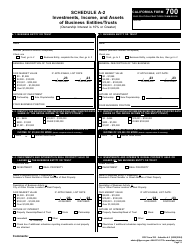

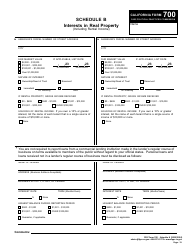

This version of the form is not currently in use and is provided for reference only. Download this version of

FPPC Form 700 Schedule E

for the current year.

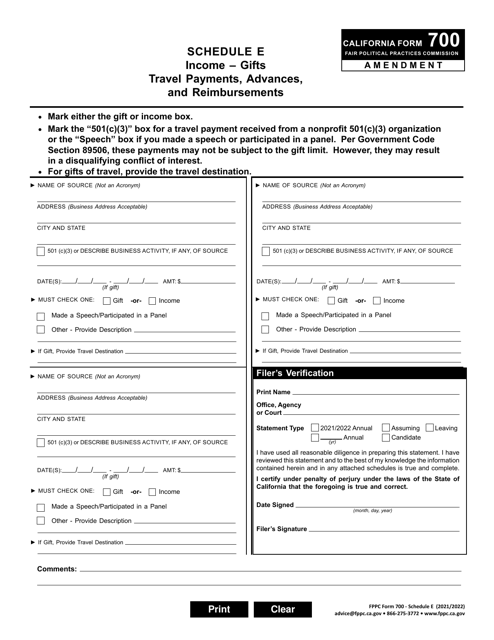

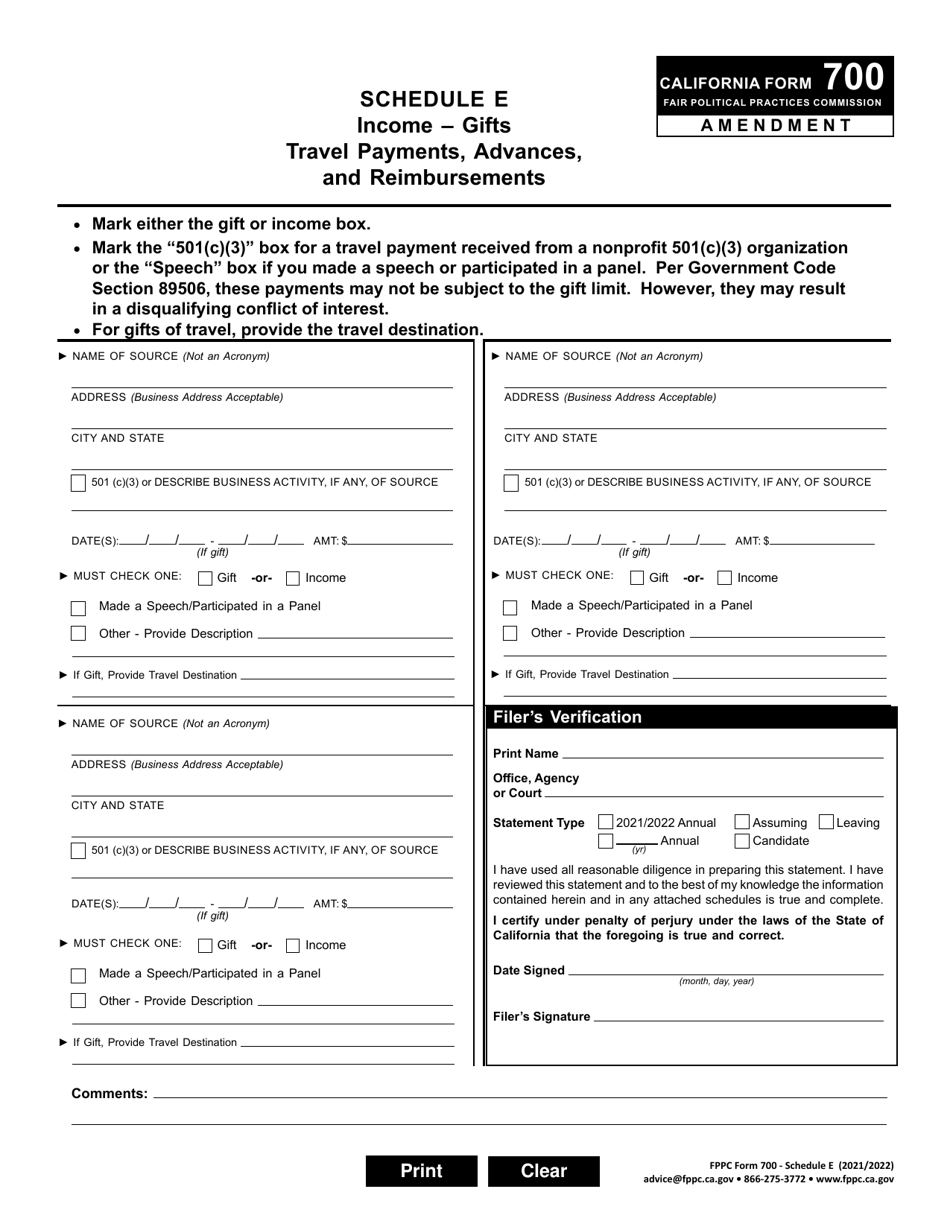

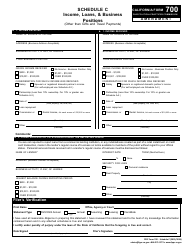

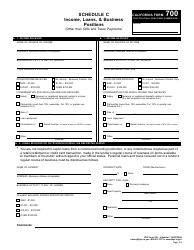

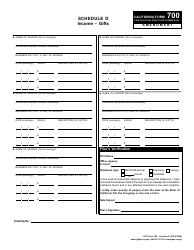

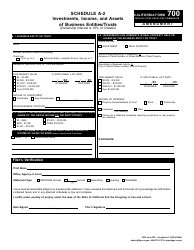

FPPC Form 700 Schedule E Income - Gifts Travel Payments, Advances, and Reimbursements - Amendment - California

What Is FPPC Form 700 Schedule E?

This is a legal form that was released by the California Fair Political Practices Commission - a government authority operating within California.The document is a supplement to FPPC Form 700, Statement of Economic Interests Cover Page - Amendment. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is FPPC Form 700 Schedule E Income?

A: FPPC Form 700 Schedule E Income is a section of a financial disclosure form required by the Fair Political Practices Commission (FPPC) in California. It pertains to reporting gifts, travel payments, advances, and reimbursements received.

Q: What does Schedule E Income cover?

A: Schedule E Income covers gifts, travel payments, advances, and reimbursements received by individuals who are required to disclose their financial information in accordance with FPPC regulations.

Q: Who is required to complete FPPC Form 700 Schedule E Income?

A: Public officials, candidates for public office, and certain government employees in California are generally required to complete FPPC Form 700, which may include Schedule E Income if applicable.

Q: What information needs to be reported on Schedule E Income?

A: Schedule E Income requires the disclosure of the source, date, and value of any gifts, travel payments, advances, and reimbursements received by the filer.

Q: When should Schedule E Income be filed?

A: Schedule E Income should be filed annually, along with the complete FPPC Form 700, no later than April 1st or within 30 days of assuming or leaving office, when applicable.

Q: Are all gifts and travel payments reportable on Schedule E Income?

A: No, there are certain exceptions and thresholds for reporting gifts and travel payments on Schedule E Income, as specified by the FPPC regulations. It's important to review the instructions and seek guidance if needed.

Q: Can gifts and travel payments received from family members be excluded from Schedule E Income?

A: Generally, gifts and travel payments received from an individual's family members do not need to be reported on Schedule E Income. However, it's recommended to consult the FPPC guidelines for specific rules and exceptions.

Q: Are there penalties for non-compliance with FPPC Form 700 Schedule E Income?

A: Yes, failure to comply with the reporting requirements of FPPC Form 700, including Schedule E Income, may result in fines and other legal consequences. It's important to meet the filing deadlines and provide accurate information.

Form Details:

- The latest edition provided by the California Fair Political Practices Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of FPPC Form 700 Schedule E by clicking the link below or browse more documents and templates provided by the California Fair Political Practices Commission.