This version of the form is not currently in use and is provided for reference only. Download this version of

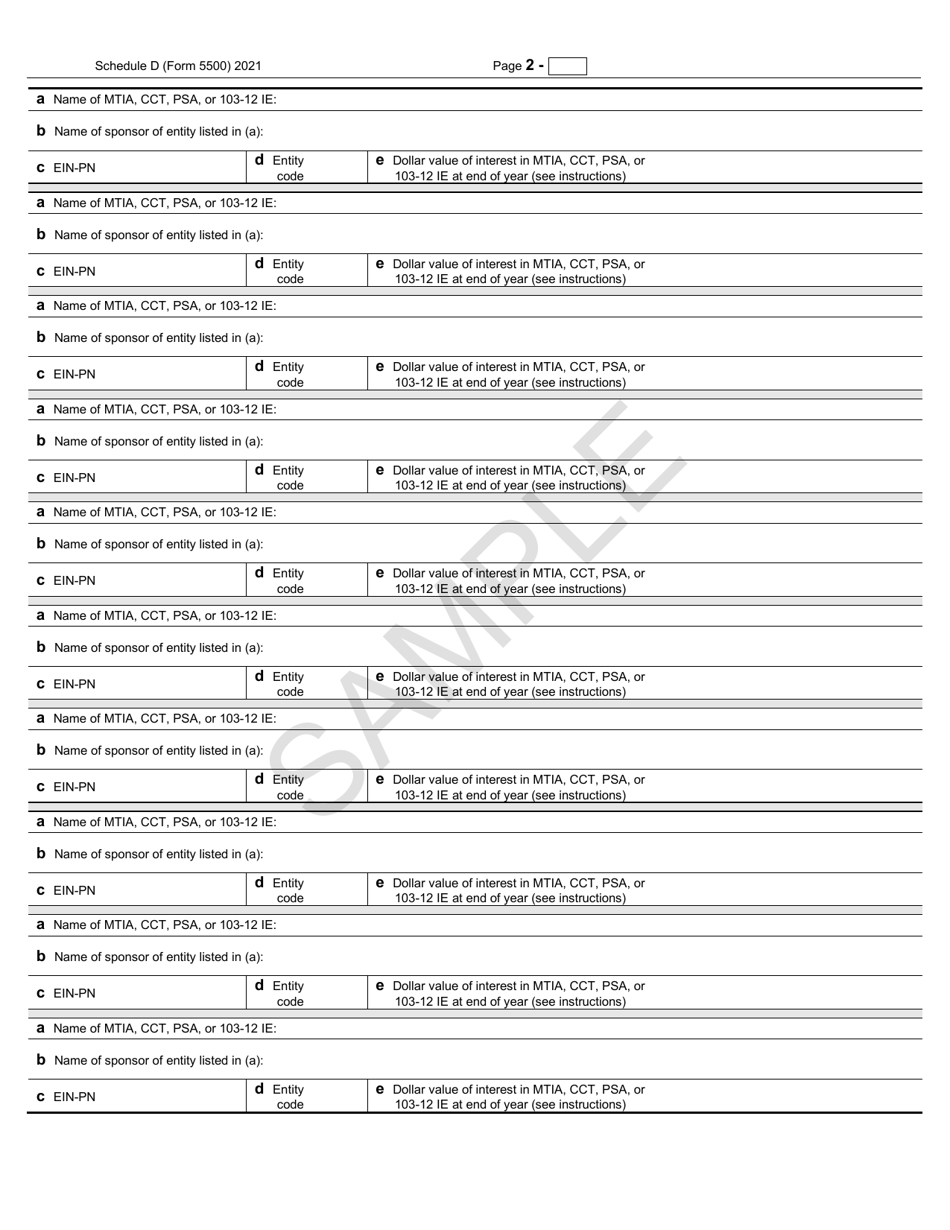

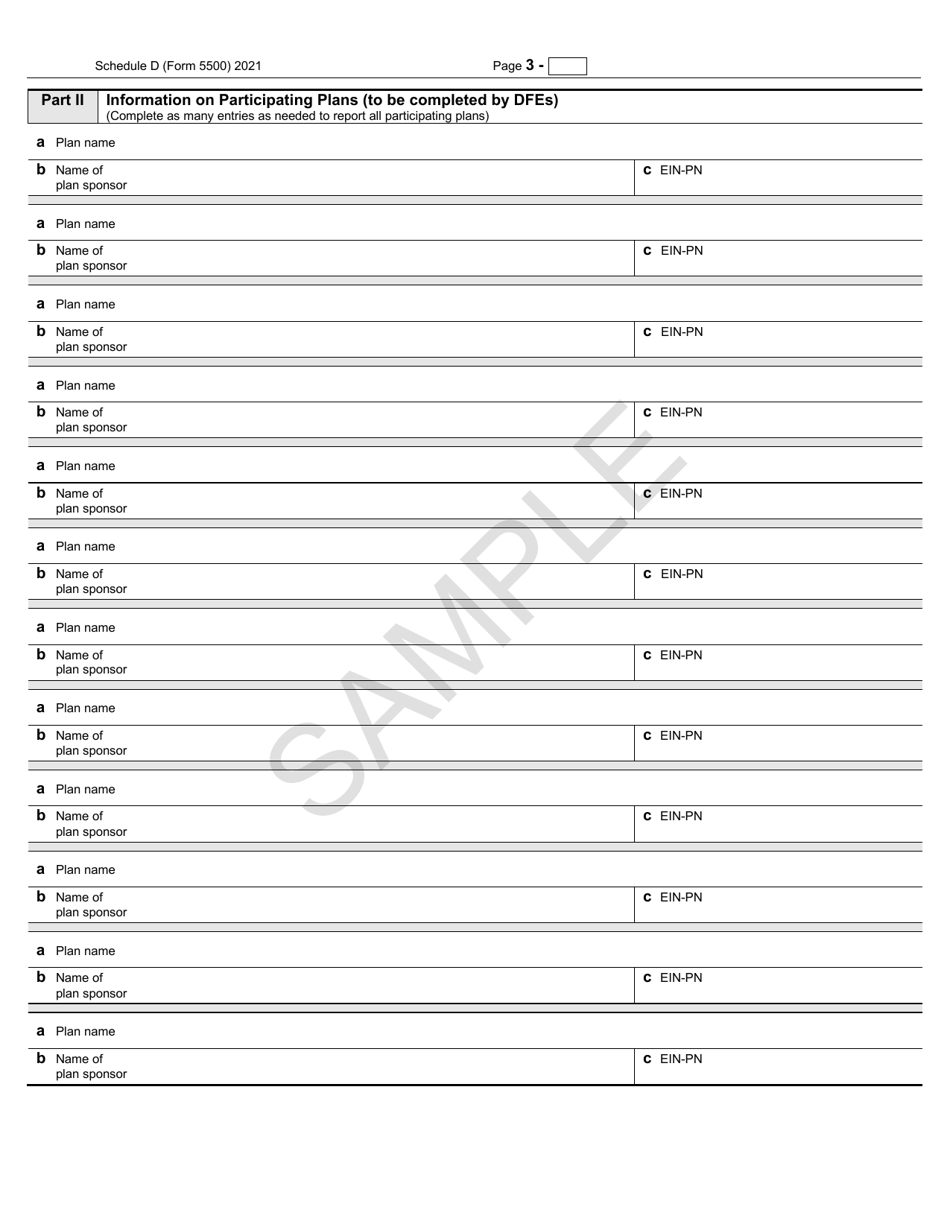

Form 5500 Schedule D

for the current year.

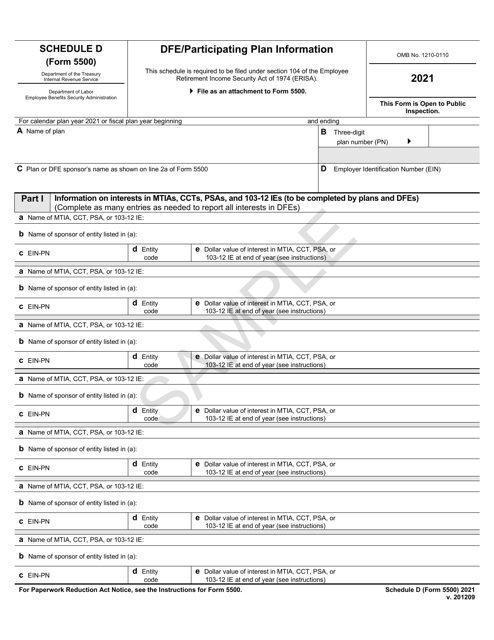

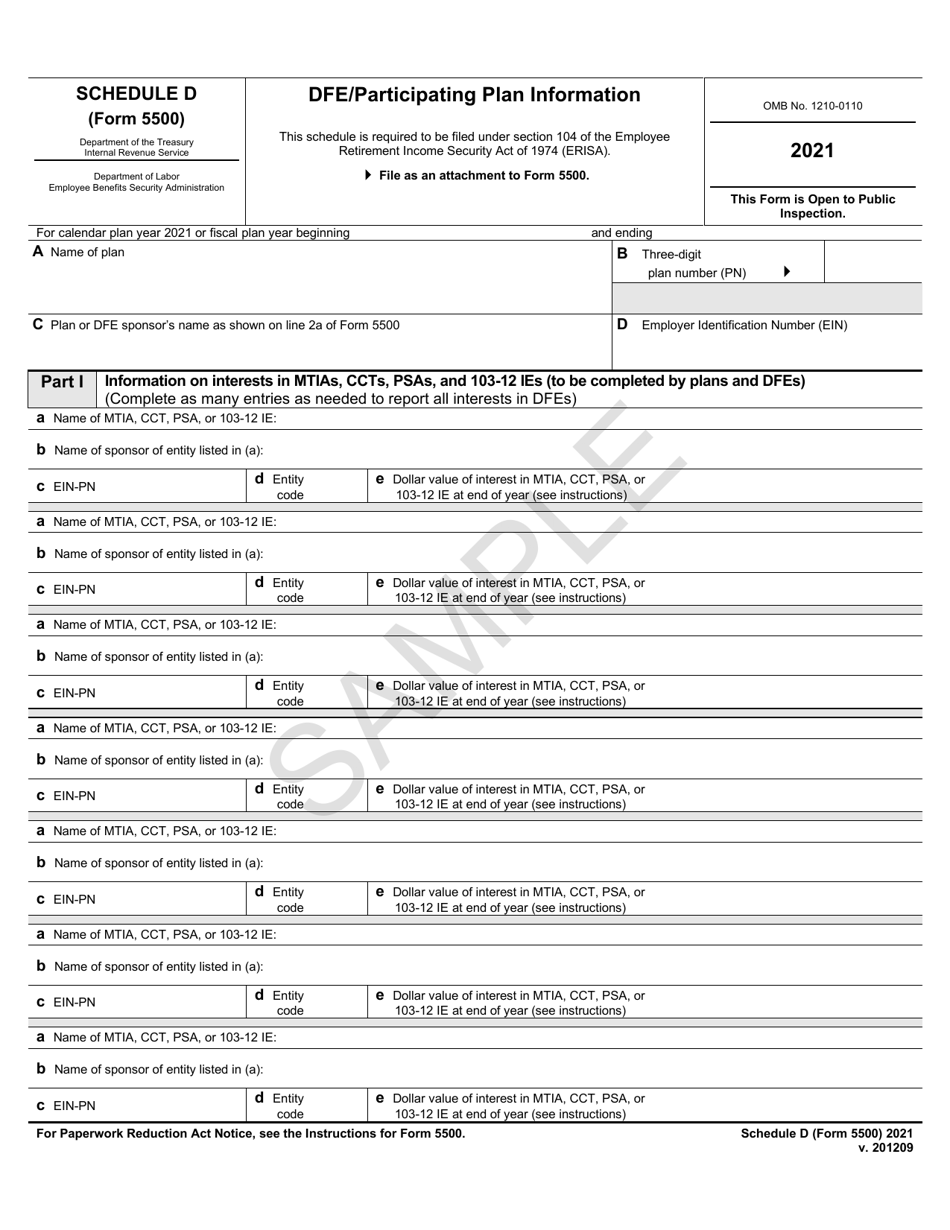

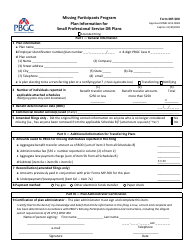

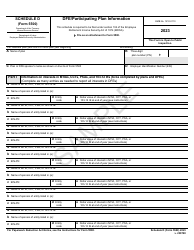

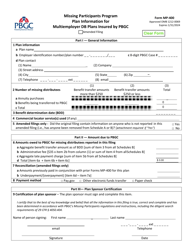

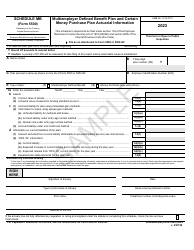

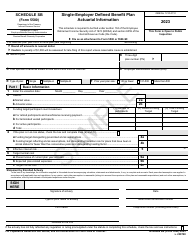

Form 5500 Schedule D Dfe / Participating Plan Information - Sample

What Is Form 5500 Schedule D?

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration and used country-wide. The document is a supplement to Form 5500, Annual Return/Report of Employee Benefit Plan - Sample. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5500 Schedule D?

A: Form 5500 Schedule D is a required filing with the U.S. Department of Labor (DOL) that provides detailed information about a retirement plan's investments.

Q: What is a DFE (Direct Filing Entity)?

A: A DFE (Direct Filing Entity) is a separate legal entity that files its own Form 5500 Schedule D to report the investments held by a group of retirement plans.

Q: What is Participating Plan Information?

A: Participating Plan Information refers to the details of individual retirement plans that are included in the group filing of a DFE.

Q: Why is Form 5500 Schedule D important?

A: Form 5500 Schedule D helps the DOL monitor and regulate the investments of retirement plans, ensuring they are in compliance with regulations and fiduciary responsibilities.

Q: Who is required to file Form 5500 Schedule D?

A: DFEs and participating plans are required to file Form 5500 Schedule D if they meet certain eligibility thresholds, such as having assets exceeding $10 million.

Q: What information is required in Form 5500 Schedule D?

A: Form 5500 Schedule D requires detailed information about the investments held by the retirement plans, including the name of the investment, fair market value, and type of asset class.

Q: When is Form 5500 Schedule D due?

A: Form 5500 Schedule D is generally due seven months after the end of the plan year, which is typically July 31st for calendar year plans.

Q: Are there any penalties for not filing Form 5500 Schedule D?

A: Yes, failure to file Form 5500 Schedule D can result in significant penalties, including fines and potential legal consequences.

Q: Can I file Form 5500 Schedule D electronically?

A: Yes, Form 5500 Schedule D can be filed electronically through the DOL's EFAST2 system.

Q: Is Form 5500 Schedule D the only filing required for retirement plans?

A: No, Form 5500 Schedule D is just one part of the overall Form 5500 series, which includes additional schedules and attachments depending on the specific characteristics of the retirement plan.

Form Details:

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5500 Schedule D by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.