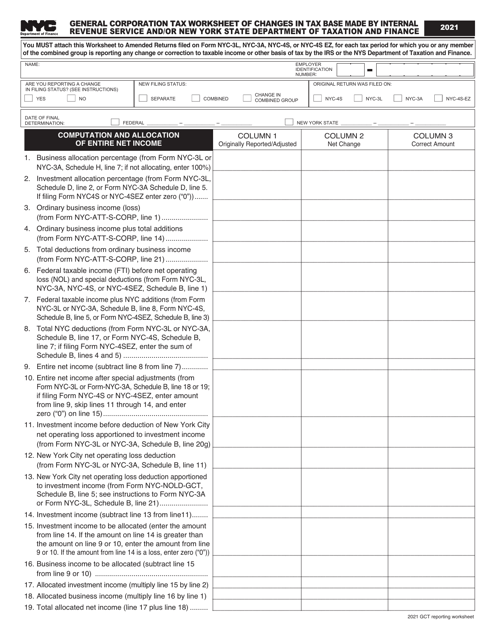

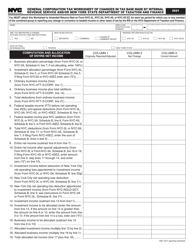

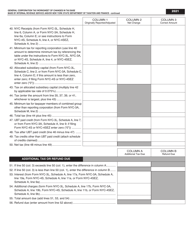

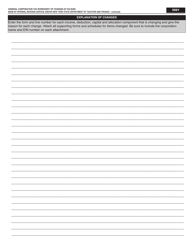

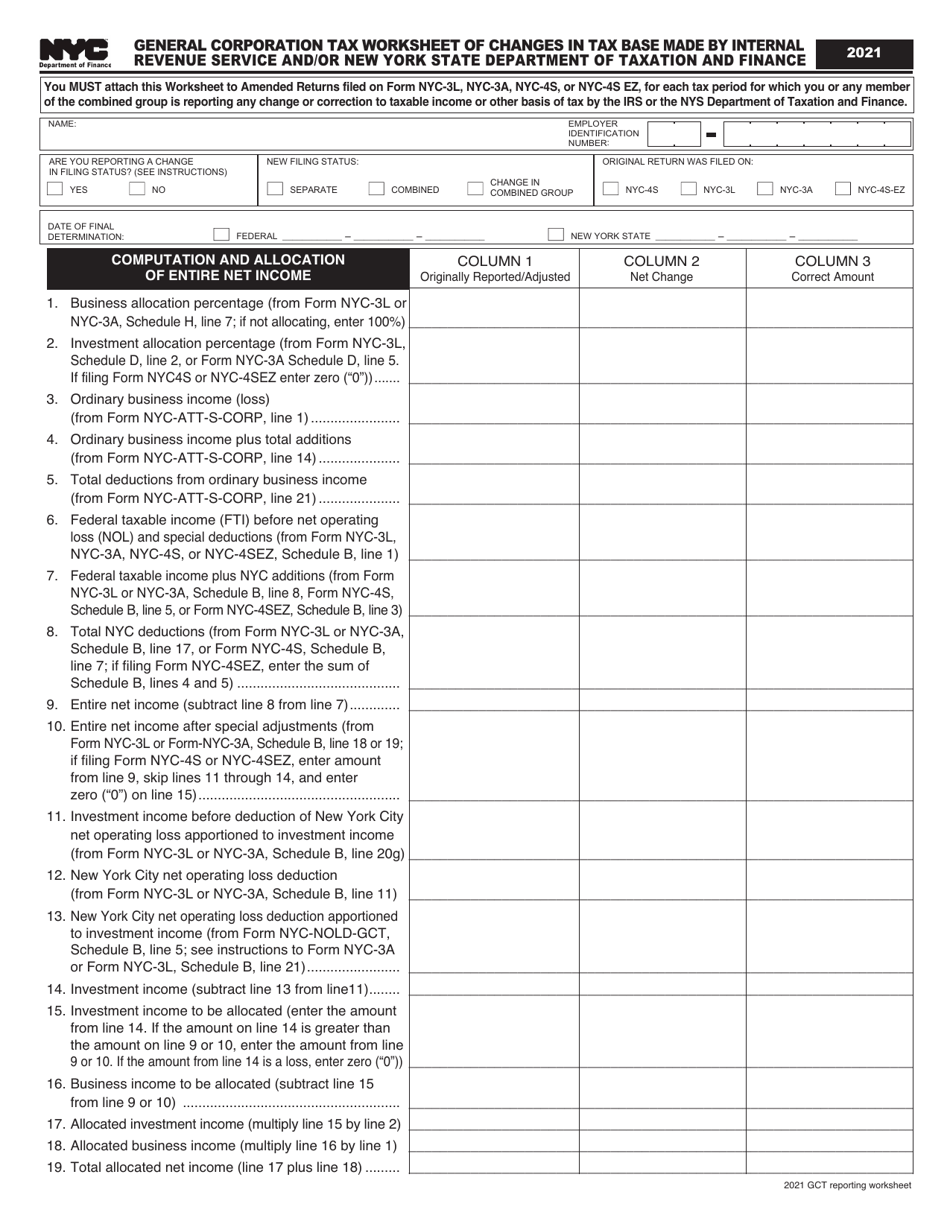

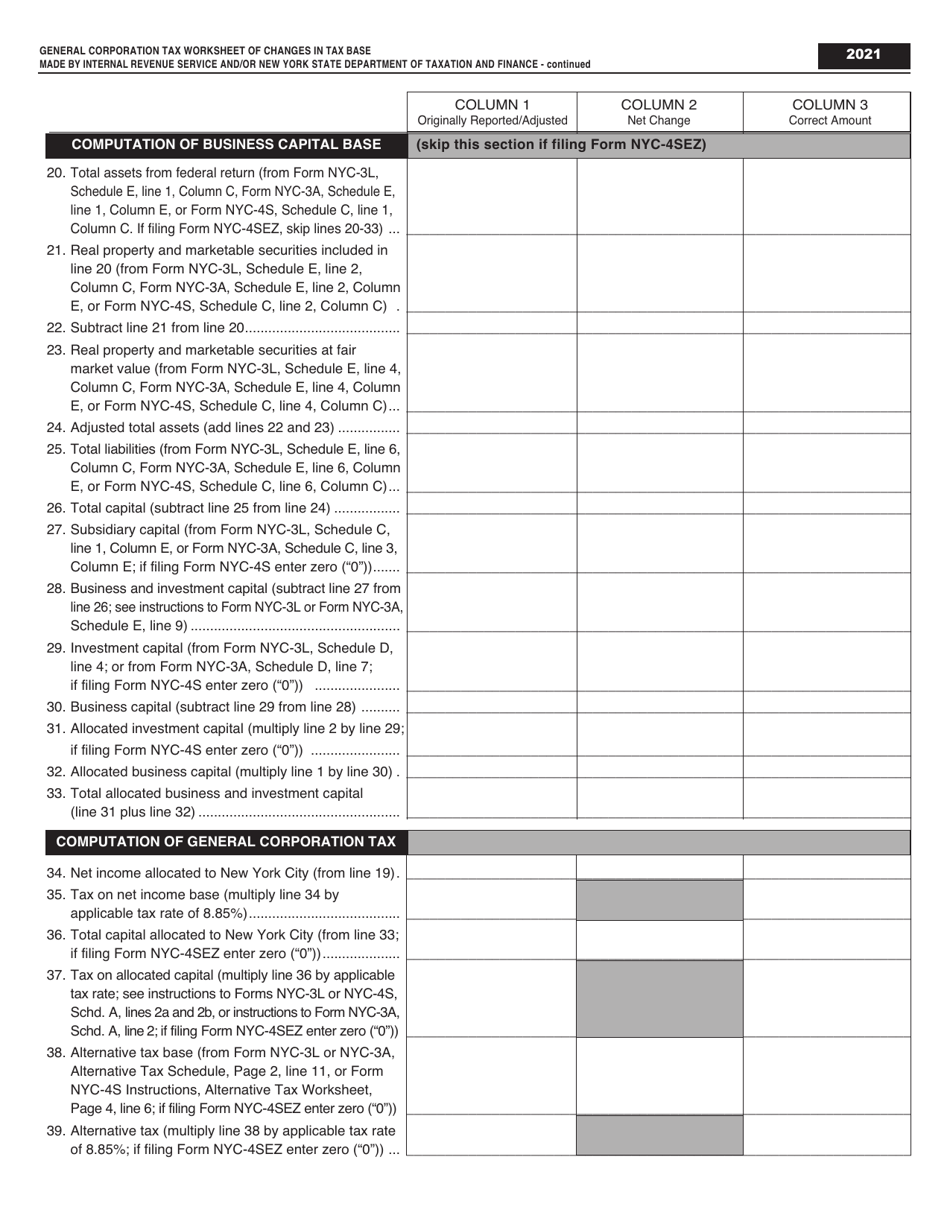

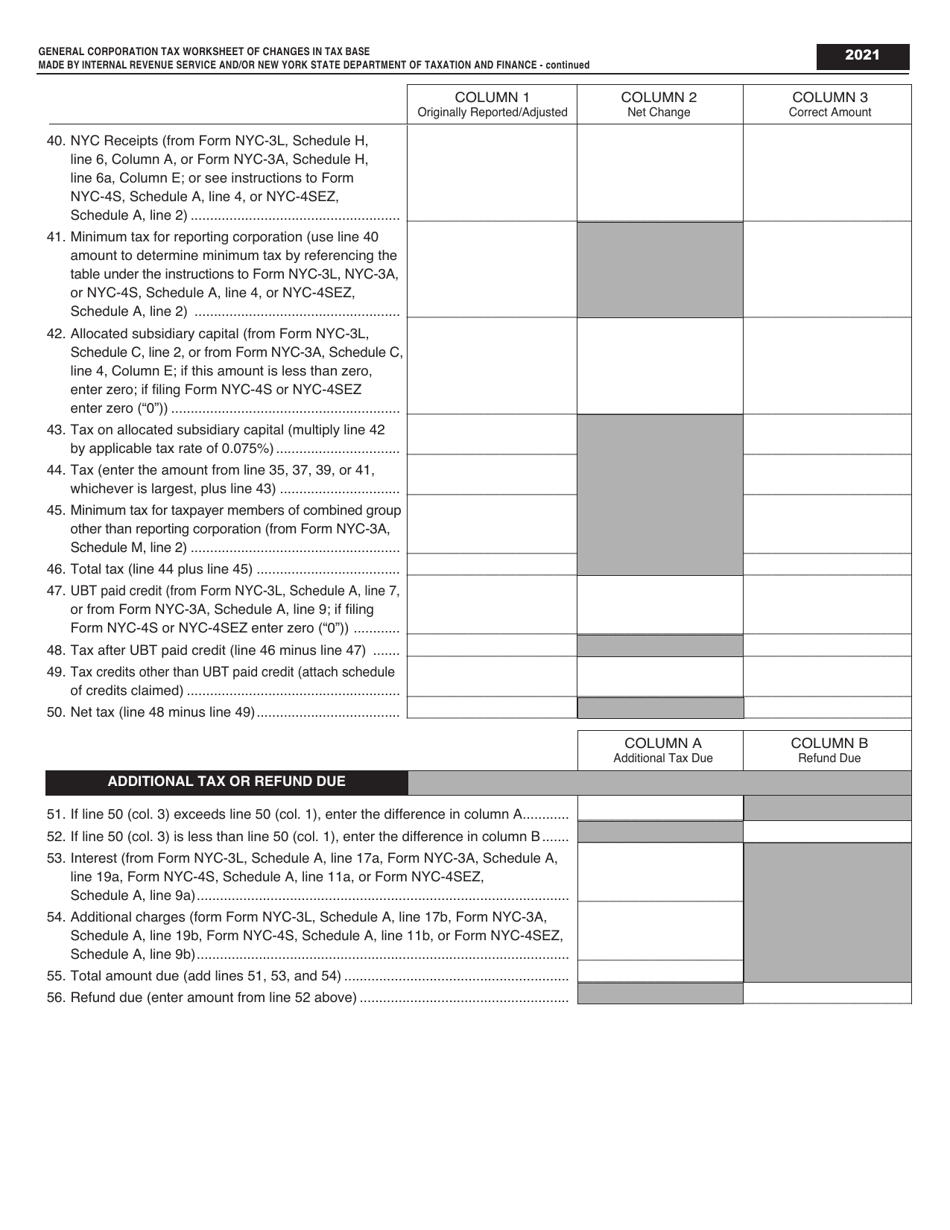

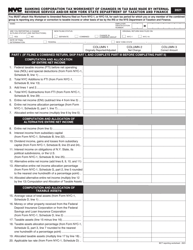

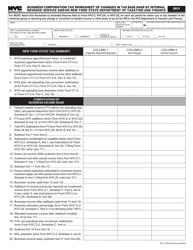

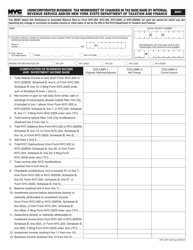

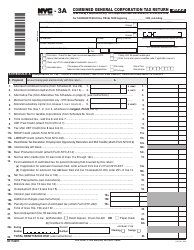

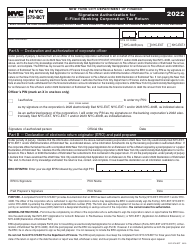

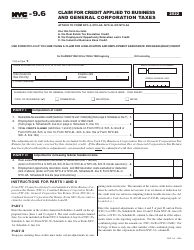

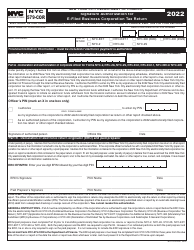

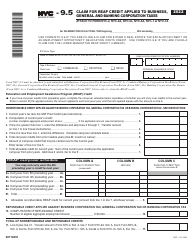

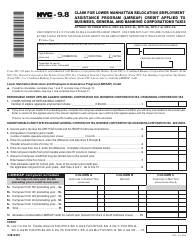

General Corporation Tax Worksheet of Changes in Tax Base Made by Internal Revenue Service and / or New York State Department of Taxation and Finance - New York City

General Corporation Tax Worksheet of Changes in Tax Base Made by Internal Revenue Service and/or New York State Department of Taxation and Finance is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

FAQ

Q: What is the General Corporation Tax?

A: The General Corporation Tax is a tax imposed on corporations in New York City.

Q: Who administers the General Corporation Tax?

A: The General Corporation Tax is administered by the Internal Revenue Service and New York State Department of Taxation and Finance.

Q: What is a tax base?

A: A tax base refers to the amount of income or assets that are subject to taxation.

Q: What is the purpose of the worksheet?

A: The worksheet is used to track changes in the tax base made by the Internal Revenue Service and/or New York State Department of Taxation and Finance.

Q: Why would the tax base change?

A: The tax base may change due to new regulations, changes in accounting methods, or adjustments made by the tax authorities.

Q: Who is required to use this worksheet?

A: Corporations subject to the General Corporation Tax in New York City are required to use this worksheet.

Q: How does this worksheet help with tax calculations?

A: The worksheet helps corporations determine their tax liability by tracking changes in the tax base.

Q: Is this worksheet specific to New York City?

A: Yes, this worksheet is specific to corporations subject to the General Corporation Tax in New York City.

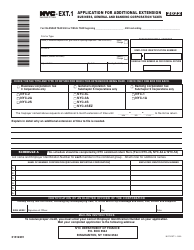

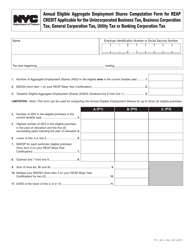

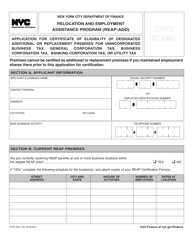

Form Details:

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.