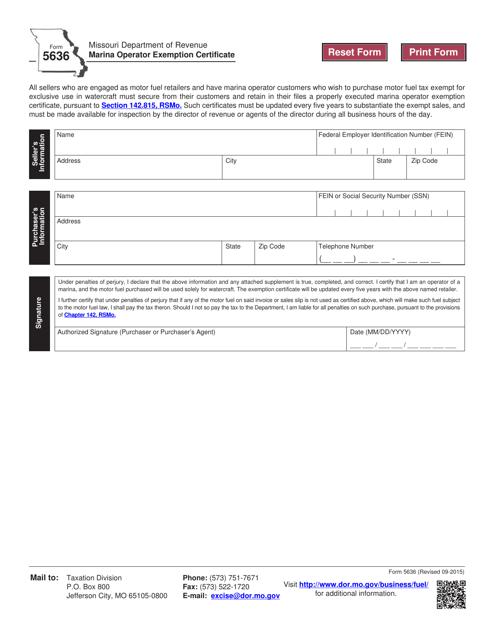

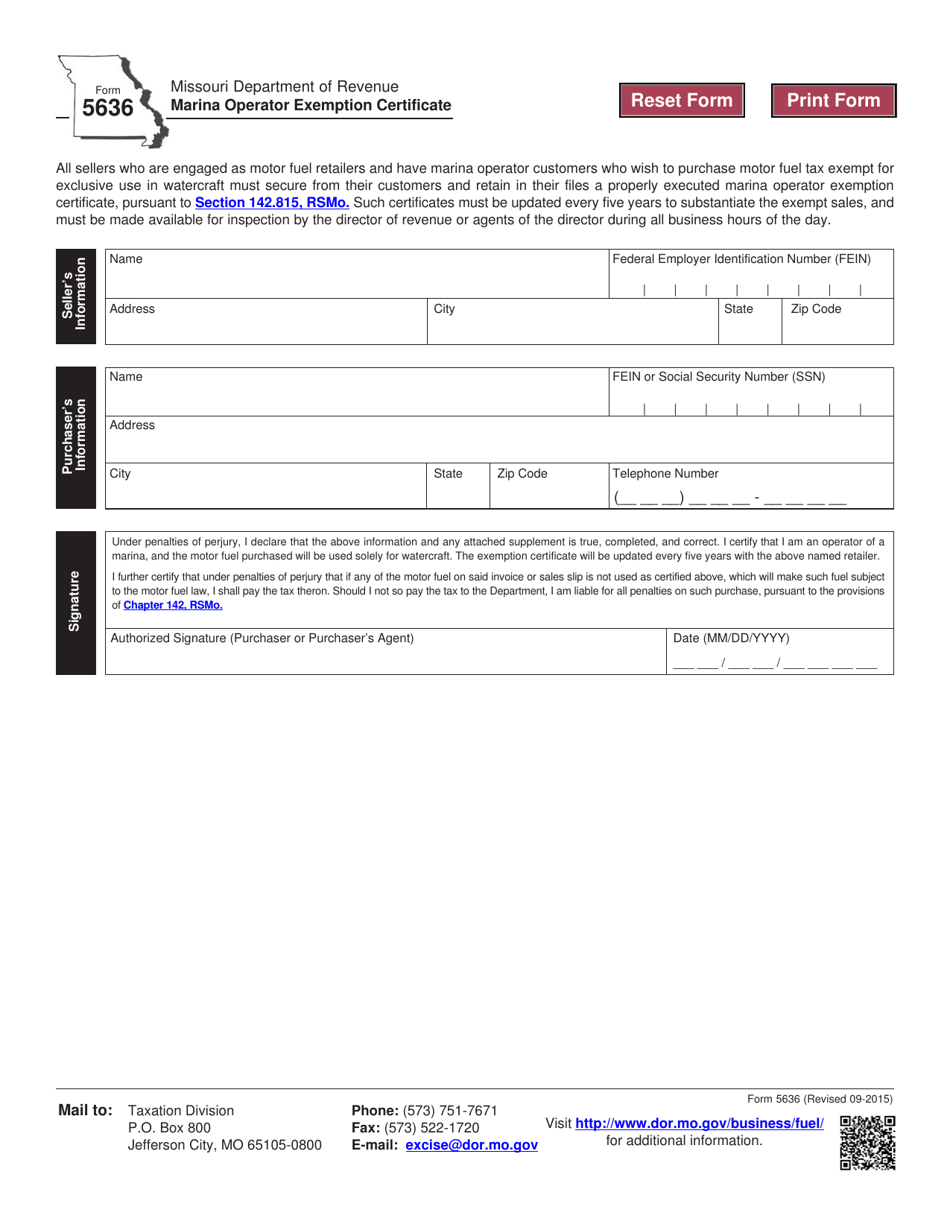

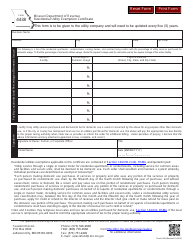

Form 5636 Marina Operator Exemption Certificate - Missouri

What Is Form 5636?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5636?

A: Form 5636 is the Marina Operator Exemption Certificate.

Q: Who needs to fill out Form 5636?

A: Marina operators in Missouri need to fill out Form 5636.

Q: What is the purpose of Form 5636?

A: The purpose of Form 5636 is to apply for an exemption from sales and use tax on certain items used in the operation of a marina in Missouri.

Q: What information is required on Form 5636?

A: Form 5636 requires information about the marina operator, the marina location, and the items for which the exemption is being sought.

Q: Are there any supporting documents that need to be submitted with Form 5636?

A: Yes, the marina operator must submit a copy of the marina's business license, sales tax license, and any other documents requested by the Department of Revenue.

Q: Is there a deadline for submitting Form 5636?

A: Form 5636 should be submitted at least 30 days before the start of the marina operator's tax period.

Q: Is there a fee for submitting Form 5636?

A: No, there is no fee for submitting Form 5636.

Q: Who should I contact if I have questions about Form 5636?

A: If you have questions about Form 5636, you should contact the Missouri Department of Revenue.

Form Details:

- Released on September 1, 2015;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5636 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.