This version of the form is not currently in use and is provided for reference only. Download this version of

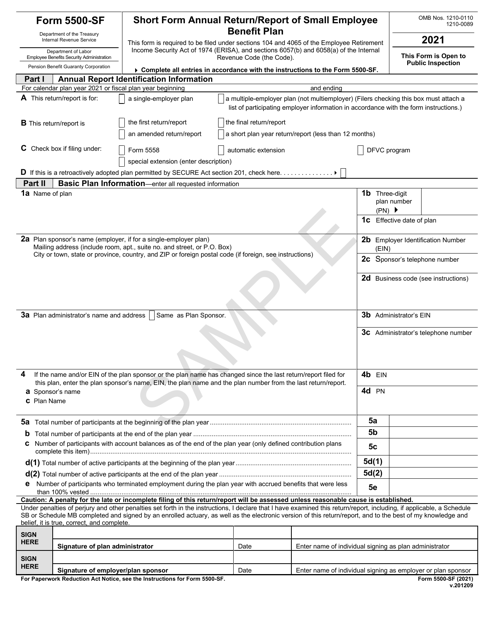

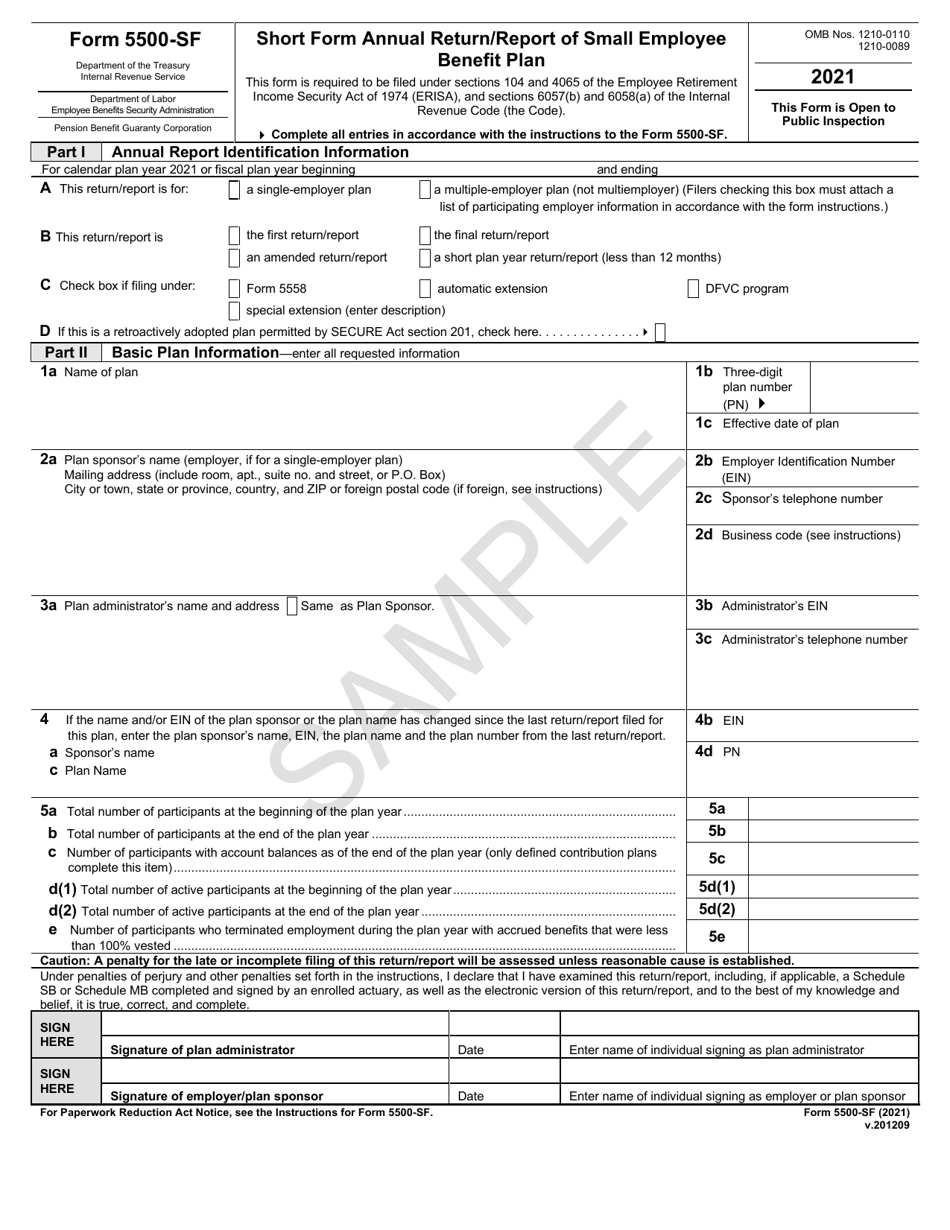

Form 5500-SF

for the current year.

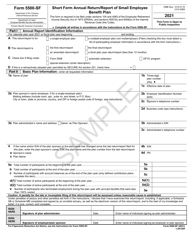

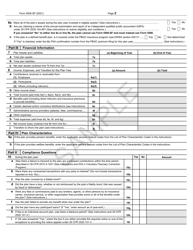

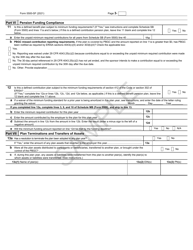

Form 5500-SF Short Form Annual Return / Report of Small Employee Benefit Plan - Sample

What Is Form 5500-SF?

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration on December 9, 2020 and used country-wide. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 5500-SF?

A: Form 5500-SF is a short form annual return/report for small employee benefit plans.

Q: Who needs to file Form 5500-SF?

A: Small employee benefit plans need to file Form 5500-SF.

Q: What is the purpose of filing Form 5500-SF?

A: The purpose of filing Form 5500-SF is to report financial information and other relevant details about the employee benefit plan.

Q: Is Form 5500-SF mandatory?

A: Yes, filing Form 5500-SF is mandatory for small employee benefit plans.

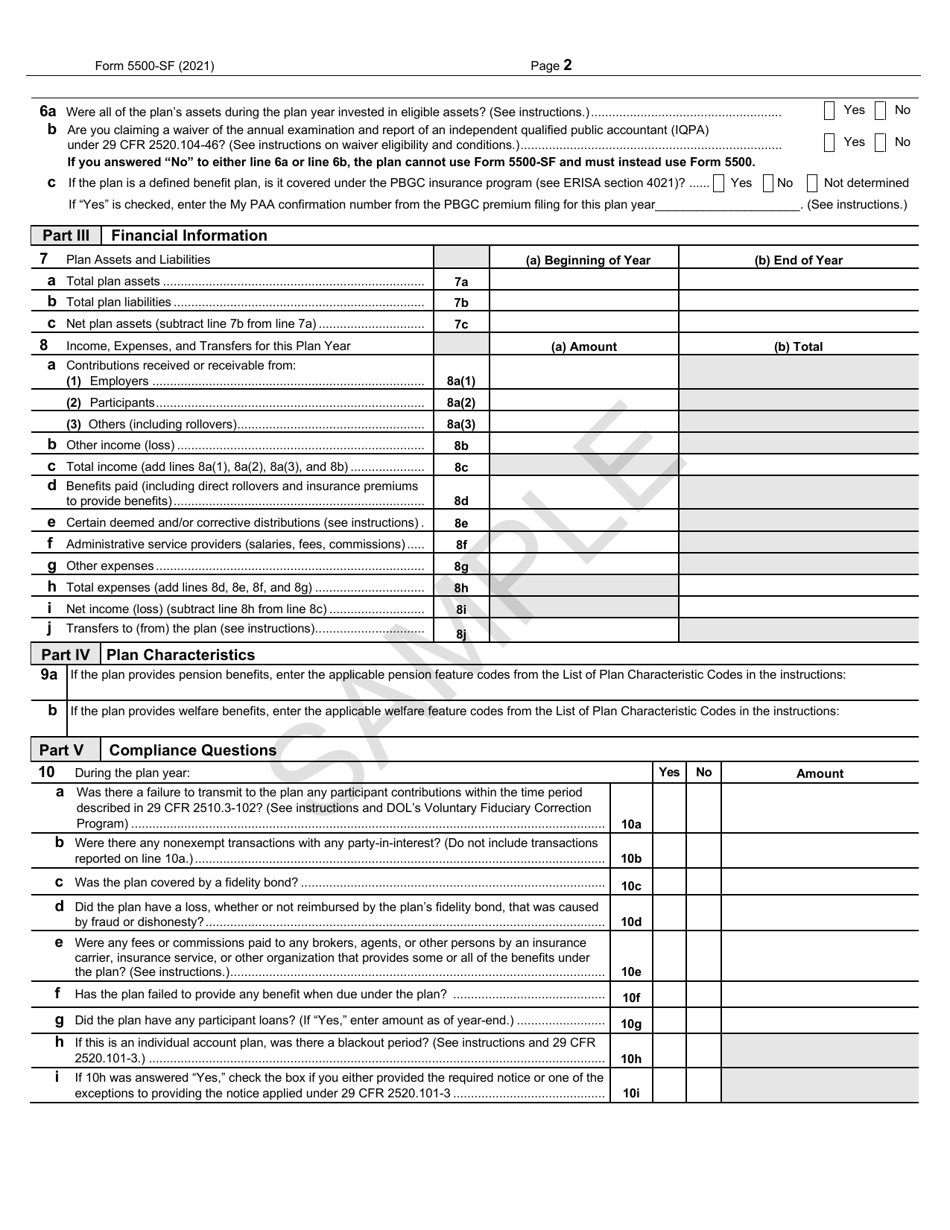

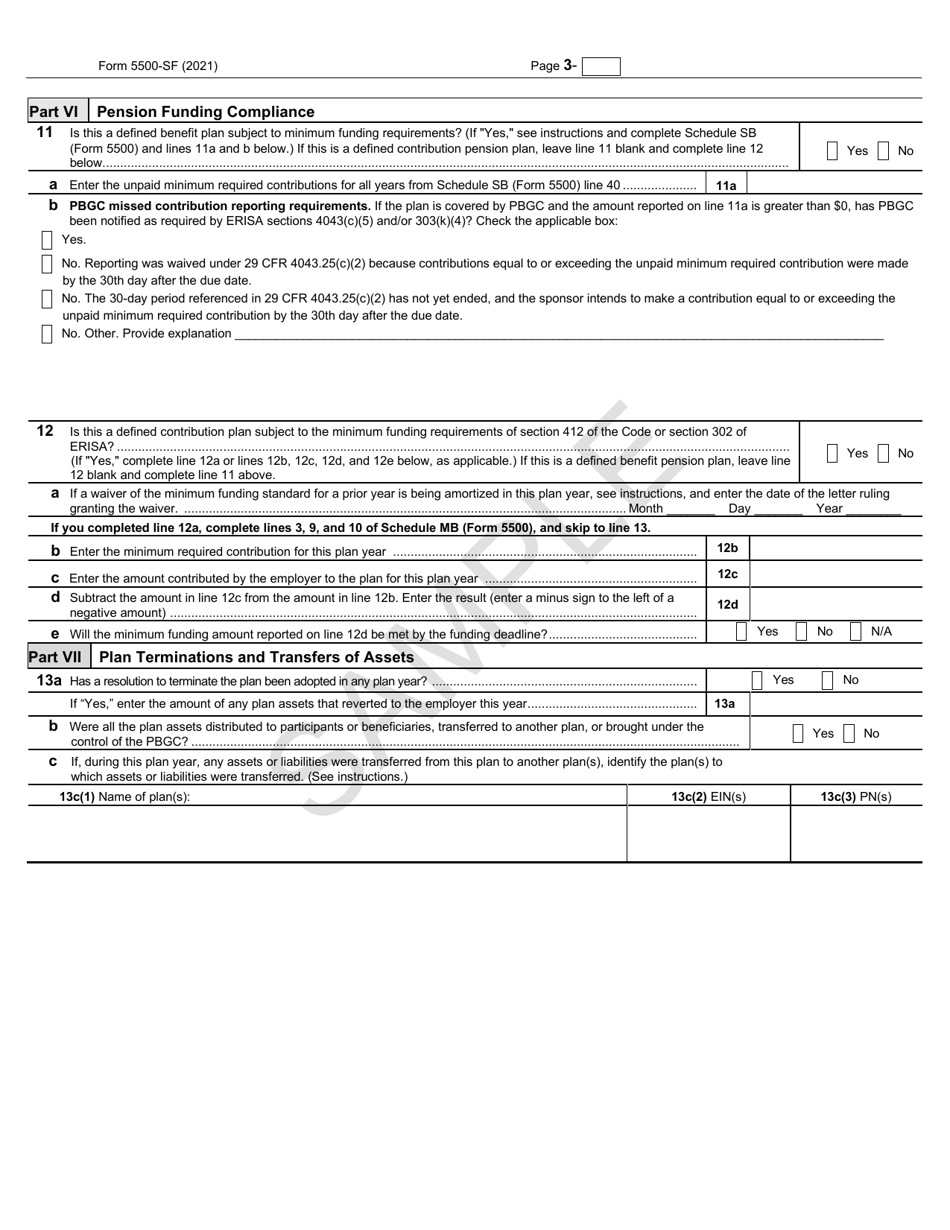

Q: What information is required in Form 5500-SF?

A: Form 5500-SF requires information on plan assets, participant counts, financial transactions, and other plan details.

Q: When is the deadline to file Form 5500-SF?

A: The deadline to file Form 5500-SF is generally the last day of the seventh month after the plan year ends.

Form Details:

- Released on December 9, 2020;

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 5500-SF by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.