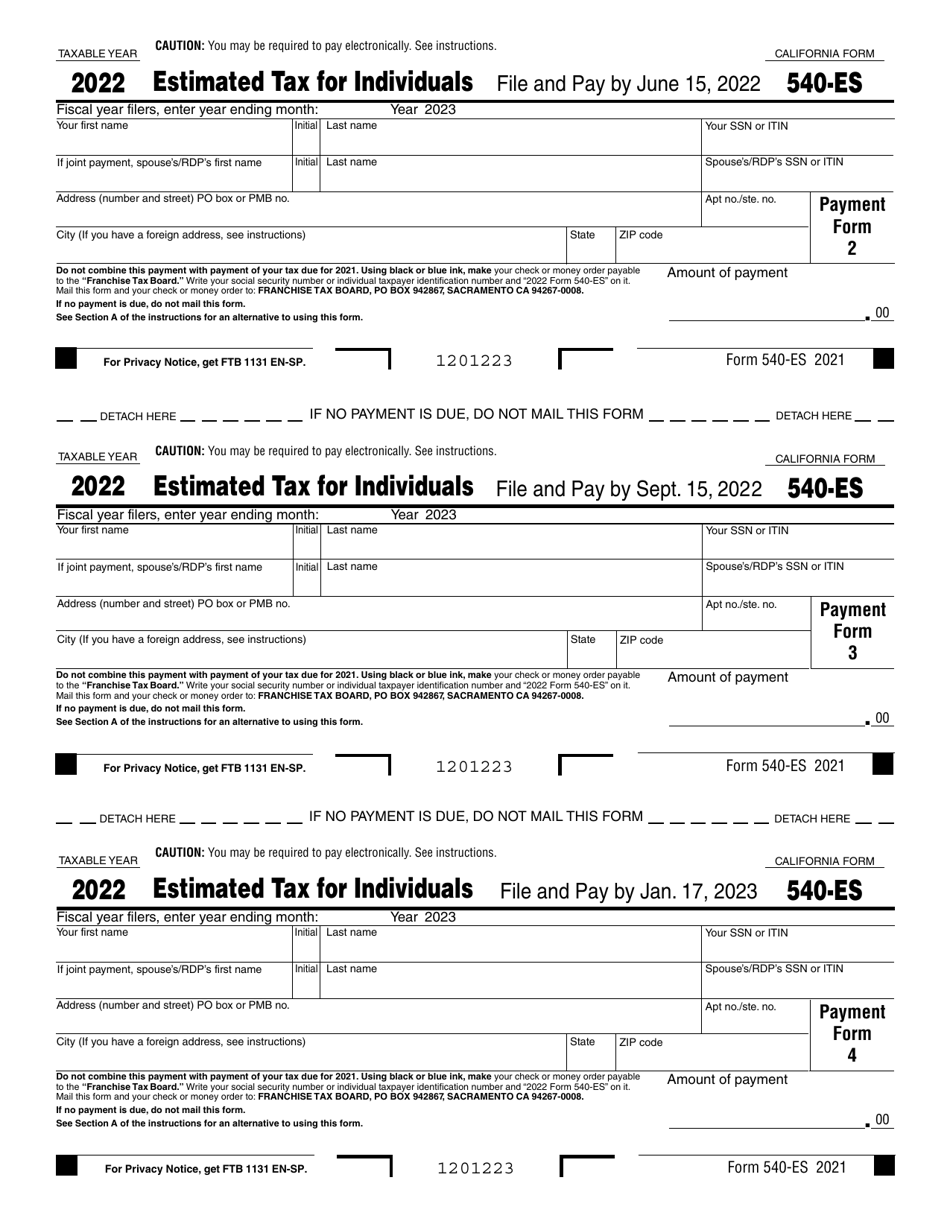

This version of the form is not currently in use and is provided for reference only. Download this version of

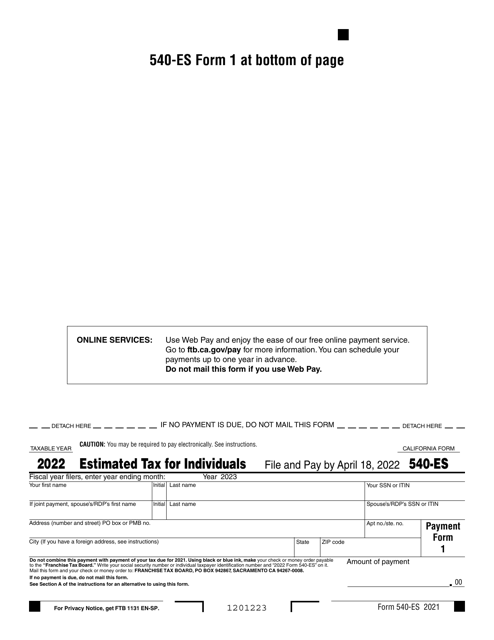

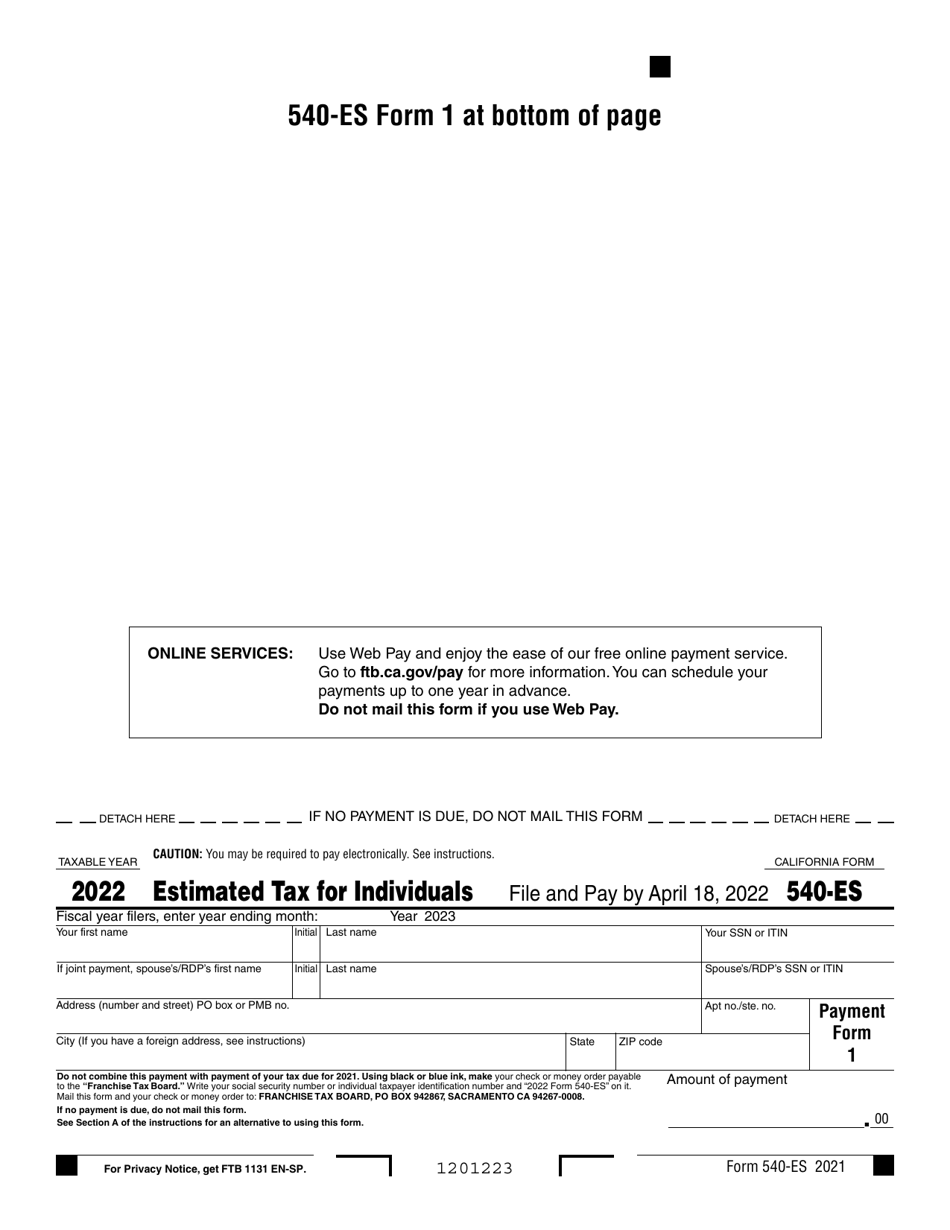

Form 540-ES

for the current year.

Form 540-ES Estimated Tax for Individuals - California

What Is Form 540-ES?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 540-ES?

A: Form 540-ES is a tax form used by individuals in California to pay estimated taxes.

Q: Who needs to file Form 540-ES?

A: Individuals in California who expect to owe tax of $500 or more for the tax year need to file Form 540-ES.

Q: What is the purpose of Form 540-ES?

A: The purpose of Form 540-ES is to help individuals in California pay their estimated tax liabilities throughout the year.

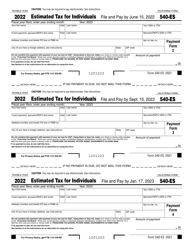

Q: When is Form 540-ES due?

A: Form 540-ES is generally due on April 15th, June 15th, September 15th, and January 15th of the following year.

Q: What happens if I don't file Form 540-ES?

A: If you don't file Form 540-ES or underpay your estimated taxes, you may be subject to penalties and interest.

Q: Are there any exceptions to filing Form 540-ES?

A: There are certain exceptions for farmers and fishermen, who may have different filing requirements.

Q: Can I use Form 540-ES to pay federal taxes?

A: No, Form 540-ES is specific to California state taxes and cannot be used to pay federal taxes.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 540-ES by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.