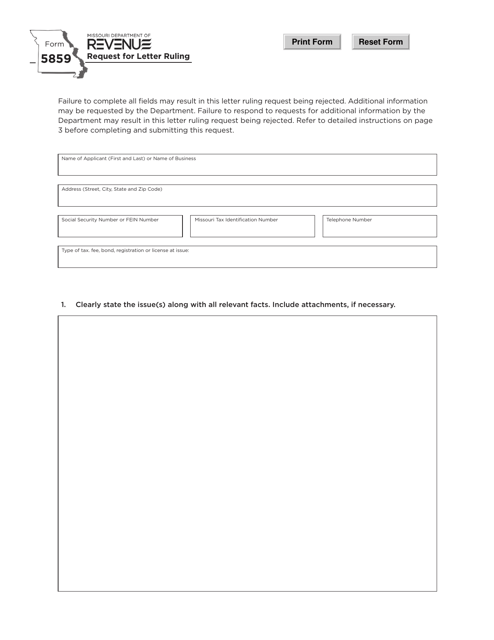

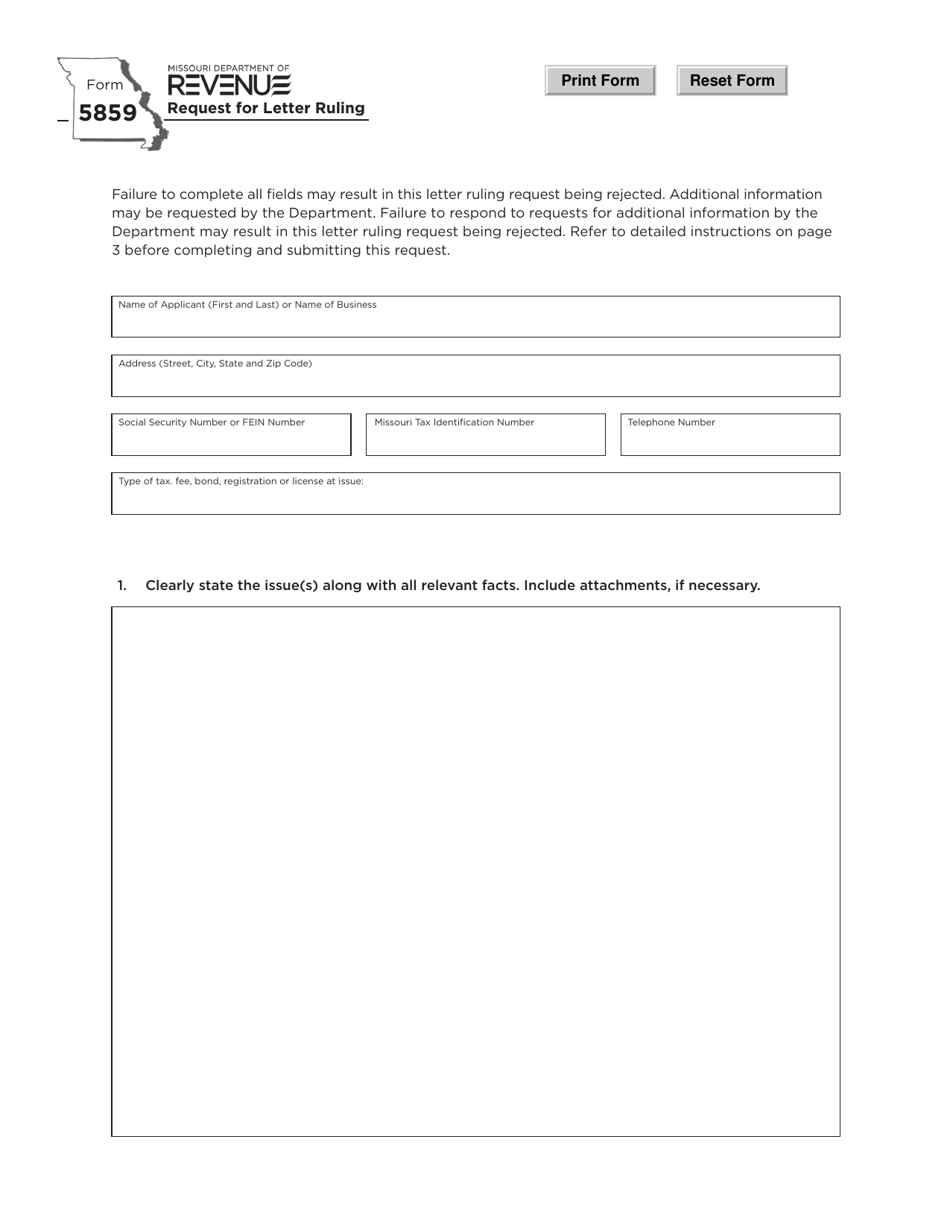

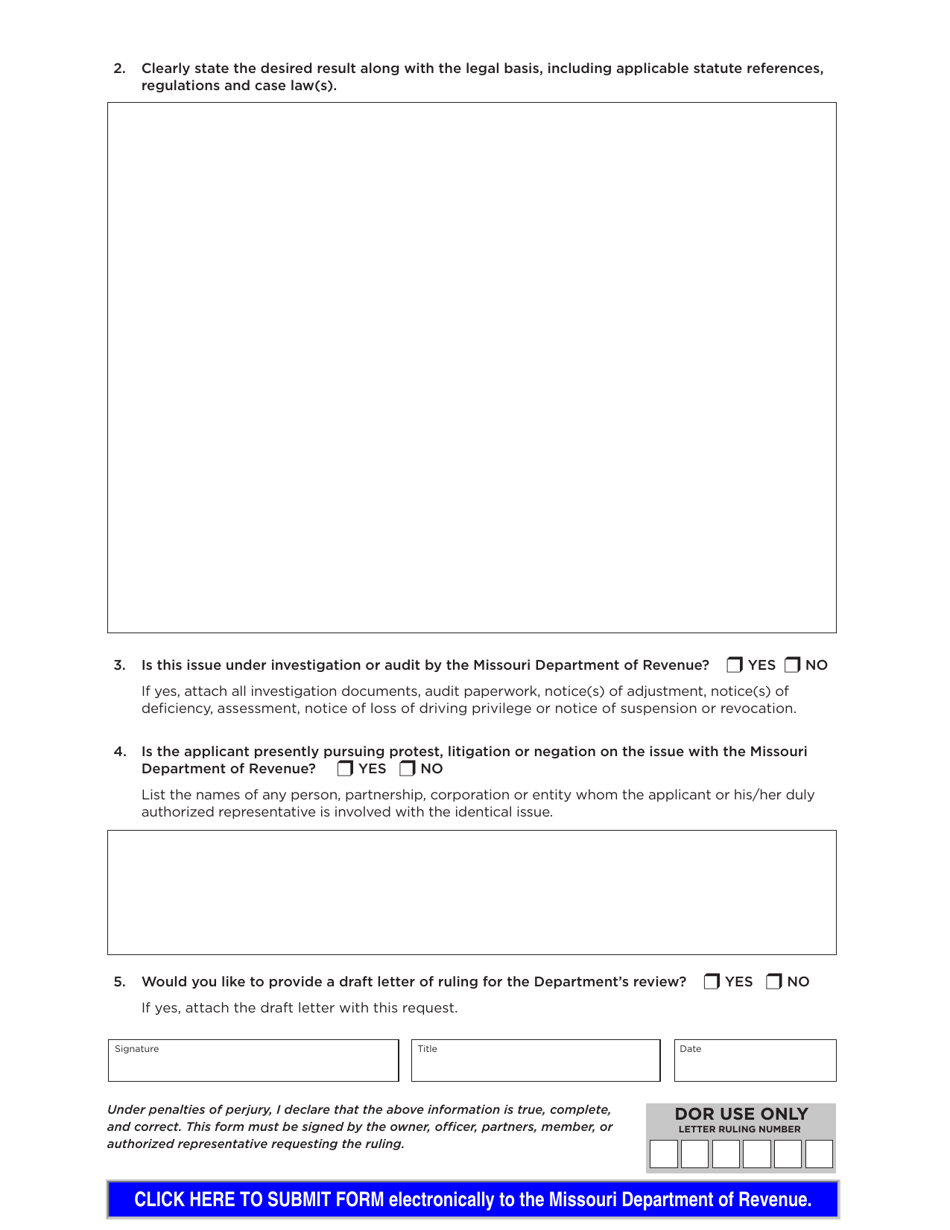

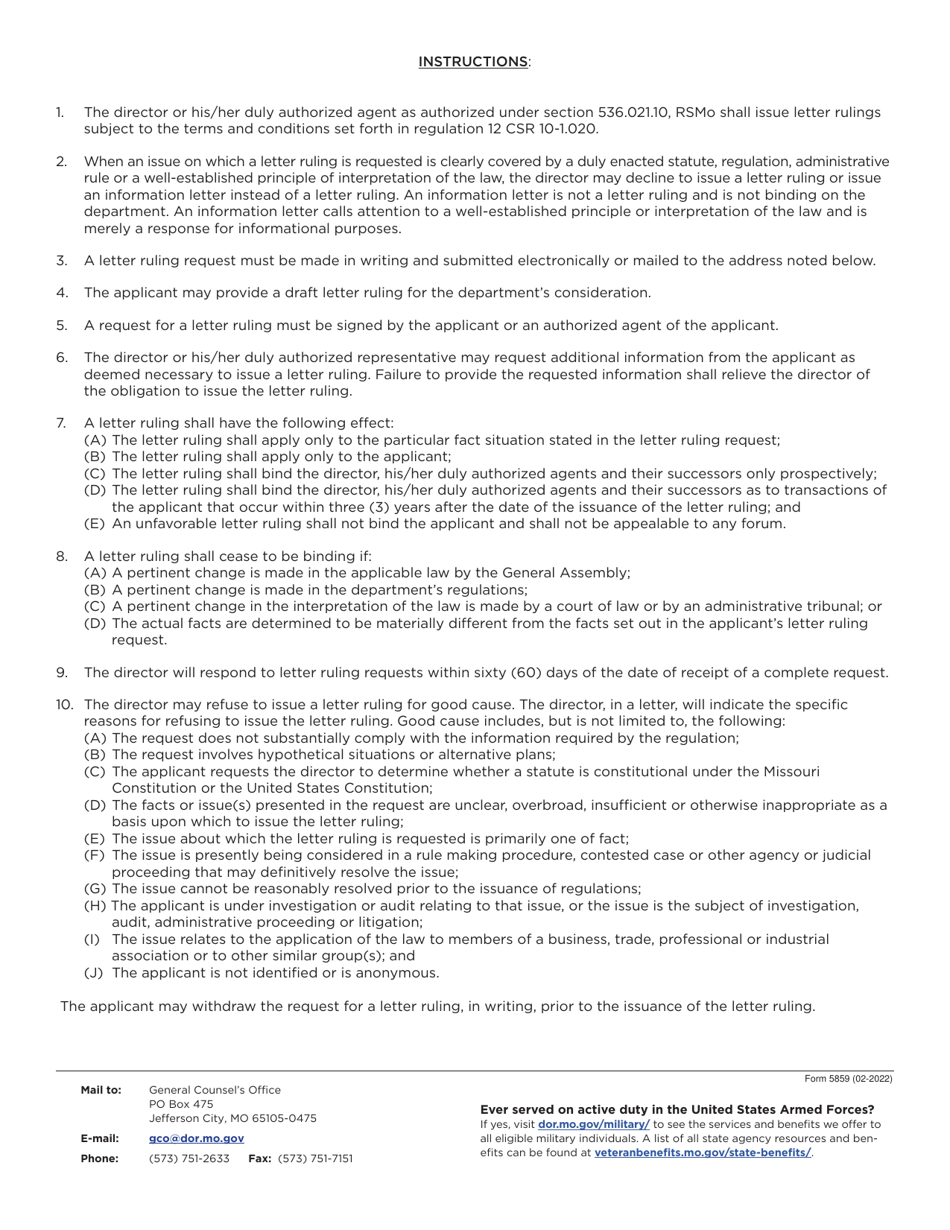

Form 5859 Request for Letter Ruling - Missouri

What Is Form 5859?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

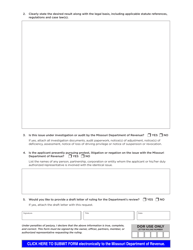

Q: What is Form 5859 Request for Letter Ruling?

A: Form 5859 is used to request a letter ruling from the Missouri Department of Revenue.

Q: What is a letter ruling?

A: A letter ruling is an official written statement issued by the tax authority that provides guidance on how a specific tax law applies to a particular taxpayer's situation.

Q: When should I use Form 5859?

A: You should use Form 5859 when you need clarification on how a specific tax law applies to your situation and want an official ruling from the Missouri Department of Revenue.

Q: Is there a fee for requesting a letter ruling using Form 5859?

A: Yes, there is a fee for requesting a letter ruling. The fee amount is specified on the form and may vary depending on the complexity of the issue.

Q: How long does it take to receive a letter ruling?

A: The processing time for a letter ruling request can vary depending on the complexity of the issue and the workload of the Missouri Department of Revenue. It is recommended to allow several weeks for a response.

Q: Can I rely on a letter ruling from the Missouri Department of Revenue?

A: Yes, you can generally rely on a letter ruling from the Missouri Department of Revenue to determine your tax obligations. However, it's important to note that letter rulings are specific to the taxpayer and the particular facts and circumstances of their situation.

Q: What should I do if I disagree with a letter ruling?

A: If you disagree with a letter ruling, you have the right to appeal the decision. The process for appealing a letter ruling is outlined in the Missouri tax laws and regulations.

Q: Are letter rulings confidential?

A: Letter rulings are generally confidential and are not made public. However, the Missouri Department of Revenue may disclose the rulings to other tax authorities or as required by law.

Q: Can a letter ruling be used as precedent for other taxpayers?

A: No, a letter ruling is binding only for the taxpayer who requested it and cannot be used as precedent for other taxpayers.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5859 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.