This version of the form is not currently in use and is provided for reference only. Download this version of

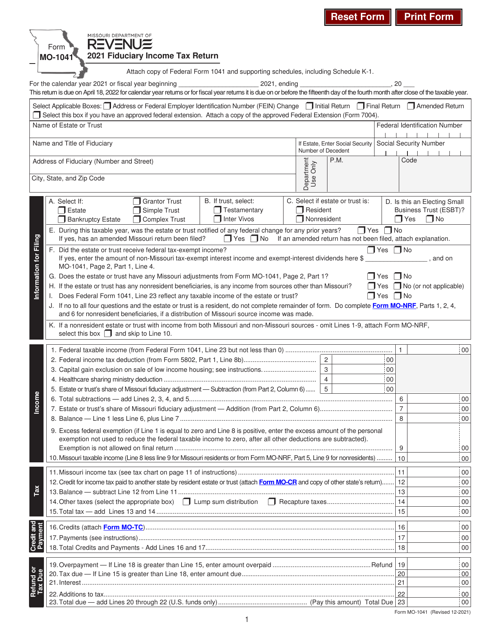

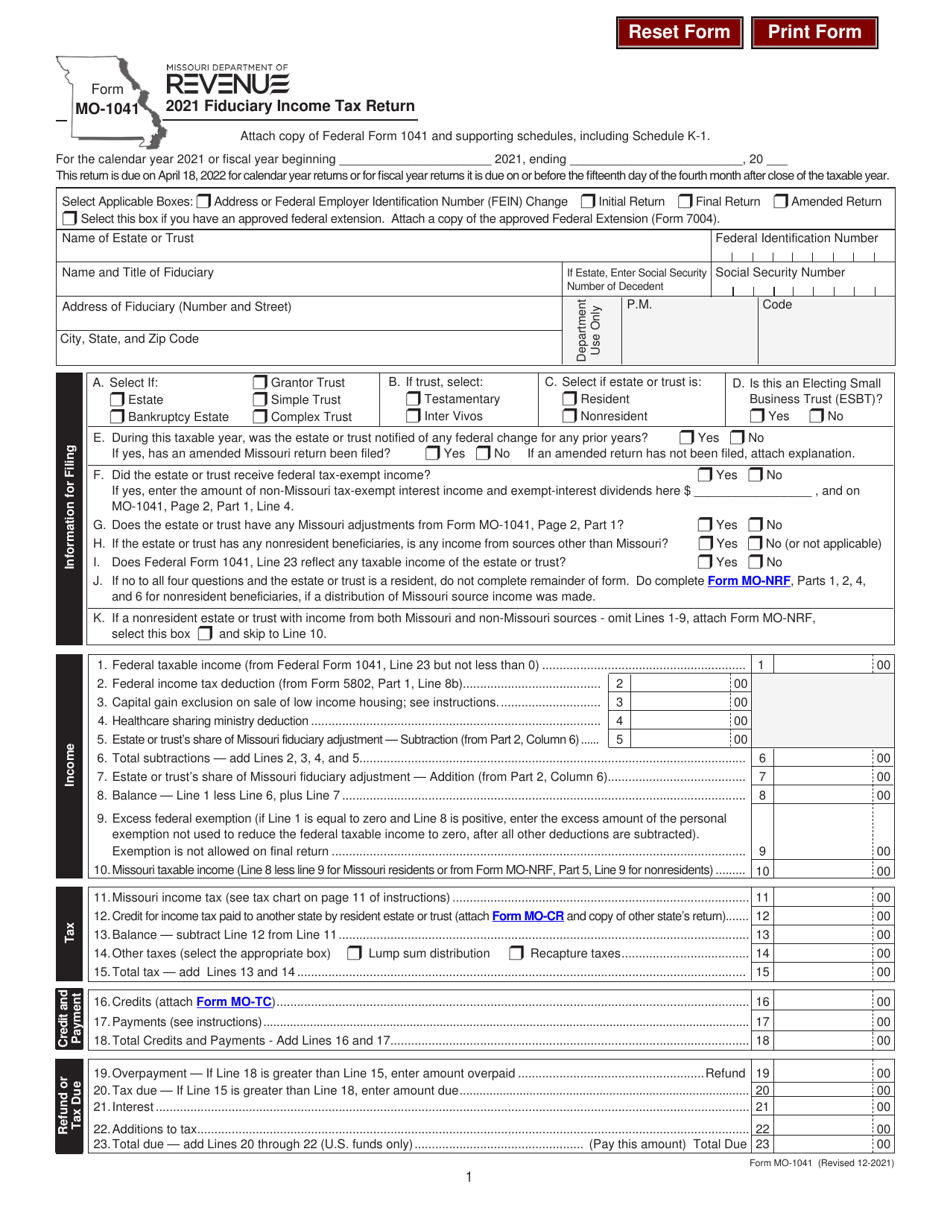

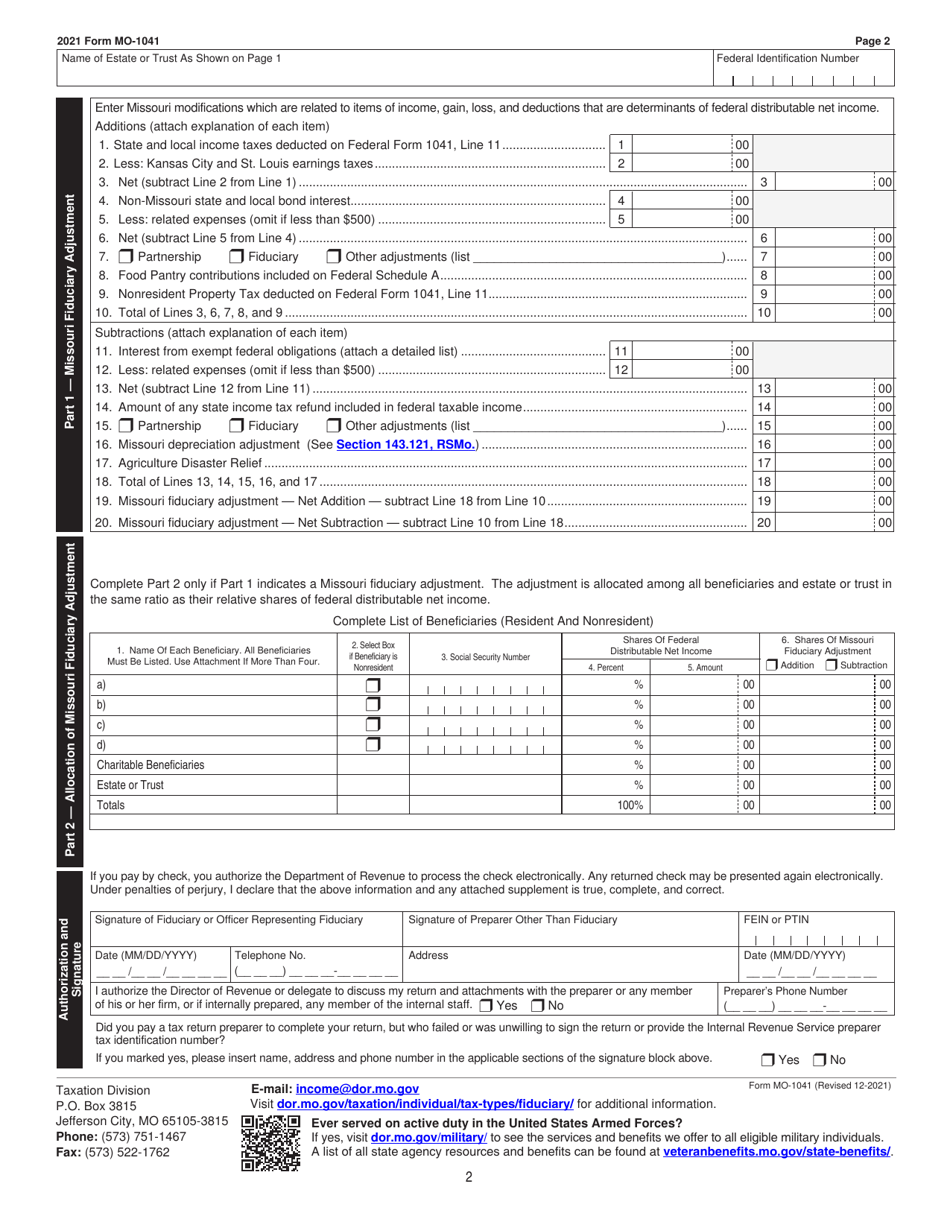

Form MO-1041

for the current year.

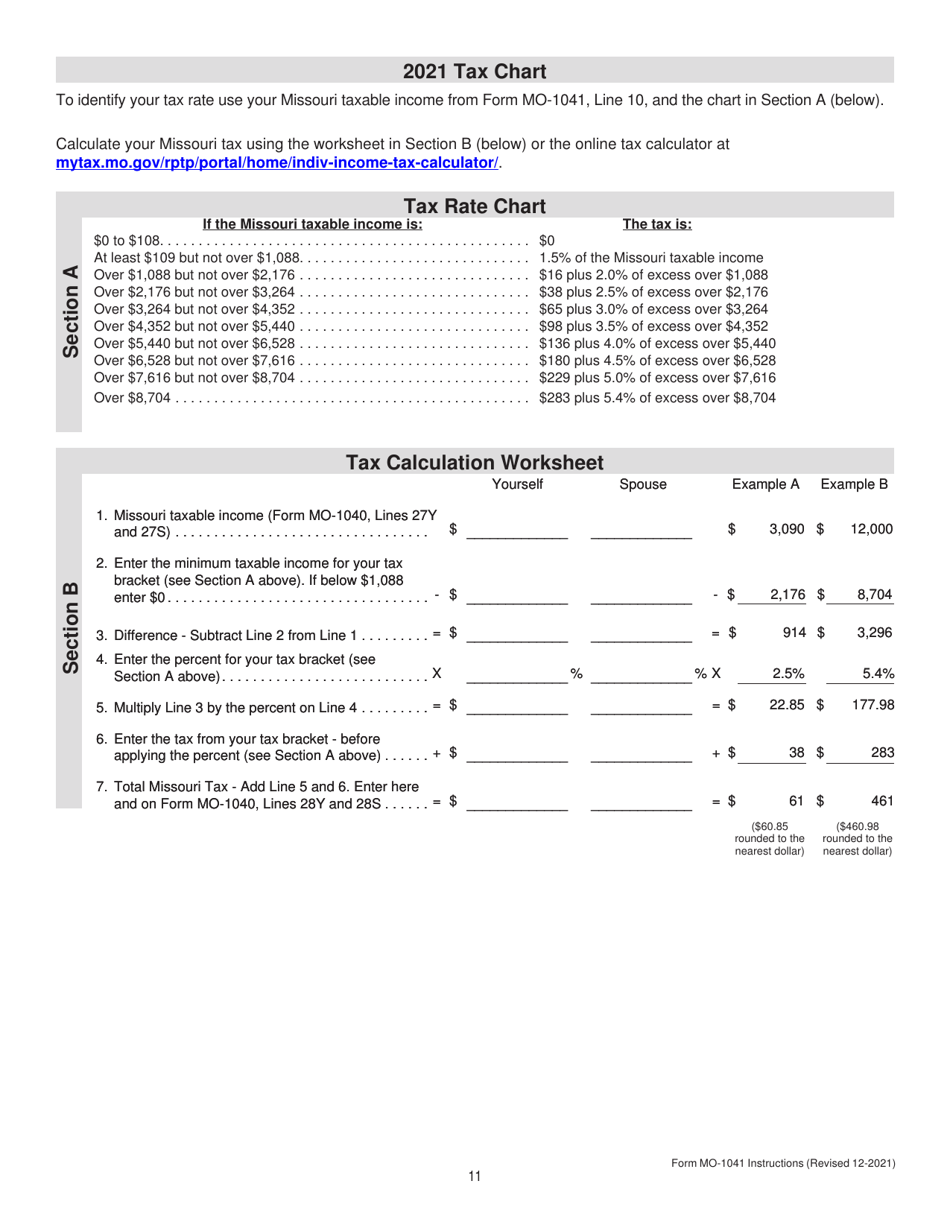

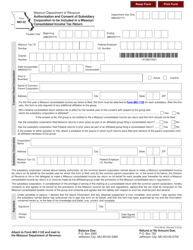

Form MO-1041 Fiduciary Income Tax Return - Missouri

What Is Form MO-1041?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-1041?

A: Form MO-1041 is the Fiduciary Income Tax Return specific to the state of Missouri.

Q: Who needs to file Form MO-1041?

A: Fiduciaries or trustees who are responsible for managing income and assets on behalf of a deceased person or a trust may need to file Form MO-1041.

Q: What is the purpose of Form MO-1041?

A: Form MO-1041 is used to report the income, deductions, credits, and tax liability of the estate or trust.

Q: When is Form MO-1041 due?

A: Form MO-1041 is due on or before the 15th day of the fourth month following the close of the tax year, which is generally April 15th for calendar year filers.

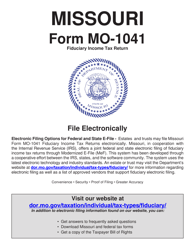

Q: Can Form MO-1041 be filed electronically?

A: Yes, Form MO-1041 can be filed electronically using the Department of Revenue's Missouri Taxpayer Access Point (TAP) system.

Q: Are there any penalties for late filing of Form MO-1041?

A: Yes, there may be penalties for late filing or underpayment of tax. It is important to file and pay on time to avoid these penalties.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-1041 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.