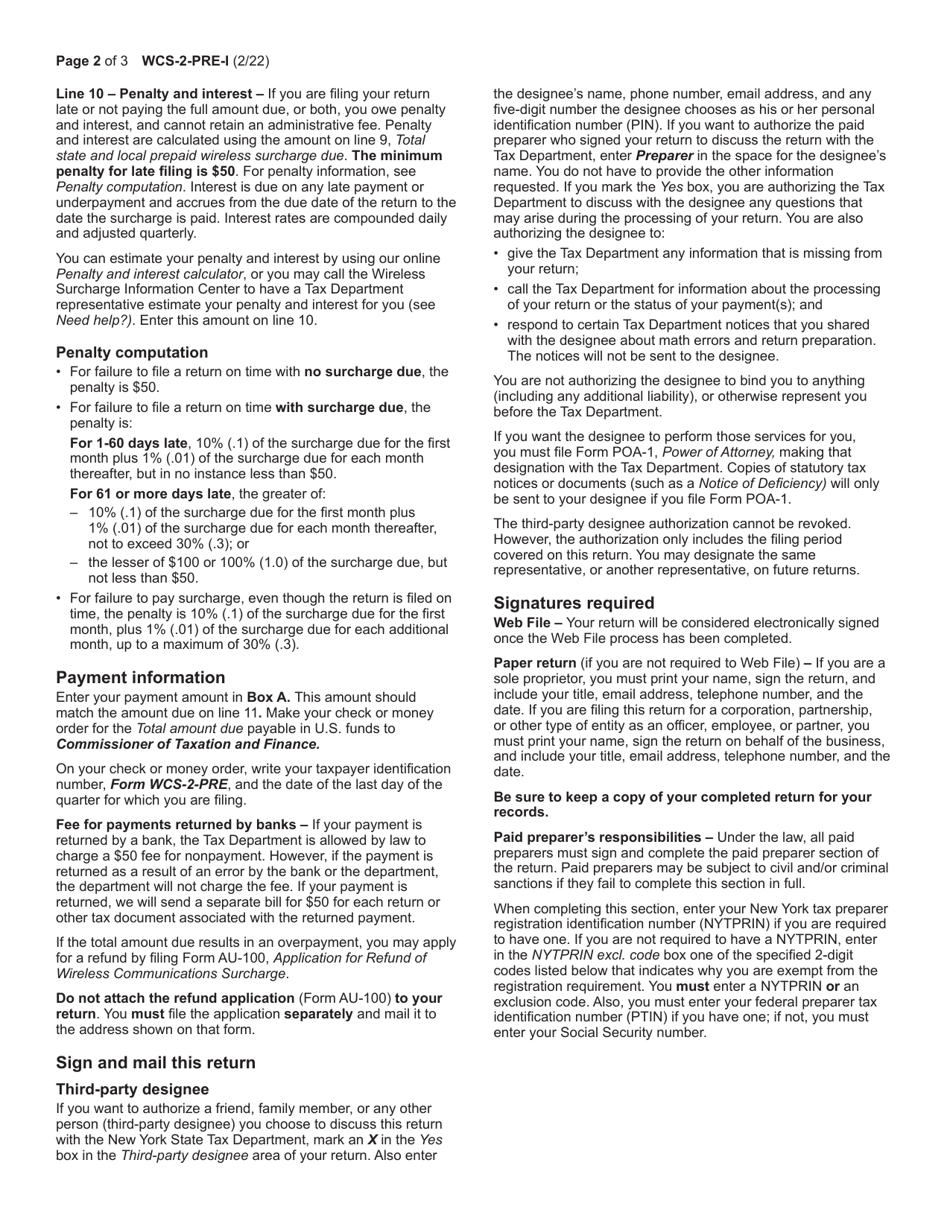

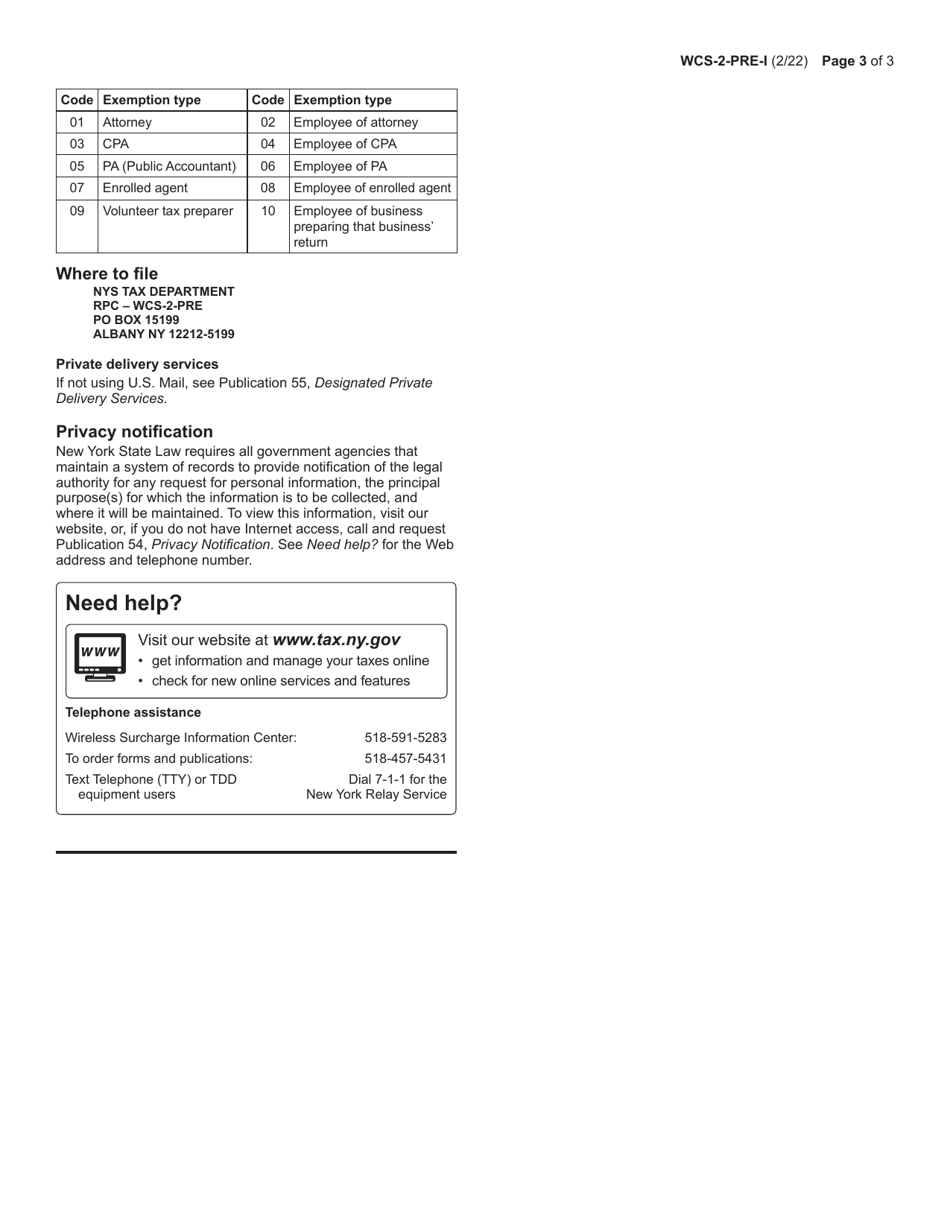

This version of the form is not currently in use and is provided for reference only. Download this version of

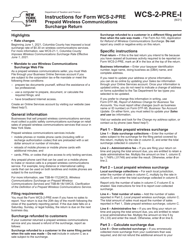

Instructions for Form WCS-2-PRE

for the current year.

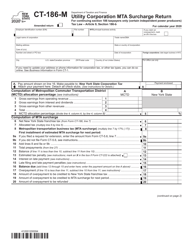

Instructions for Form WCS-2-PRE Prepaid Wireless Communications Surcharge Return - New York

This document contains official instructions for Form WCS-2-PRE , Prepaid Wireless Communications Surcharge Return - a form released and collected by the New York State Department of Taxation and Finance.

FAQ

Q: What is Form WCS-2-PRE?

A: Form WCS-2-PRE is the Prepaid Wireless Communications Surcharge Return form in New York.

Q: Who needs to file Form WCS-2-PRE?

A: Anyone who sells prepaid wireless communications services in New York is required to file Form WCS-2-PRE.

Q: What is the purpose of Form WCS-2-PRE?

A: The purpose of Form WCS-2-PRE is to report and remit the prepaid wireless communications surcharge collected from customers.

Q: How often do I need to file Form WCS-2-PRE?

A: Form WCS-2-PRE is due quarterly, with the due dates falling on the last day of April, July, October, and January.

Q: Are there any penalties for not filing Form WCS-2-PRE?

A: Yes, there are penalties for late or non-filing of Form WCS-2-PRE. It is important to file the form on time to avoid penalties.

Q: What if I no longer sell prepaid wireless communications services in New York?

A: If you no longer sell prepaid wireless communications services in New York, you should notify the Department of Taxation and Finance and stop filing Form WCS-2-PRE.

Q: Is the prepaid wireless communications surcharge refundable?

A: No, the prepaid wireless communications surcharge is not refundable. It must be remitted to the Department of Taxation and Finance.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.