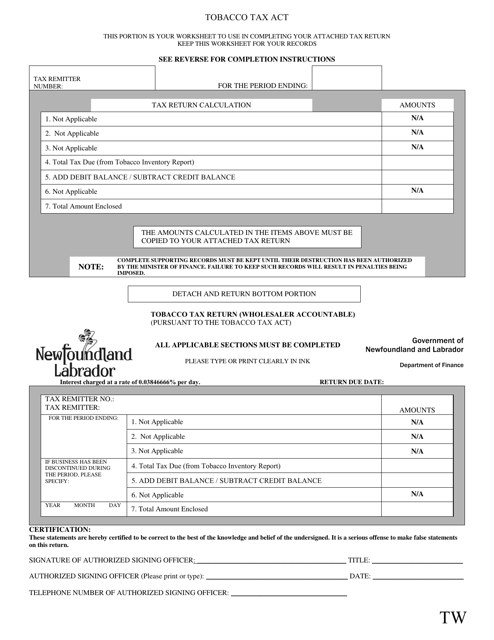

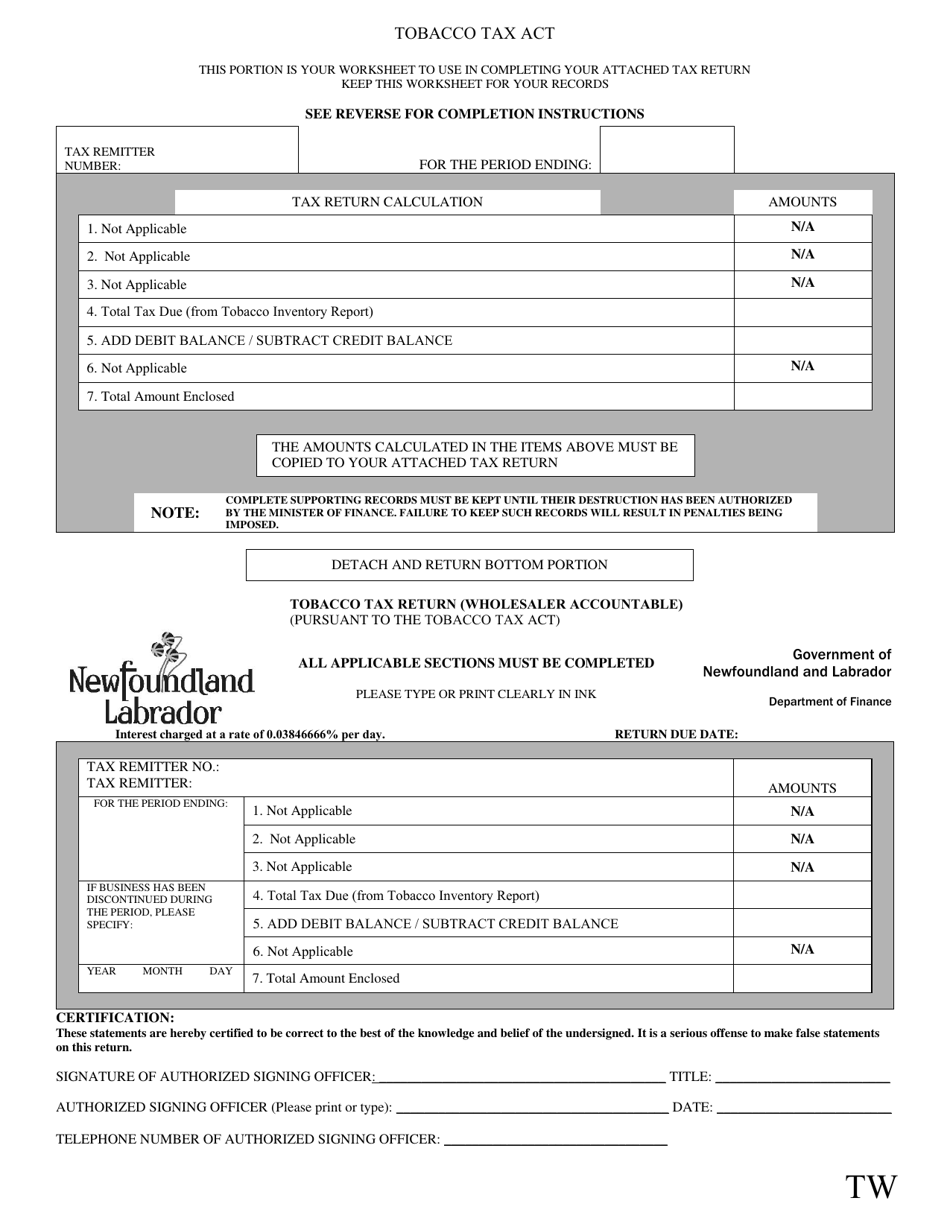

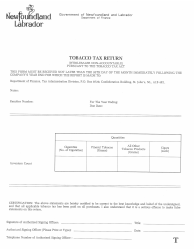

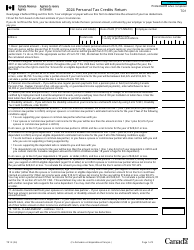

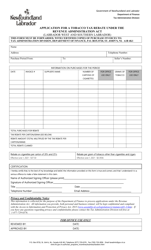

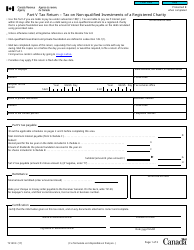

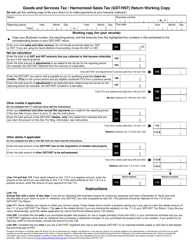

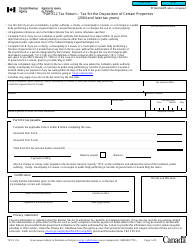

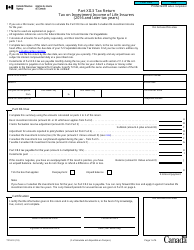

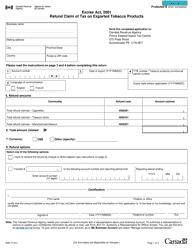

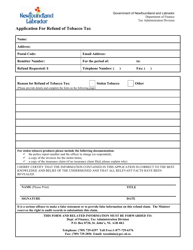

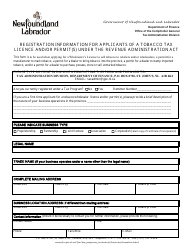

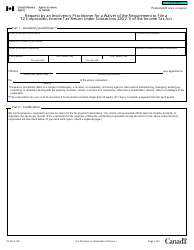

Tobacco Tax Return (Wholesaler Accountable) - Newfoundland and Labrador, Canada

The Tobacco Tax Return (Wholesaler Accountable) in Newfoundland and Labrador, Canada is used for wholesalers to report and pay the taxes on tobacco products that they have sold in the province.

In Newfoundland and Labrador, Canada, the wholesaler is responsible for filing the tobacco tax return.

FAQ

Q: What is a tobacco tax return?

A: A tobacco tax return is a form that wholesalers in Newfoundland and Labrador, Canada need to file to report and pay the taxes on tobacco products.

Q: Who needs to file a tobacco tax return in Newfoundland and Labrador?

A: Wholesalers of tobacco products in Newfoundland and Labrador need to file a tobacco tax return.

Q: What is the purpose of the tobacco tax return?

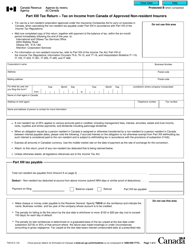

A: The purpose of the tobacco tax return is to ensure that wholesalers of tobacco products in Newfoundland and Labrador are reporting and paying the correct amount of taxes.

Q: How often do wholesalers need to file a tobacco tax return?

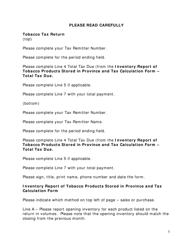

A: Wholesalers in Newfoundland and Labrador need to file a tobacco tax return on a monthly basis.

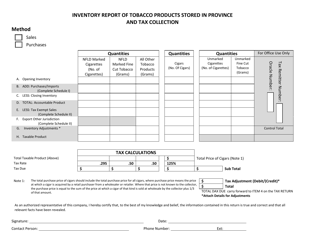

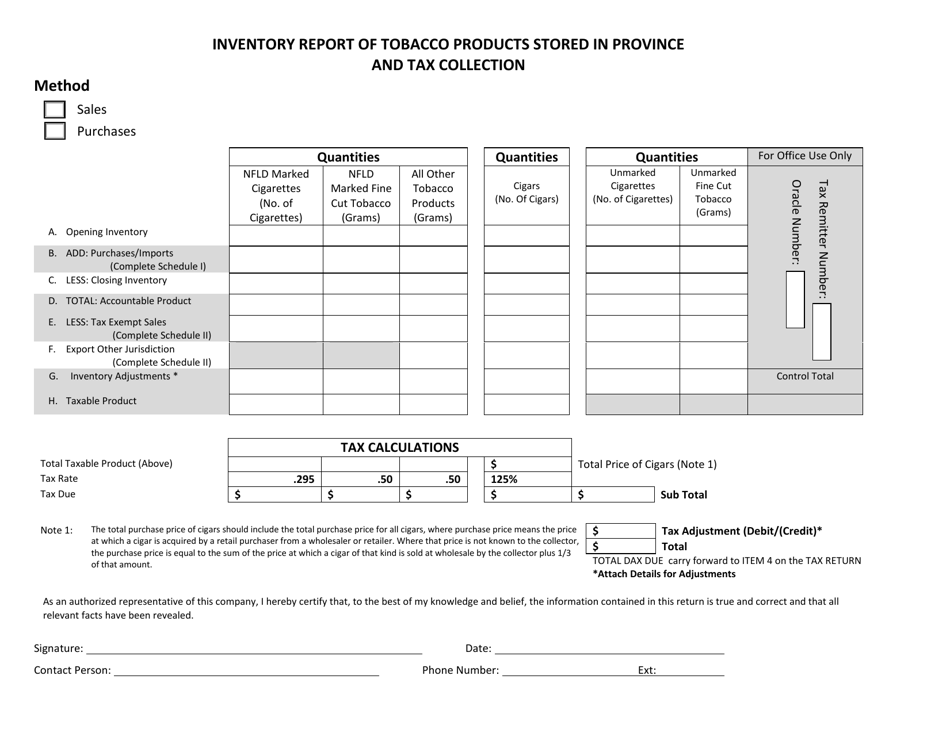

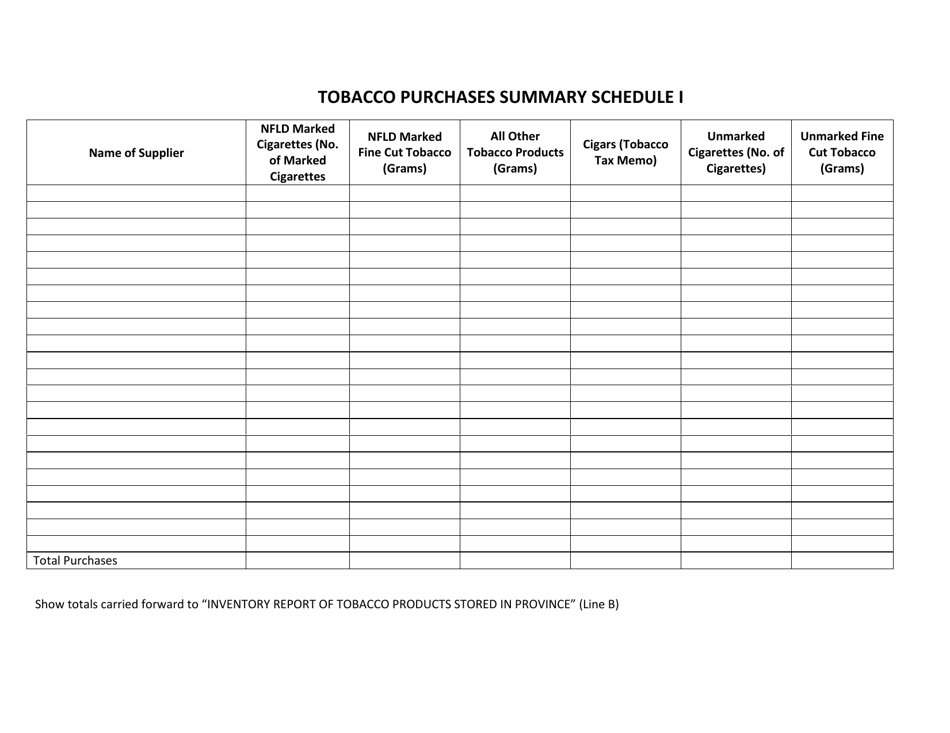

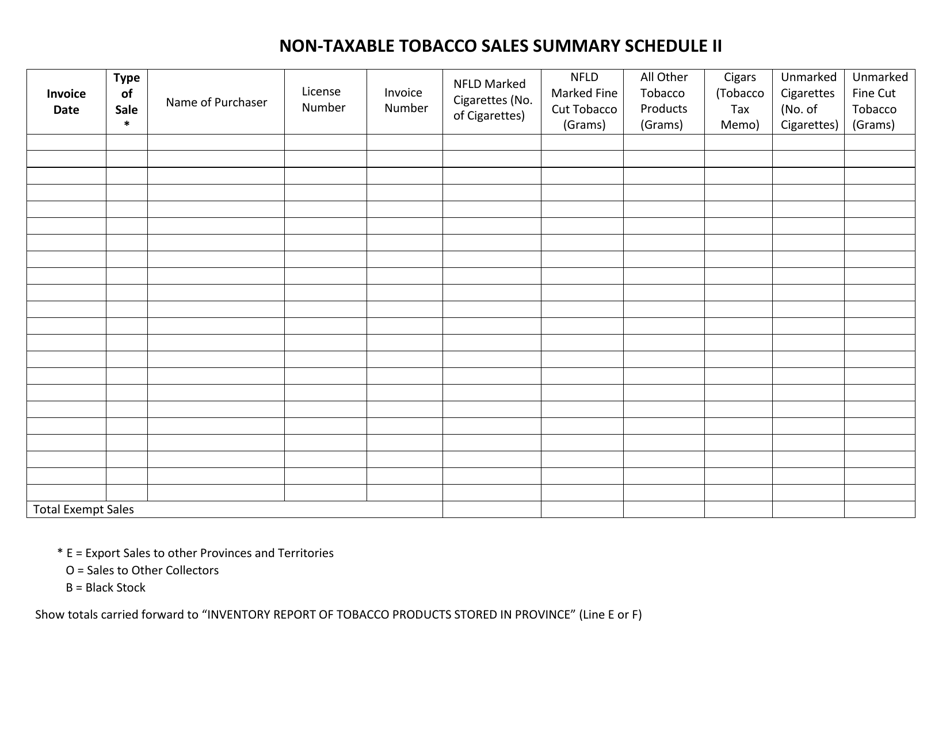

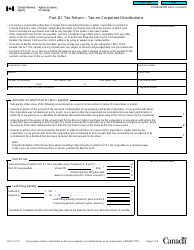

Q: What information is required on the tobacco tax return?

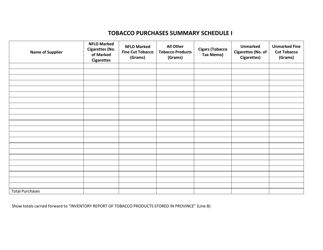

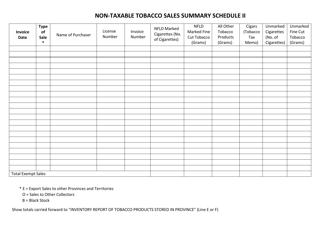

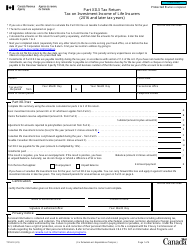

A: The tobacco tax return requires wholesalers to provide information such as the quantity of tobacco products purchased, quantity sold, and the calculated amount of taxes owed.

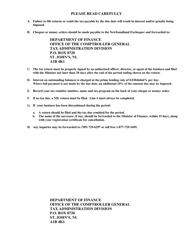

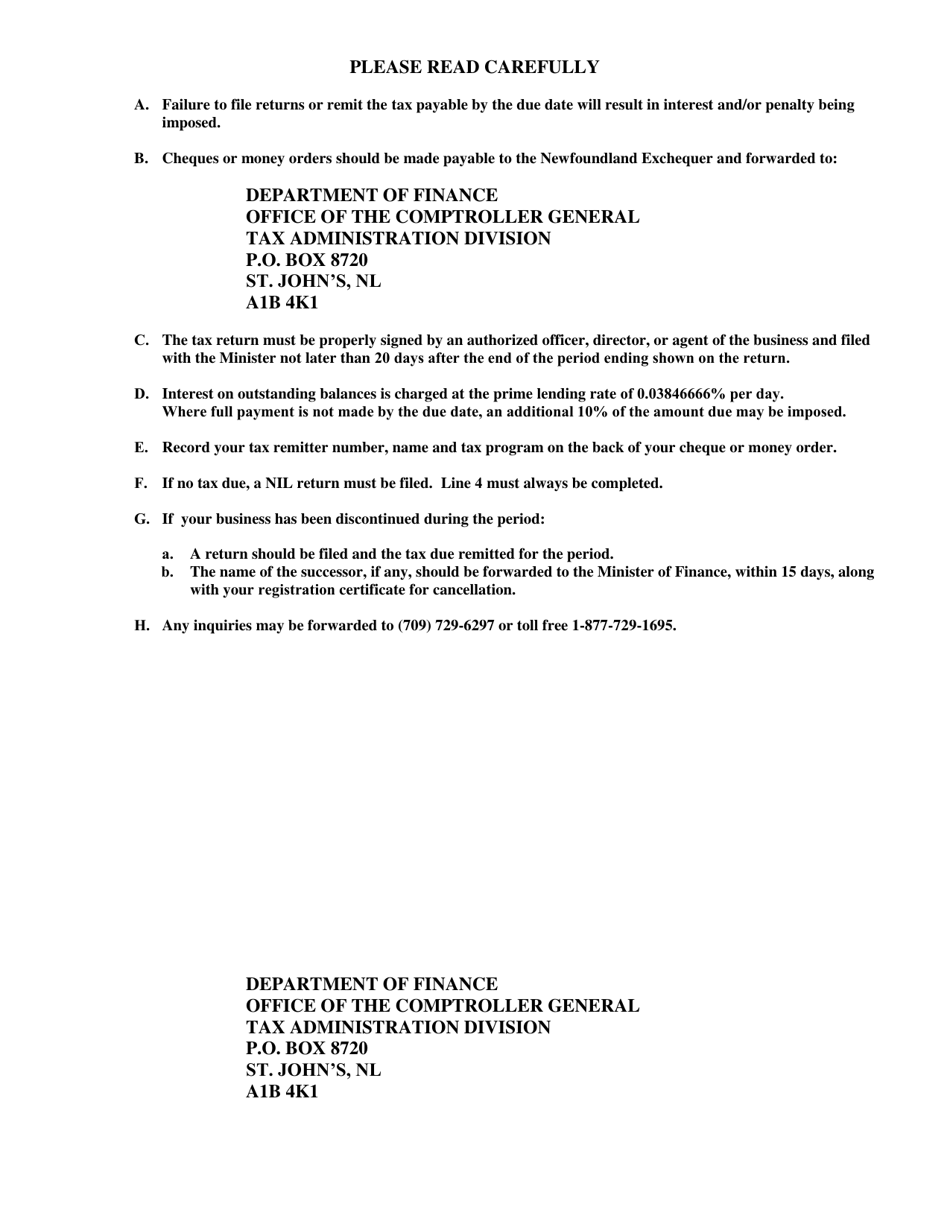

Q: What happens if a wholesaler fails to file a tobacco tax return?

A: If a wholesaler fails to file a tobacco tax return in Newfoundland and Labrador, they may be subject to penalties and fines.

Q: Can wholesalers claim deductions on the tobacco tax return?

A: Yes, wholesalers may be able to claim deductions for certain circumstances, such as returns and allowances, as specified in the instructions for the tobacco tax return form.

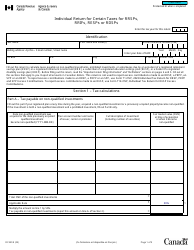

Q: Are there any other requirements for wholesalers regarding tobacco taxes?

A: Yes, wholesalers may also be required to maintain records of their tobacco purchases and sales, which may be subject to inspection by the government.