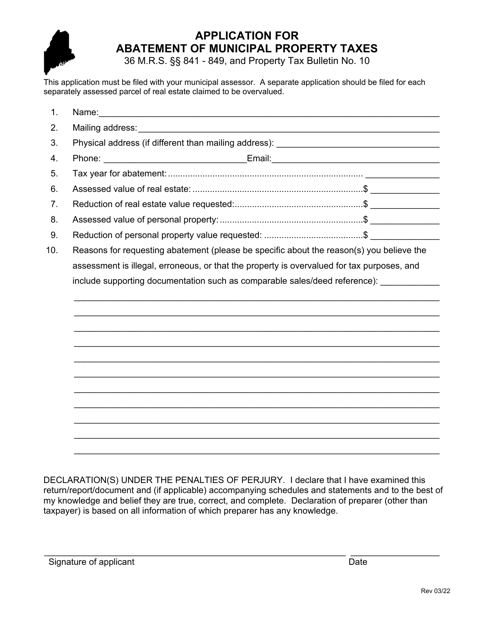

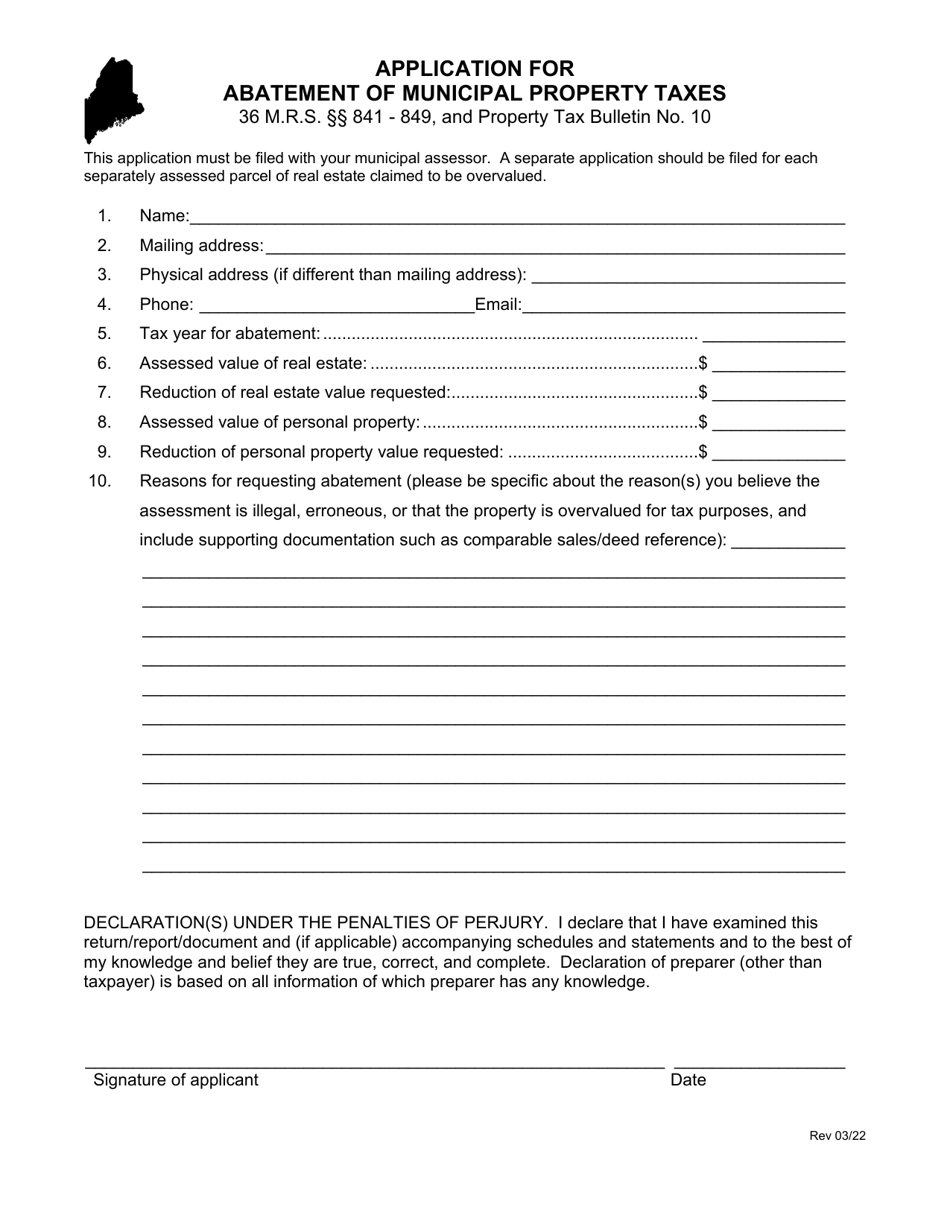

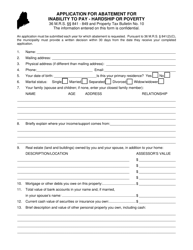

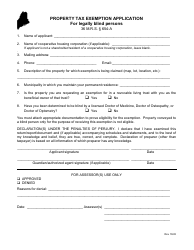

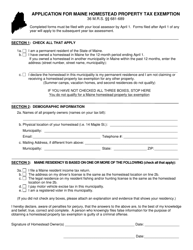

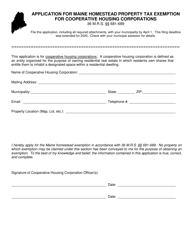

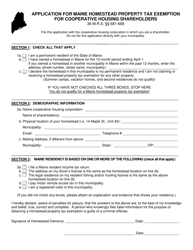

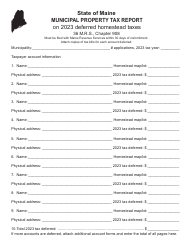

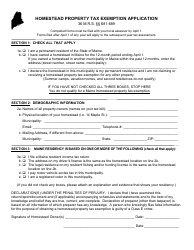

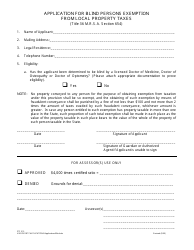

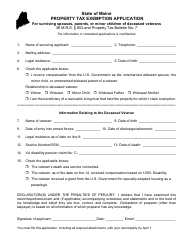

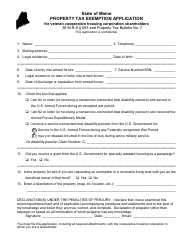

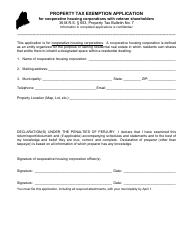

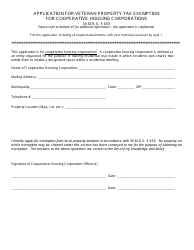

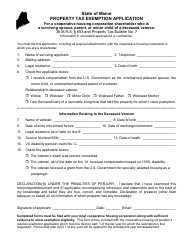

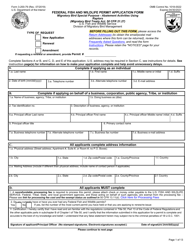

Application for Abatement of Municipal Property Taxes - Maine

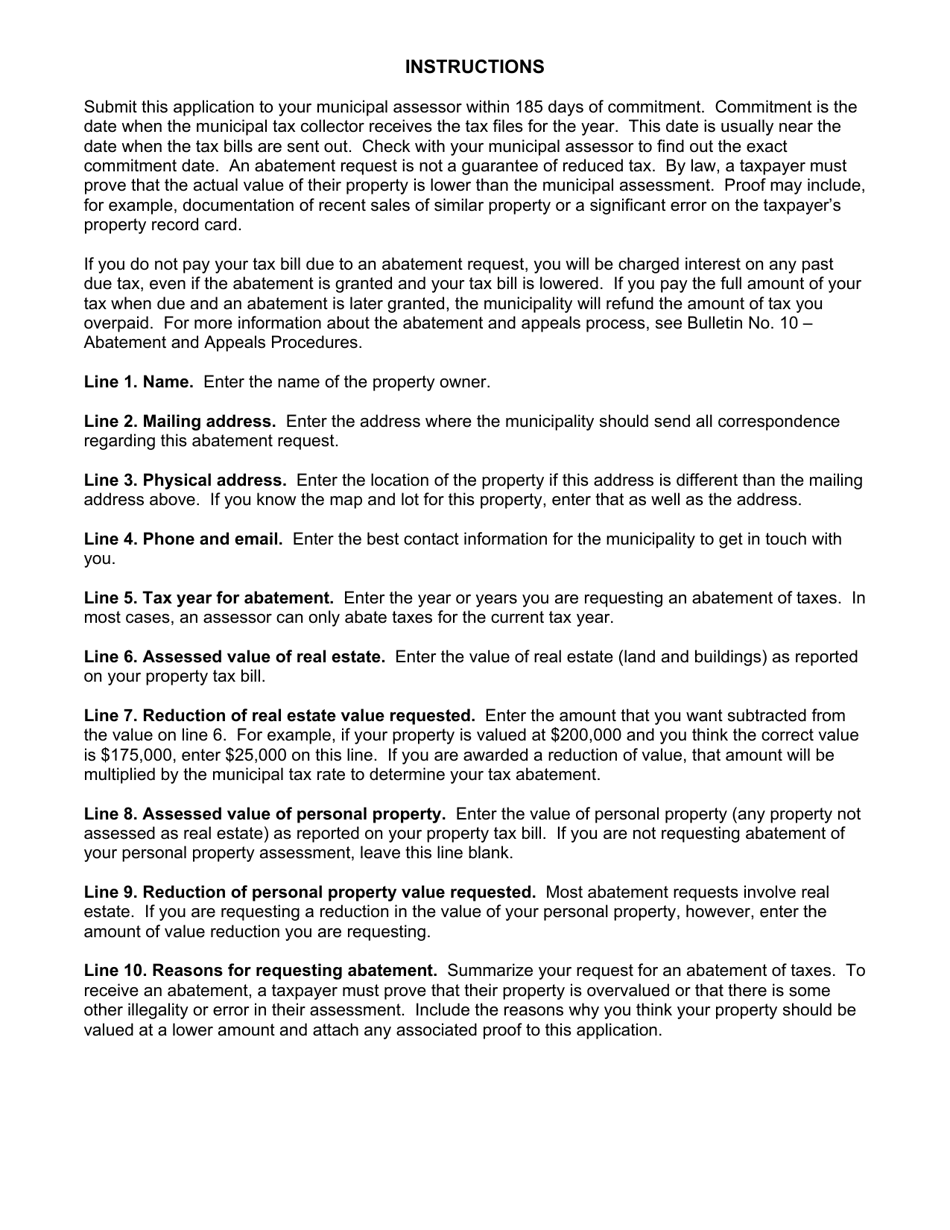

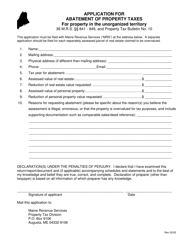

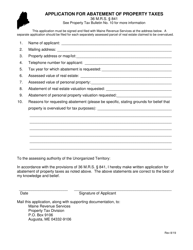

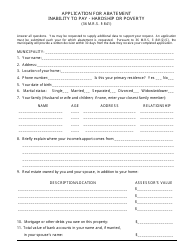

Application for Abatement of Municipal Property Taxes is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is an application for abatement of municipal property taxes?

A: It is a request made by a property owner to have their property tax assessment reduced.

Q: Who can apply for an abatement of municipal property taxes in Maine?

A: Any property owner in Maine can apply for an abatement.

Q: What is the purpose of applying for an abatement?

A: The purpose is to lower the property tax assessment and potentially reduce the amount of taxes owed.

Q: What are the eligible reasons for applying for an abatement?

A: Valid reasons can include errors in property assessment, overvaluation of property, or other relevant factors.

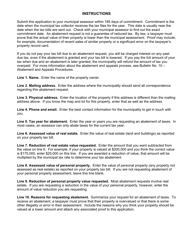

Q: How can I apply for an abatement of municipal property taxes in Maine?

A: You need to complete and submit the application form to the appropriate municipal office.

Q: What is the deadline to submit an application for abatement?

A: The deadline is usually within a specific timeframe after the tax bill is issued.

Q: Is there a fee to file an application for abatement?

A: There is usually a small fee associated with filing the application.

Q: What happens after I submit the abatement application?

A: The municipality will review the application and make a decision on whether to grant or deny the abatement request.

Q: Can I appeal the decision if my abatement application is denied?

A: Yes, you can appeal the decision through the Maine Board of Assessment Review.

Q: Can I apply for an abatement of property taxes for previous years?

A: In most cases, abatements are only available for the current tax year.

Form Details:

- Released on March 1, 2022;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.