This version of the form is not currently in use and is provided for reference only. Download this version of

Form 89-386

for the current year.

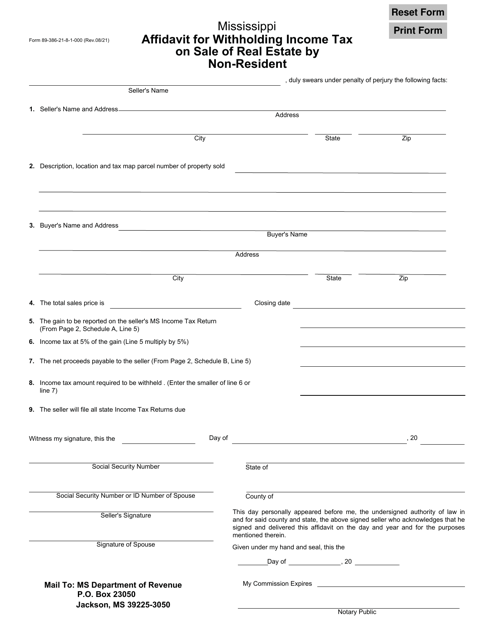

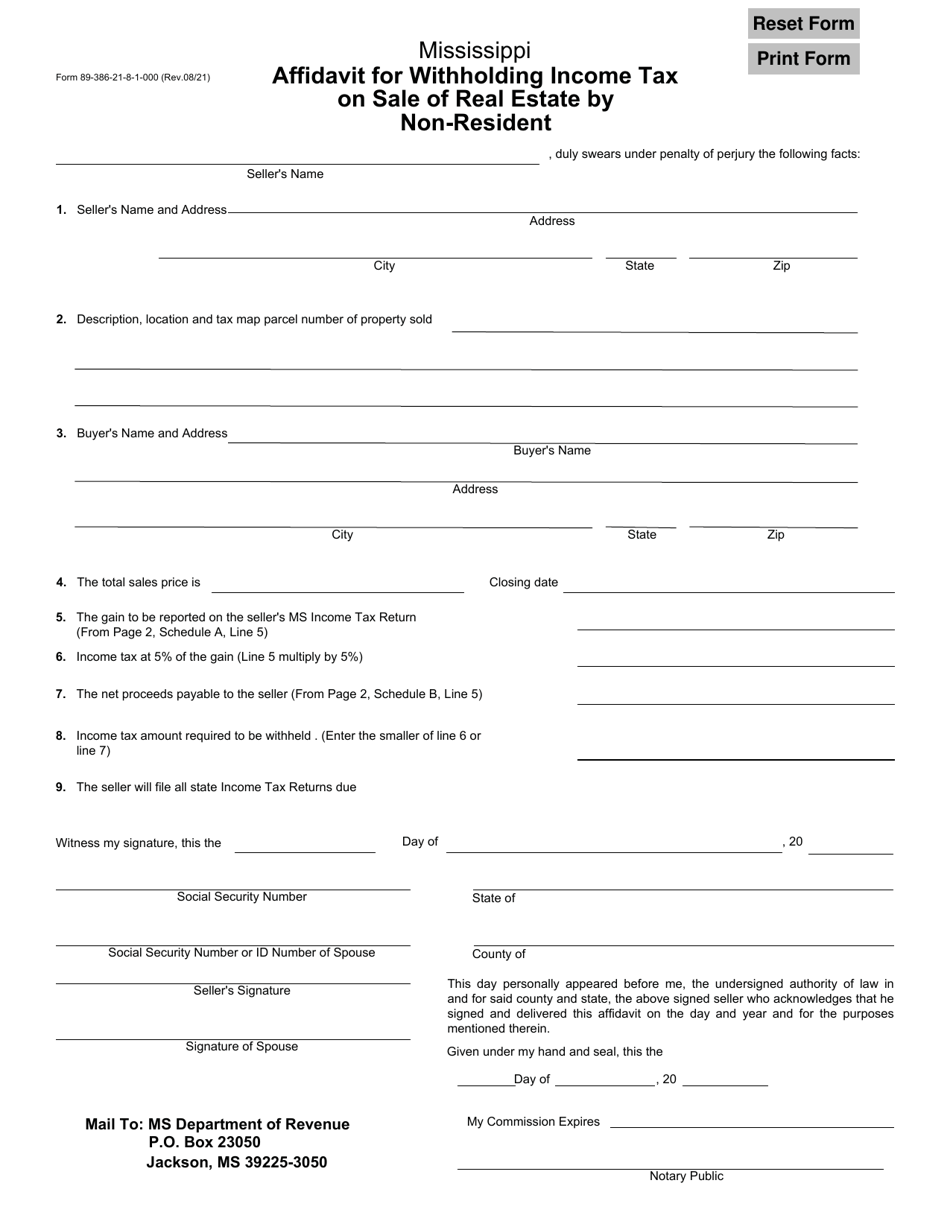

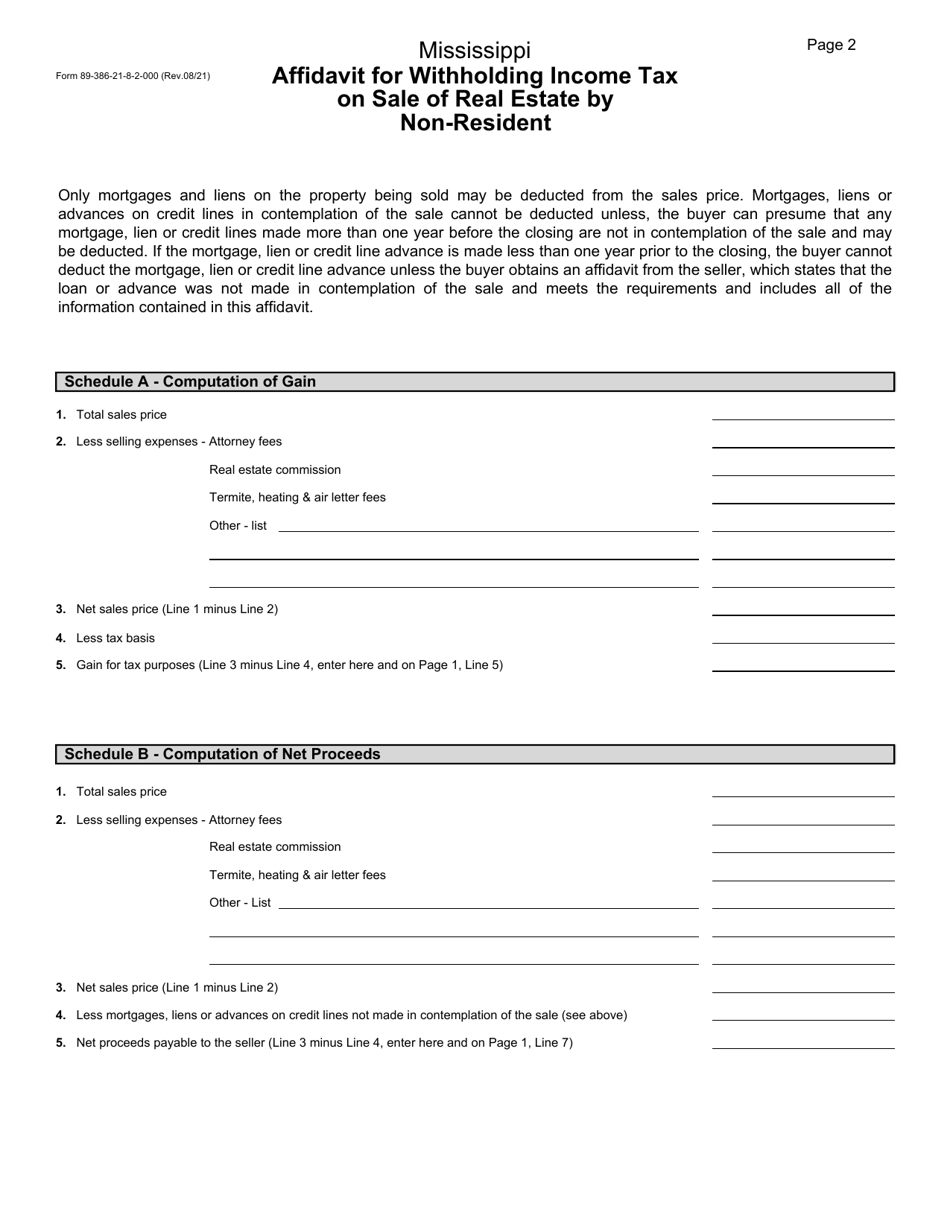

Form 89-386 Affidavit for Withholding Income Tax on Sale of Real Estate by Non-resident - Mississippi

What Is Form 89-386?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 89-386?

A: Form 89-386 is an affidavit used in Mississippi to withhold income tax on the sale of real estate by a non-resident.

Q: Who needs to file Form 89-386?

A: Non-residents of Mississippi who are selling real estate in the state and want to withhold income tax from the proceeds of the sale need to file Form 89-386.

Q: Why would a non-resident need to withhold income tax on the sale of real estate in Mississippi?

A: Mississippi law requires that non-residents withhold income tax on the sale of real estate to ensure payment of any potential tax liability.

Q: How do I file Form 89-386?

A: Form 89-386 should be filed with the Mississippi Department of Revenue.

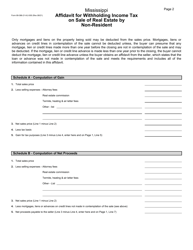

Q: What information do I need to provide on Form 89-386?

A: The form requires information about the seller, the buyer, the real estate transaction, and the amount of income tax to be withheld.

Q: Is there a deadline for filing Form 89-386?

A: Form 89-386 should be filed at least three days before the date of the real estate closing.

Q: What happens after I file Form 89-386?

A: Once the form is filed, the Mississippi Department of Revenue will provide the seller with a withholding certificate or a denial letter.

Q: Can I get a refund of the withheld income tax?

A: Non-residents who have overpaid their income tax through withholding can file a Mississippi income tax return to claim a refund.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 89-386 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.