This version of the form is not currently in use and is provided for reference only. Download this version of

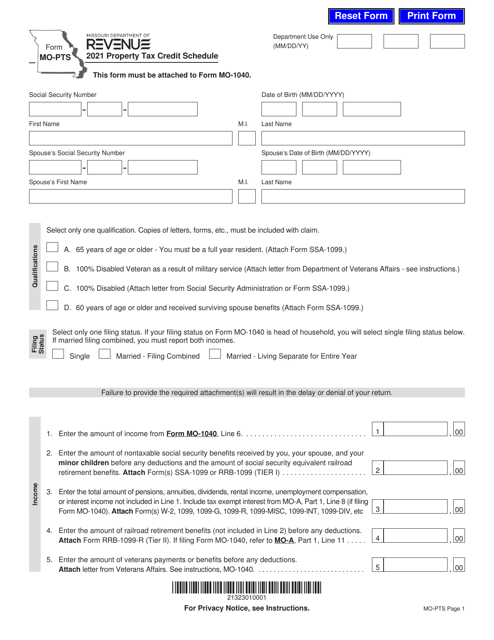

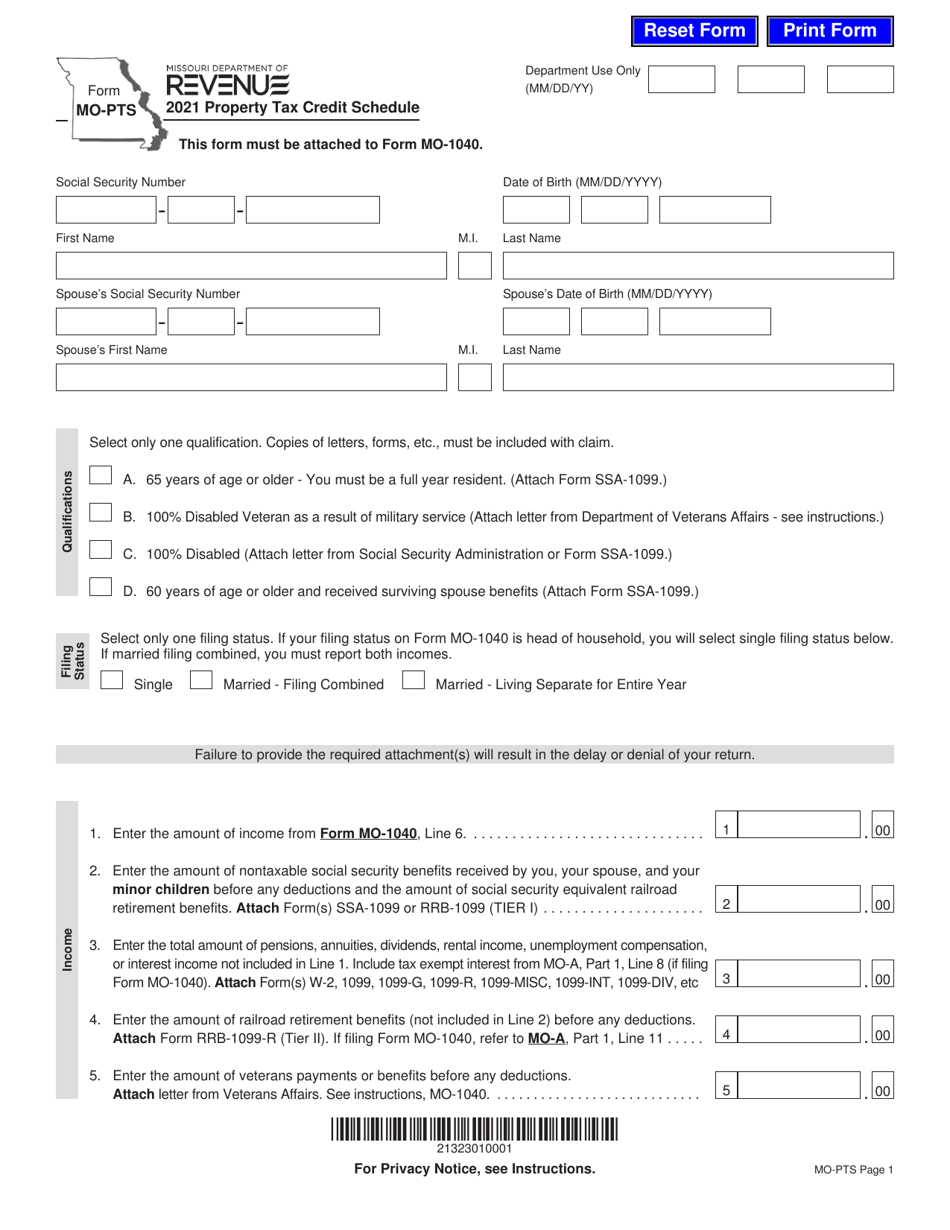

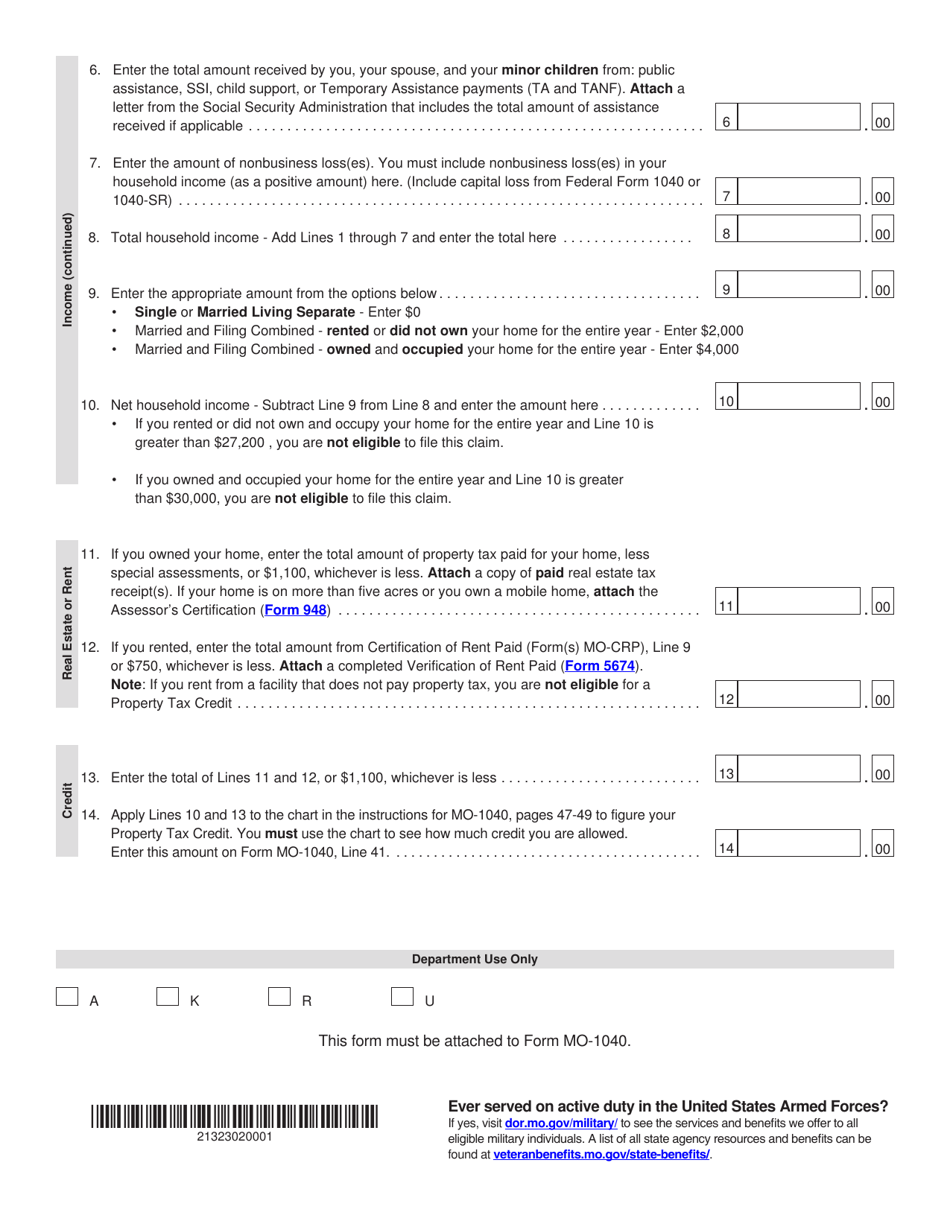

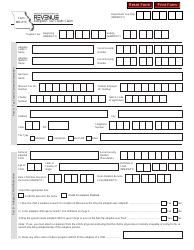

Form MO-PTS

for the current year.

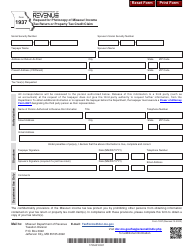

Form MO-PTS Property Tax Credit Schedule - Missouri

What Is Form MO-PTS?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-PTS?

A: Form MO-PTS is the Property Tax Credit Schedule for the state of Missouri.

Q: What is the purpose of Form MO-PTS?

A: The purpose of Form MO-PTS is to calculate and claim the property tax credit for eligible Missouri residents.

Q: Who is eligible to use Form MO-PTS?

A: Missouri residents who meet certain income and property ownership requirements are eligible to use Form MO-PTS.

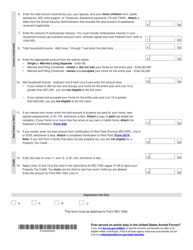

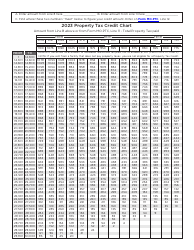

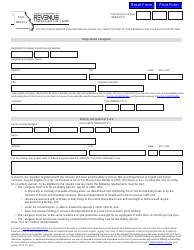

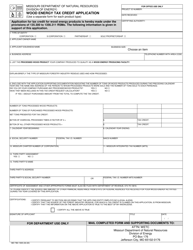

Q: What information is needed to complete Form MO-PTS?

A: To complete Form MO-PTS, you will need information such as your total household income, property tax paid, and other household expenses.

Q: When is the deadline to file Form MO-PTS?

A: The deadline to file Form MO-PTS is April 15th of the year following the tax year.

Q: Is there a fee to file Form MO-PTS?

A: No, there is no fee to file Form MO-PTS.

Q: What happens after I file Form MO-PTS?

A: After filing Form MO-PTS, the Missouri Department of Revenue will review your information and determine if you are eligible for the property tax credit.

Q: How long does it take to receive the property tax credit?

A: The processing time for the property tax credit varies, but it typically takes several weeks to receive the credit once your application is approved.

Form Details:

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-PTS by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.