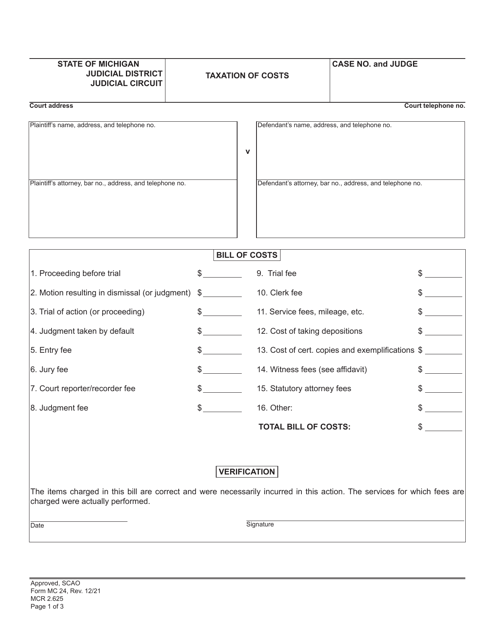

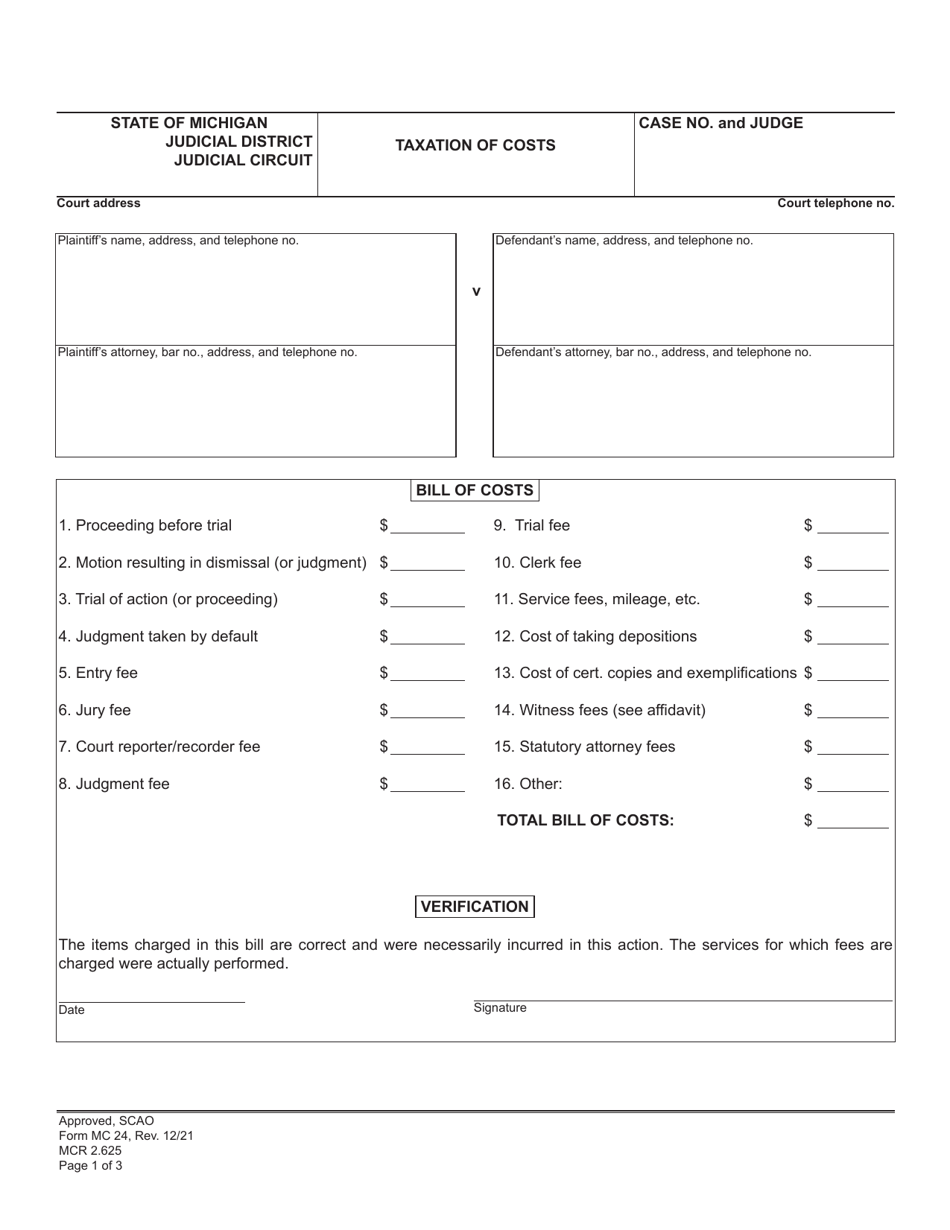

Form MC24 Taxation of Costs - Michigan

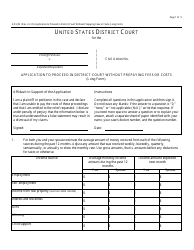

What Is Form MC24?

This is a legal form that was released by the Michigan Courts - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form MC24?

A: Form MC24 is a tax form used in Michigan to determine the taxation of costs.

Q: What does the Form MC24 do?

A: The Form MC24 helps determine how costs are taxed in Michigan.

Q: Who needs to fill out Form MC24?

A: Anyone in Michigan who wants to calculate the taxation of costs needs to fill out Form MC24.

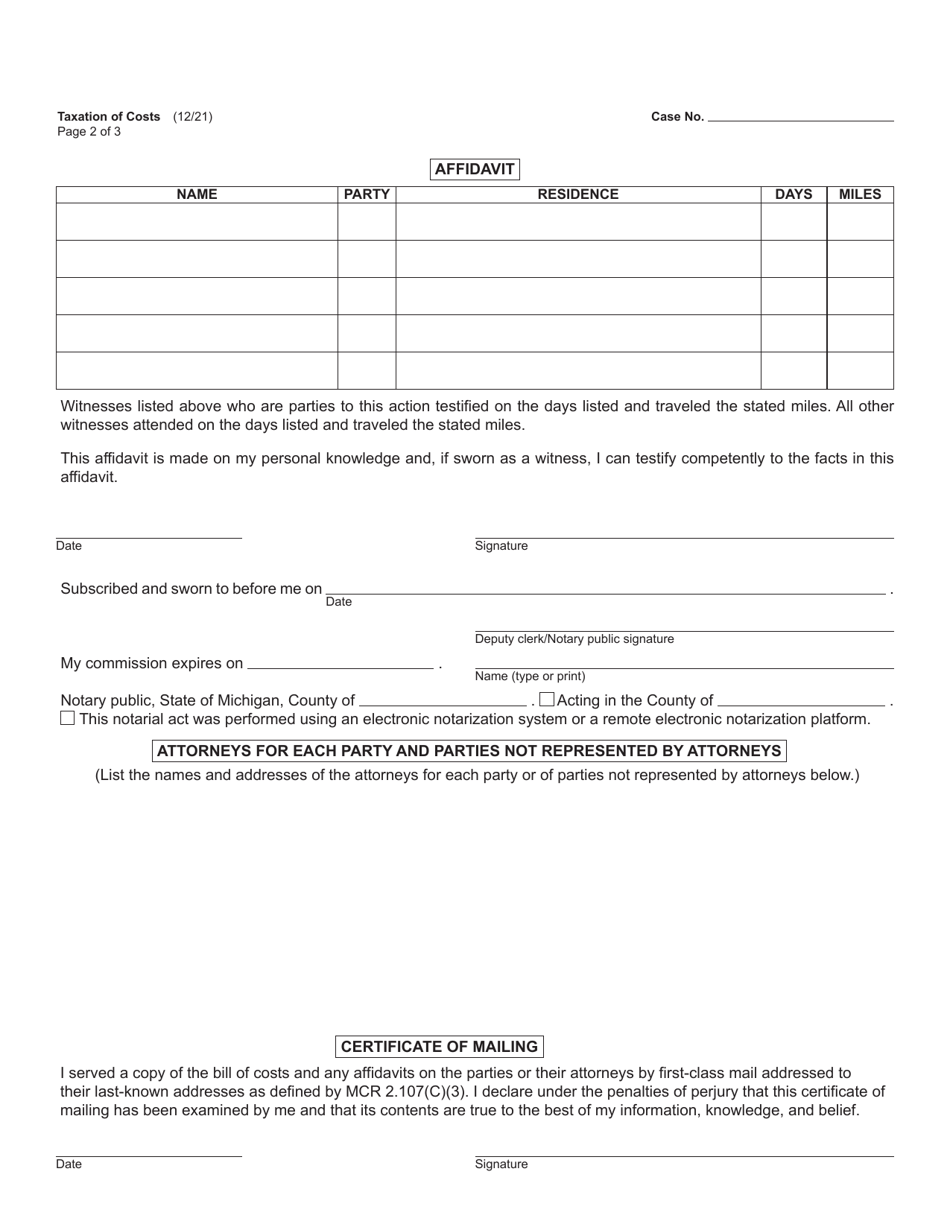

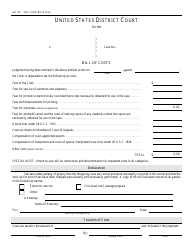

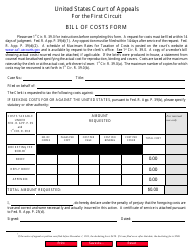

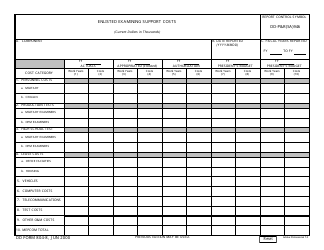

Q: What type of costs does Form MC24 cover?

A: Form MC24 covers various types of costs, including attorney fees, witness fees, and other court-related costs.

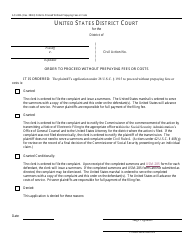

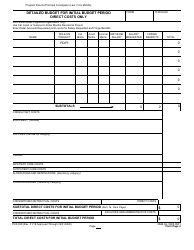

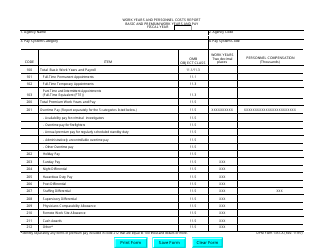

Q: How do I calculate the taxation of costs using Form MC24?

A: The instructions on Form MC24 will guide you through the calculation process. It typically involves determining the total taxable costs and applying the appropriate tax rate.

Q: When is the deadline for filing Form MC24?

A: The deadline for filing Form MC24 depends on the specific tax year and is usually specified on the form itself or in the instructions.

Q: What happens if I don't file Form MC24?

A: If you fail to file Form MC24 when required, you may be subject to penalties and interest charges.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Michigan Courts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MC24 by clicking the link below or browse more documents and templates provided by the Michigan Courts.