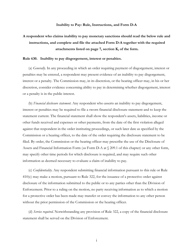

This version of the form is not currently in use and is provided for reference only. Download this version of

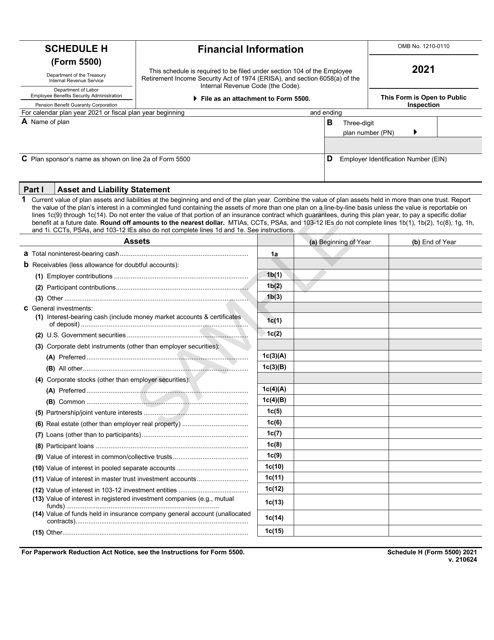

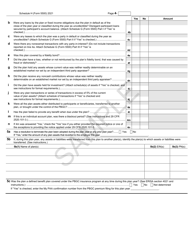

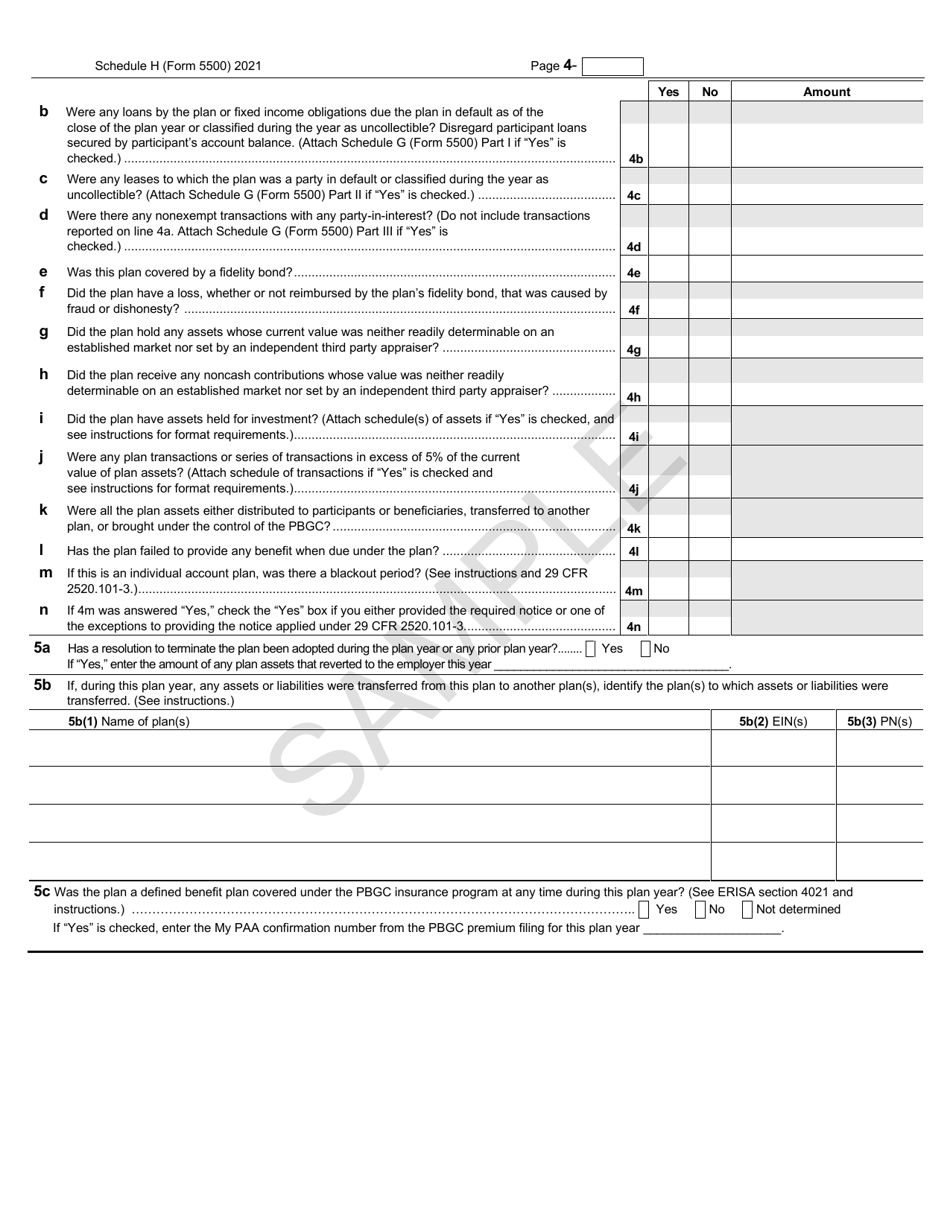

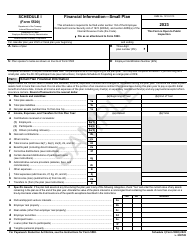

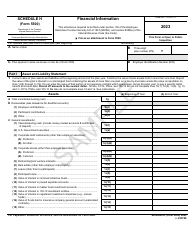

Form 5500 Schedule H

for the current year.

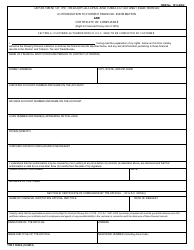

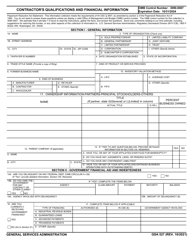

Form 5500 Schedule H Financial Information - Sample

What Is Form 5500 Schedule H?

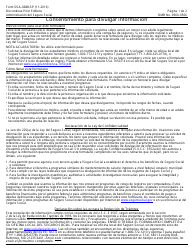

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration and used country-wide. The document is a supplement to Form 5500, Annual Return/Report of Employee Benefit Plan - Sample. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5500 Schedule H?

A: Form 5500 Schedule H is a financial information form that must be filed with the IRS by retirement plans and employee benefit plans.

Q: Who needs to file Form 5500 Schedule H?

A: Retirement plans and employee benefit plans are required to file Form 5500 Schedule H.

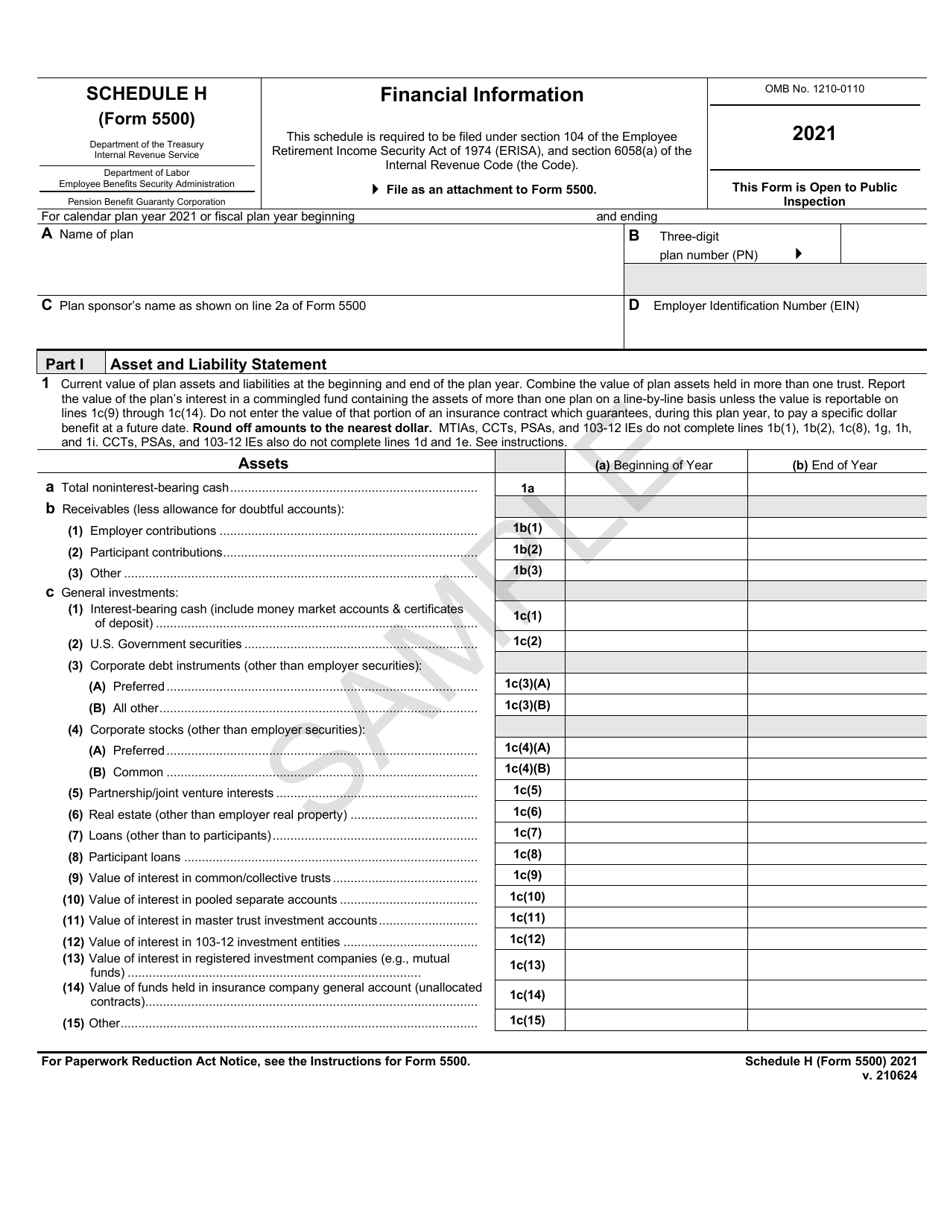

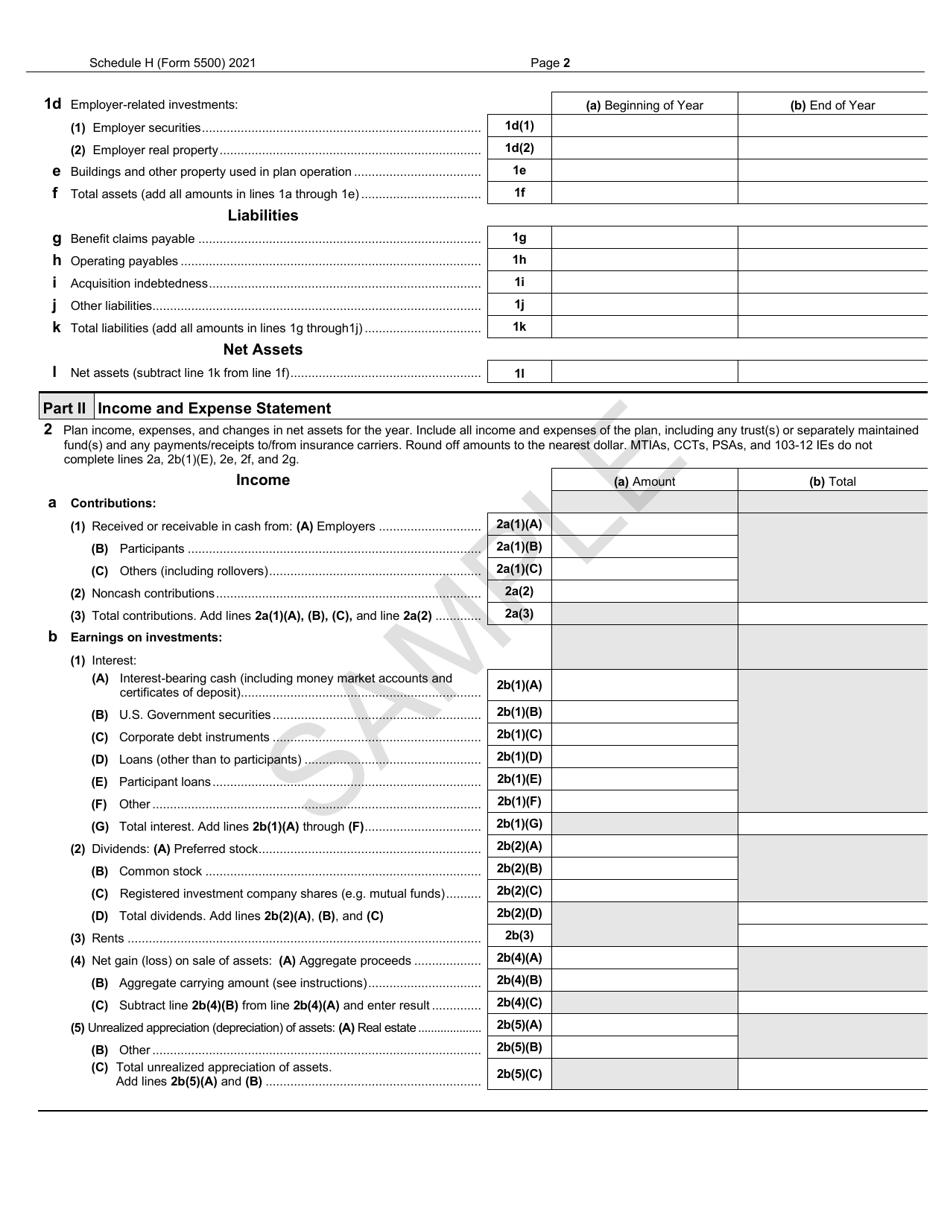

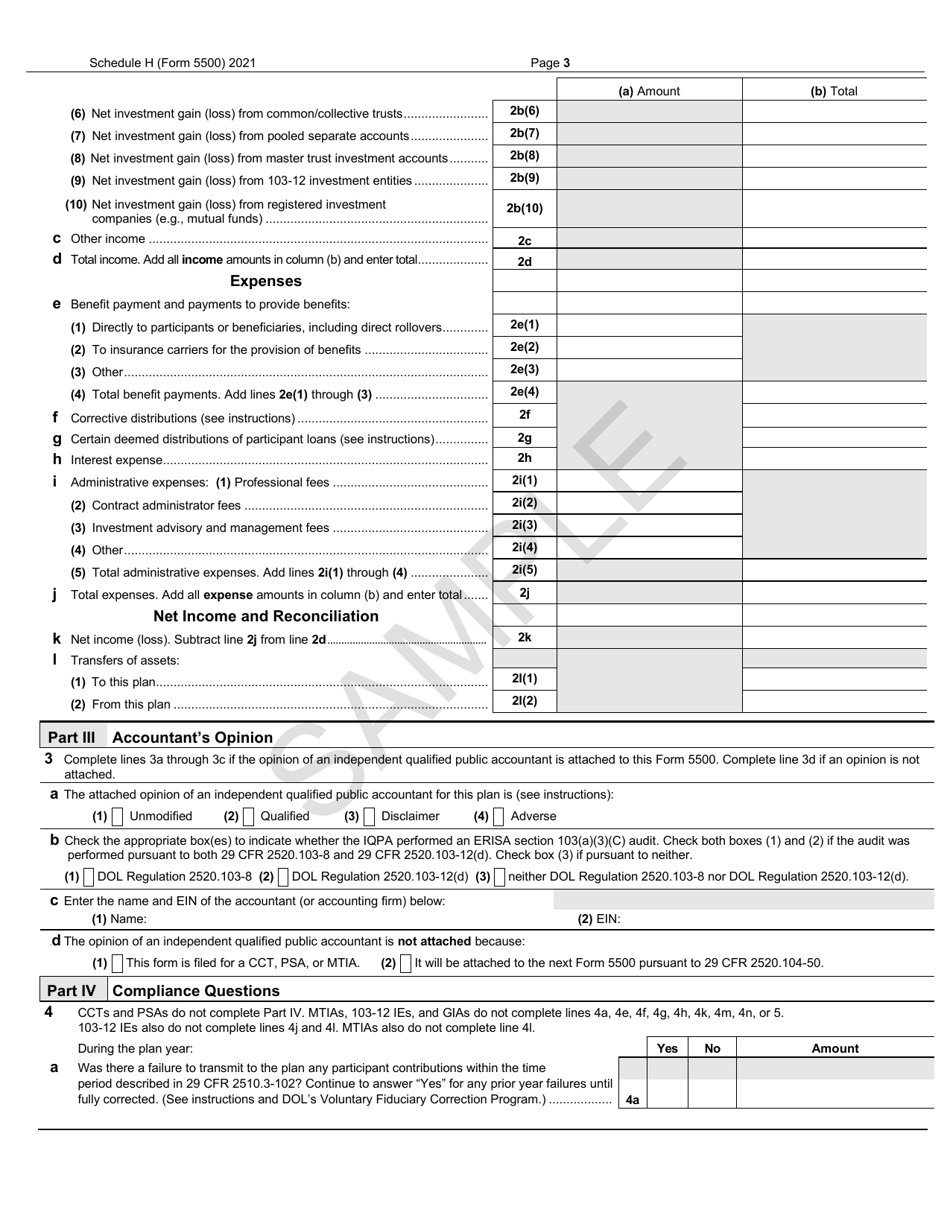

Q: What information does Form 5500 Schedule H contain?

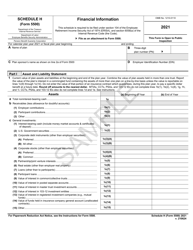

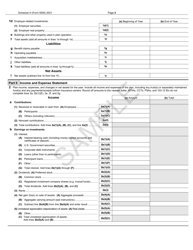

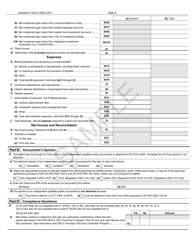

A: Form 5500 Schedule H contains financial information about the plan, including its assets, liabilities, income, and expenses.

Q: Why is Form 5500 Schedule H important?

A: Form 5500 Schedule H provides transparency and accountability for retirement plans and employee benefit plans, ensuring that they are properly managing their finances.

Q: How often do you need to file Form 5500 Schedule H?

A: Form 5500 Schedule H must be filed annually.

Q: What are the consequences of not filing Form 5500 Schedule H?

A: Failure to file Form 5500 Schedule H can result in penalties and legal consequences, including fines and possible loss of tax-exempt status for the plan.

Q: Is there a deadline for filing Form 5500 Schedule H?

A: Yes, Form 5500 Schedule H must be filed by the last day of the seventh month after the plan year ends.

Q: Can I file Form 5500 Schedule H electronically?

A: Yes, you can file Form 5500 Schedule H electronically through the Department of Labor's EFAST2 system or through approved vendors.

Q: Do I need to attach any additional documents with Form 5500 Schedule H?

A: Depending on the plan, you may need to attach additional schedules and documents, such as audited financial statements or actuarial reports, with Form 5500 Schedule H.

Form Details:

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5500 Schedule H by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.