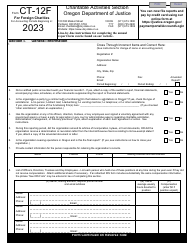

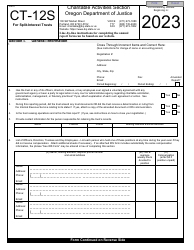

This version of the form is not currently in use and is provided for reference only. Download this version of

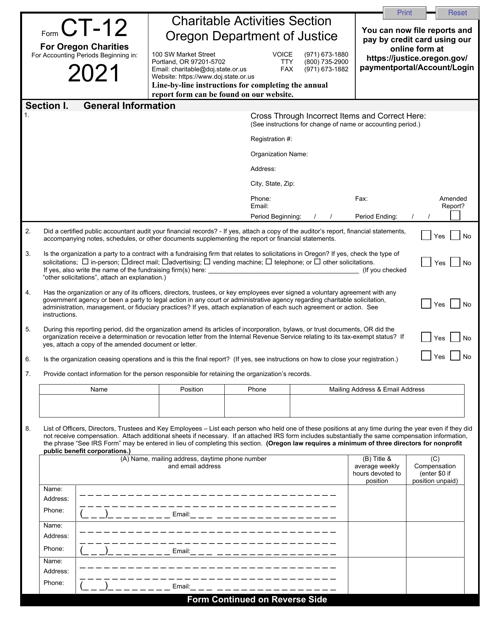

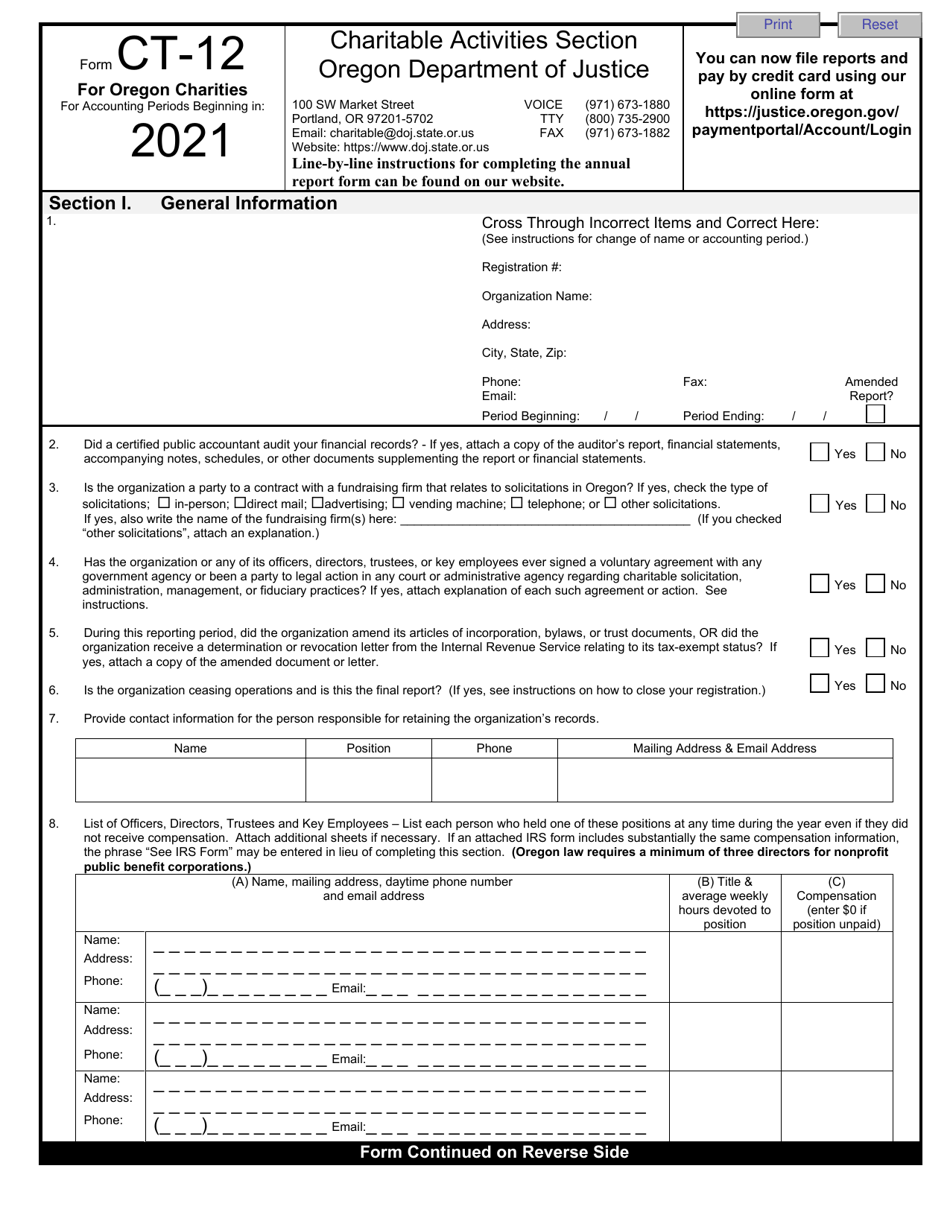

Form CT-12

for the current year.

Form CT-12 Charitable Activities Form for Oregon Charities - Oregon

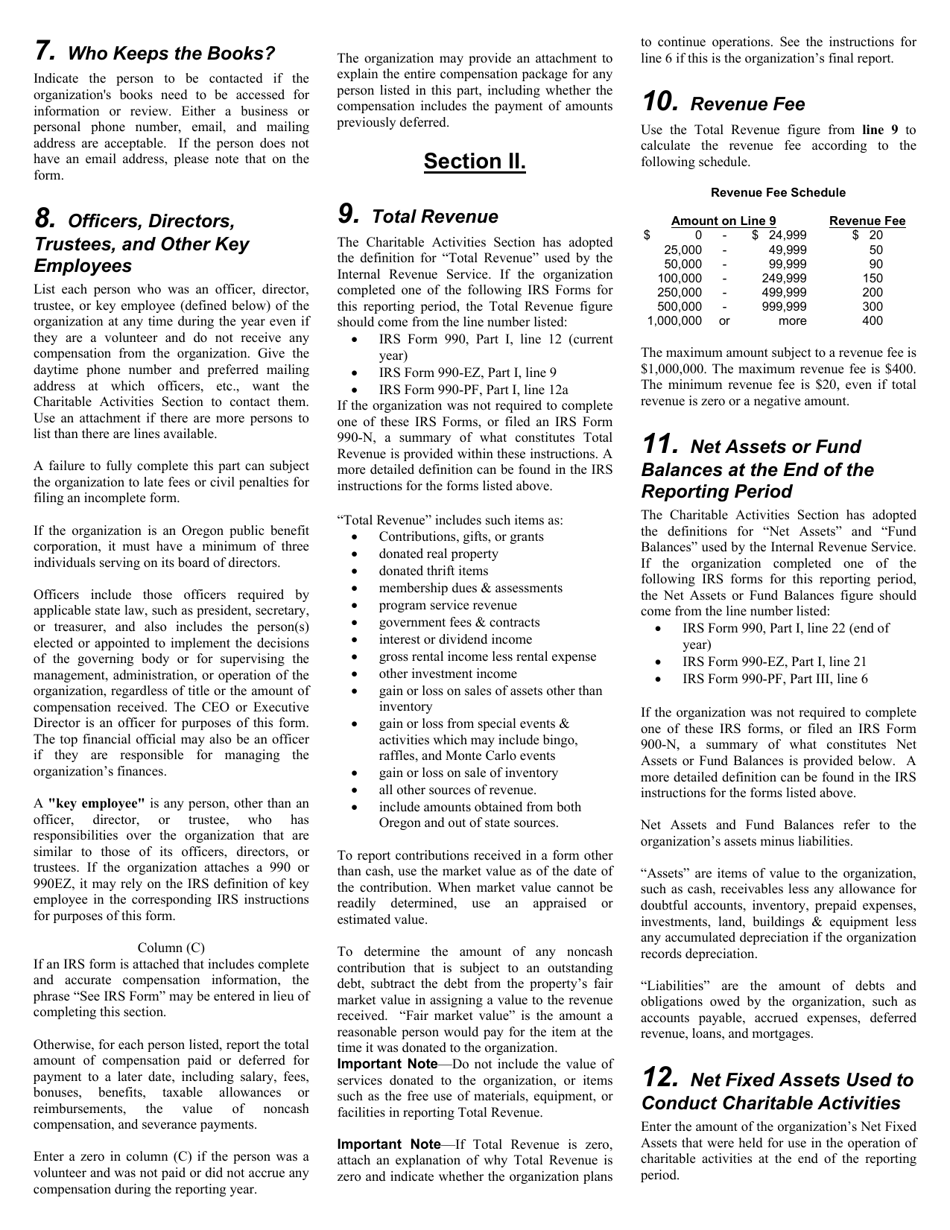

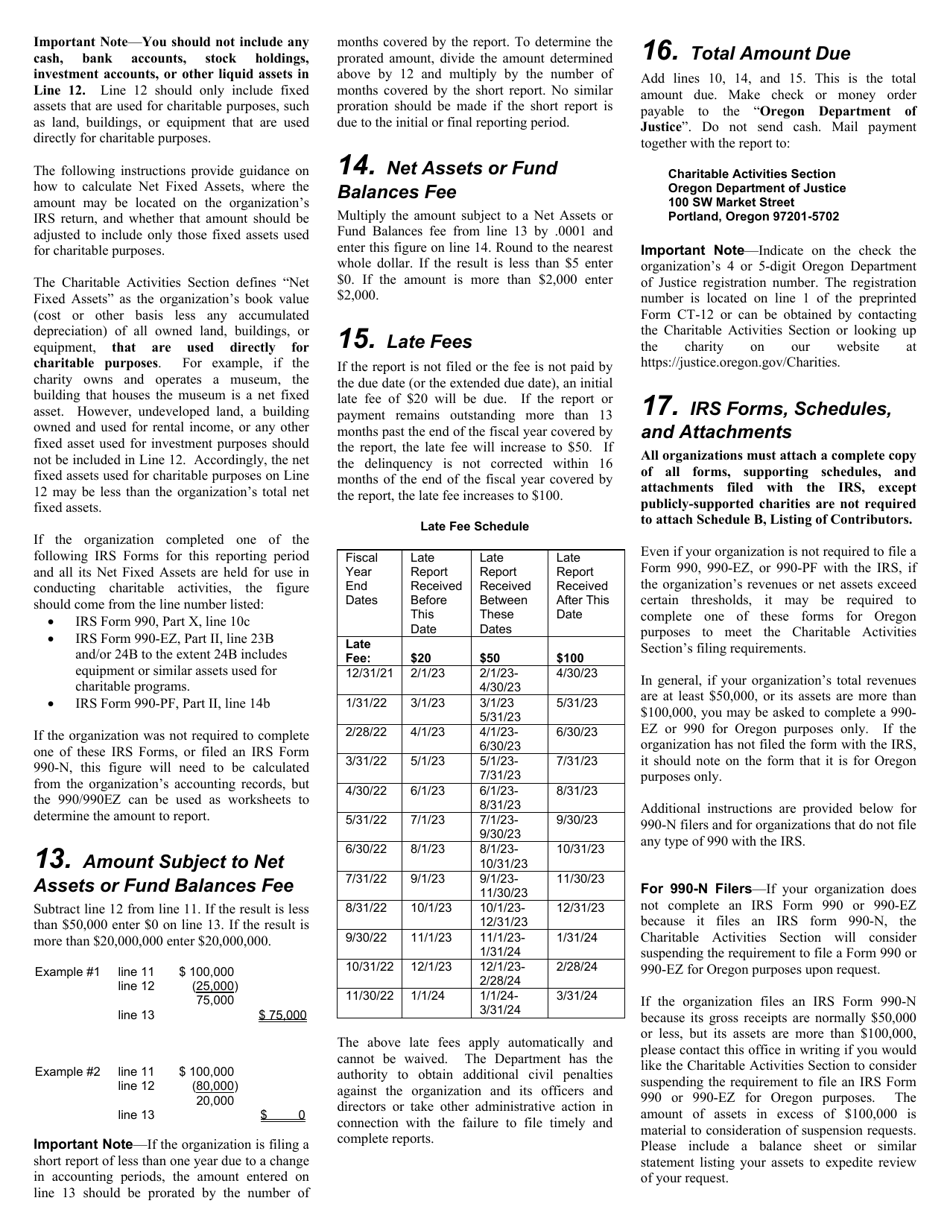

What Is Form CT-12?

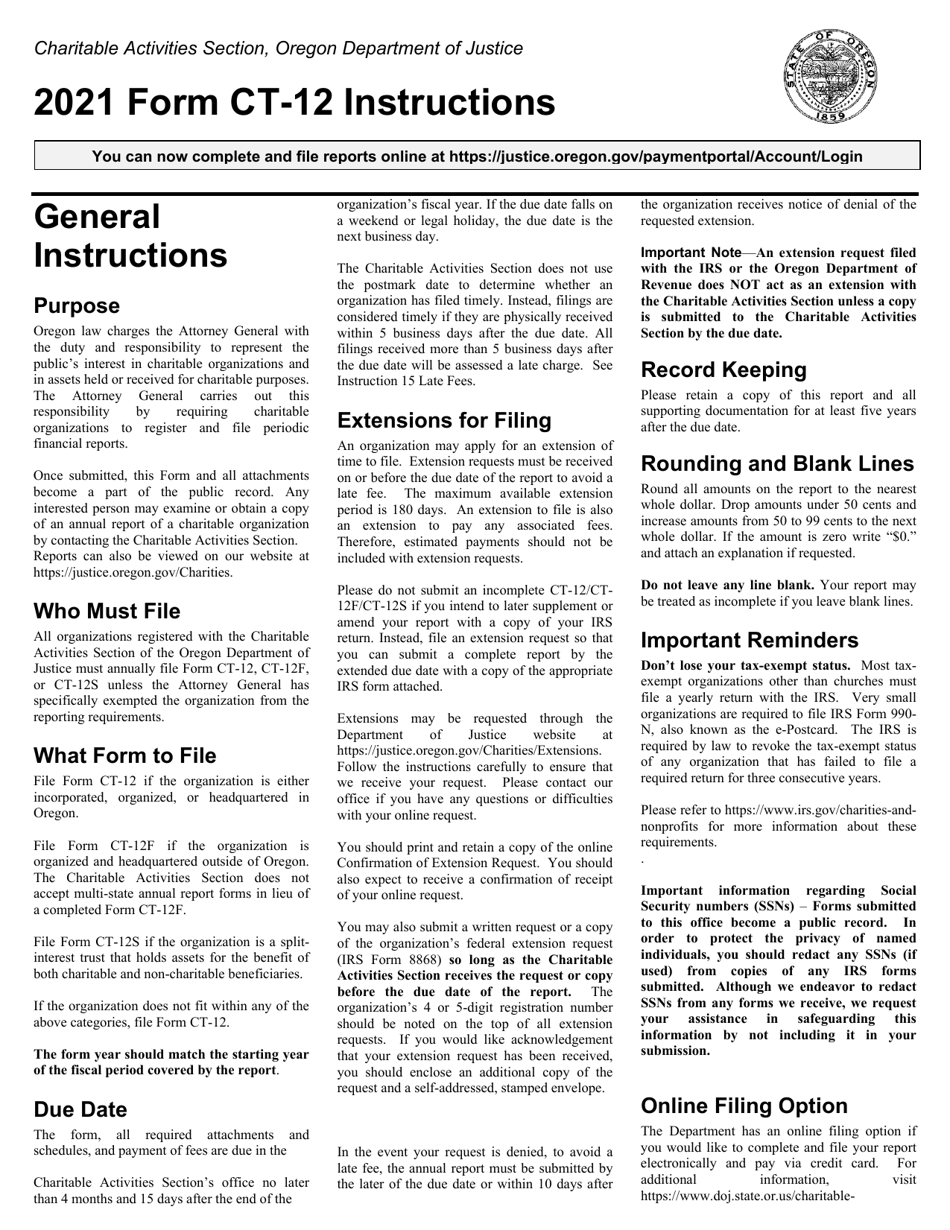

This is a legal form that was released by the Oregon Department of Justice - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-12?

A: Form CT-12 is the Charitable Activities Form for Oregon Charities.

Q: Who needs to file Form CT-12?

A: Oregon Charities need to file Form CT-12.

Q: What is the purpose of Form CT-12?

A: The purpose of Form CT-12 is to report information about the charitable activities of Oregon Charities.

Q: When is Form CT-12 due?

A: Form CT-12 is due by the 15th day of the 5th month after the end of the organization's fiscal year.

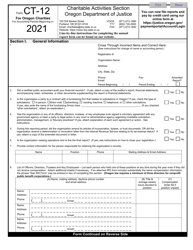

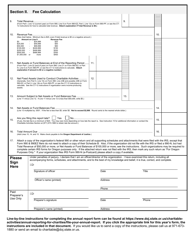

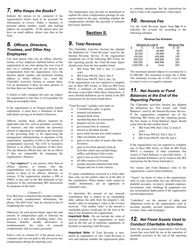

Q: What information do I need to provide on Form CT-12?

A: You need to provide information about your organization's activities, income, expenses, and other relevant details.

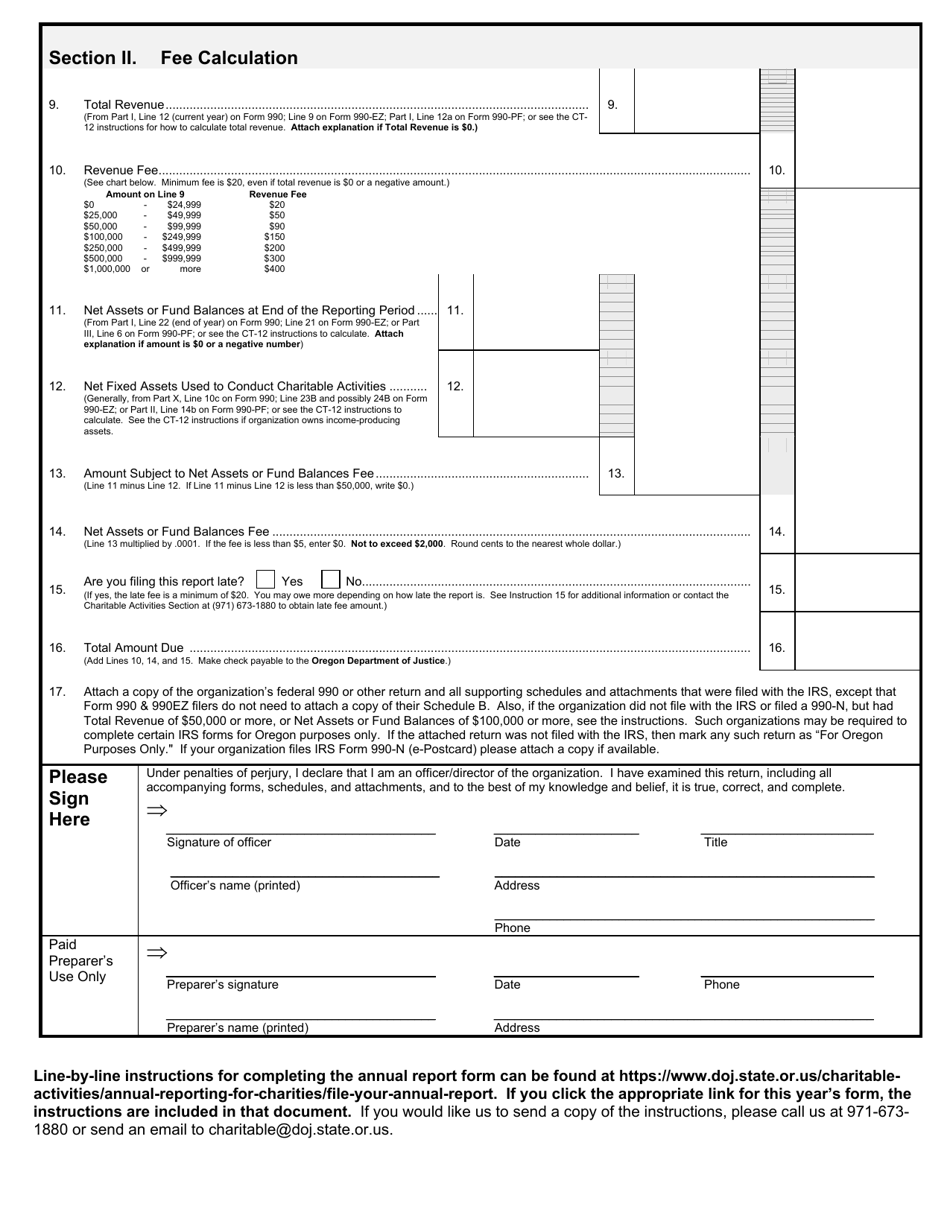

Q: Are there any filing fees for Form CT-12?

A: There are no filing fees for Form CT-12.

Q: What happens if I don't file Form CT-12?

A: Failure to file Form CT-12 may result in penalties and the loss of tax-exempt status for your organization.

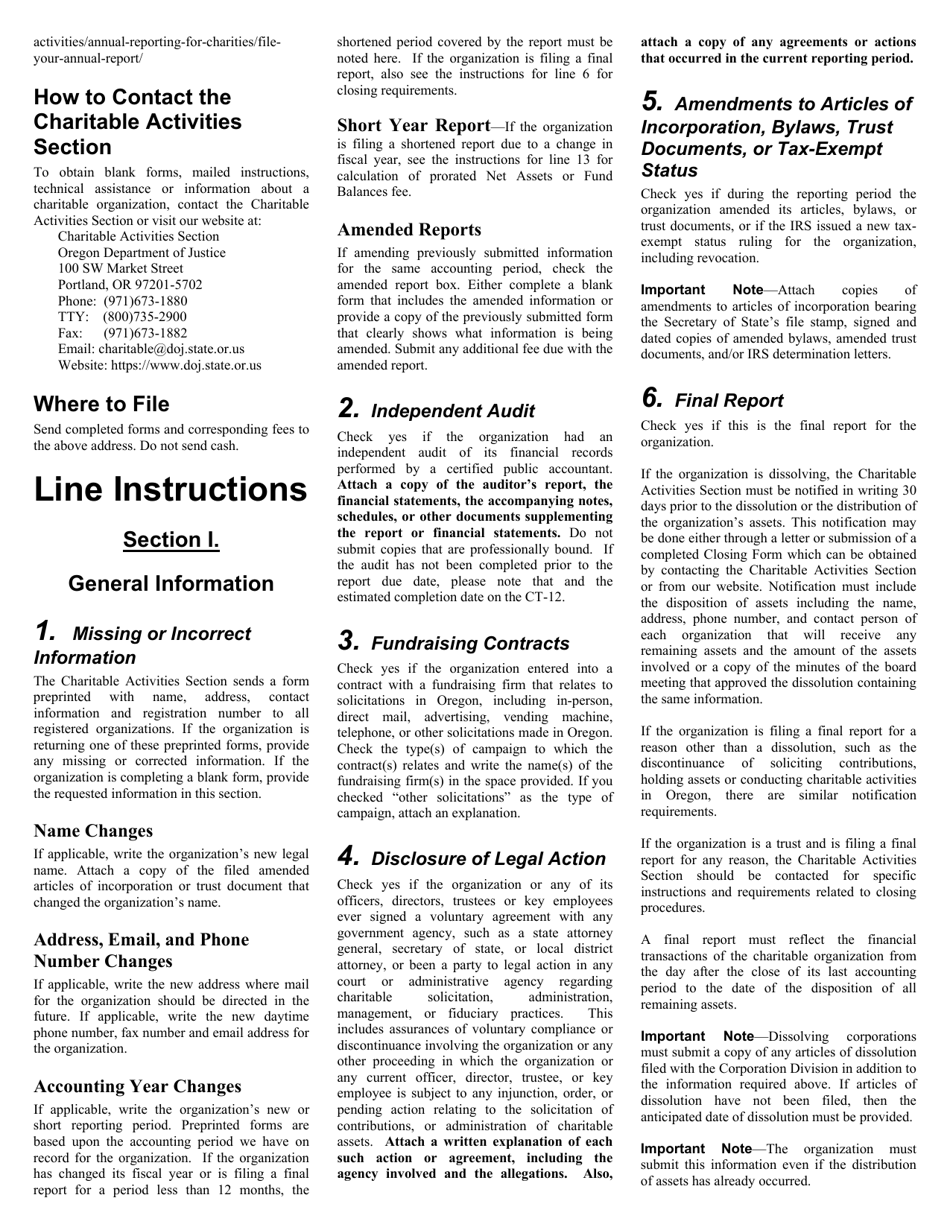

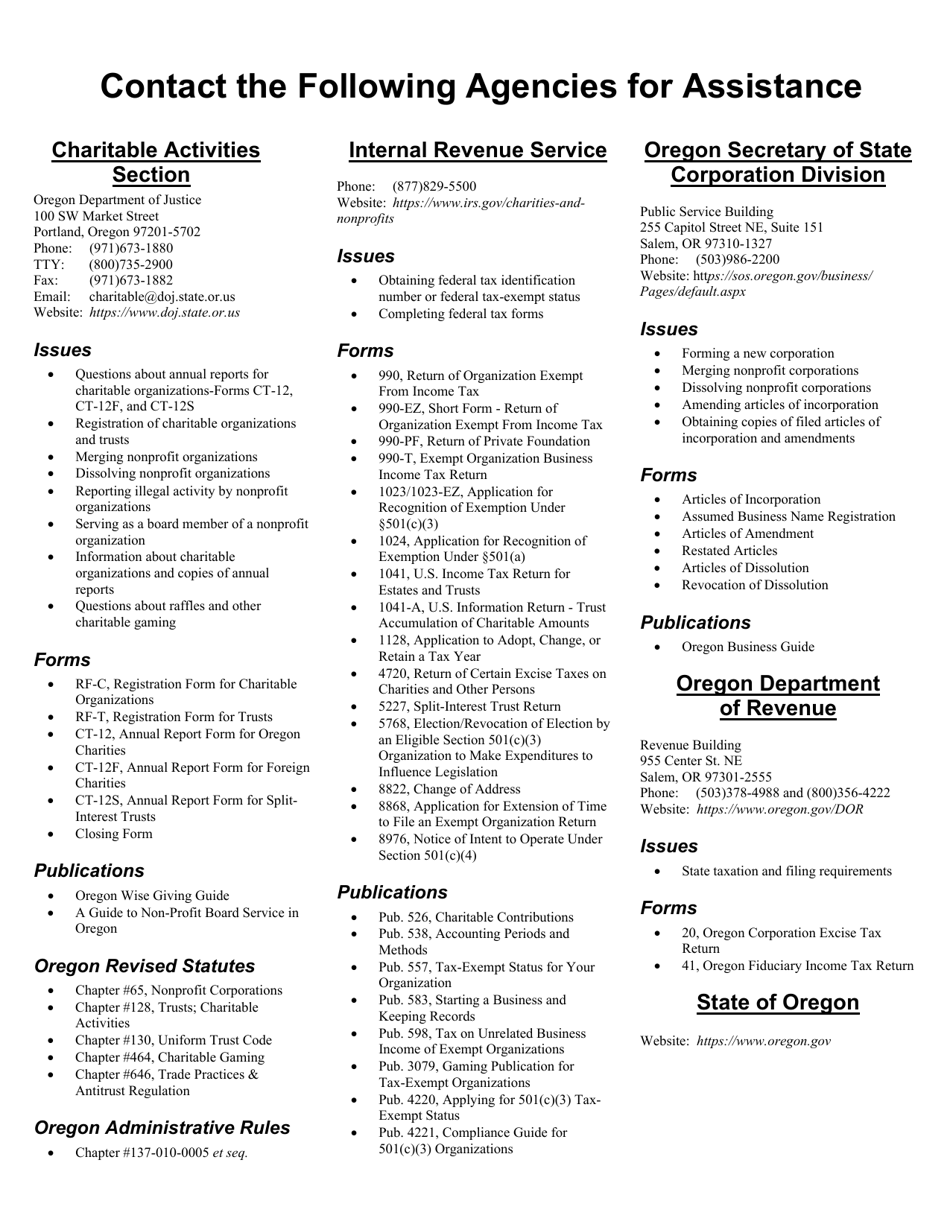

Q: What should I do if I have questions or need assistance with Form CT-12?

A: You can contact the Oregon Department of Revenue for guidance and assistance with Form CT-12.

Form Details:

- The latest edition provided by the Oregon Department of Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-12 by clicking the link below or browse more documents and templates provided by the Oregon Department of Justice.