This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form WCS-1

for the current year.

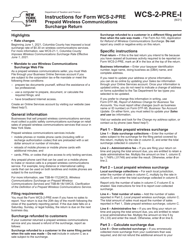

Instructions for Form WCS-1 Postpaid Wireless Communications Surcharge Return - New York

This document contains official instructions for Form WCS-1 , Postpaid Wireless Communications Surcharge Return - a form released and collected by the New York State Department of Taxation and Finance.

FAQ

Q: What is Form WCS-1?

A: Form WCS-1 is a return form for reporting and paying the Postpaid Wireless Communications Surcharge in New York.

Q: Who needs to file Form WCS-1?

A: Any business or individual that provides postpaid wireless communication services in New York and is subject to the surcharge needs to file Form WCS-1.

Q: What is the purpose of the Postpaid Wireless Communications Surcharge?

A: The surcharge is used to generate revenue for the support of emergency services in New York.

Q: When is Form WCS-1 due?

A: Form WCS-1 is typically due on a quarterly basis. The due dates are April 30th, July 31st, October 31st, and January 31st.

Q: How can I file Form WCS-1?

A: Form WCS-1 can be filed electronically or by mail. The instructions on the form provide detailed information on how to file.

Q: What information do I need to complete Form WCS-1?

A: You will need information regarding your postpaid wireless communication services provided in New York, including the number of customer accounts and the total charges subject to the surcharge.

Q: Are there any penalties for late filing or non-payment?

A: Yes, there are penalties for late filing or non-payment. It is important to file and pay on time to avoid these penalties.

Q: Are there any exemptions to the Postpaid Wireless Communications Surcharge?

A: Yes, there are certain exemptions available. The instructions on Form WCS-1 provide details on these exemptions.

Q: Who can I contact for more information?

A: For more information or assistance with Form WCS-1, you can contact the New York State Department of Taxation and Finance.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.