This version of the form is not currently in use and is provided for reference only. Download this version of

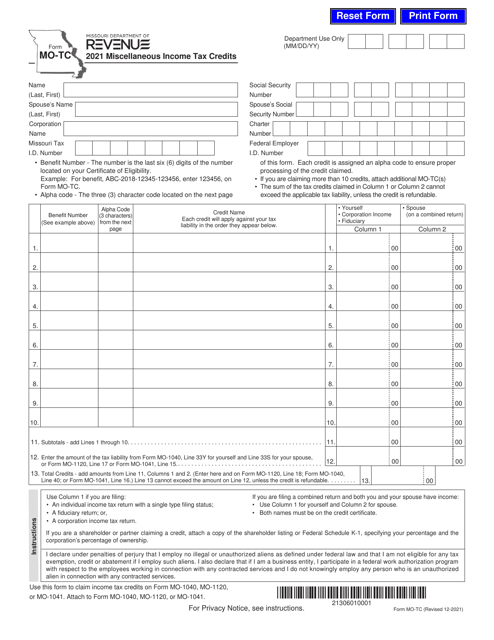

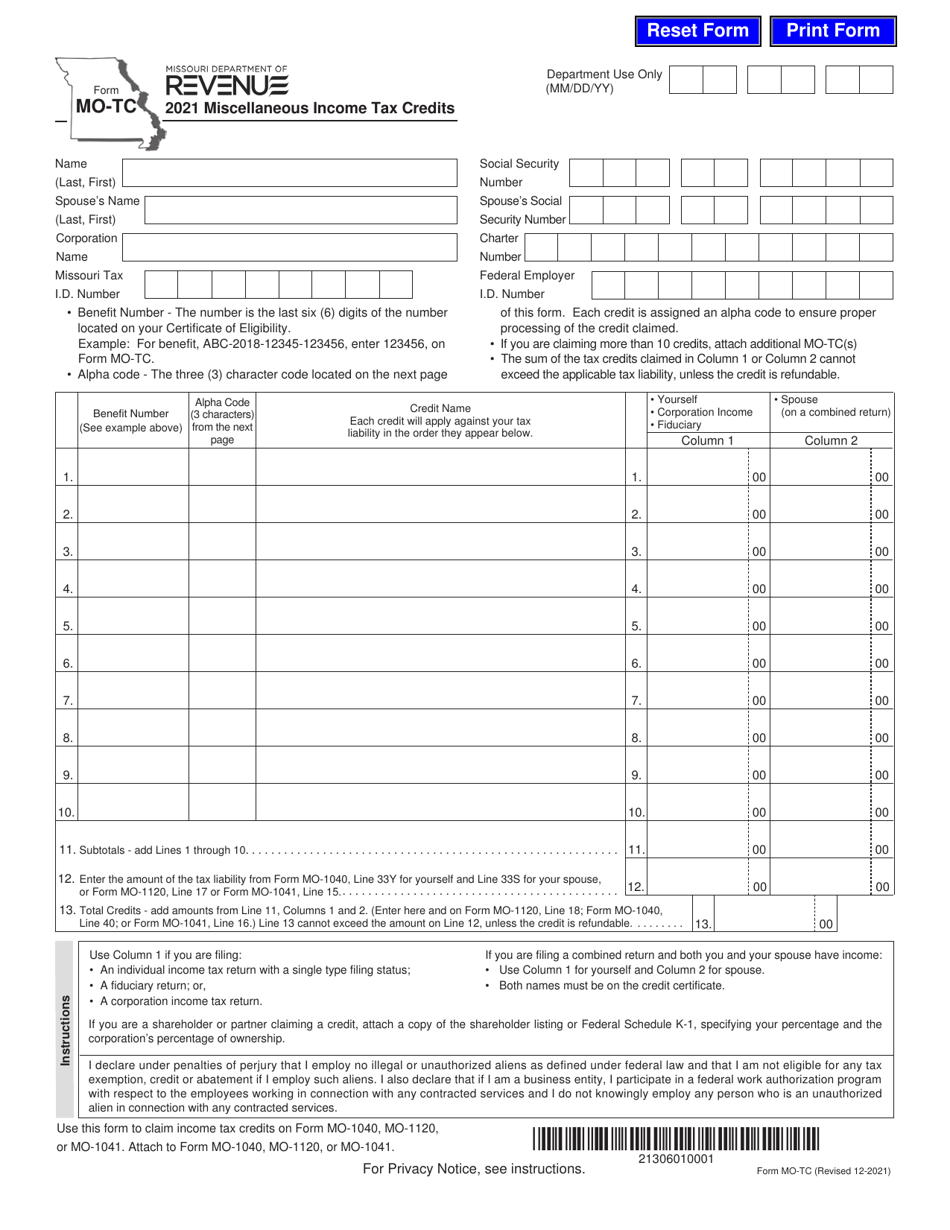

Form MO-TC

for the current year.

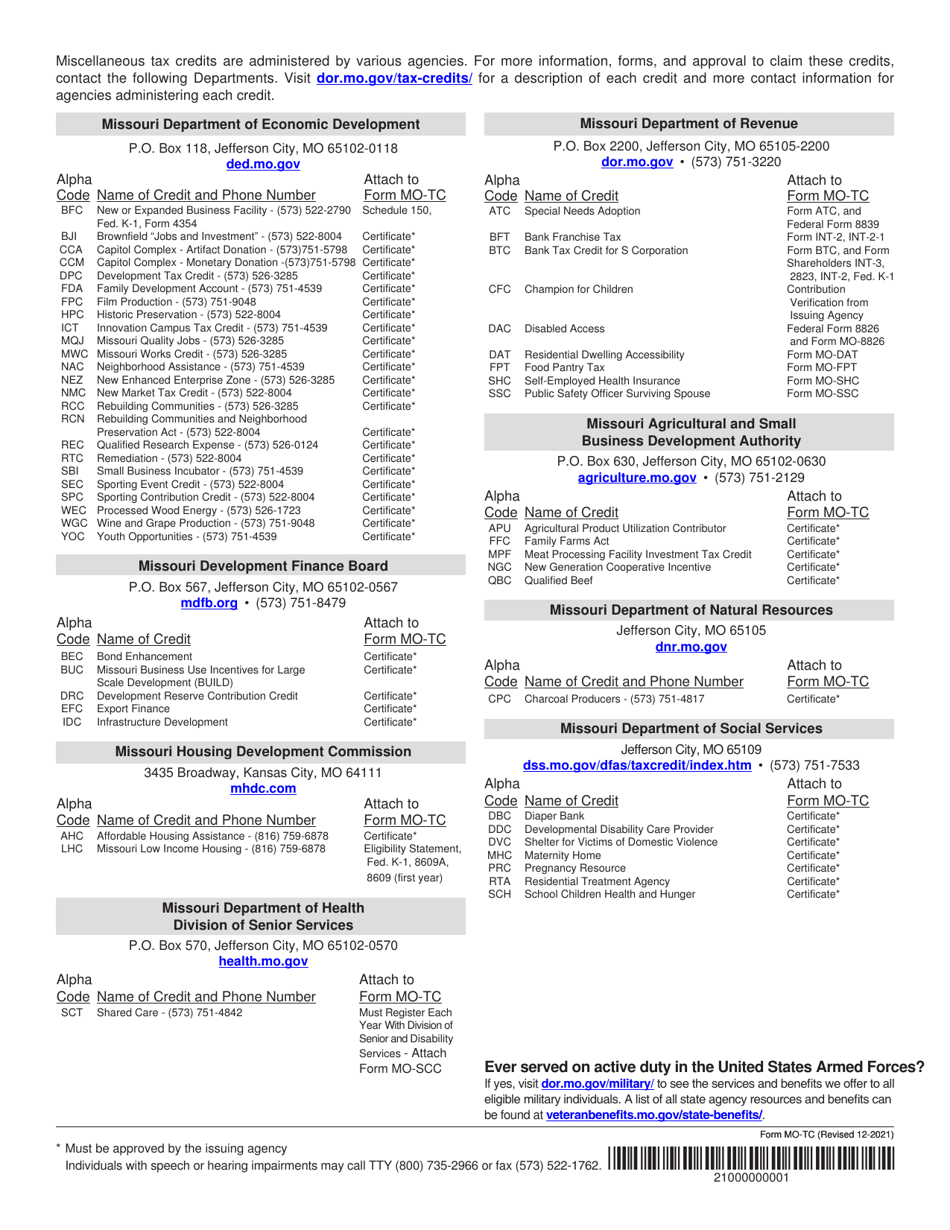

Form MO-TC Miscellaneous Income Tax Credits - Missouri

What Is Form MO-TC?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-TC?

A: Form MO-TC is a form used to claim miscellaneous income tax credits in Missouri.

Q: What are miscellaneous income tax credits?

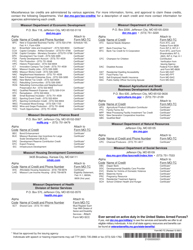

A: Miscellaneous income tax credits are credits that can be claimed for various purposes, such as property tax credit, elderly and disabled tax credit, and child and dependent care credit.

Q: Who can use Form MO-TC?

A: Form MO-TC can be used by individuals who are eligible to claim miscellaneous income tax credits in Missouri.

Q: How do I fill out Form MO-TC?

A: You should follow the instructions provided with the form to accurately fill out the required information.

Q: Is there a deadline to file Form MO-TC?

A: Yes, the deadline to file Form MO-TC is the same as the Missouri state income tax filing deadline.

Q: Are there any income limits for claiming miscellaneous income tax credits?

A: Yes, there are income limits for certain credits. Refer to the instructions for Form MO-TC for more details.

Q: What should I do if I have questions or need assistance with Form MO-TC?

A: If you have questions or need assistance with Form MO-TC, you can contact the Missouri Department of Revenue or consult a tax professional.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-TC by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.