This version of the form is not currently in use and is provided for reference only. Download this version of

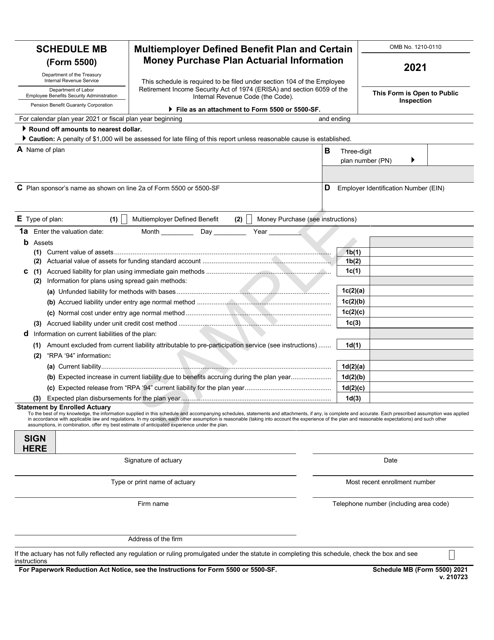

Form 5500 Schedule MB

for the current year.

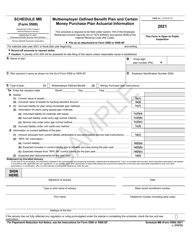

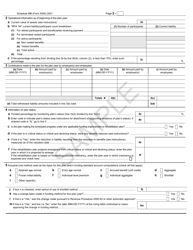

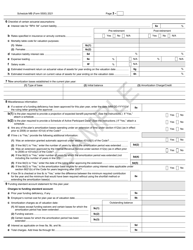

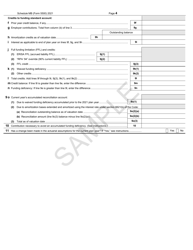

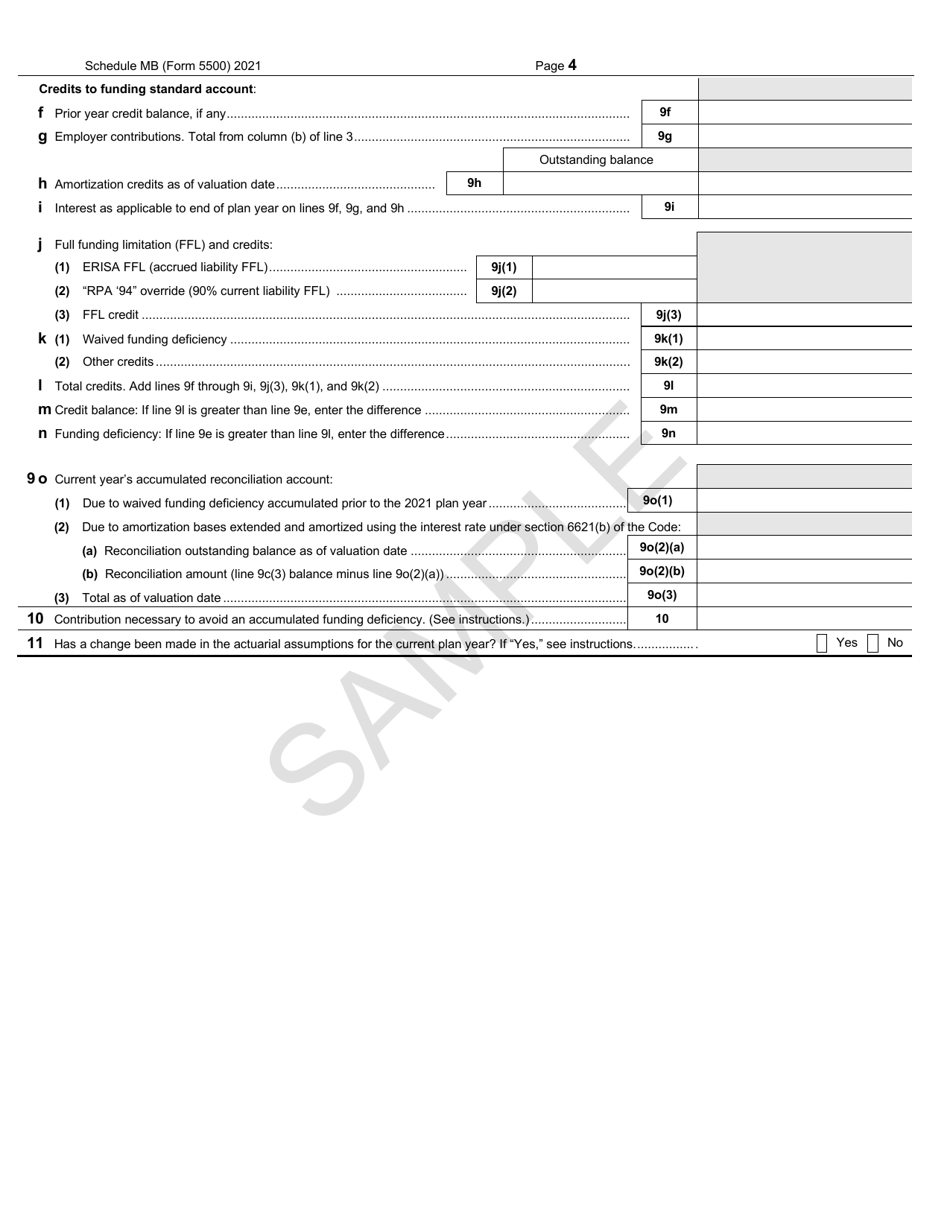

Form 5500 Schedule MB Multiemployer Defined Benefit Plan and Certain Money Purchase Plan Actuarial Information - Sample

What Is Form 5500 Schedule MB?

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration on July 23, 2021 and used country-wide. The document is a supplement to Form 5500, Annual Return/Report of Employee Benefit Plan - Sample. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5500 Schedule MB?

A: Form 5500 Schedule MB is a form that provides actuarial information for multiemployer defined benefit plans and certain money purchase plans.

Q: What is the purpose of Form 5500 Schedule MB?

A: The purpose of Form 5500 Schedule MB is to report actuarial information about these types of pension plans.

Q: Who is required to file Form 5500 Schedule MB?

A: Employers who have multiemployer defined benefit plans or certain money purchase plans are required to file Form 5500 Schedule MB.

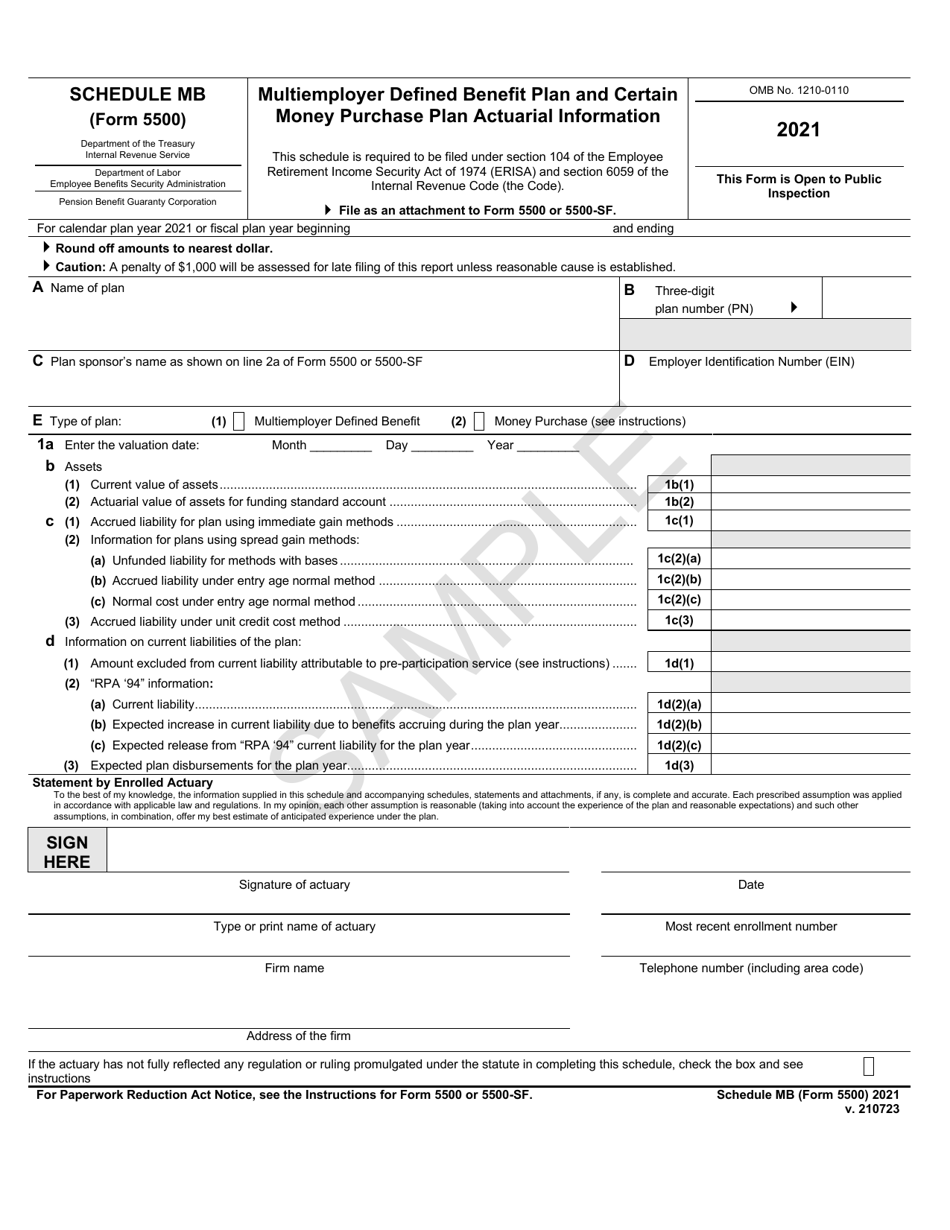

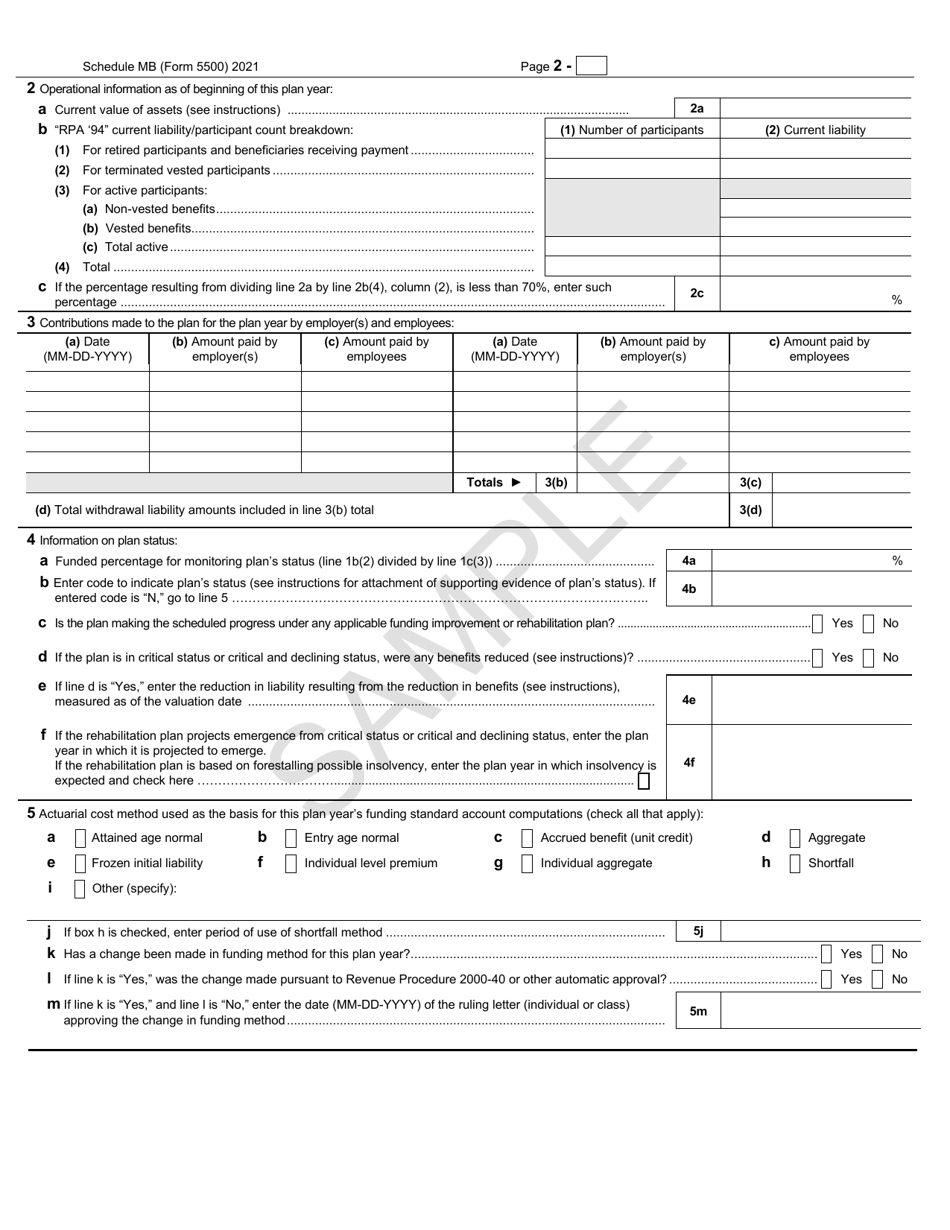

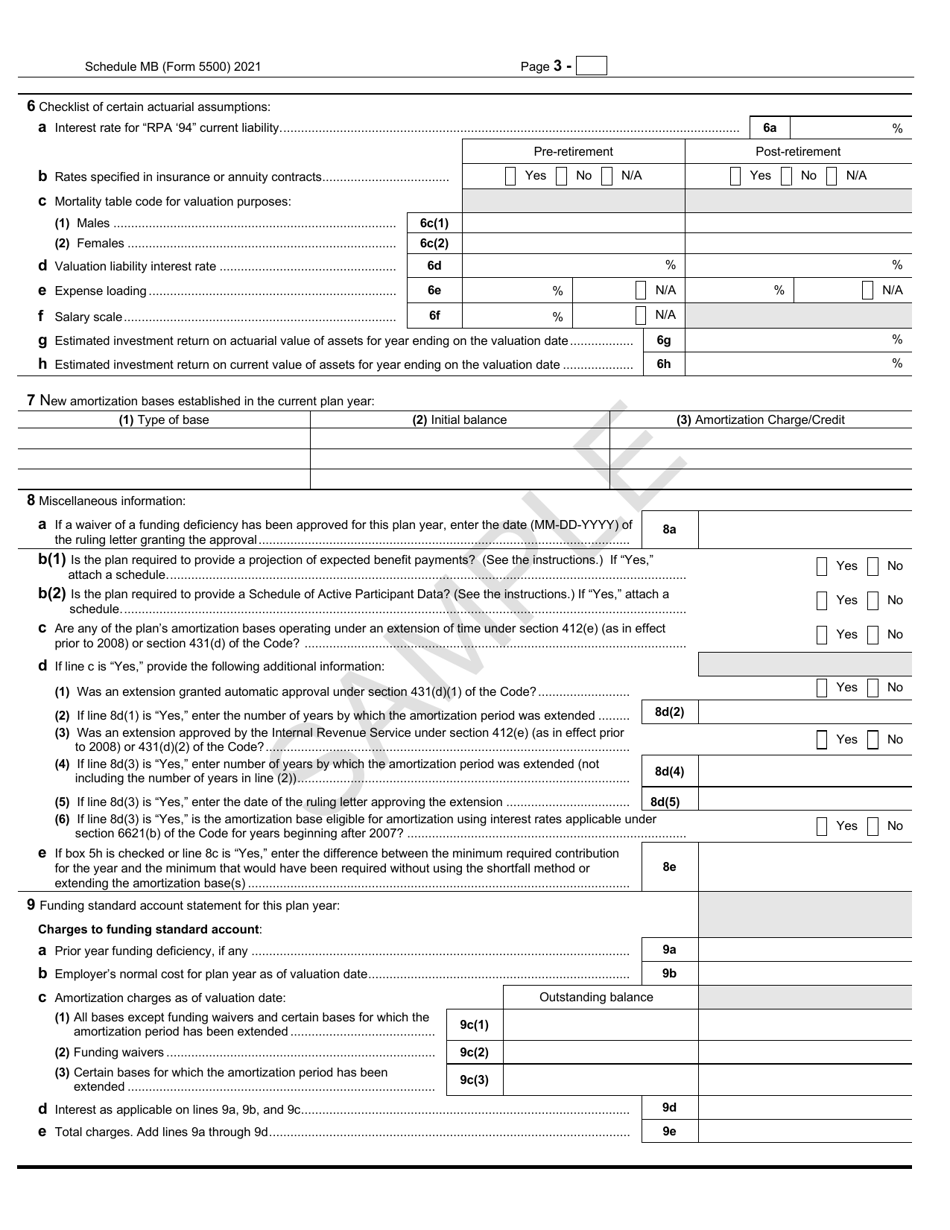

Q: What information is included in Form 5500 Schedule MB?

A: Form 5500 Schedule MB includes information such as the plan's funding status, contribution rates, and accounting for plan changes.

Q: Do individual plan participants need to file Form 5500 Schedule MB?

A: No, individuals do not need to file Form 5500 Schedule MB. It is filed by the employer or plan administrator.

Q: Are there any penalties for not filing Form 5500 Schedule MB?

A: Yes, there are penalties for not filing Form 5500 Schedule MB. The penalties can be significant and can increase for each day the form remains unfiled.

Form Details:

- Released on July 23, 2021;

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5500 Schedule MB by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.