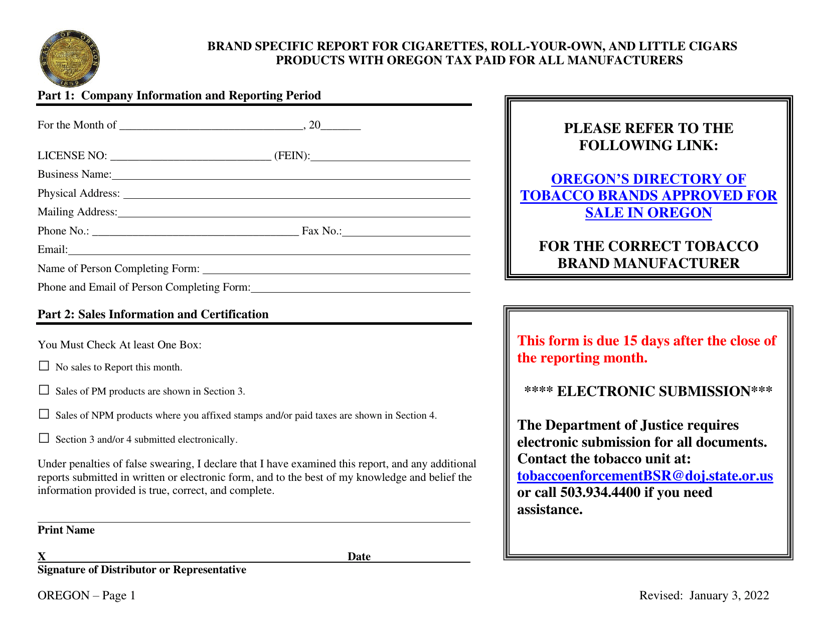

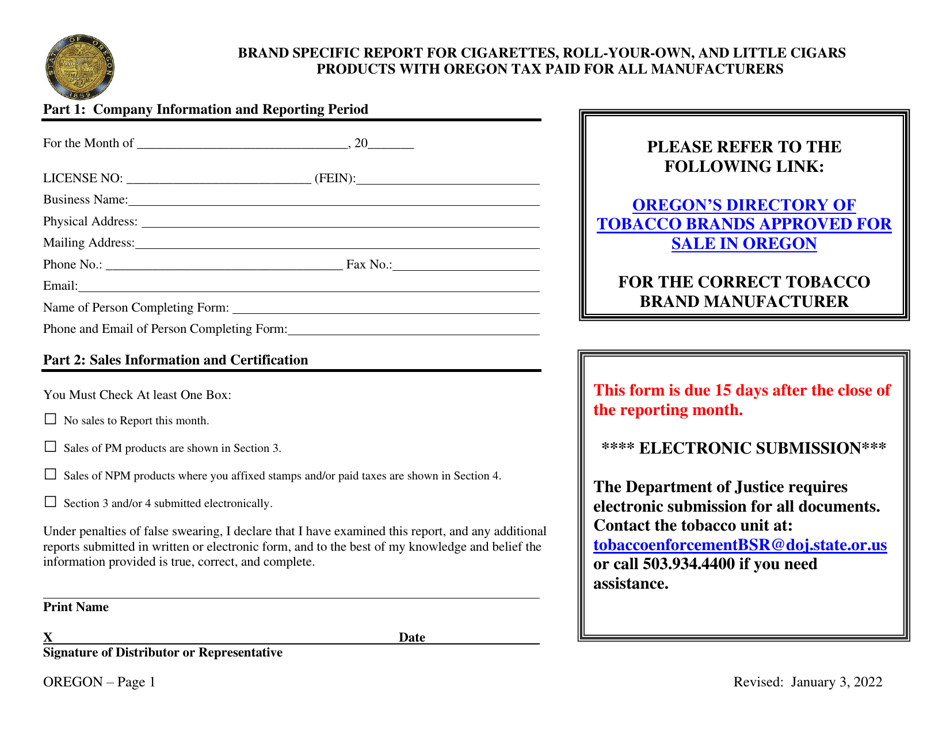

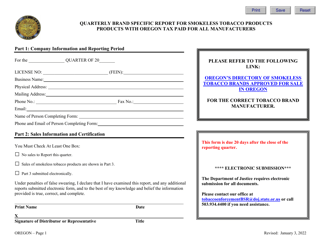

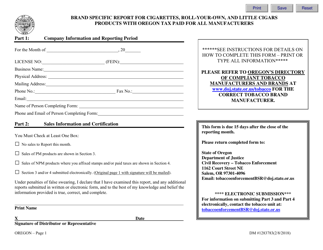

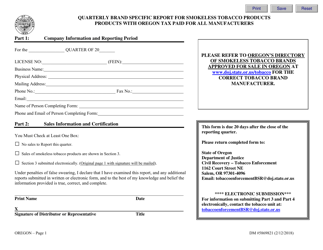

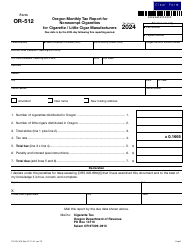

Brand Specific Report for Cigarettes, Roll-Your-Own, and Little Cigars Products With Oregon Tax Paid for All Manufacturers Signature Cover Page - Oregon

Brand Specific Report for Cigarettes, Roll-Your-Own, and Tax Paid for All Manufacturers Signature Cover Page is a legal document that was released by the Oregon Department of Justice - a government authority operating within Oregon.

FAQ

Q: What is the Brand Specific Report?

A: The Brand Specific Report is a document that provides details on cigarettes, roll-your-own tobacco, and little cigars products with Oregon tax paid for all manufacturers.

Q: What does the report cover?

A: The report covers information on cigarettes, roll-your-own tobacco, and little cigars products with Oregon tax paid for all manufacturers.

Q: What products are included in the report?

A: The report includes information on cigarettes, roll-your-own tobacco, and little cigars products.

Q: What is the purpose of the Signature Cover Page?

A: The Signature Cover Page is a document that confirms the authenticity and accuracy of the Brand Specific Report.

Q: Who is required to submit the Brand Specific Report?

A: Manufacturers of cigarettes, roll-your-own tobacco, and little cigars are required to submit the Brand Specific Report.

Q: What is Oregon tax paid?

A: Oregon tax paid refers to the state tax that has been paid for the cigarettes, roll-your-own tobacco, and little cigars products in Oregon.

Q: Why is it important to have Oregon tax paid?

A: Having Oregon tax paid indicates that the required state taxes for the cigarettes, roll-your-own tobacco, and little cigars products have been properly paid.

Q: What information does the report provide?

A: The report provides detailed information about the manufacturers and the products, including tax payment details, quantities, and other relevant data.

Form Details:

- Released on January 3, 2022;

- The latest edition currently provided by the Oregon Department of Justice;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Department of Justice.