This version of the form is not currently in use and is provided for reference only. Download this version of

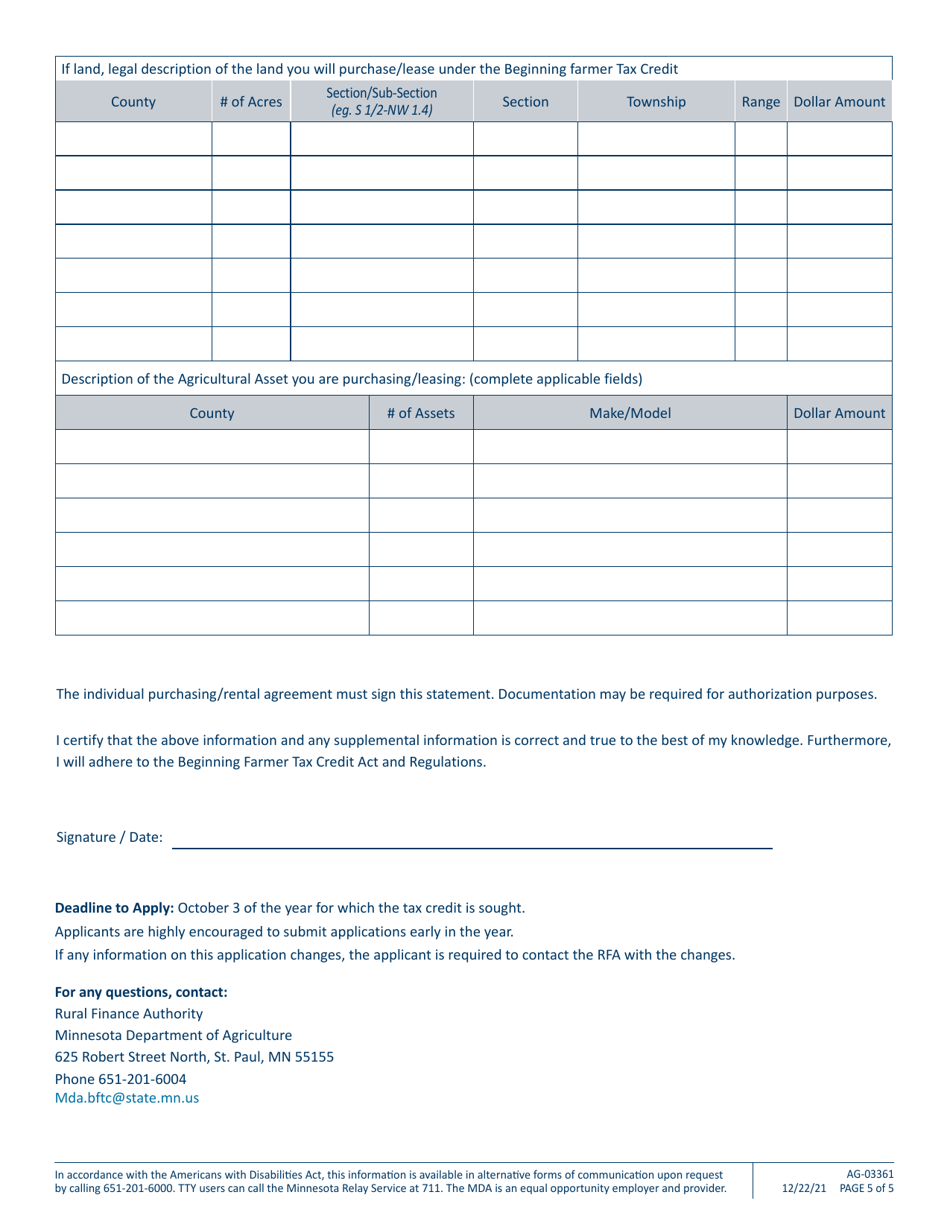

Form AG-03361

for the current year.

Form AG-03361 Minnesota Beginning Farmer Tax Credit Application - Minnesota

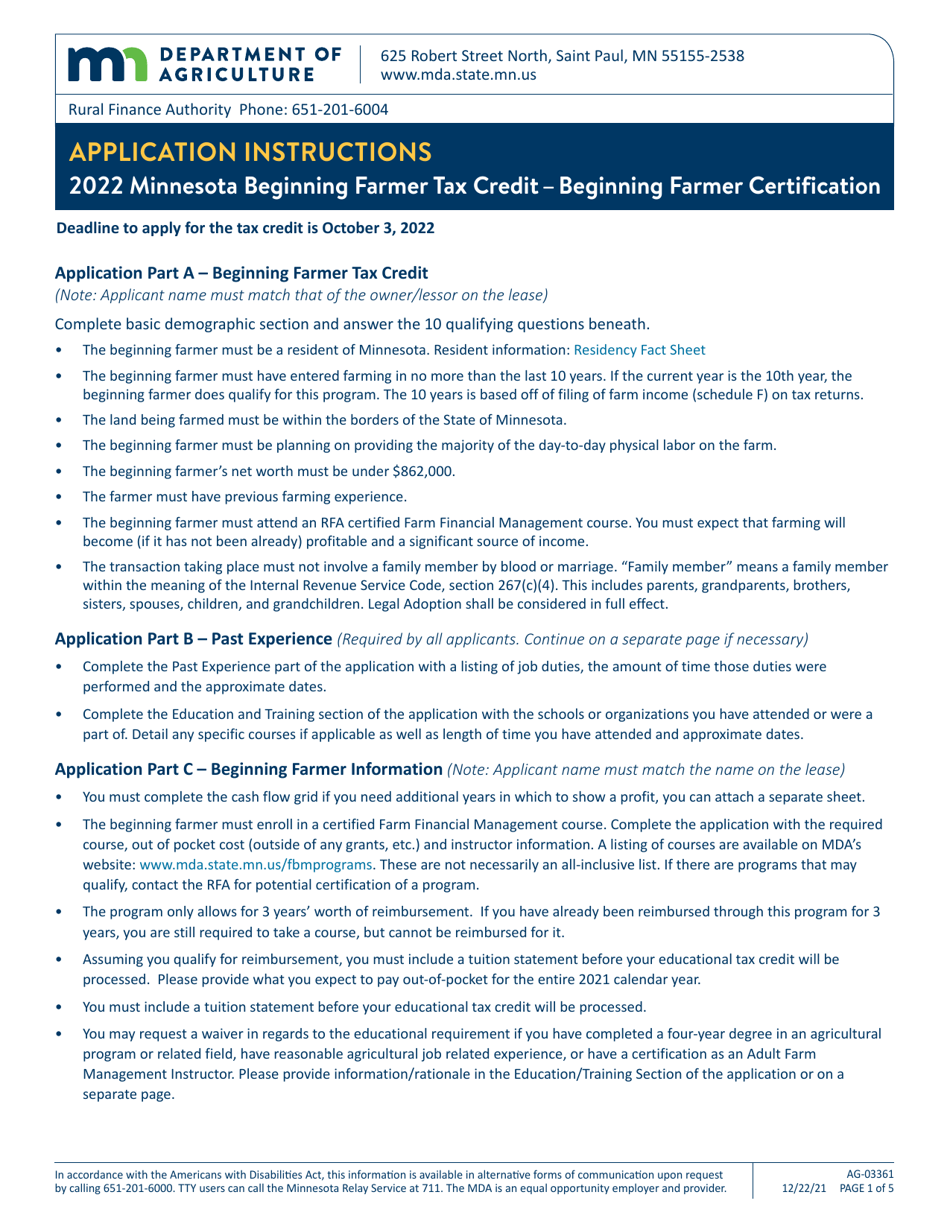

What Is Form AG-03361?

This is a legal form that was released by the Minnesota Department of Agriculture - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

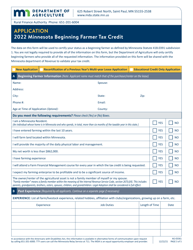

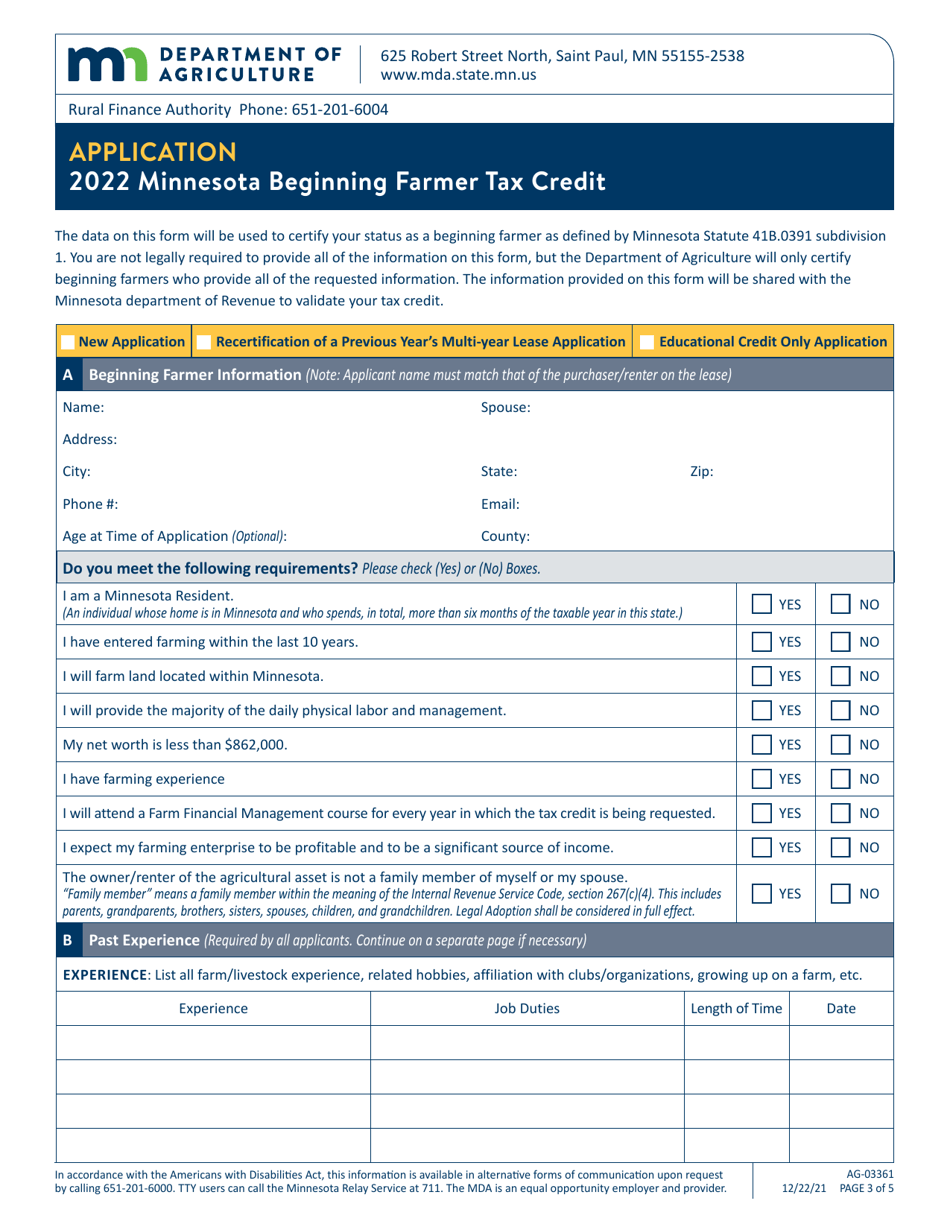

Q: What is Form AG-03361?

A: Form AG-03361 is the Minnesota Beginning Farmer Tax Credit Application.

Q: What is the purpose of Form AG-03361?

A: The purpose of Form AG-03361 is to apply for the Minnesota Beginning Farmer Tax Credit.

Q: Who should use Form AG-03361?

A: Form AG-03361 should be used by individuals or entities who are beginning farmers in Minnesota and want to apply for the tax credit.

Q: What is the Minnesota Beginning Farmer Tax Credit?

A: The Minnesota Beginning Farmer Tax Credit is a tax credit available to eligible beginning farmers in Minnesota.

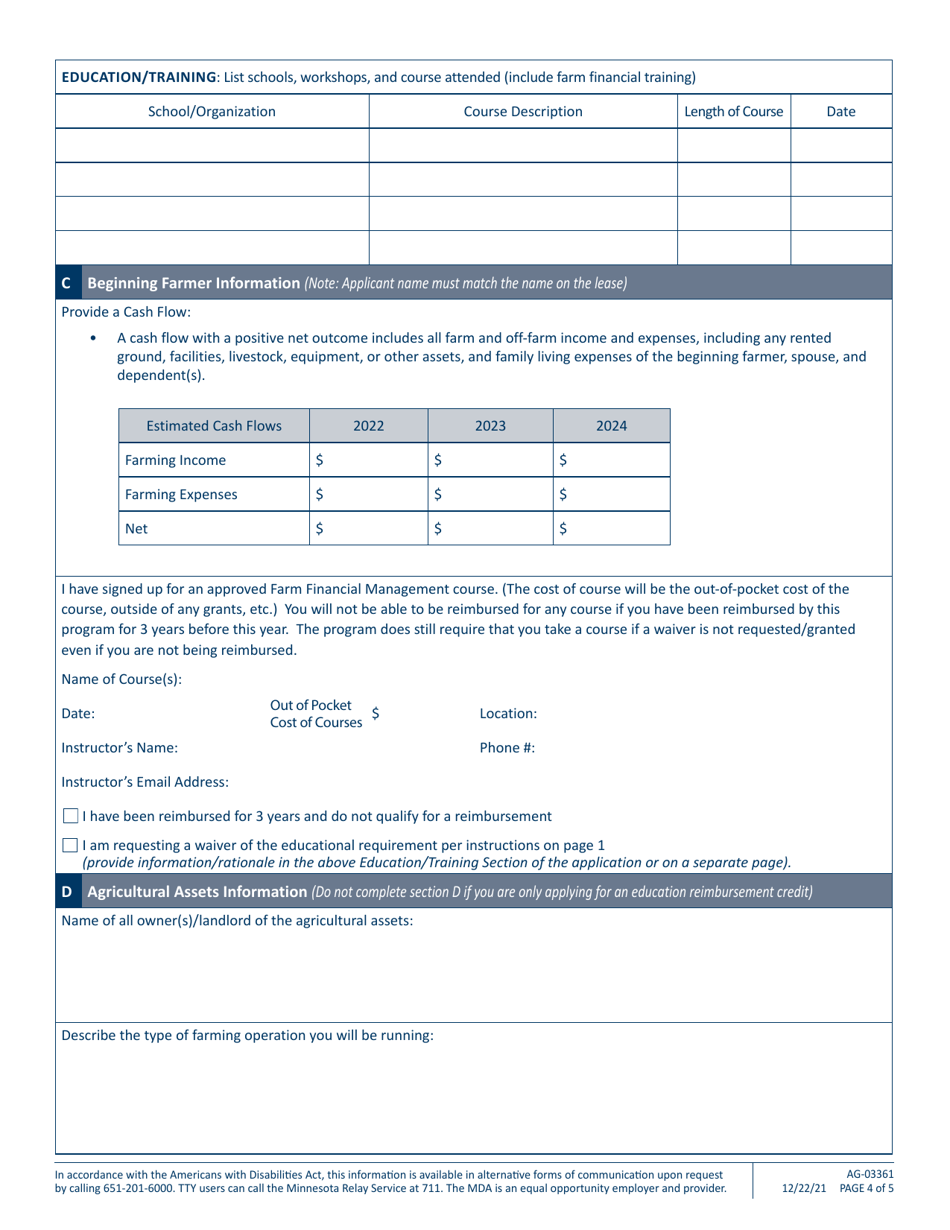

Q: How can I qualify as a beginning farmer?

A: To qualify as a beginning farmer, you must meet certain criteria set by the state of Minnesota, including having a net worth below a certain threshold and actively participating in the business of farming.

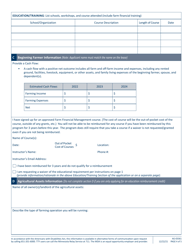

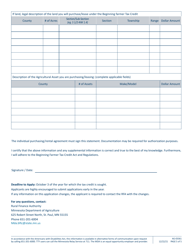

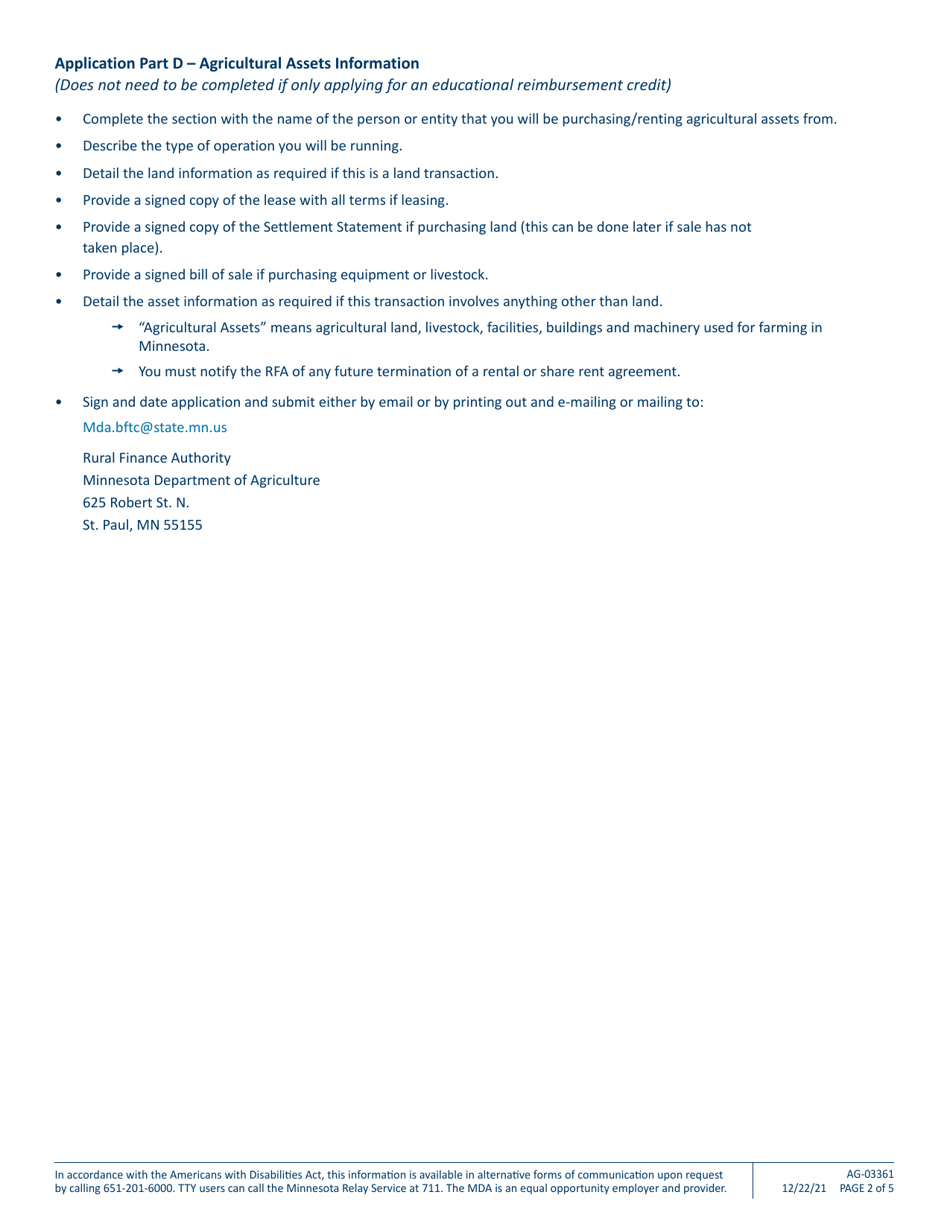

Q: What documents do I need to submit with Form AG-03361?

A: You will need to submit supporting documentation, such as financial statements, to verify your eligibility as a beginning farmer.

Q: When is the deadline to submit Form AG-03361?

A: The deadline to submit Form AG-03361 is typically April 15th of the year following the tax year for which you are claiming the credit.

Q: Is the Minnesota Beginning Farmer Tax Credit refundable?

A: No, the Minnesota Beginning Farmer Tax Credit is not refundable. It can only be used to offset your tax liability.

Q: Can I carry forward unused tax credits?

A: No, unused Minnesota Beginning Farmer Tax Credits cannot be carried forward to future years.

Form Details:

- Released on December 22, 2021;

- The latest edition provided by the Minnesota Department of Agriculture;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AG-03361 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Agriculture.