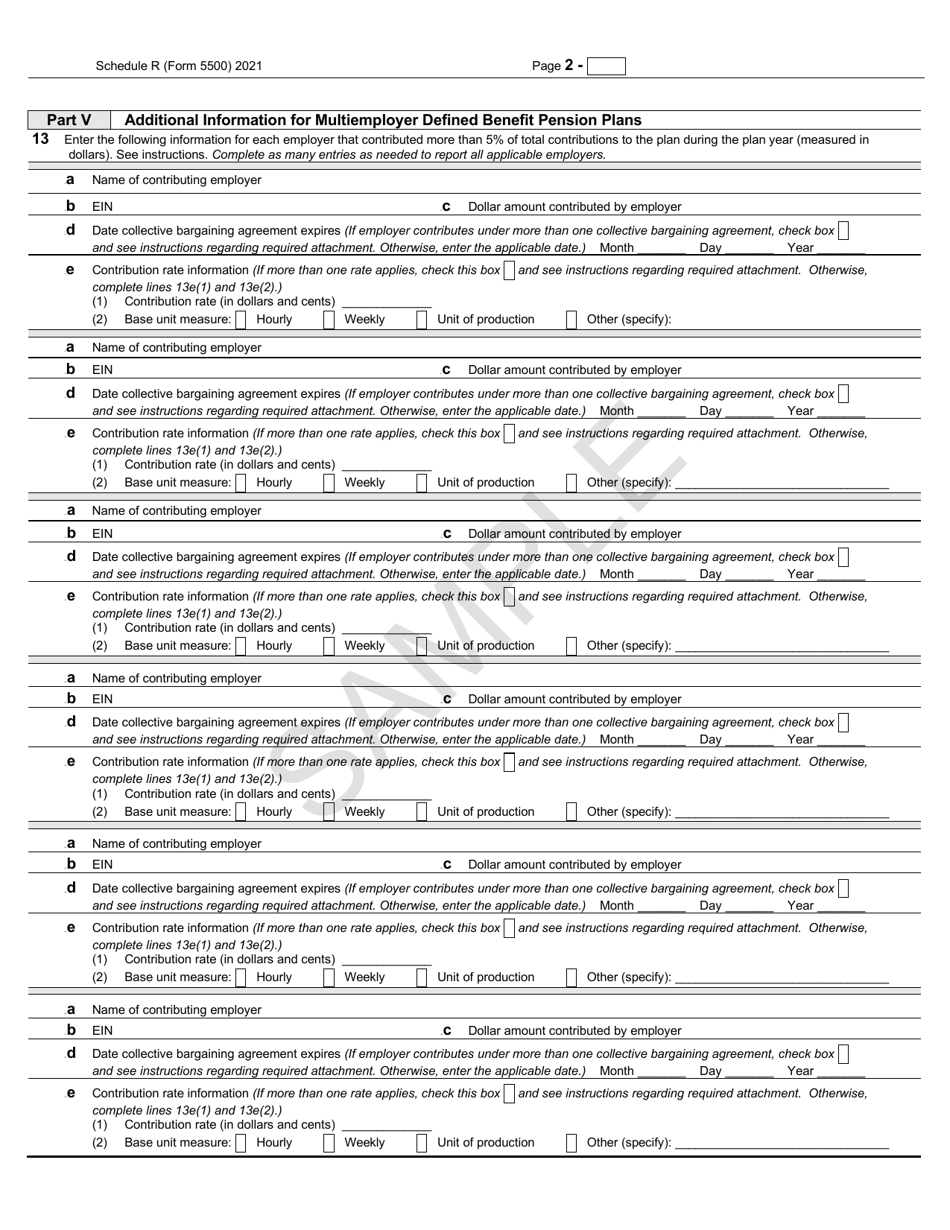

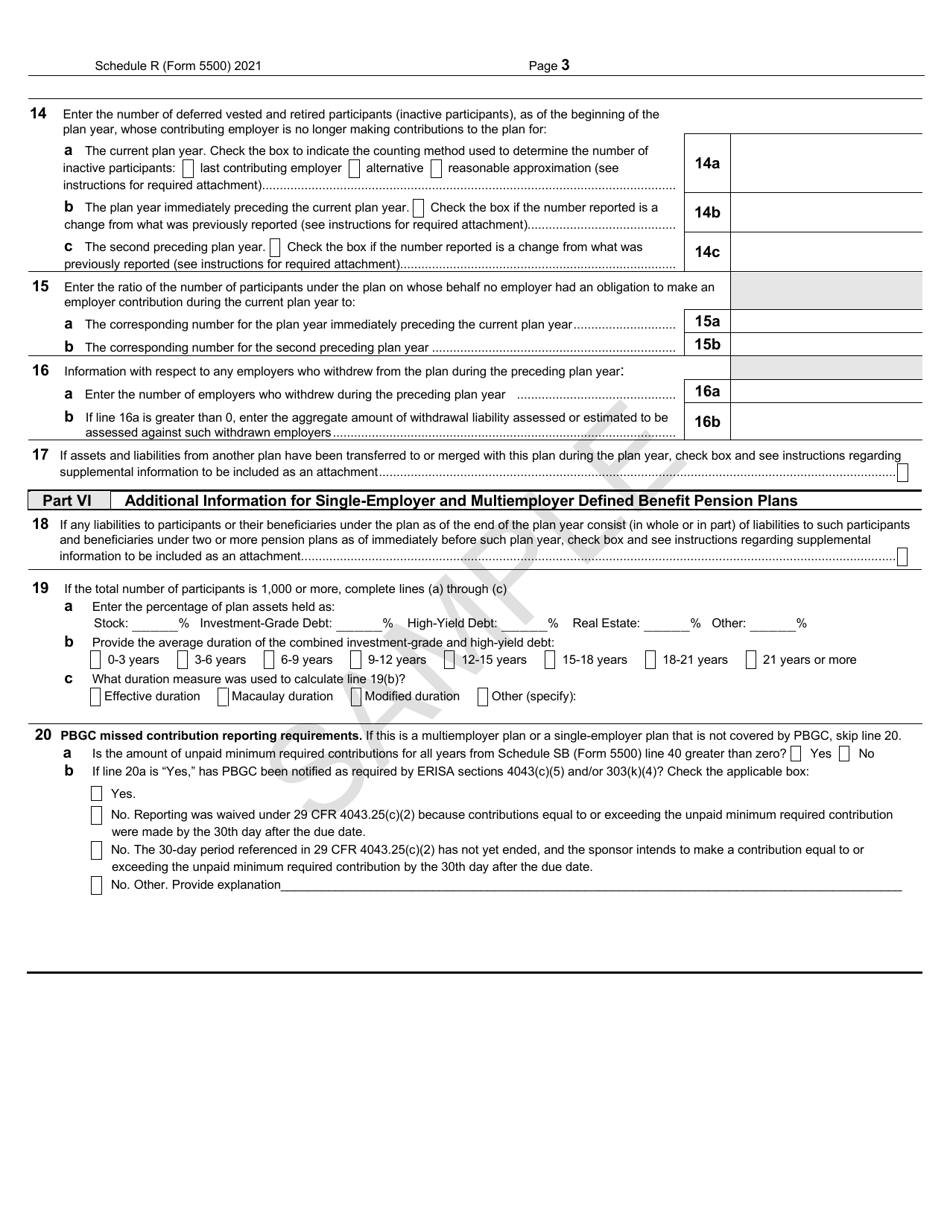

Q: What information is required on Form 5500 Schedule R?

A: Form 5500 Schedule R requires information such as the plan name, plan number, plan administrator's name, and financial information about the plan.

Q: When is Form 5500 Schedule R due?

A: Form 5500 Schedule R is due by the last day of the seventh month after the plan year ends.

Form Details:

- Released on June 24, 2021;

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5500 Schedule R by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.