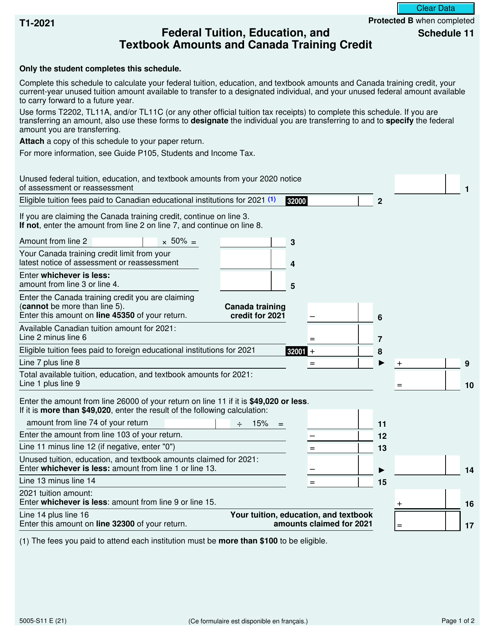

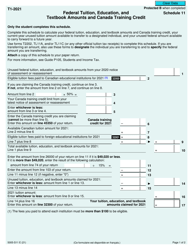

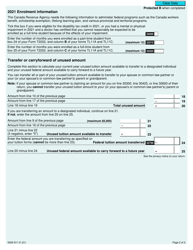

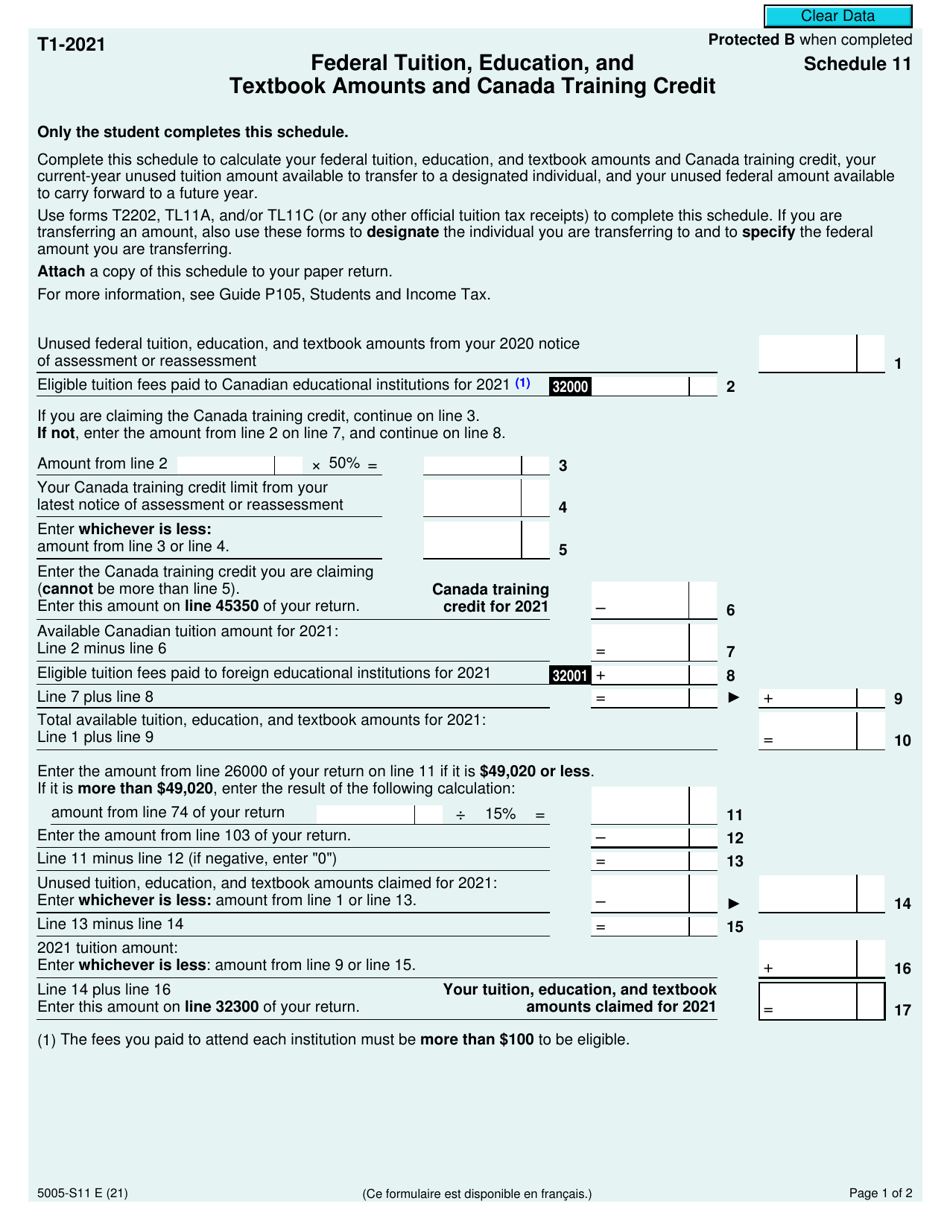

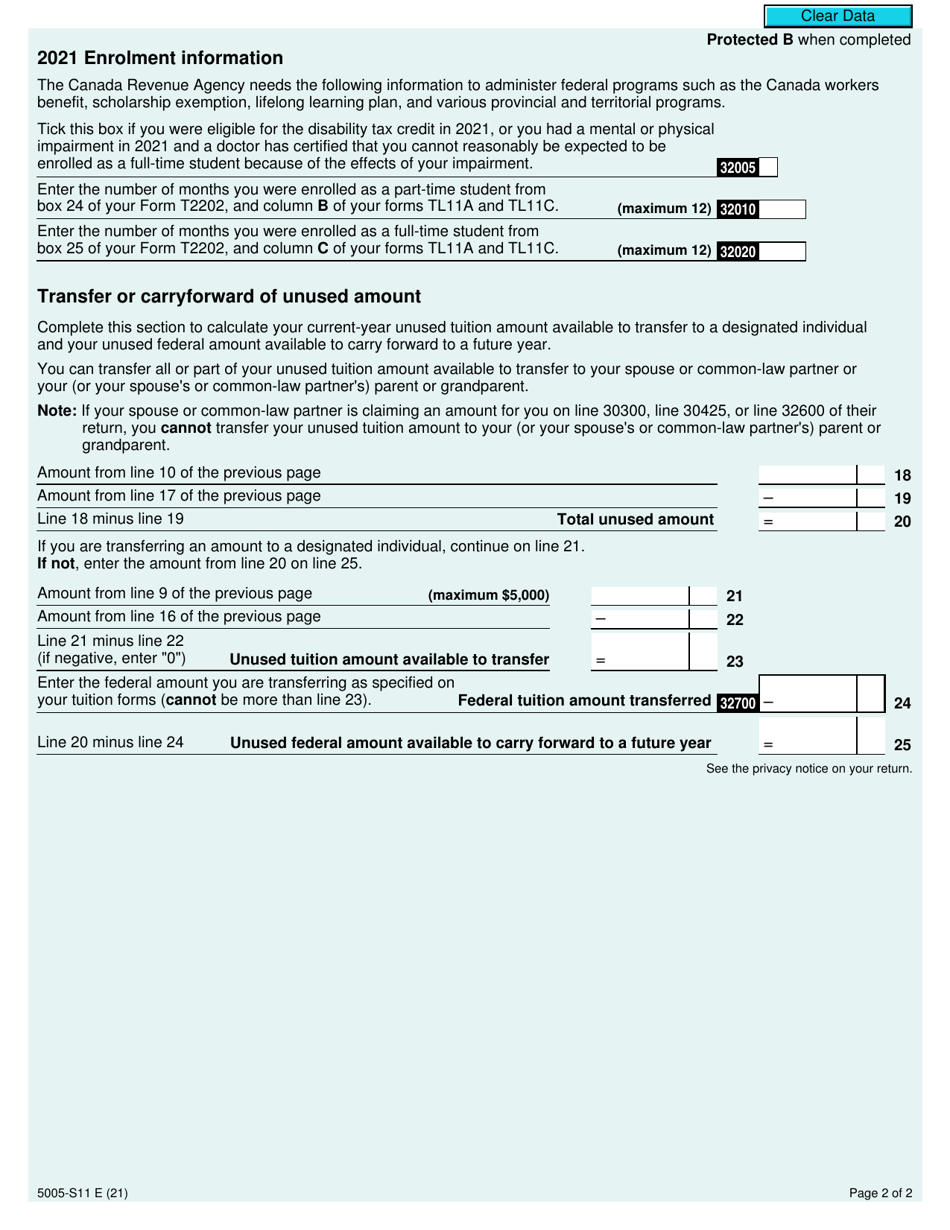

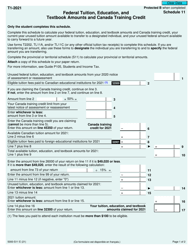

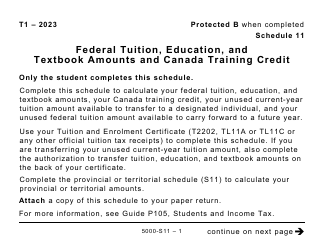

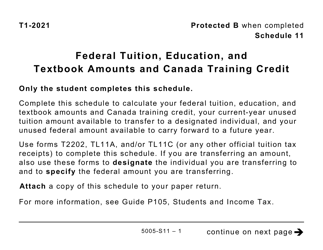

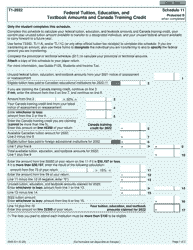

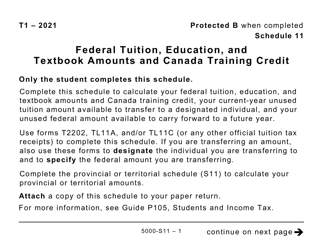

Form 5005 Schedule 11 Federal Tuition, Education, and Textbook Amounts and Canada Training Credit (For Quebec and Non-residents of Canada Only) - Canada

Form 5005 Schedule 11 is used in Canada for claiming federal tuition, education, and textbook amounts, as well as the Canada Training Credit. It is specifically for residents of Quebec and non-residents of Canada.

The Form 5005 Schedule 11 for Federal Tuition, Education, and Textbook Amounts and Canada Training Credit is filed by residents of Quebec and non-residents of Canada.

FAQ

Q: What is form 5005 Schedule 11?

A: Form 5005 Schedule 11 is a document used in Canada to claim federal tuition, education, and textbook amounts, as well as the Canada Training Credit for Quebec and non-residents of Canada.

Q: Who can use form 5005 Schedule 11?

A: Form 5005 Schedule 11 can be used by residents of Quebec and non-residents of Canada who are eligible to claim the federal tuition, education, and textbook amounts, as well as the Canada Training Credit.

Q: What can be claimed using form 5005 Schedule 11?

A: Form 5005 Schedule 11 allows individuals to claim the federal tuition, education, and textbook amounts, and the Canada Training Credit.

Q: What are the federal tuition, education, and textbook amounts?

A: The federal tuition, education, and textbook amounts are tax credits that can be claimed by eligible individuals to reduce their income tax. These amounts are based on the tuition fees and textbooks purchased for post-secondary education.

Q: What is the Canada Training Credit?

A: The Canada Training Credit is a new refundable tax credit introduced in 2019. It allows eligible individuals to accumulate $250 annually for training and education purposes.

Q: Is form 5005 Schedule 11 only for residents of Quebec?

A: No, form 5005 Schedule 11 can also be used by non-residents of Canada who are eligible to claim the federal tuition, education, and textbook amounts, as well as the Canada Training Credit.

Q: Can I claim both the federal tuition, education, and textbook amounts and the Canada Training Credit?

A: Yes, eligible individuals can claim both the federal tuition, education, and textbook amounts and the Canada Training Credit, as long as they meet the requirements.

Q: What documentation do I need to support my claim on form 5005 Schedule 11?

A: You will need to keep supporting documents such as receipts and tax certificates to support your claim on form 5005 Schedule 11. Make sure to keep these documents in case the CRA asks for verification.

Q: When should I file form 5005 Schedule 11?

A: You should file form 5005 Schedule 11 along with your income tax return for the relevant tax year. Make sure to file it on time to avoid any penalties or interest charges.