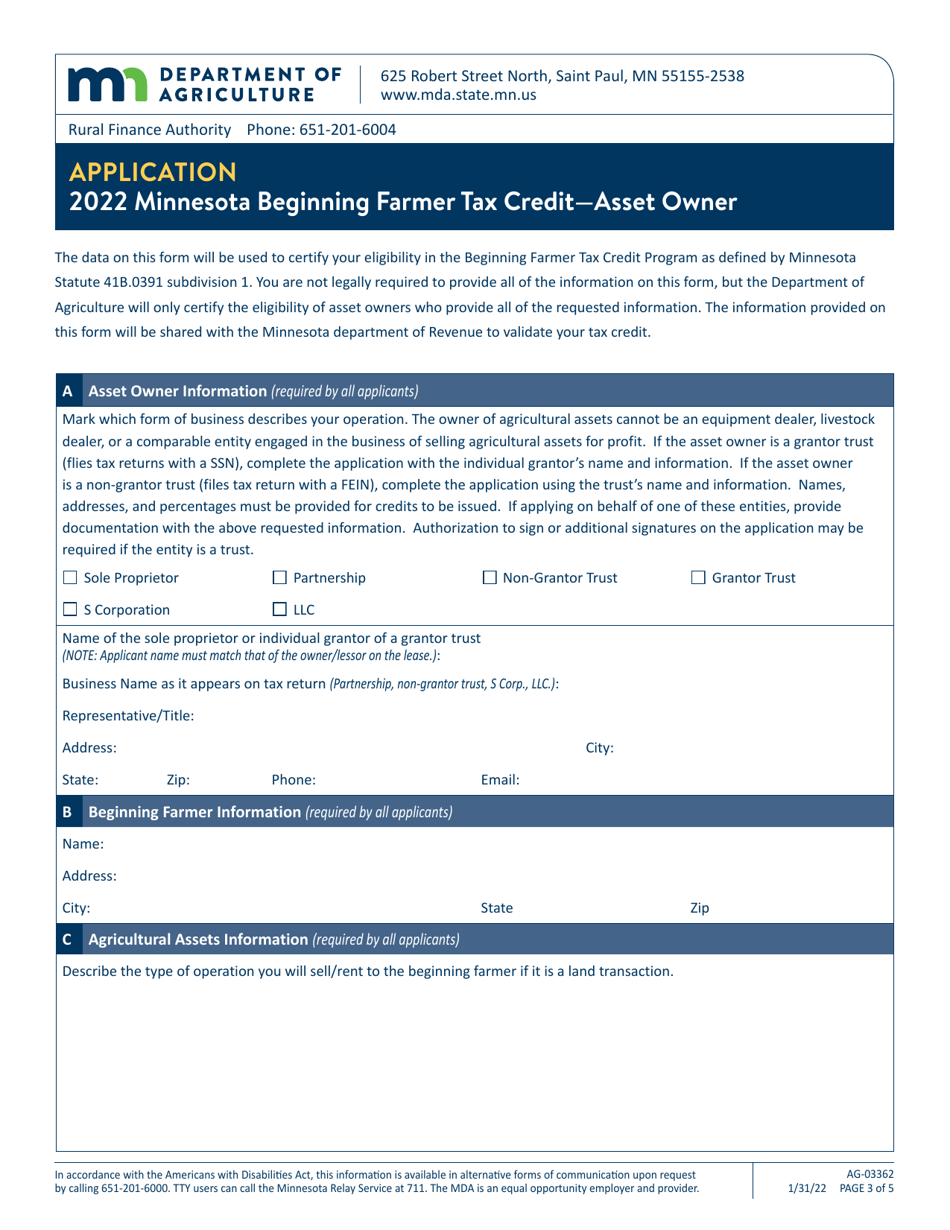

This version of the form is not currently in use and is provided for reference only. Download this version of

Form AG-03362

for the current year.

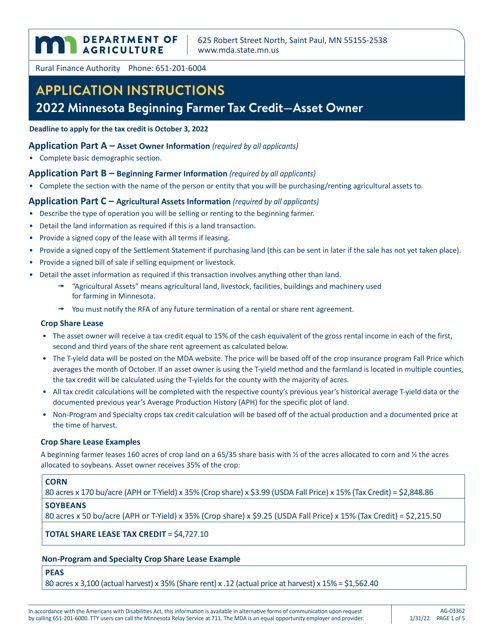

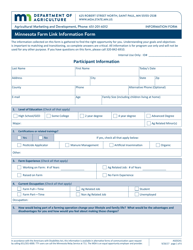

Form AG-03362 Minnesota Beginning Farmer Tax Credit - Asset Owner Application - Minnesota

What Is Form AG-03362?

This is a legal form that was released by the Minnesota Department of Agriculture - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form AG-03362?

A: The Form AG-03362 is the Minnesota Beginning FarmerTax Credit - Asset Owner Application form.

Q: What is the purpose of the Form AG-03362?

A: The purpose of the Form AG-03362 is to apply for the Minnesota Beginning Farmer Tax Credit as an asset owner.

Q: Who can use the Form AG-03362?

A: The Form AG-03362 can be used by asset owners in Minnesota who want to apply for the Beginning Farmer Tax Credit.

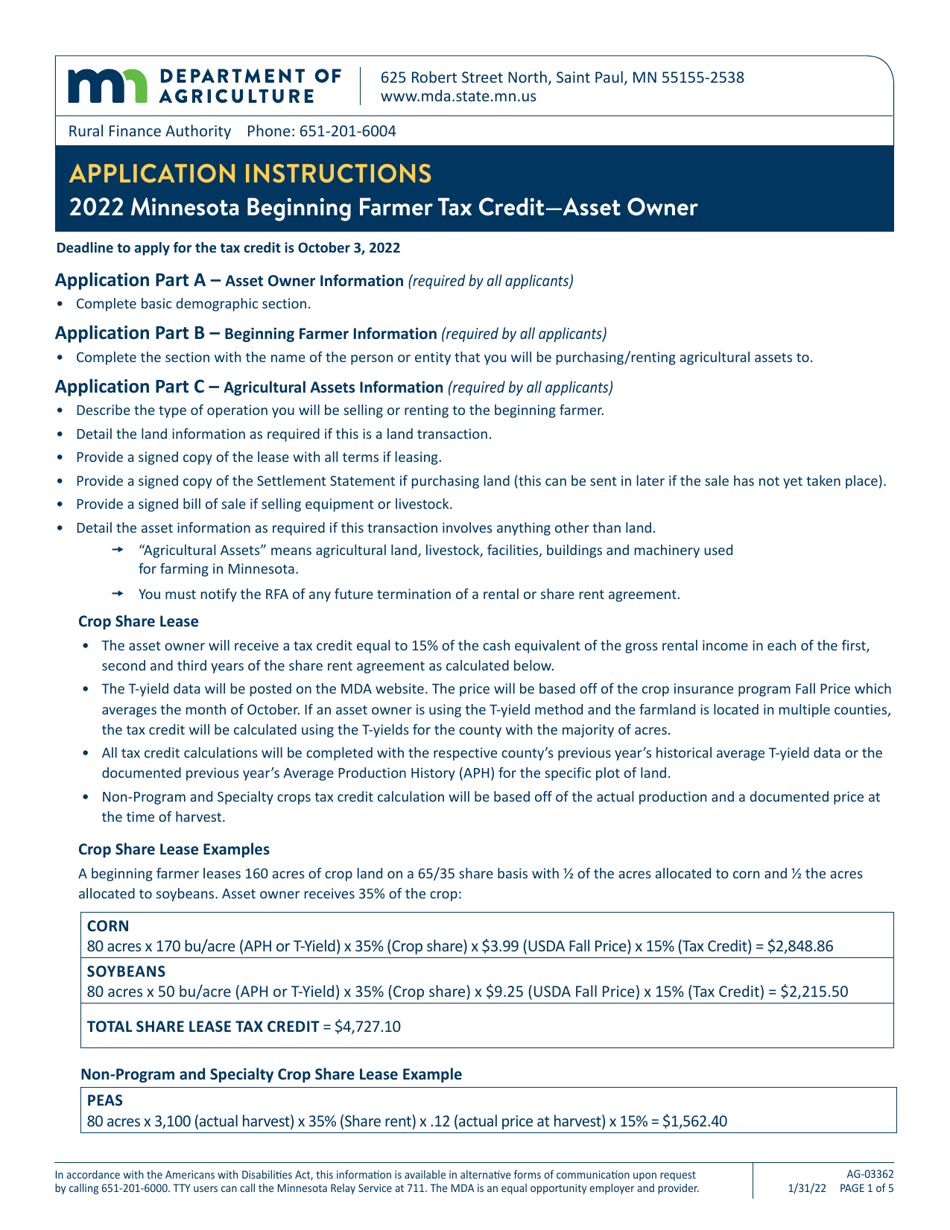

Q: What is the Beginning Farmer Tax Credit?

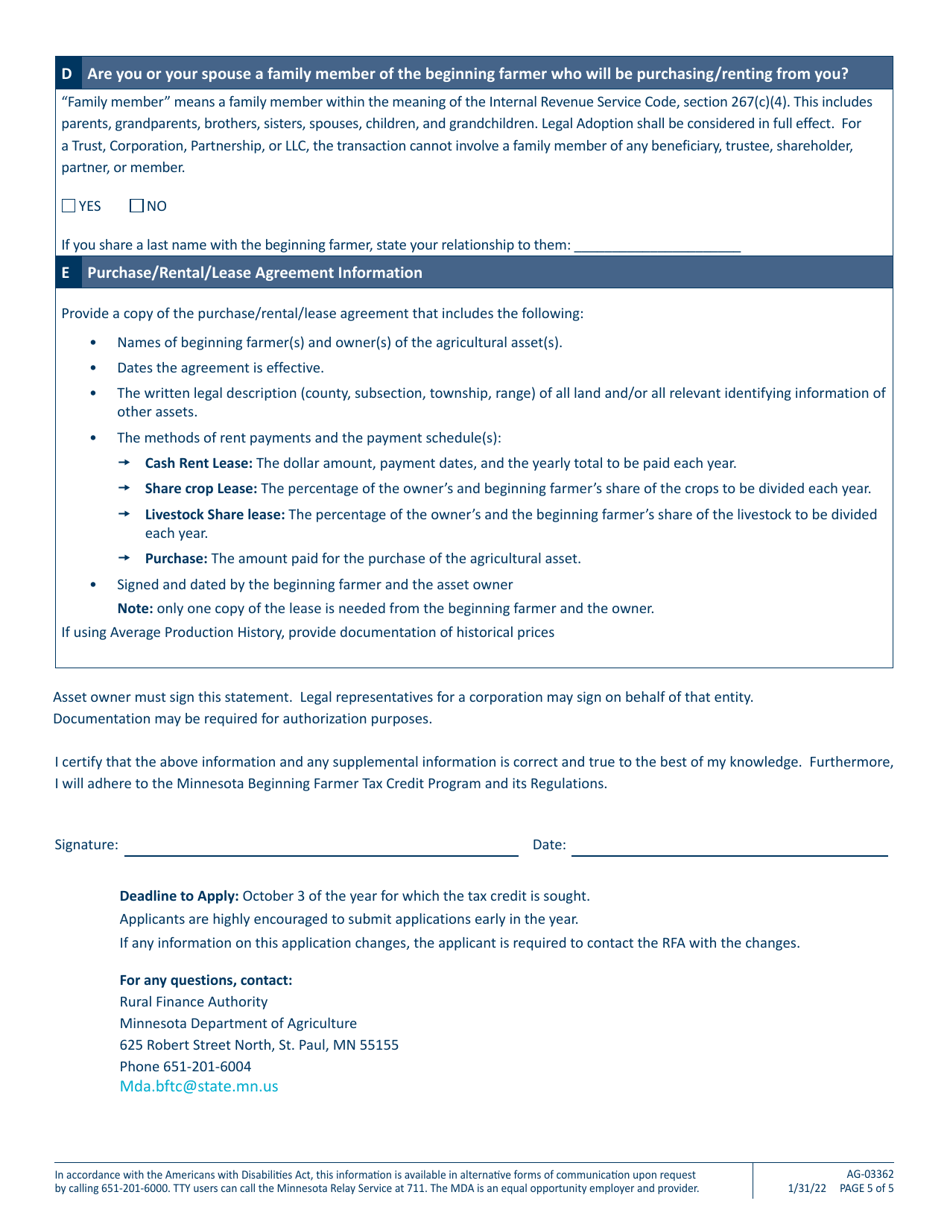

A: The Beginning Farmer Tax Credit is a tax incentive program in Minnesota designed to encourage the transfer of agricultural assets to beginning farmers.

Q: What are the eligibility requirements for the Beginning Farmer Tax Credit?

A: To be eligible for the Beginning Farmer Tax Credit, both the seller and buyer must meet certain criteria such as being a Minnesota resident and meeting the definition of a beginning farmer.

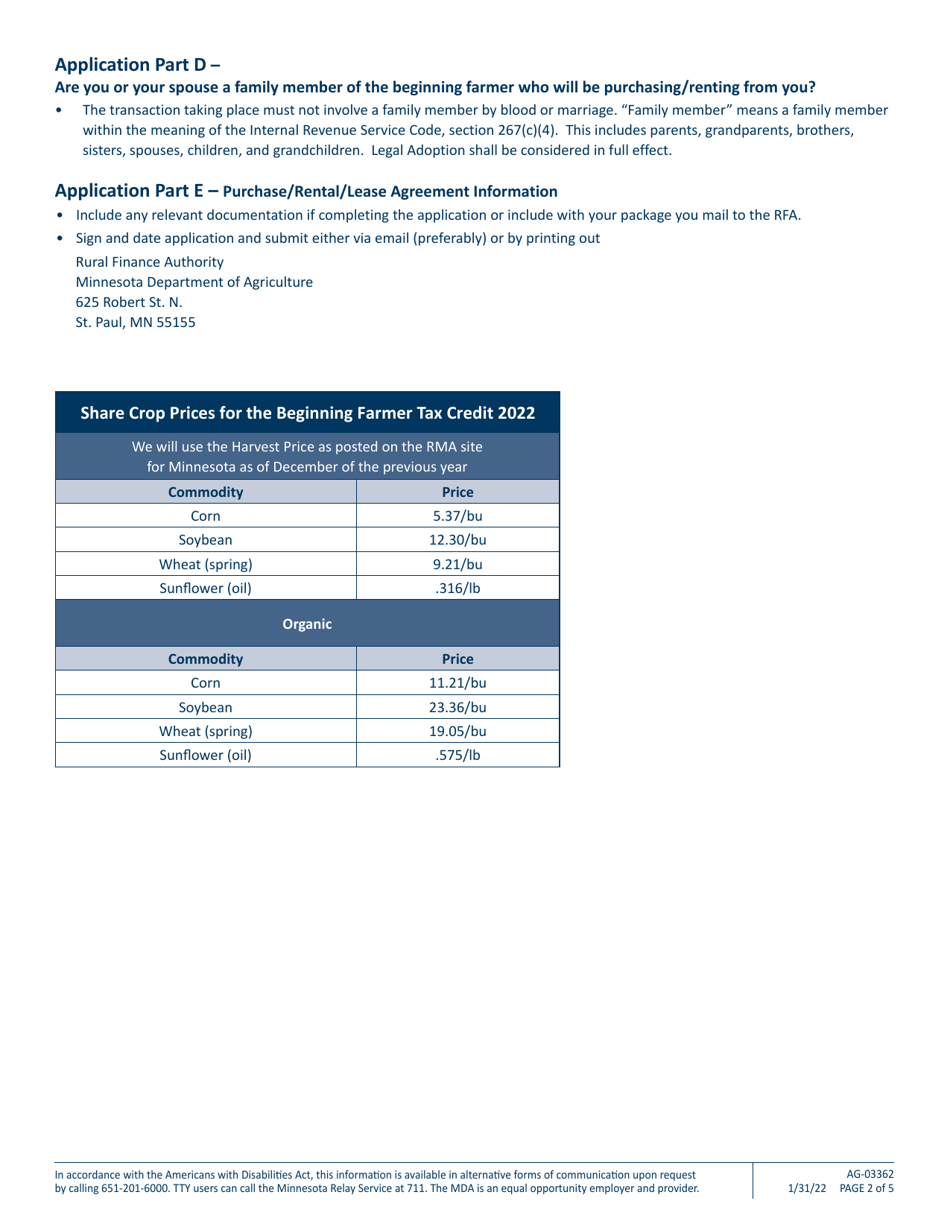

Q: Is there a limit on the amount of tax credits that can be claimed?

A: Yes, there is a limit of $32,000 in tax credits that can be claimed per year.

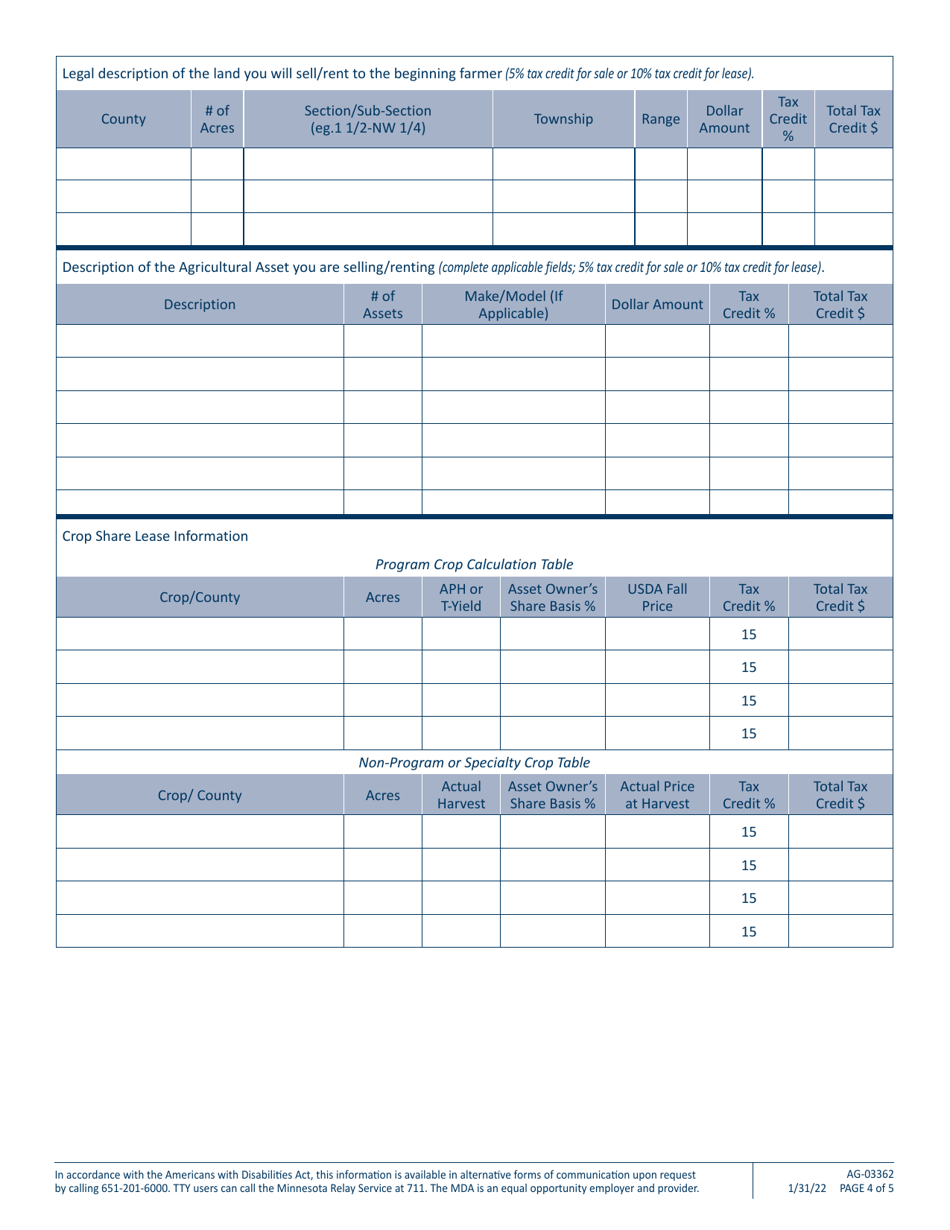

Q: What types of assets are eligible for the tax credit?

A: Eligible assets include agricultural land, livestock, and machinery.

Q: How can I submit the Form AG-03362?

A: The Form AG-03362 can be submitted electronically or by mail to the Minnesota Department of Revenue.

Q: Is there a deadline for submitting the Form AG-03362?

A: Yes, the Form AG-03362 must be submitted by December 1st of the calendar year following the year in which the transfer of assets occurred.

Form Details:

- Released on January 31, 2022;

- The latest edition provided by the Minnesota Department of Agriculture;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AG-03362 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Agriculture.