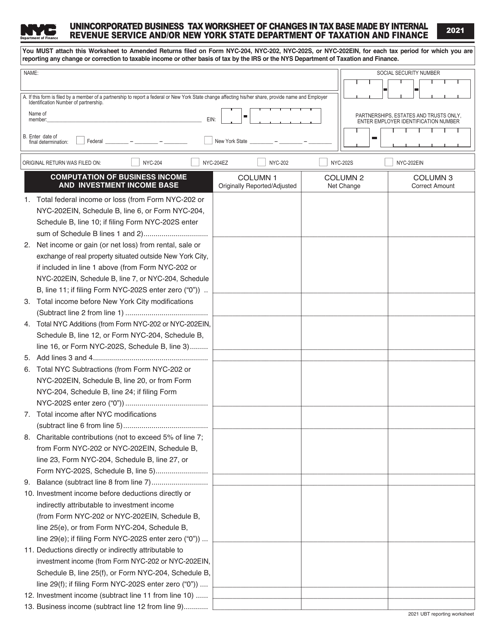

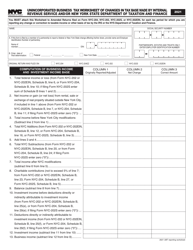

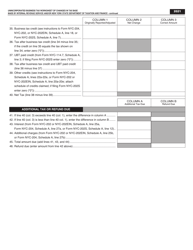

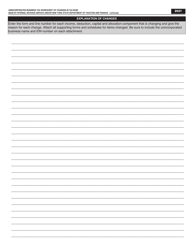

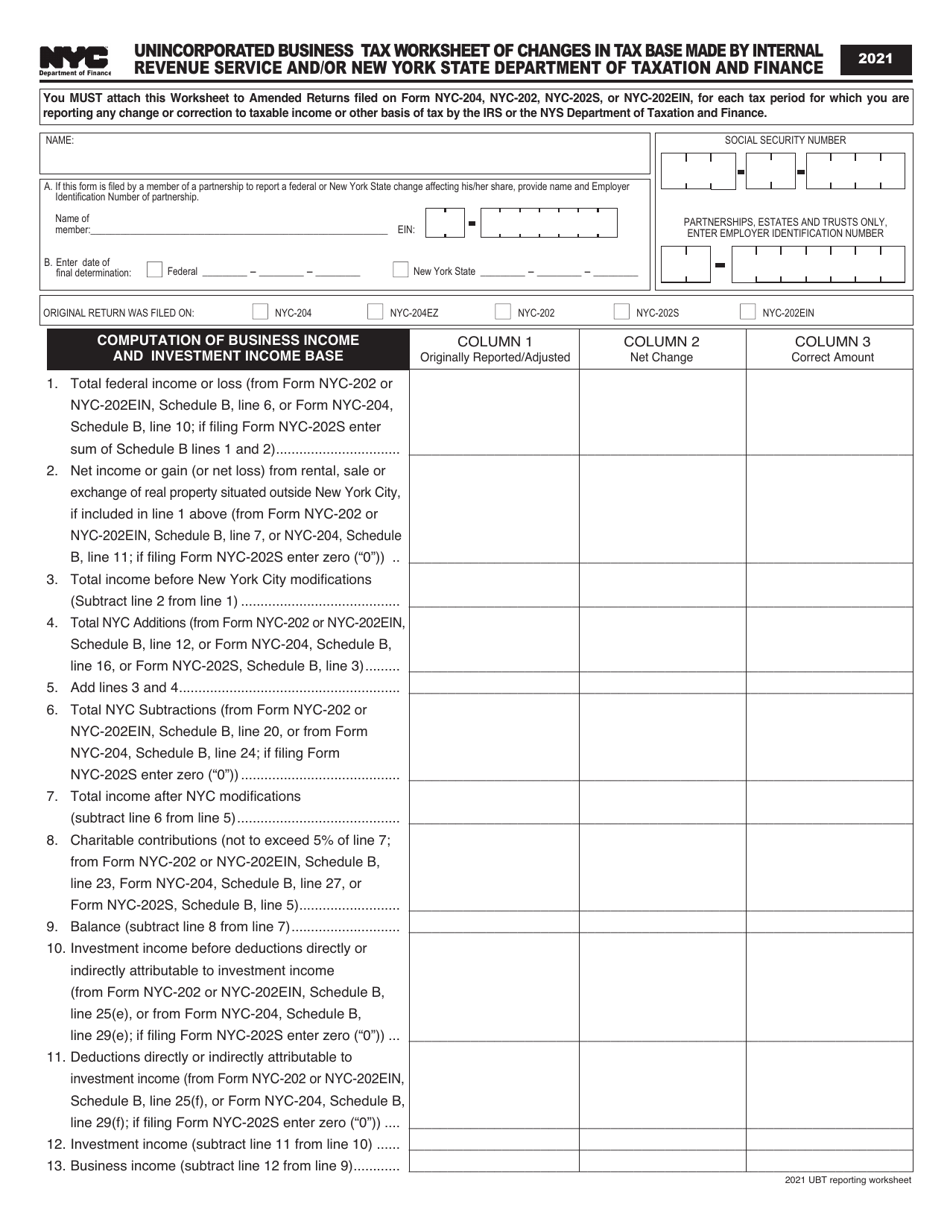

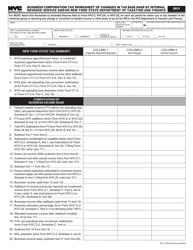

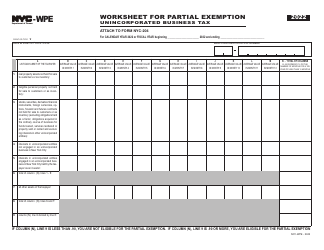

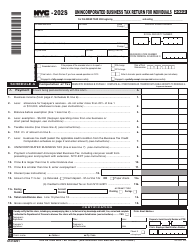

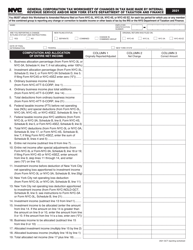

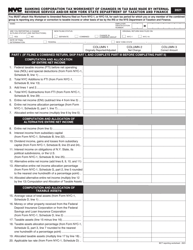

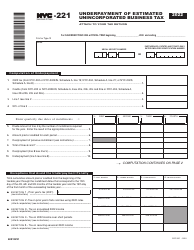

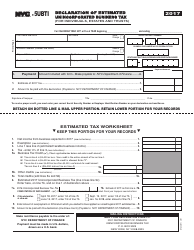

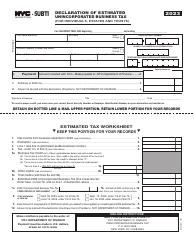

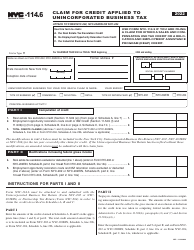

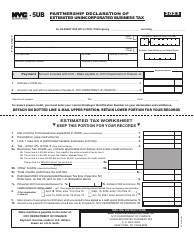

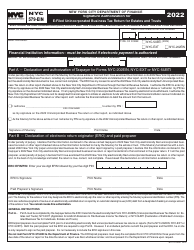

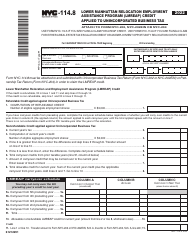

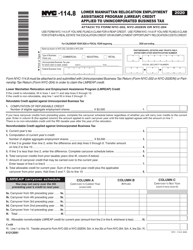

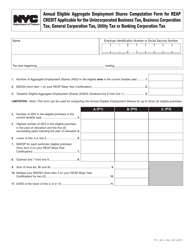

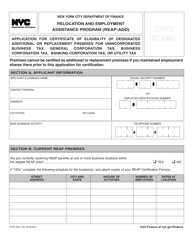

Unincorporated Business Tax Worksheet of Changes in Tax Base Made by Internal Revenue Service and / or New York State Department of Taxation and Finance - New York City

Unincorporated Business Tax Worksheet of Changes in Tax Base Made by Internal Revenue Service and/or New York State Department of Taxation and Finance is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

FAQ

Q: What is the Unincorporated Business Tax Worksheet?

A: The Unincorporated Business Tax Worksheet is a tool used to calculate changes in the tax base for unincorporated businesses.

Q: Who is responsible for making changes to the tax base?

A: The Internal Revenue Service (IRS) and/or the New York State Department of Taxation and Finance are responsible for making changes to the tax base.

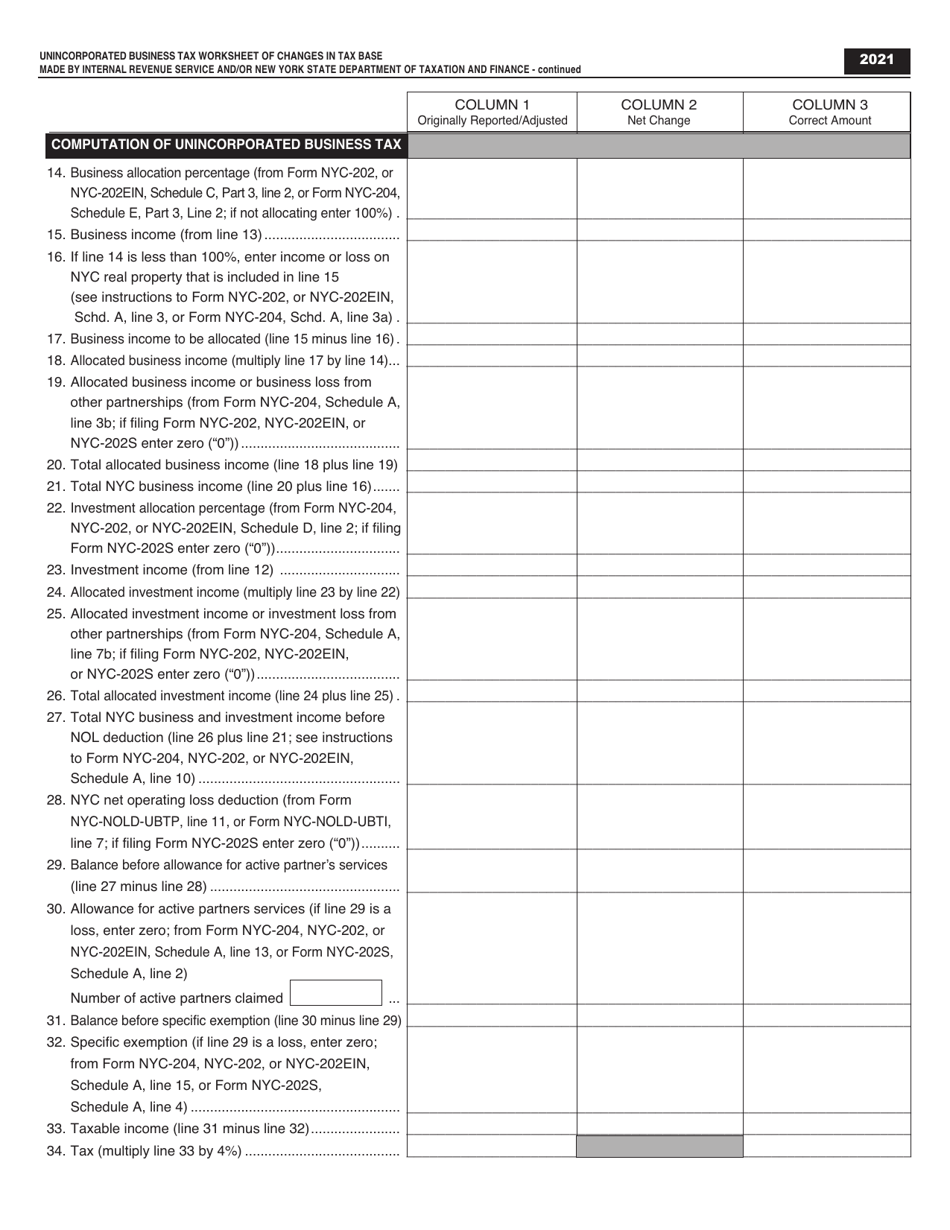

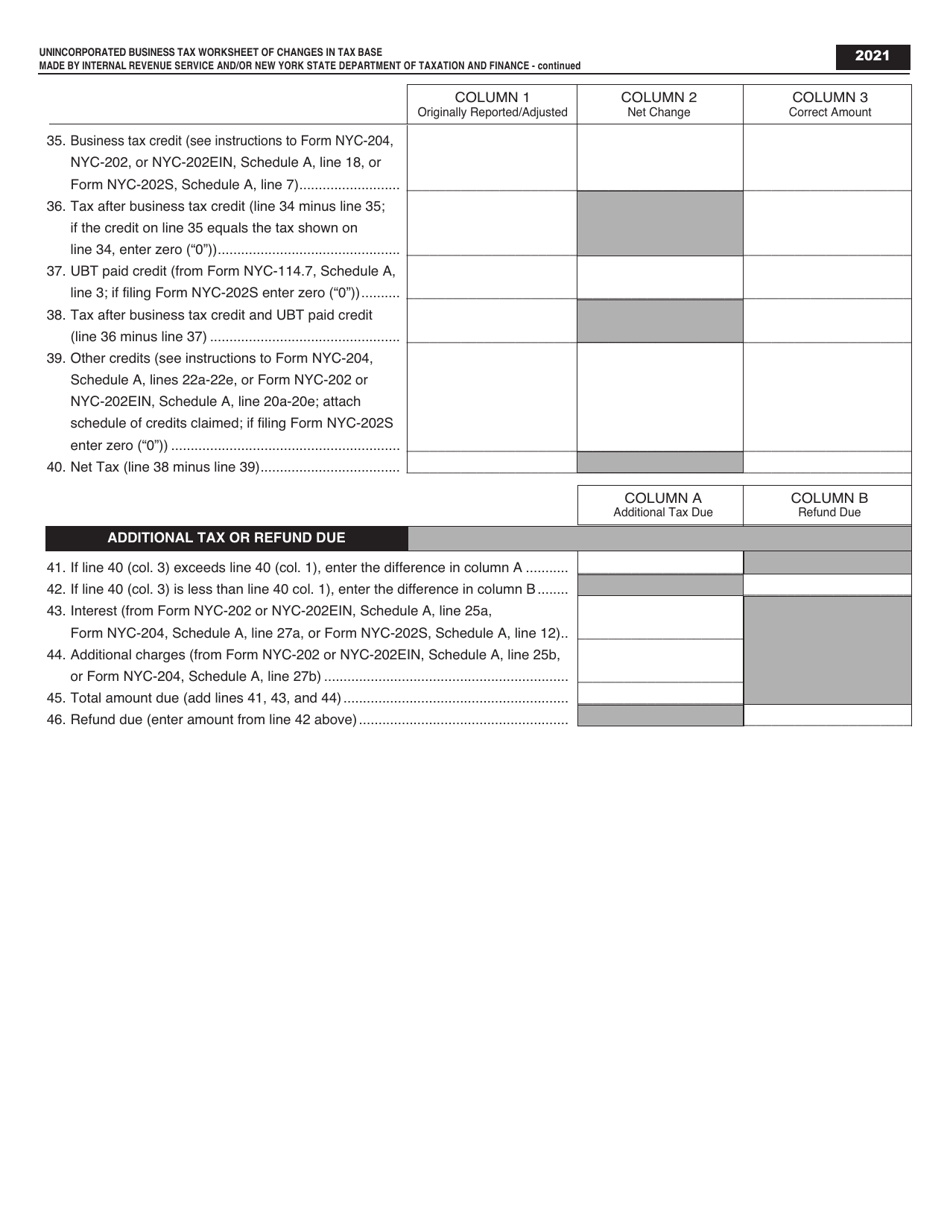

Q: What is the purpose of the worksheet?

A: The purpose of the worksheet is to accurately calculate the unincorporated business tax based on any changes made by the IRS and/or the New York State Department of Taxation and Finance.

Q: What is the tax base?

A: The tax base refers to the amount of income and deductions that are used to calculate the unincorporated business tax.

Q: Who needs to use the worksheet?

A: Unincorporated businesses in New York City may need to use the worksheet to calculate their tax liability.

Q: Are there any specific requirements for using the worksheet?

A: Yes, the IRS and the New York State Department of Taxation and Finance may provide specific instructions and requirements for using the worksheet.

Form Details:

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.