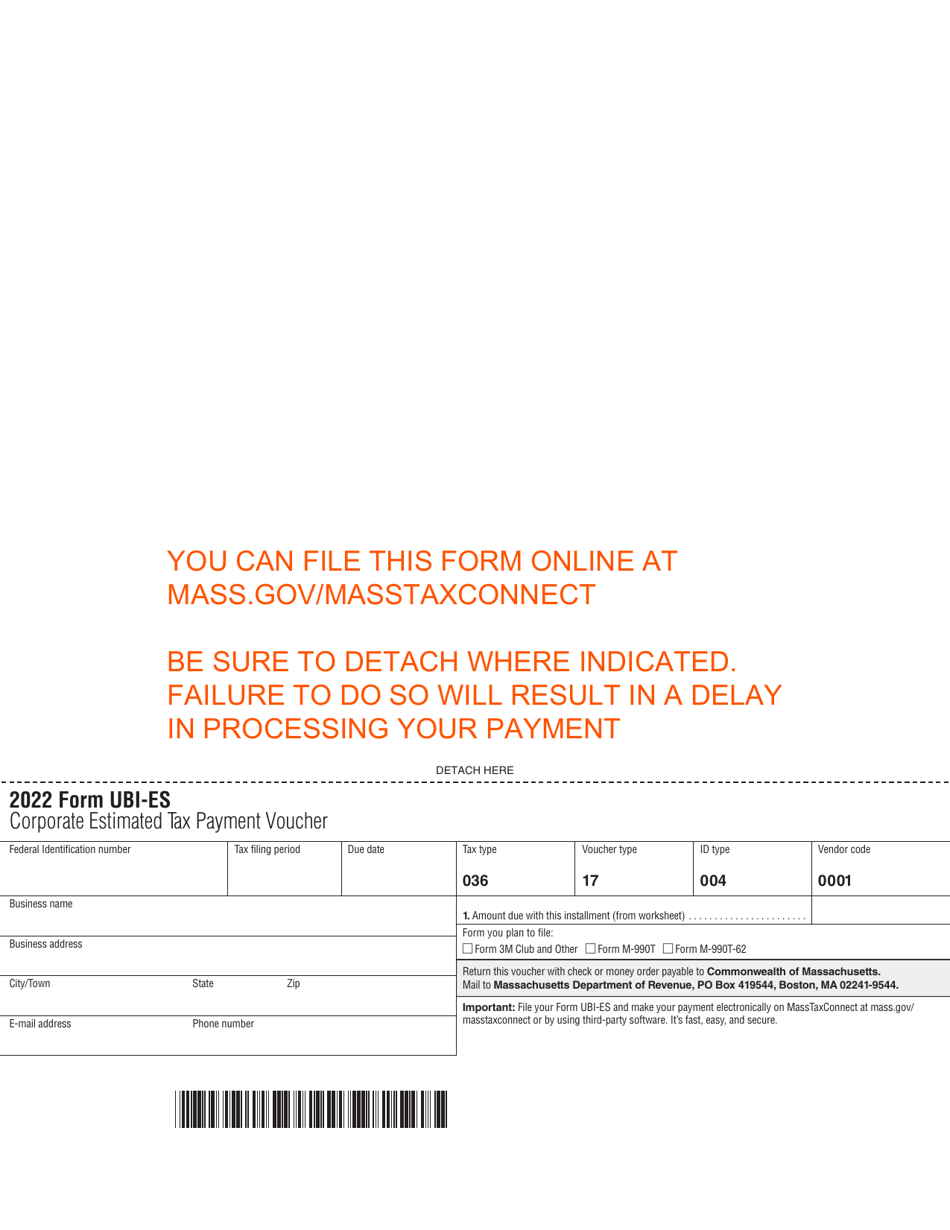

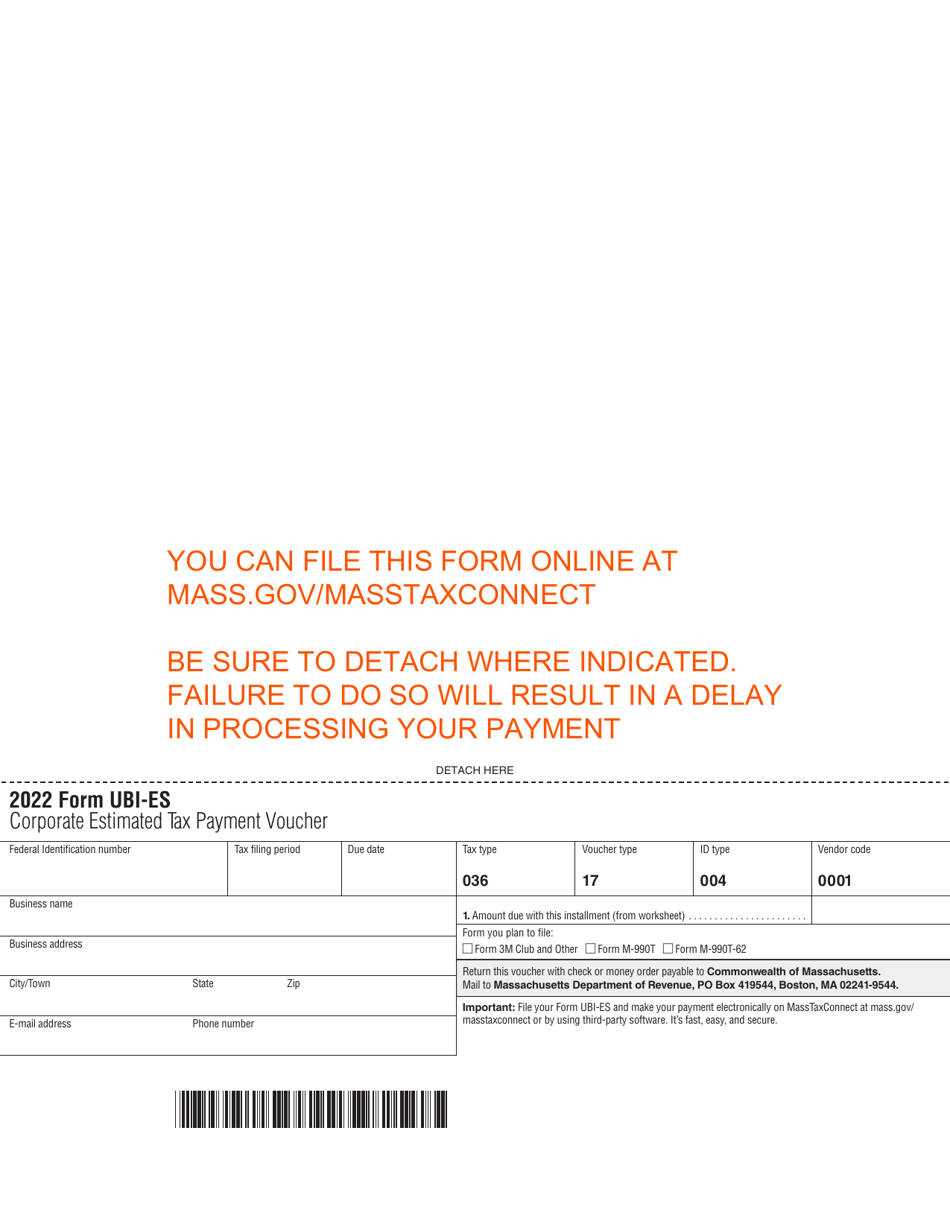

This version of the form is not currently in use and is provided for reference only. Download this version of

Form UBI-ES

for the current year.

Form UBI-ES Non-profit Entities Corporation Estimated Tax Payment Vouchers - Massachusetts

What Is Form UBI-ES?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is UBI-ES?

A: UBI-ES stands for Unrelated Business Income - Exempt Status.

Q: What are Non-profit Entities?

A: Non-profit entities are organizations that do not operate for the purpose of making a profit.

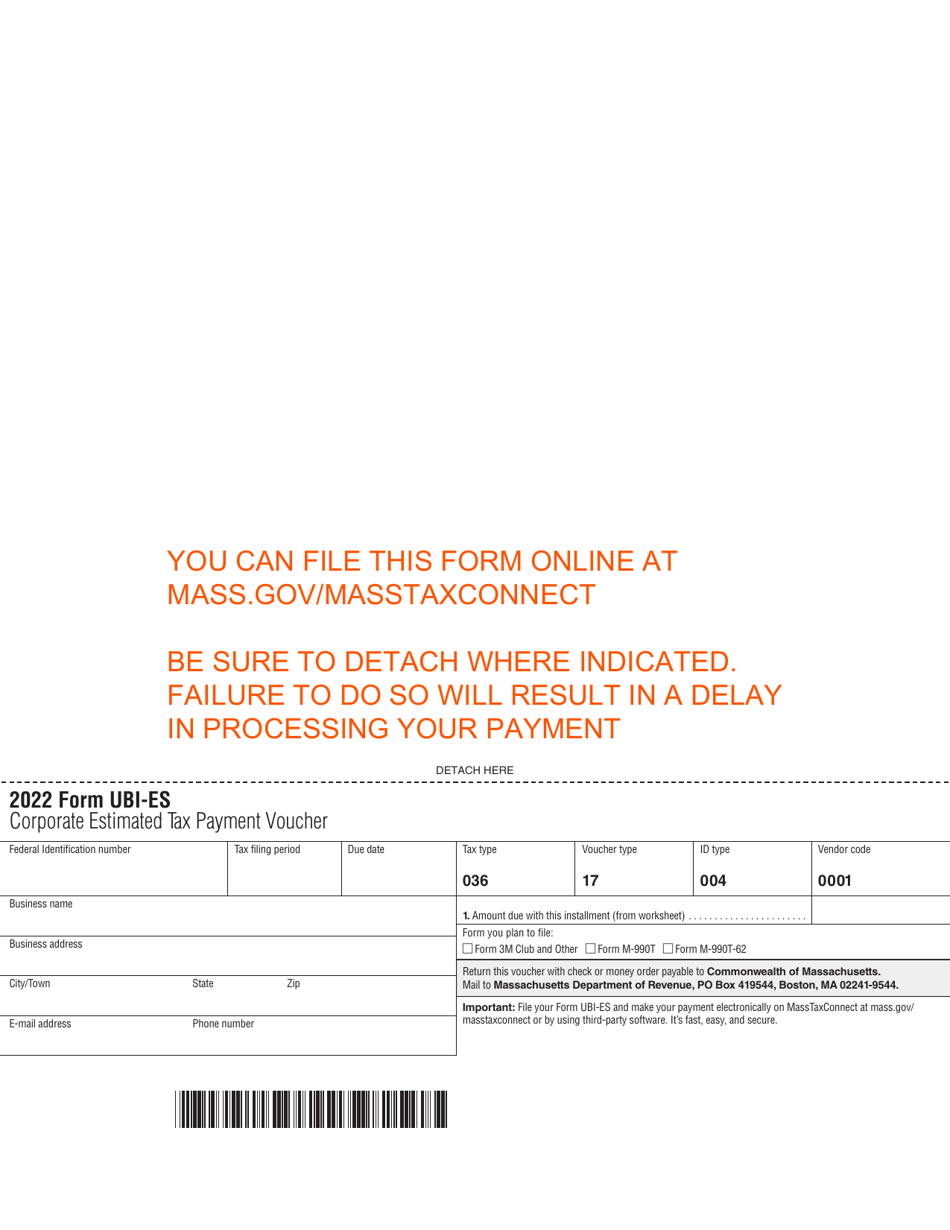

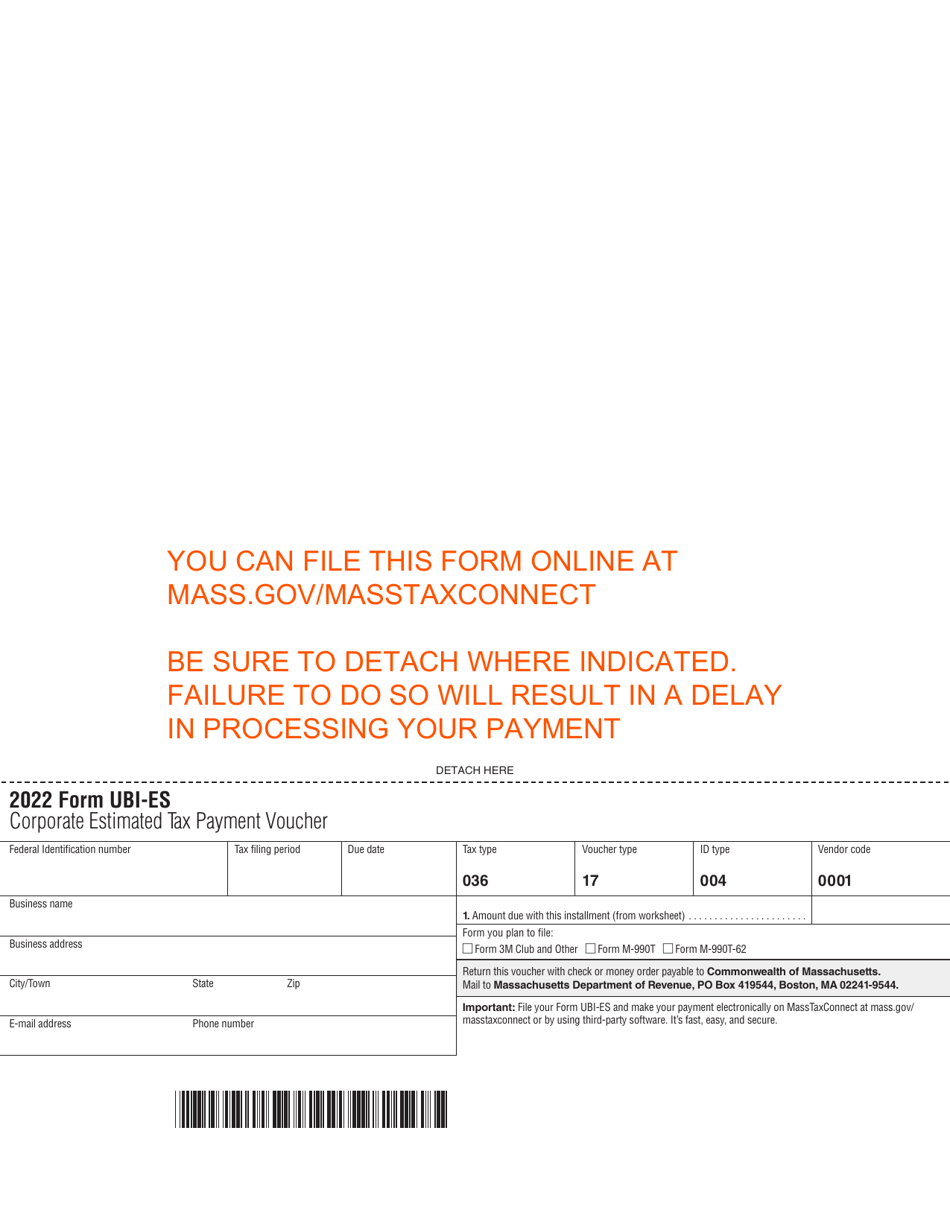

Q: What is a Corporation Estimated Tax Payment Voucher?

A: A Corporation Estimated Tax Payment Voucher is a form used to make estimated tax payments for corporations.

Q: Do non-profit entities need to make estimated tax payments?

A: Yes, non-profit entities may need to make estimated tax payments if they have unrelated business income.

Q: What is Massachusetts UBI-ES?

A: Massachusetts UBI-ES refers to the Unrelated Business Income Tax for non-profit entities in the state of Massachusetts.

Q: What is the purpose of the Estimated Tax Payment Vouchers?

A: The purpose of the Estimated Tax Payment Vouchers is to ensure that non-profit entities pay their estimated tax liability in a timely manner.

Q: How often do non-profit entities need to make estimated tax payments?

A: Non-profit entities generally need to make estimated tax payments on a quarterly basis.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form UBI-ES by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.