This version of the form is not currently in use and is provided for reference only. Download this version of

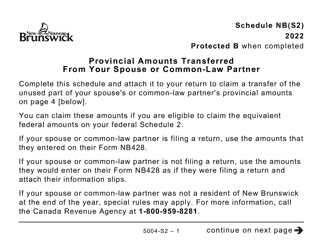

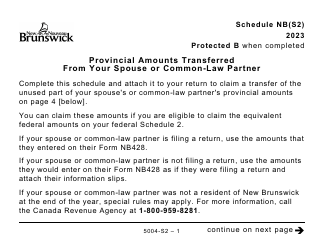

Form 5004-S2 Schedule NB(S2)

for the current year.

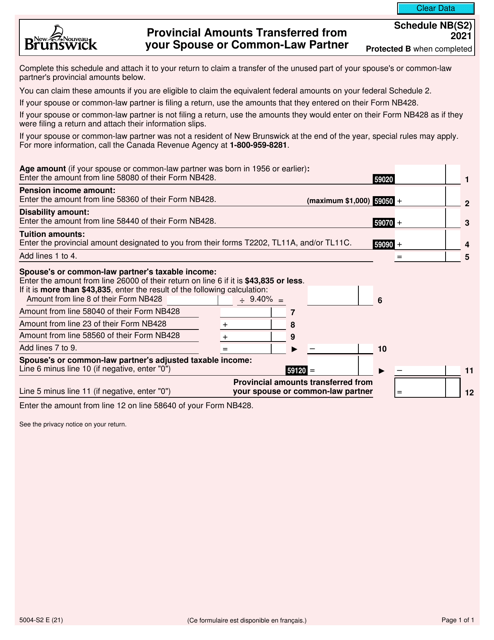

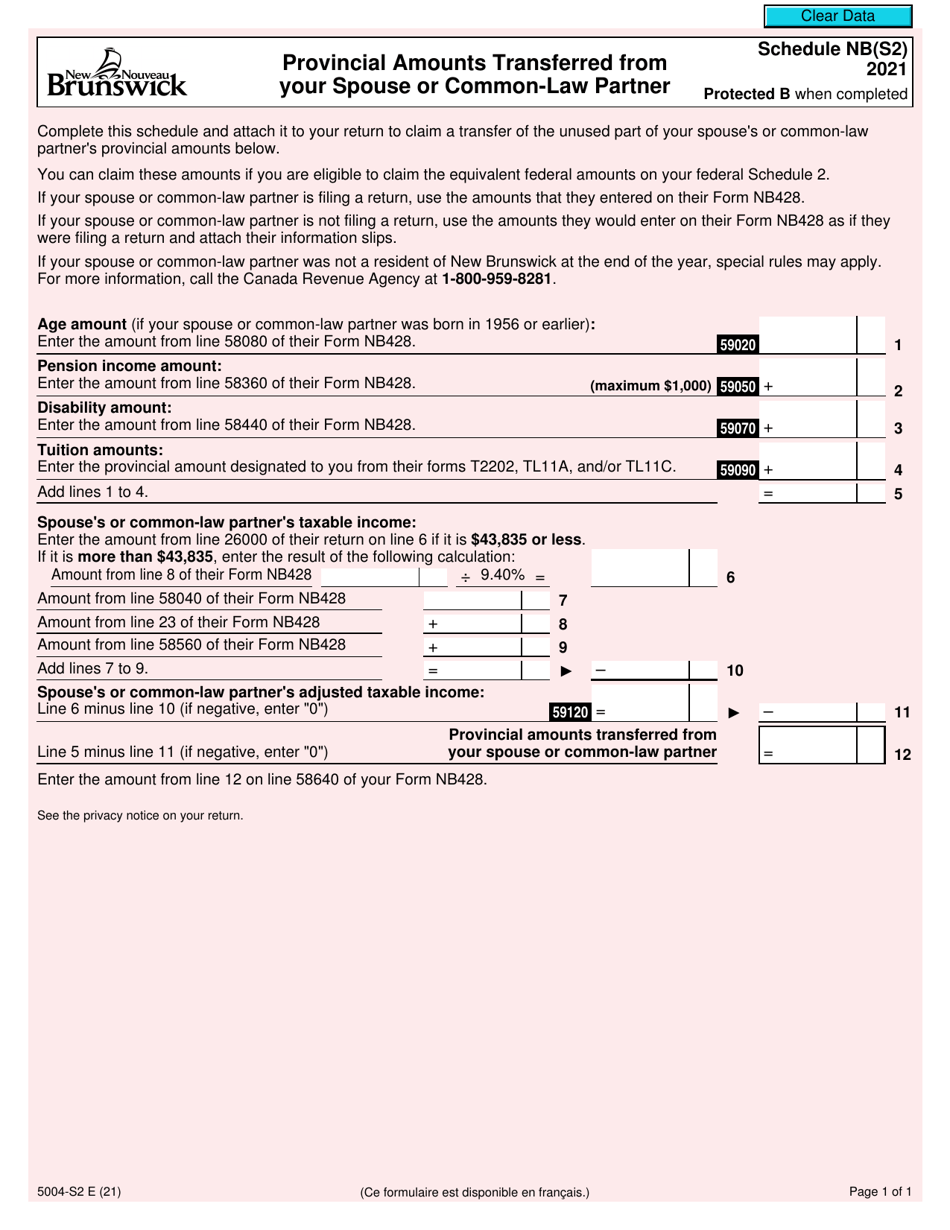

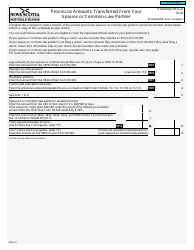

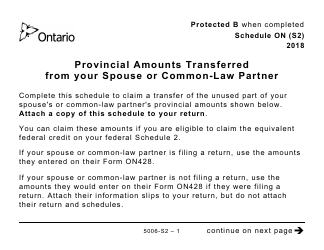

Form 5004-S2 Schedule NB(S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner - Canada

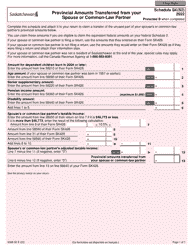

Form 5004-S2 Schedule NB(S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner in Canada is used to report any provincial tax credits or deductions that you may be eligible to transfer from your spouse or common-law partner. This form allows you to share certain tax benefits based on your marital or common-law status.

FAQ

Q: What is Form 5004-S2?

A: Form 5004-S2 is a schedule used in Canada for reporting provincial amounts transferred from your spouse or common-law partner.

Q: What is the purpose of Schedule NB(S2)?

A: The purpose of Schedule NB(S2) is to report provincial amounts transferred from your spouse or common-law partner.

Q: When is Schedule NB(S2) used?

A: Schedule NB(S2) is used when you want to report provincial amounts transferred from your spouse or common-law partner.

Q: What are provincial amounts transferred?

A: Provincial amounts transferred refer to certain tax credits or deductions that can be transferred from your spouse or common-law partner to reduce your provincial tax liability.

Q: Who is considered a spouse or common-law partner?

A: A spouse is someone you are legally married to, while a common-law partner is someone you have been living with in a conjugal relationship for at least 12 continuous months.