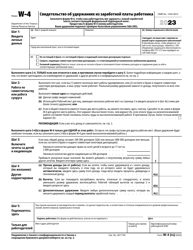

This version of the form is not currently in use and is provided for reference only. Download this version of

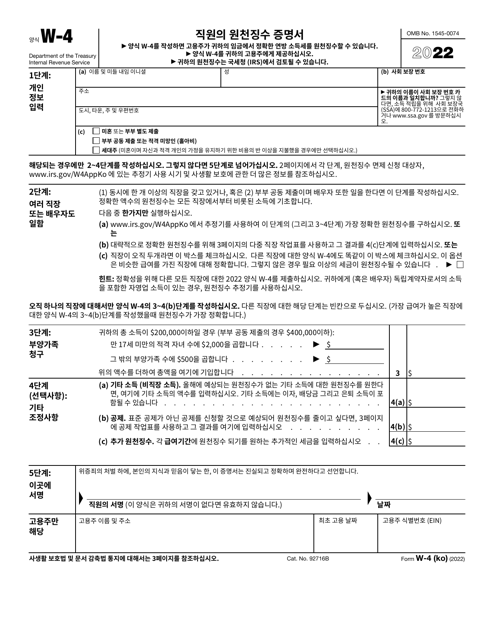

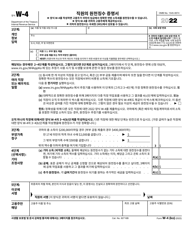

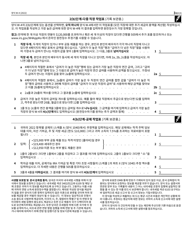

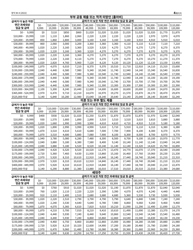

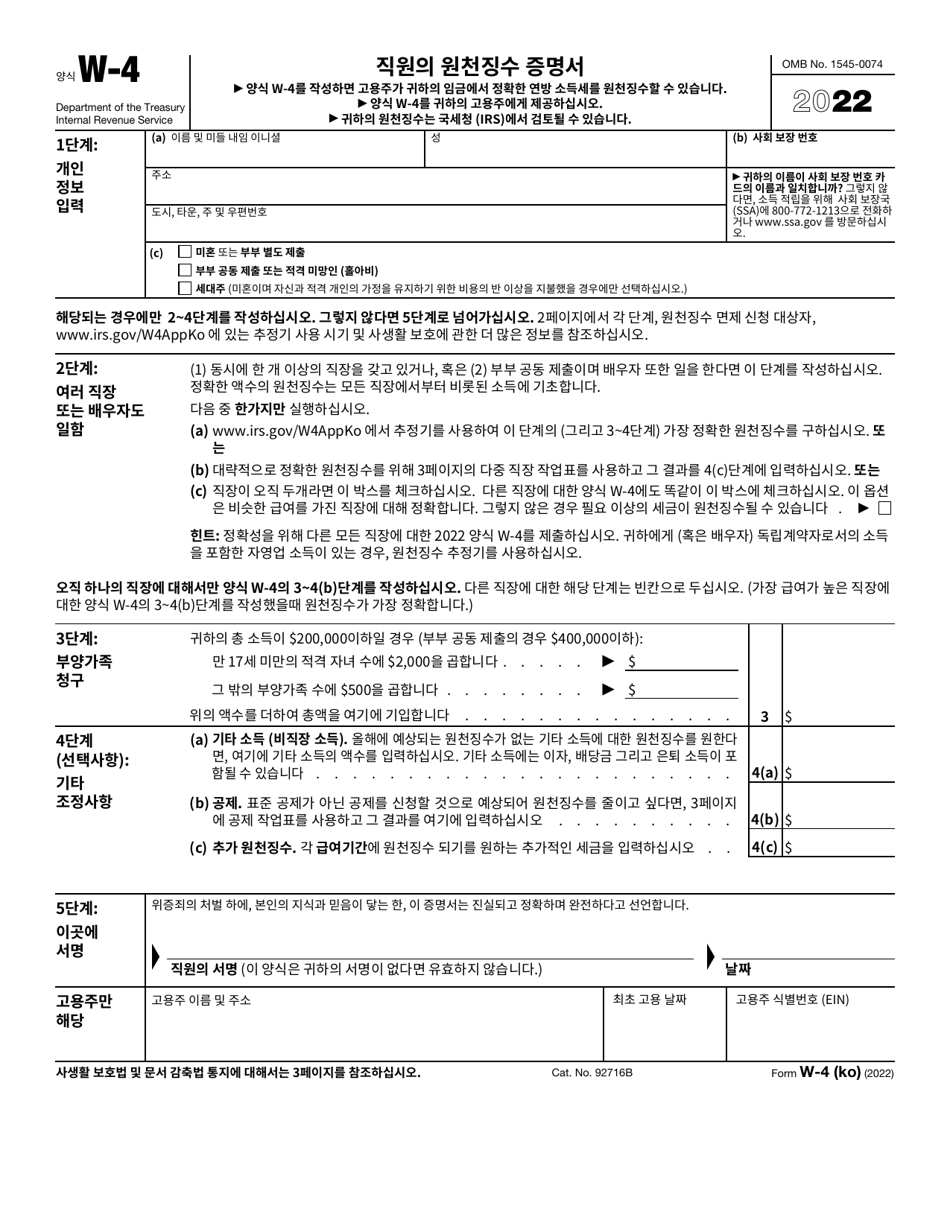

IRS Form W-4

for the current year.

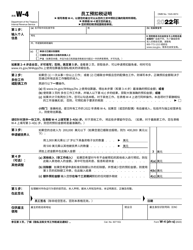

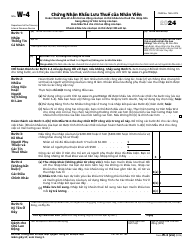

IRS Form W-4 Employee's Withholding Certificate (Korean)

The employee would file the IRS Form W-4 Employee's Withholding Certificate (Korean).

FAQ

Q: What is IRS Form W-4?

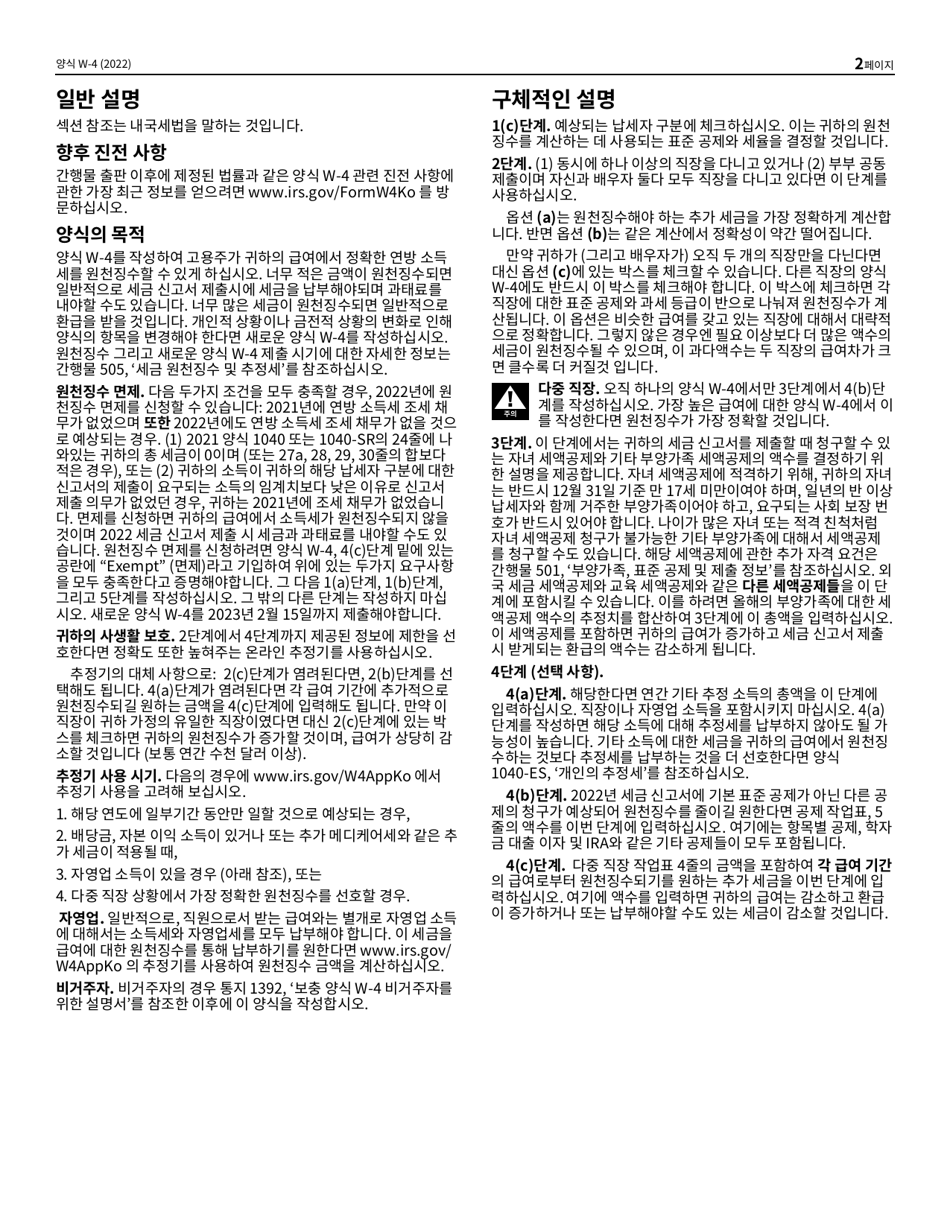

A: IRS Form W-4 is an Employee's Withholding Certificate that determines the amount of federal income tax to be withheld from an employee's paycheck.

Q: Who should fill out Form W-4?

A: All employees in the United States must fill out Form W-4.

Q: Why do I need to fill out Form W-4?

A: Filling out Form W-4 ensures that the correct amount of federal income tax is withheld from your paycheck to avoid owing taxes or receiving a large refund at the end of the year.

Q: How do I fill out Form W-4?

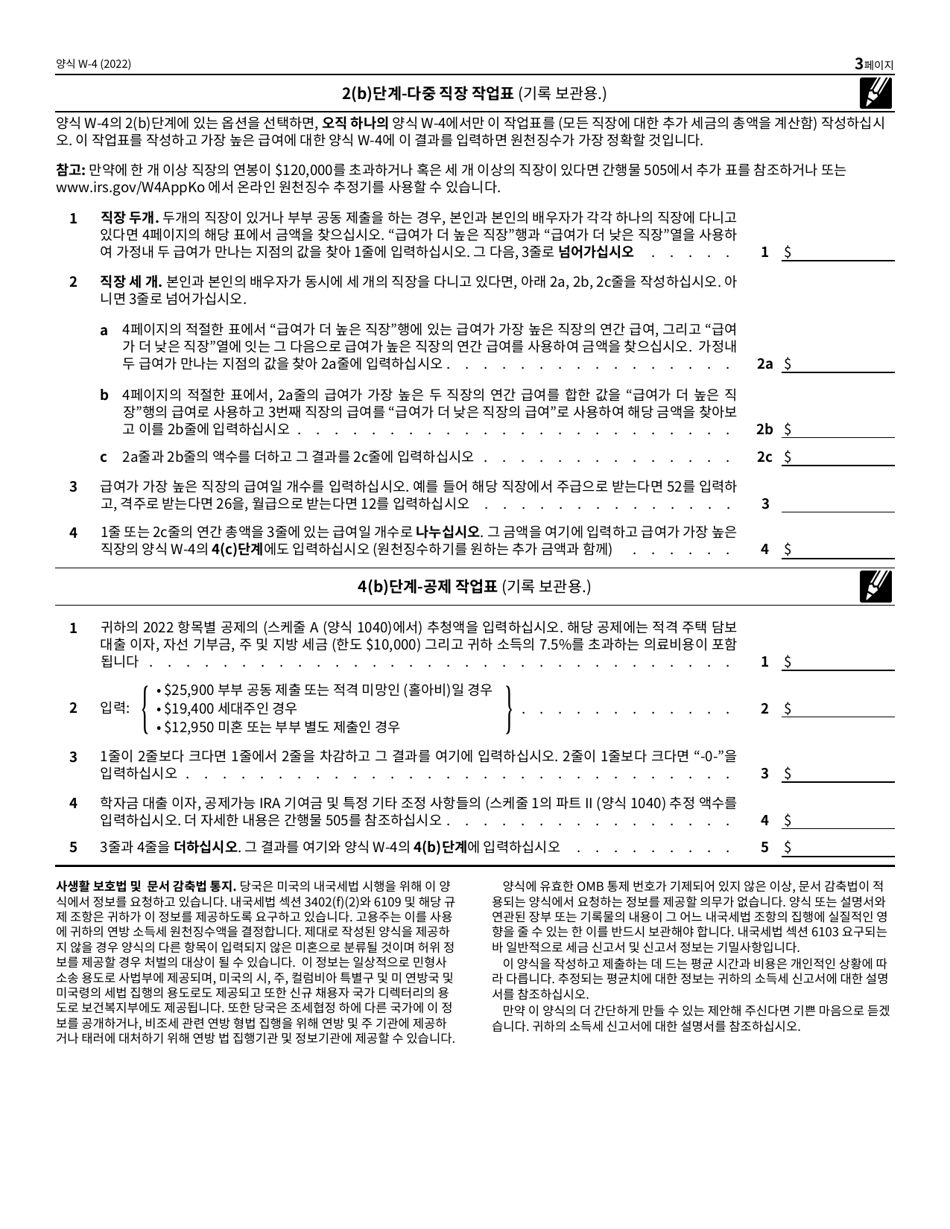

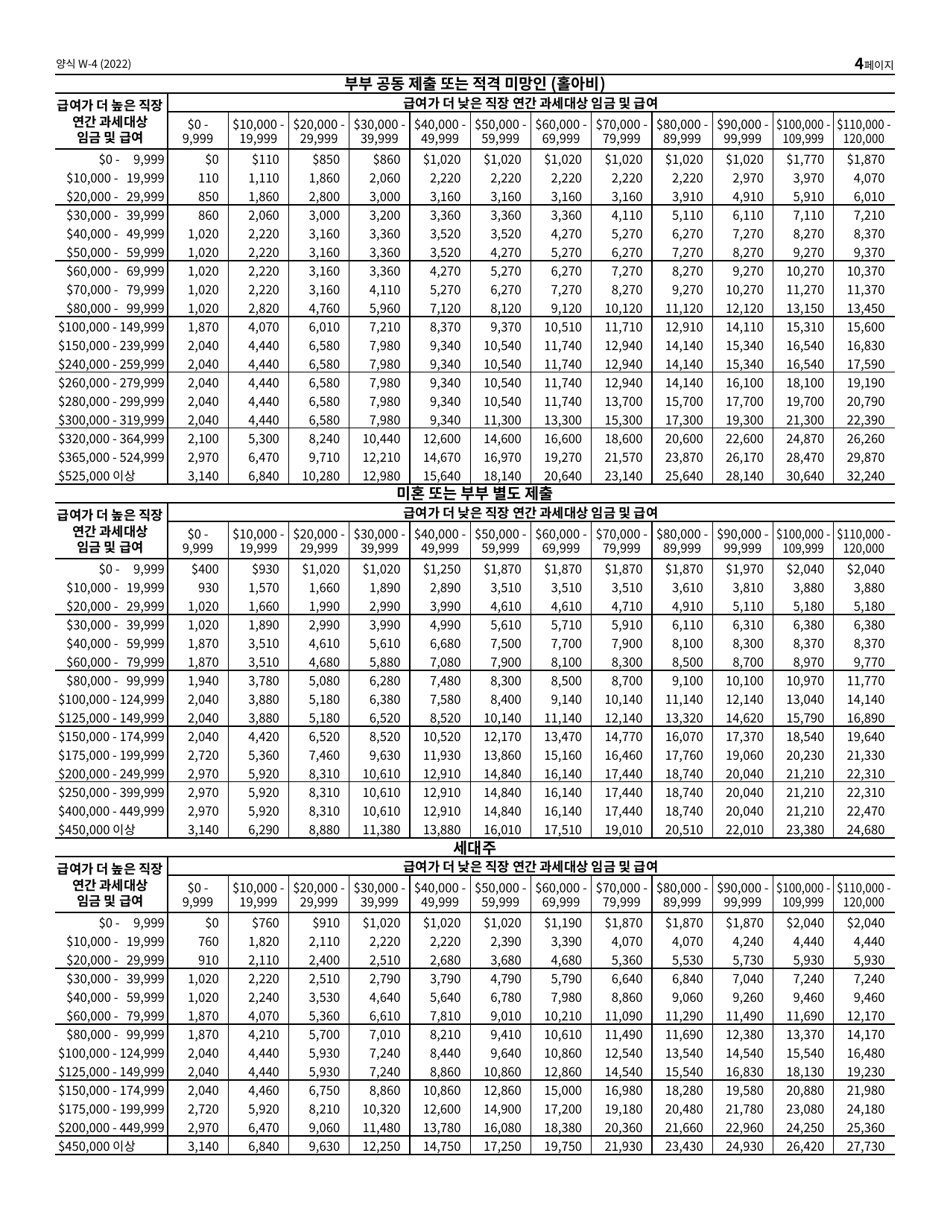

A: You need to provide information about your marital status, number of withholding allowances, and any additional amount you want to withhold.

Q: Can I change my W-4 during the year?

A: Yes, you can change your W-4 during the year if your circumstances change, such as getting married, having a child, or starting a new job.

Q: Is Form W-4 the same in every state?

A: Form W-4 is a federal tax form and is the same in every state. However, some states may have additional withholding forms for state taxes.

Q: Should I seek professional help to fill out Form W-4?

A: It is not required to seek professional help to fill out Form W-4. However, if you have complex tax situations or are unsure about how to complete the form, consulting a tax professional may be beneficial.