This version of the form is not currently in use and is provided for reference only. Download this version of

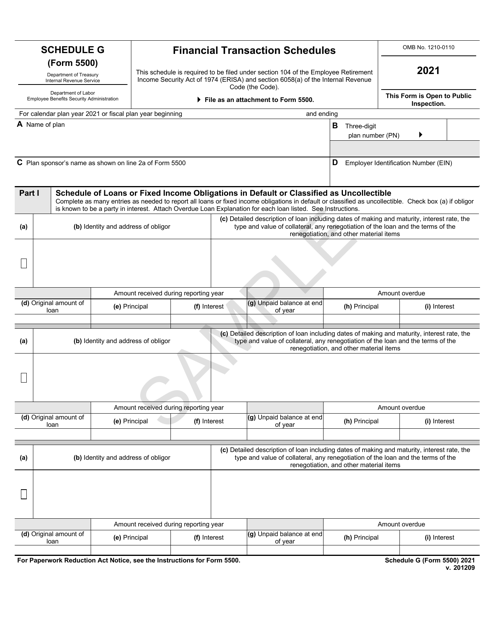

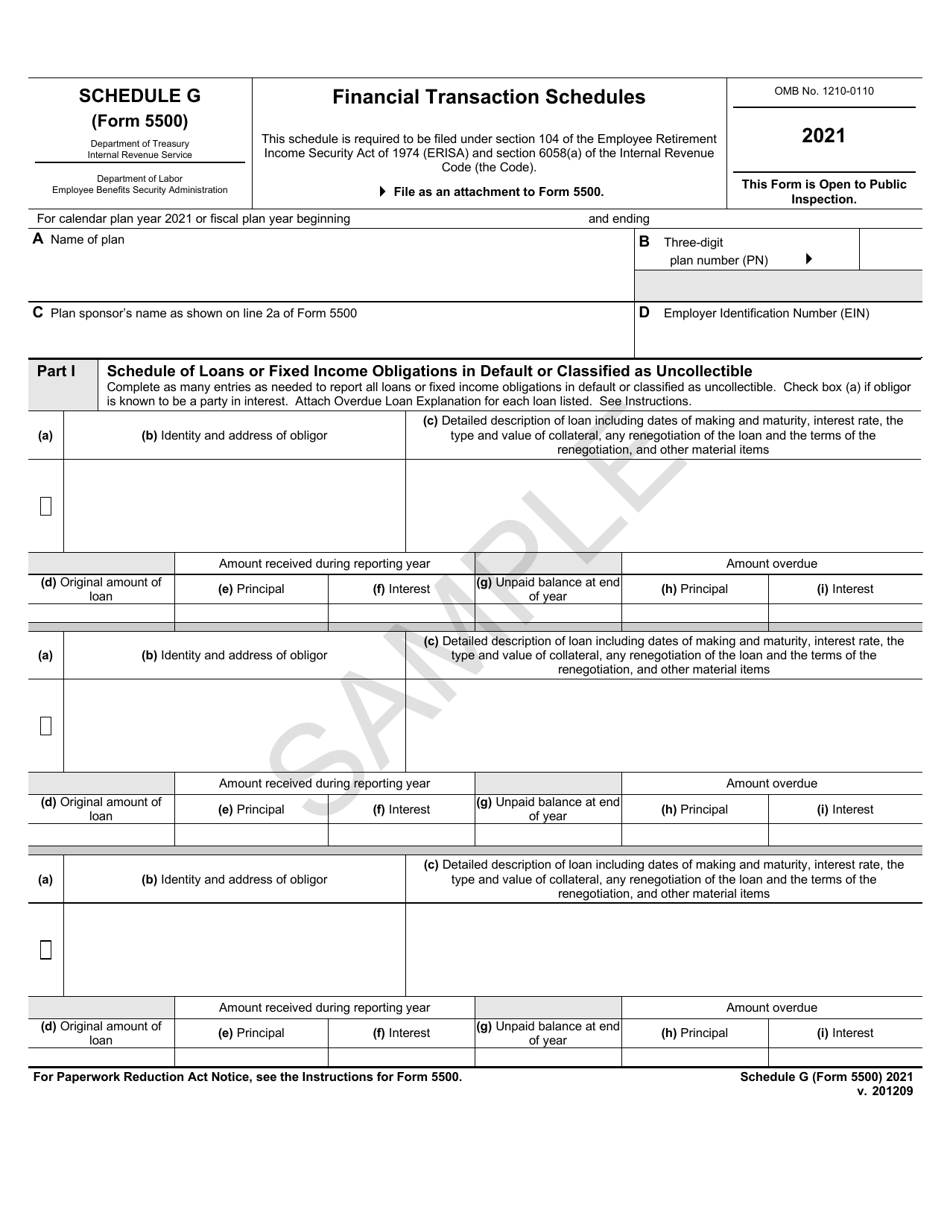

Form 5500 Schedule G

for the current year.

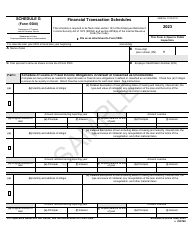

Form 5500 Schedule G Financial Transaction Schedules - Sample

What Is Form 5500 Schedule G?

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration and used country-wide. The document is a supplement to Form 5500, Annual Return/Report of Employee Benefit Plan - Sample. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5500 Schedule G?

A: Form 5500 Schedule G is a financial transaction schedule that needs to be filed along with Form 5500, the annual return/report for employee benefit plans.

Q: What is the purpose of Form 5500 Schedule G?

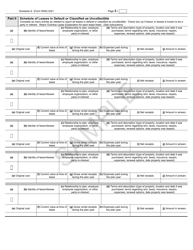

A: The purpose of Form 5500 Schedule G is to report any financial transactions or loans involving the plan, including any transactions with parties-in-interest.

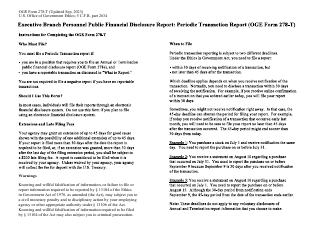

Q: Who needs to file Form 5500 Schedule G?

A: Form 5500 Schedule G needs to be filed by employee benefit plans that meet certain criteria, such as having 100 or more participants at the beginning of the plan year.

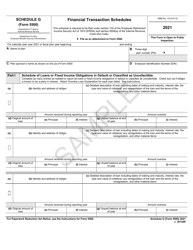

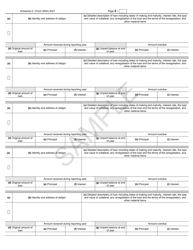

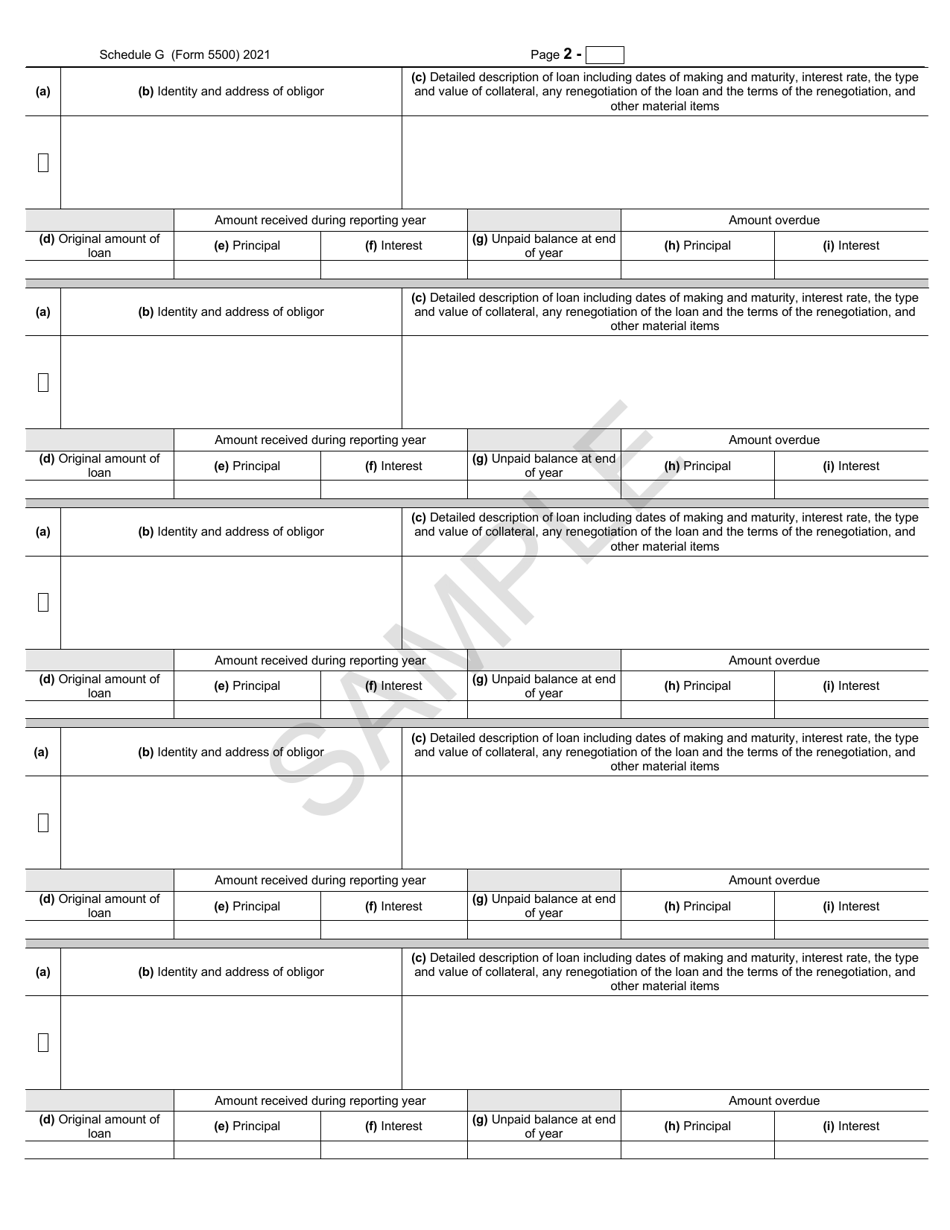

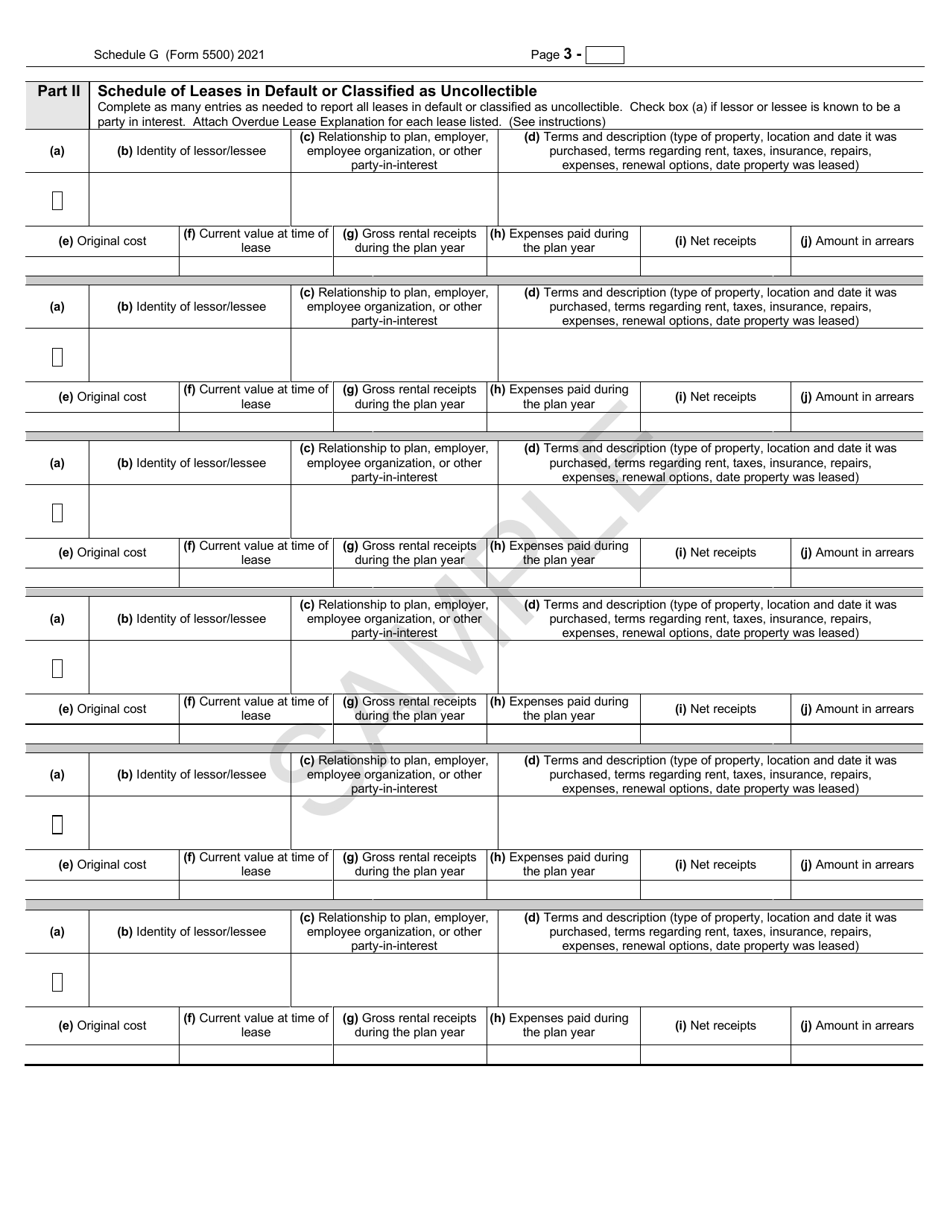

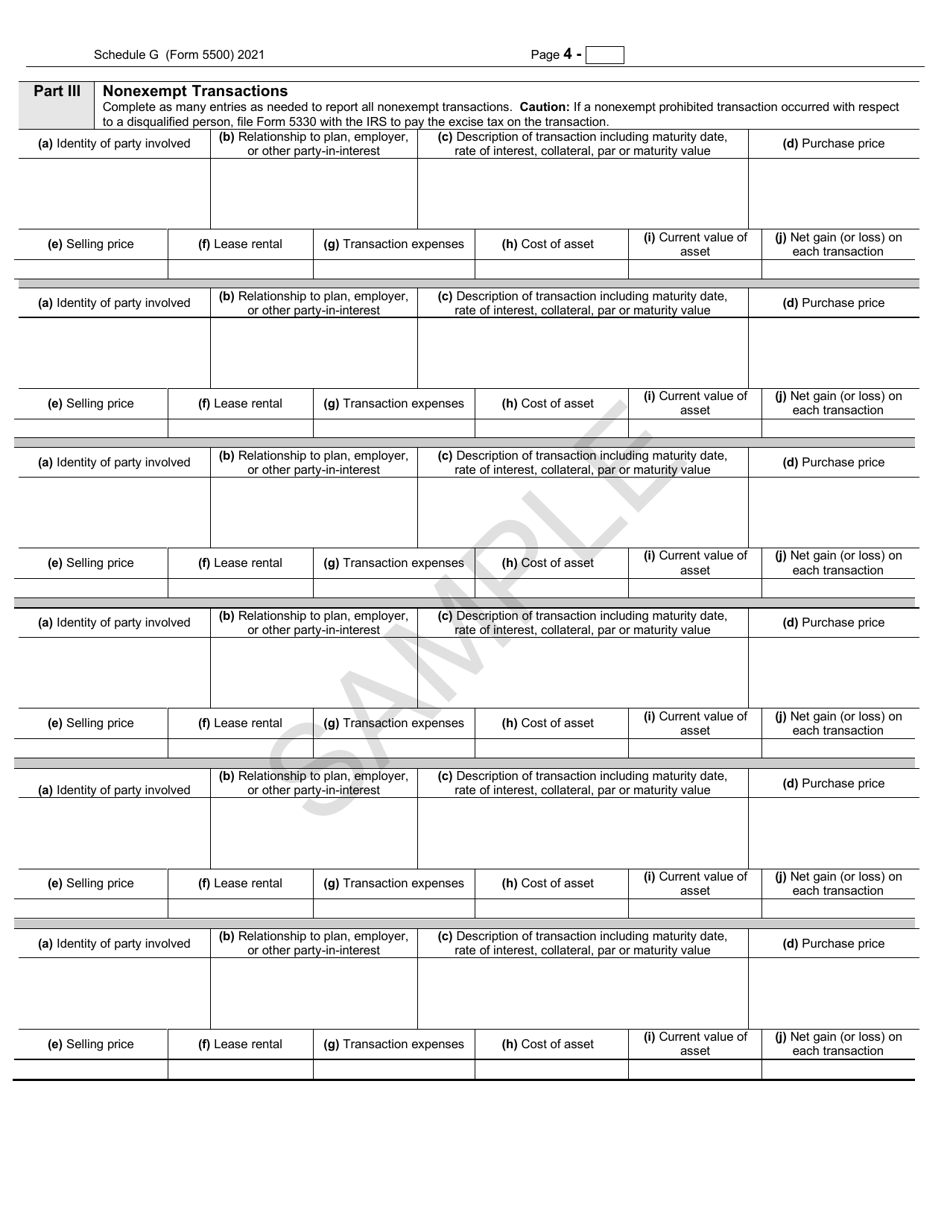

Q: What information is required on Form 5500 Schedule G?

A: Form 5500 Schedule G requires information about the plan's financial transactions, including loans made to or from the plan, as well as any transactions with parties-in-interest.

Form Details:

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5500 Schedule G by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.