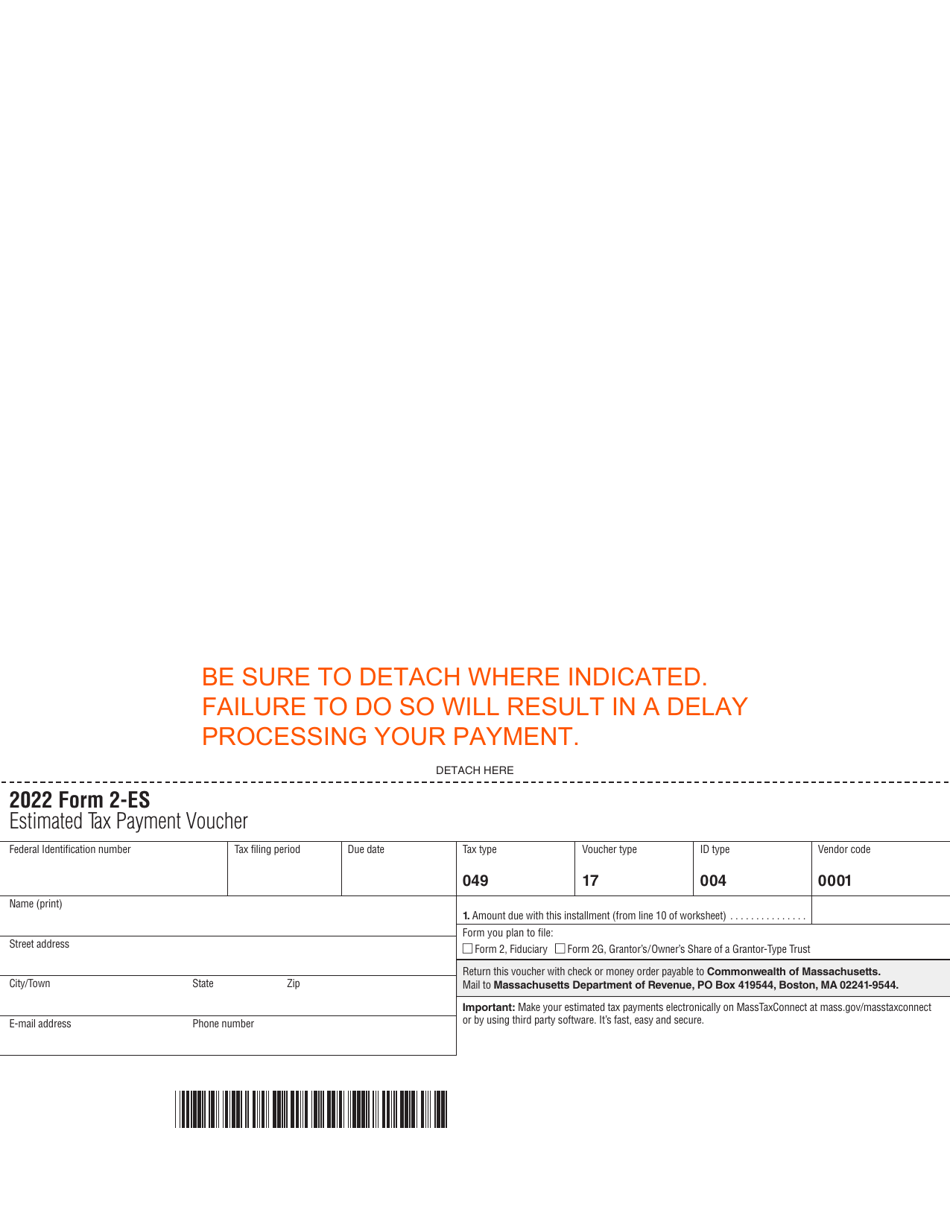

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 2-ES

for the current year.

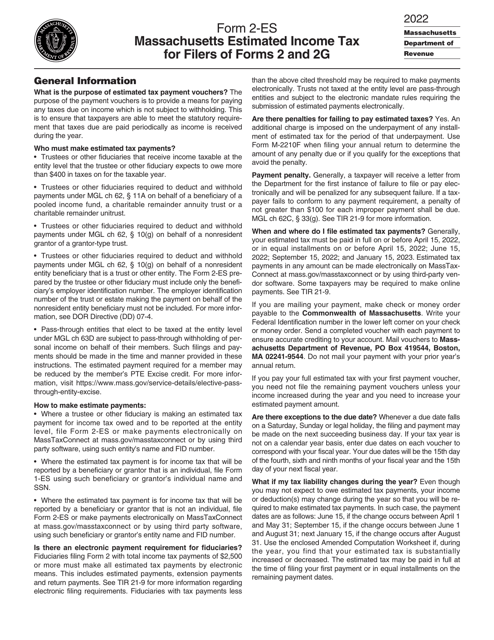

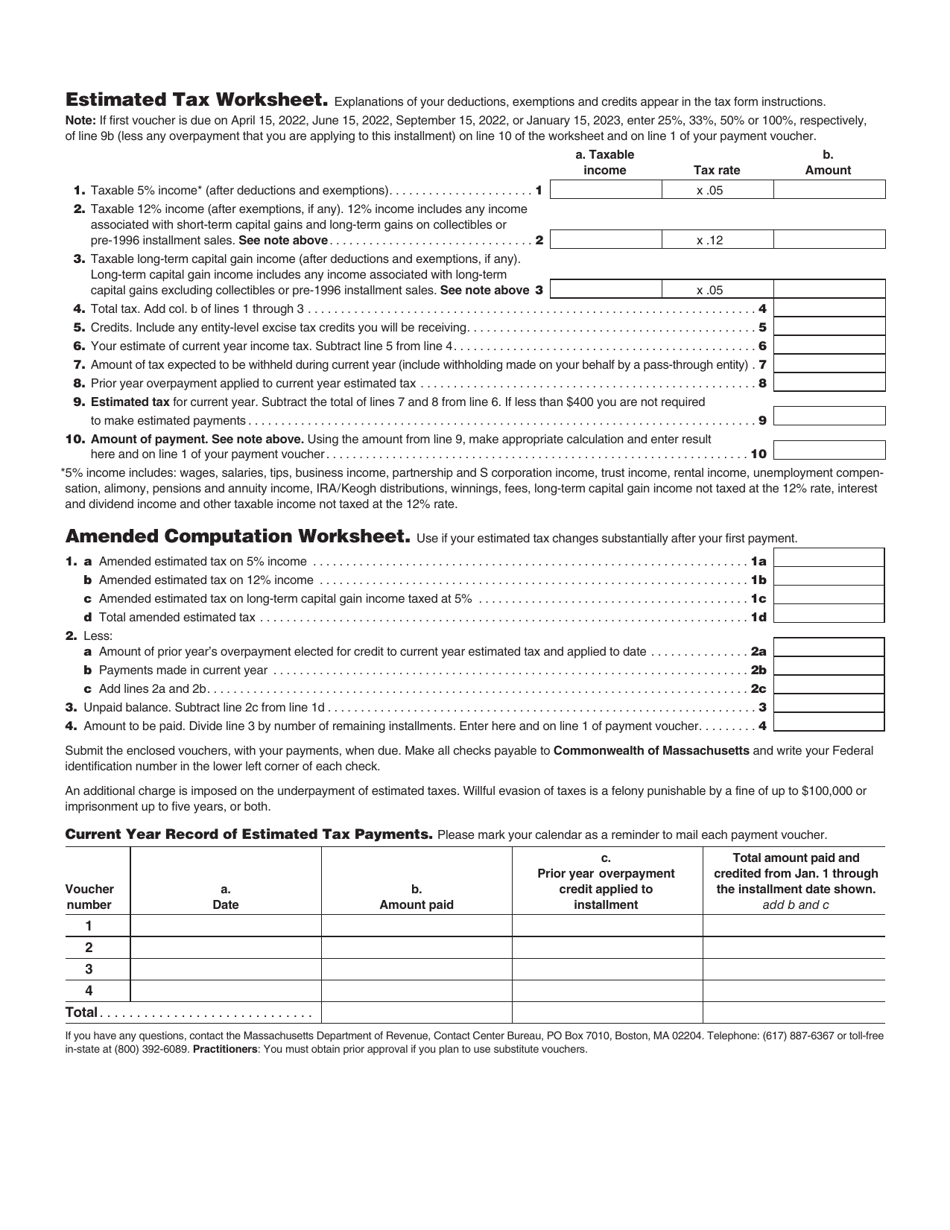

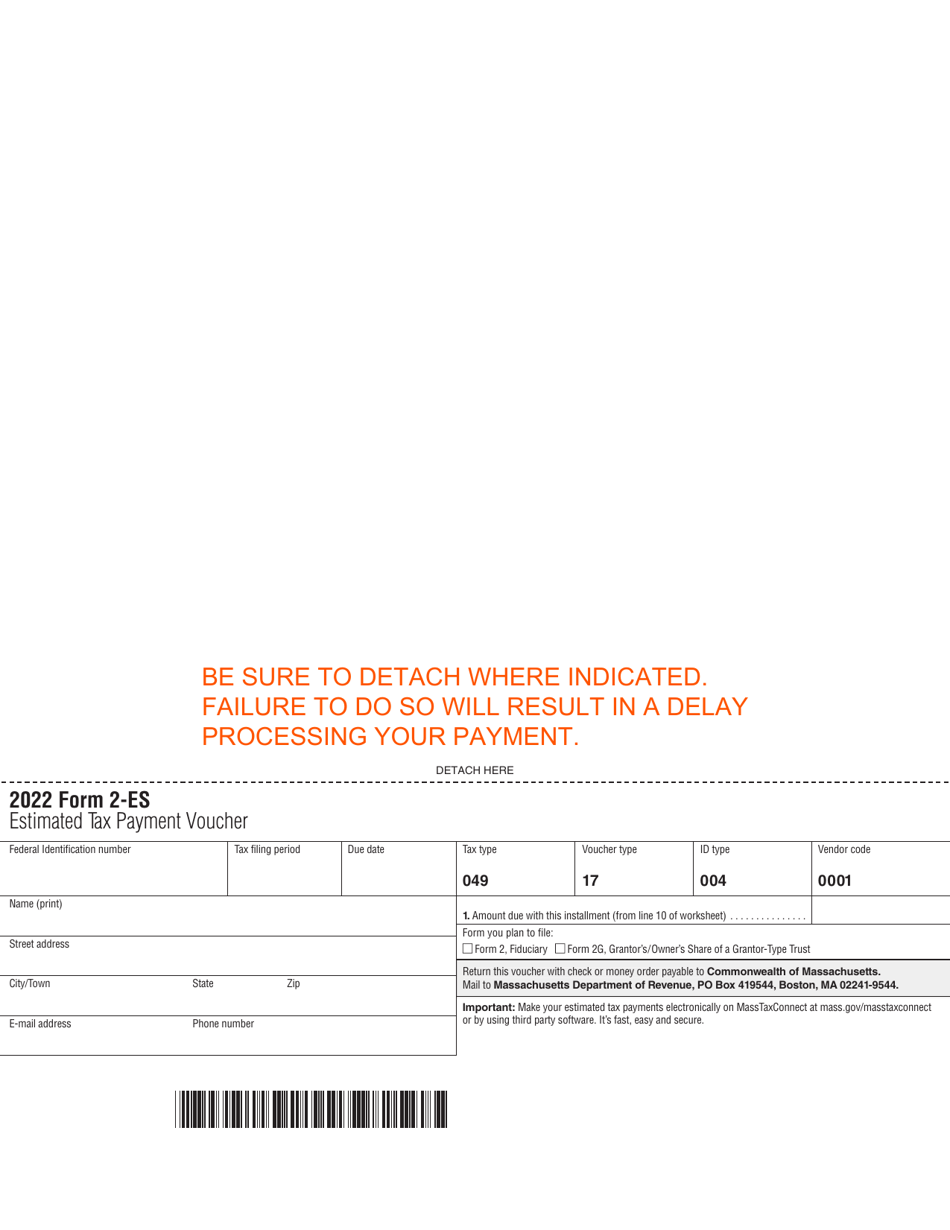

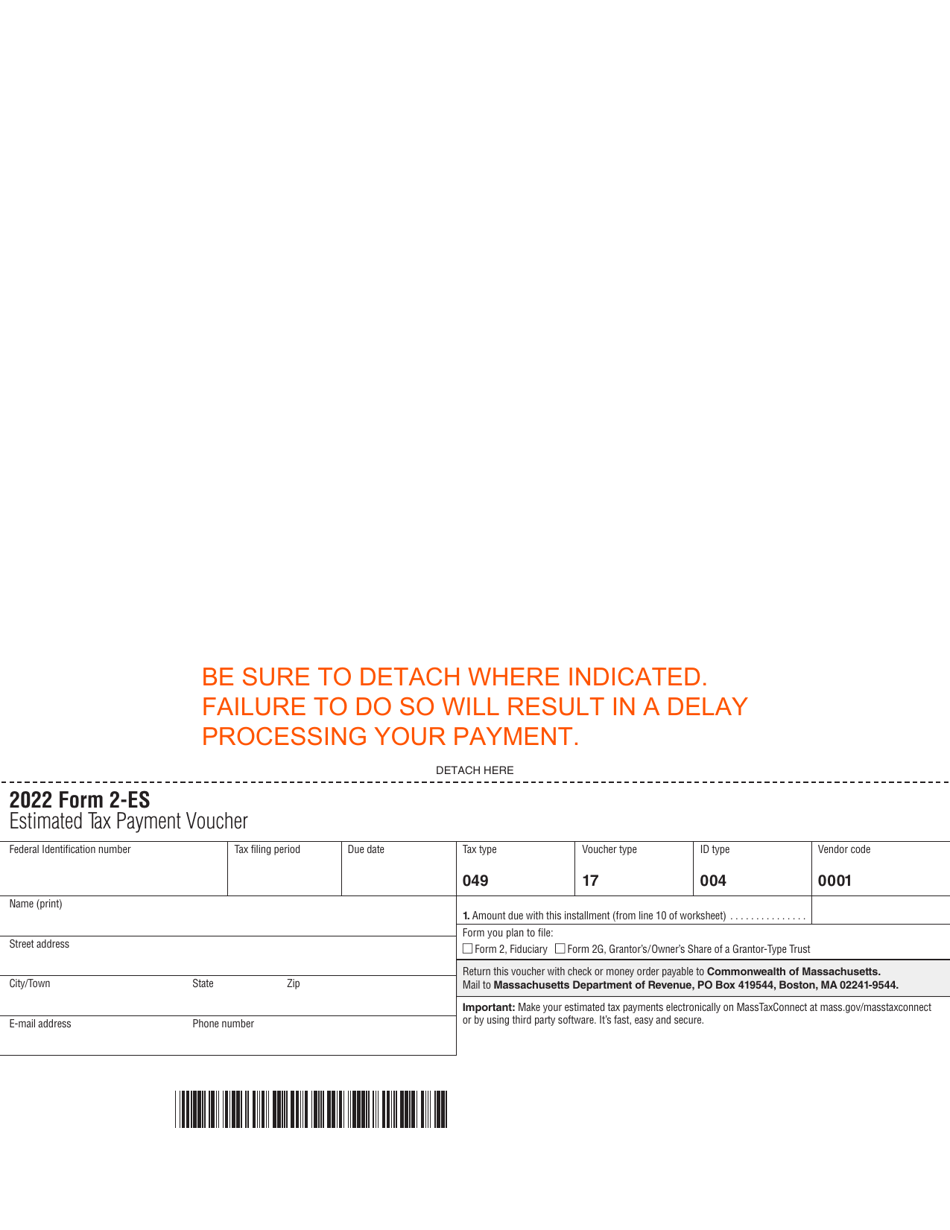

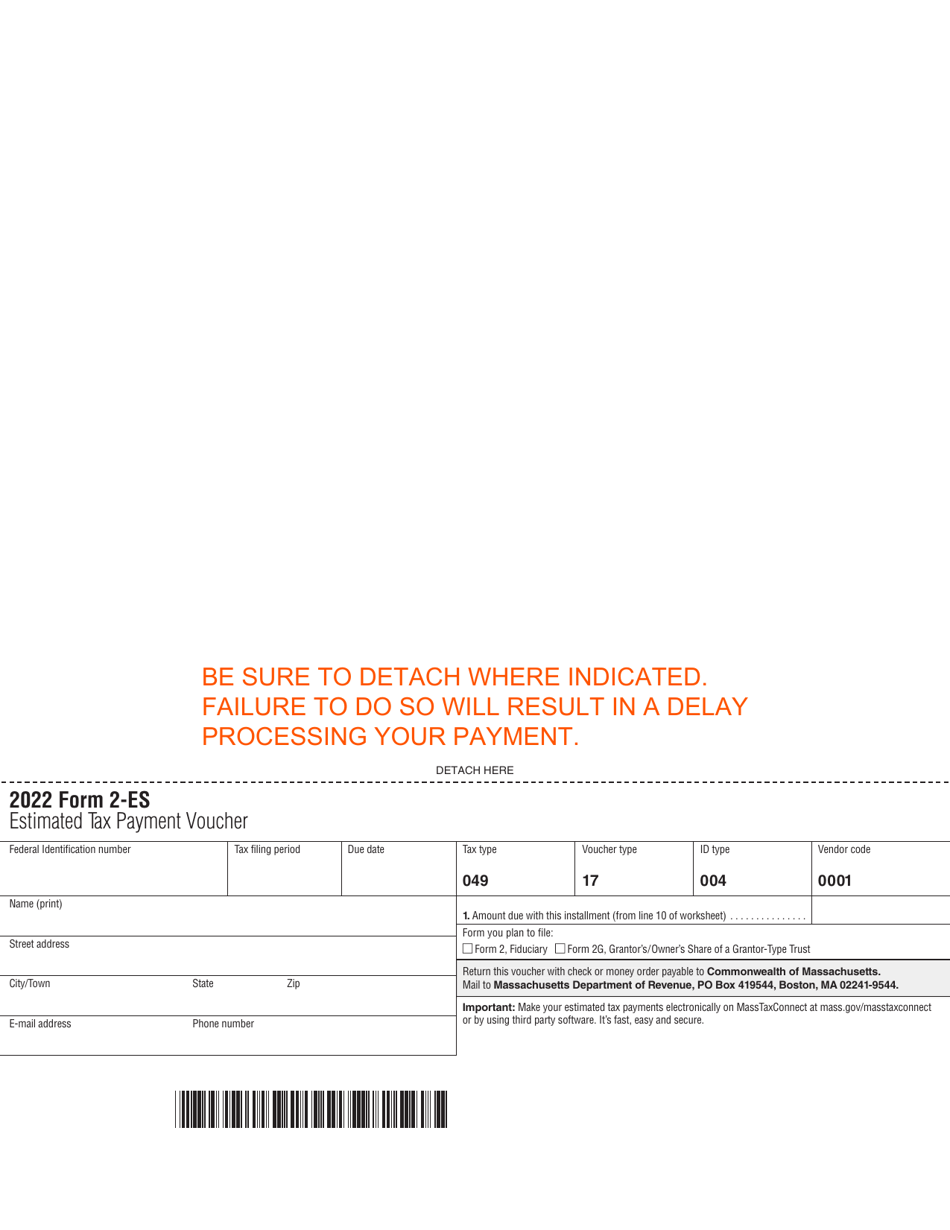

Form 2-ES Massachusetts Estimated Income Tax Payment Vouchers and Worksheet - Massachusetts

What Is Form 2-ES?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

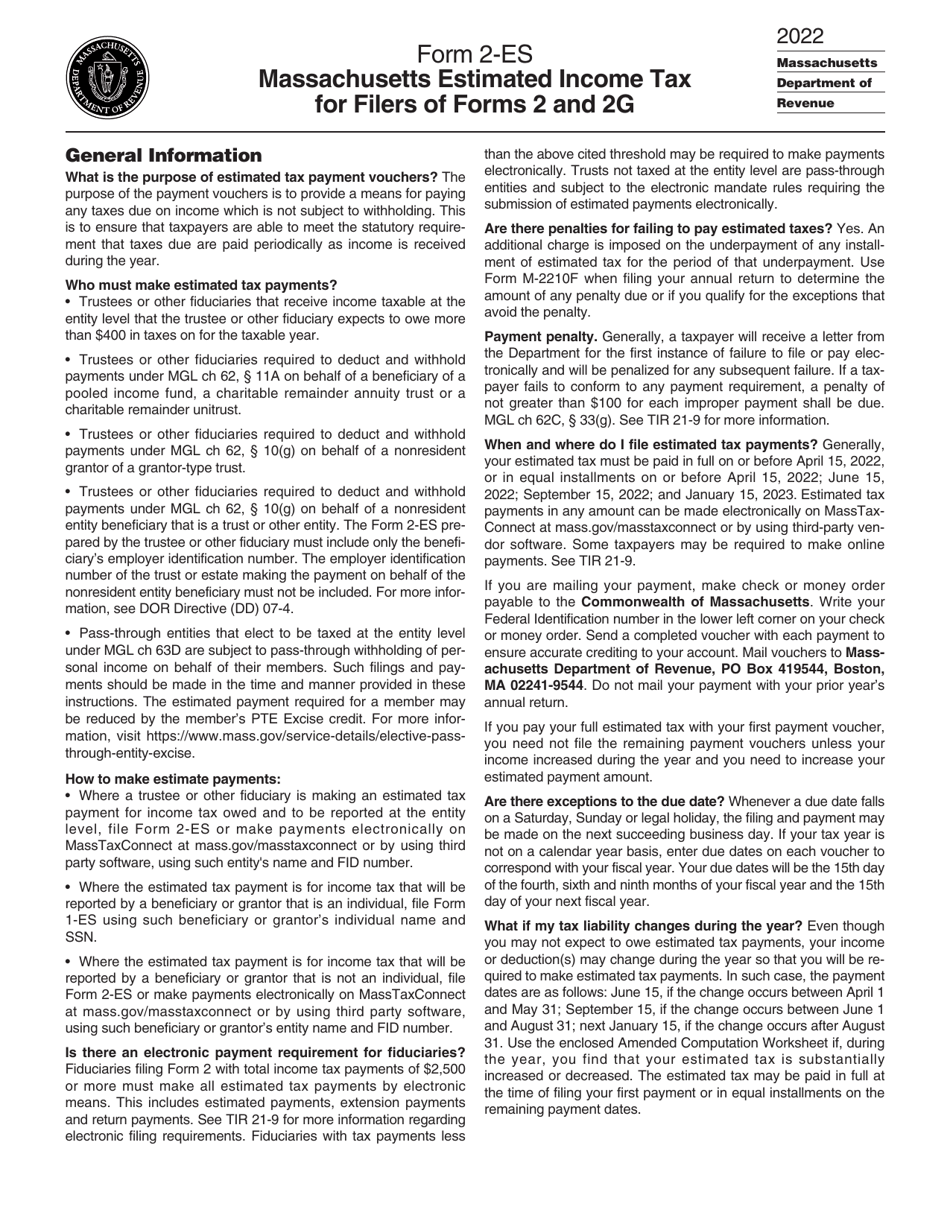

Q: What is Form 2-ES?

A: Form 2-ES is a Massachusetts Estimated Income Tax Payment Voucher and Worksheet.

Q: What is the purpose of Form 2-ES?

A: The purpose of Form 2-ES is to calculate and pay estimated income taxes in Massachusetts.

Q: Who should use Form 2-ES?

A: Form 2-ES should be used by individuals and businesses that need to make estimated income tax payments in Massachusetts.

Q: What information is required on Form 2-ES?

A: Form 2-ES requires information such as taxpayer's name, address, Social Security number or employer identification number, estimated tax due, and the payment period.

Q: How often should estimated income tax payments be made?

A: In Massachusetts, estimated income tax payments should be made quarterly.

Q: What happens if I don't make estimated income tax payments?

A: If you don't make estimated income tax payments, you may owe penalties and interest on the unpaid amount.

Q: Can I make estimated income tax payments electronically?

A: Yes, Massachusetts allows taxpayers to make estimated income tax payments electronically.

Q: Are estimated income tax payments refundable?

A: No, estimated income tax payments are not refundable. They are applied towards your total income tax liability when you file your annual tax return.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 2-ES by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.