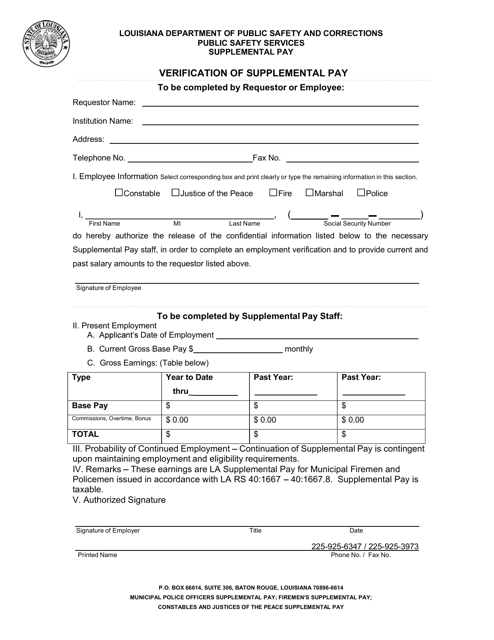

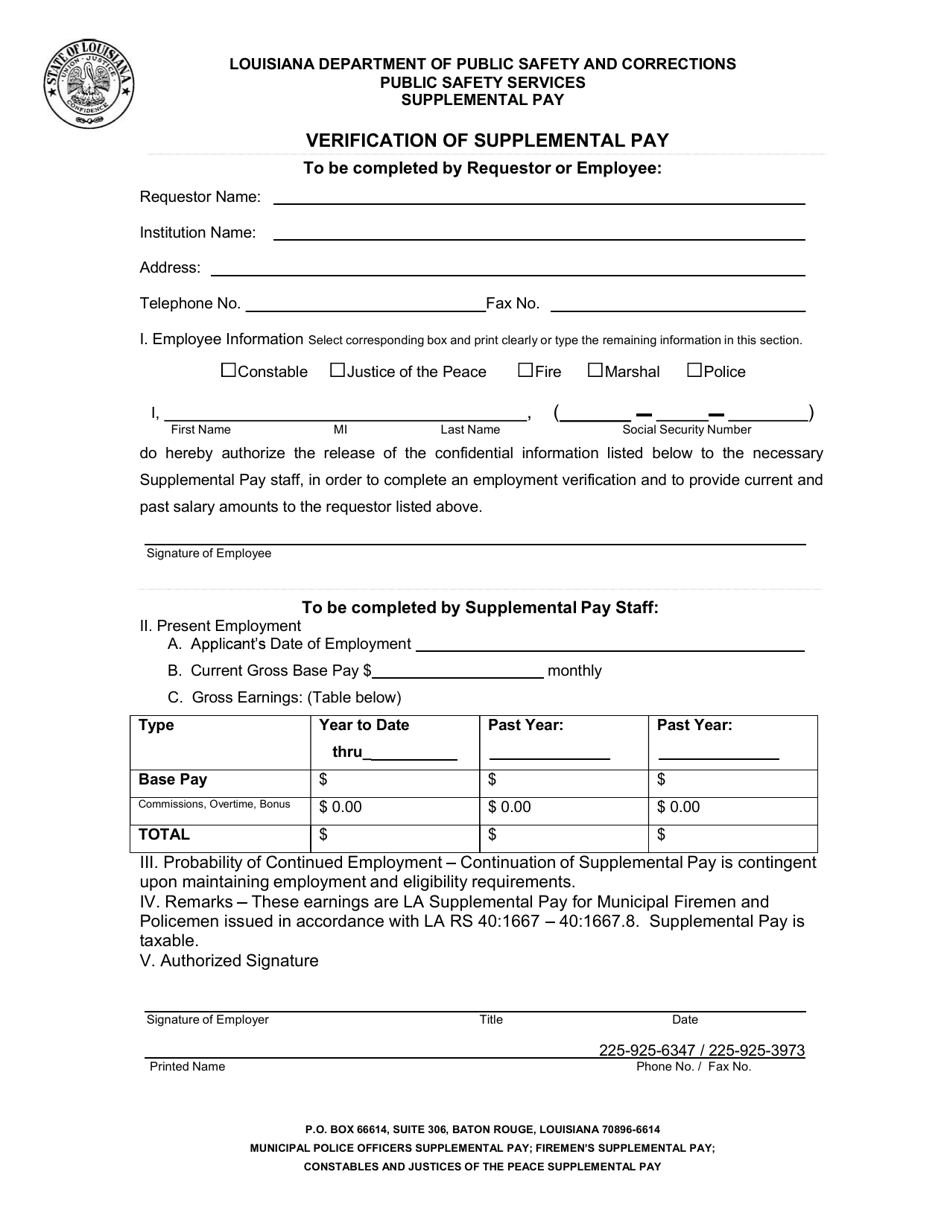

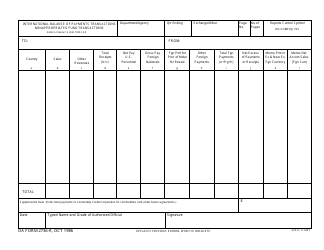

Verification of Supplemental Pay - Louisiana

Verification of Supplemental Pay is a legal document that was released by the Louisiana Department of Public Safety & Corrections - a government authority operating within Louisiana.

FAQ

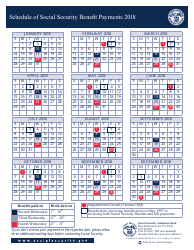

Q: What is supplemental pay?

A: Supplemental pay refers to extra compensation provided to employees in addition to their regular wages or salary.

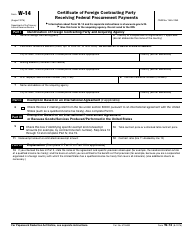

Q: Is supplemental pay taxable?

A: Yes, supplemental pay is generally taxable and subject to federal and state income taxes.

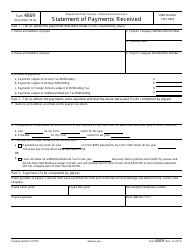

Q: What are examples of supplemental pay?

A: Examples of supplemental pay include bonuses, overtime pay, commissions, and severance pay.

Q: How is supplemental pay calculated?

A: The calculation of supplemental pay depends on the specific type of payment. It can be based on a percentage of salary, a flat amount, or determined through a formula.

Q: Are there any laws or regulations regarding supplemental pay in Louisiana?

A: Yes, Louisiana has its own laws and regulations regarding supplemental pay, including rules on overtime and commission pay.

Q: Are employers required to provide supplemental pay?

A: In general, employers are not required to provide supplemental pay. However, certain types of supplemental pay, such as overtime pay, may be required by law.

Q: Are there any limits on supplemental pay in Louisiana?

A: There are no specific limits on supplemental pay in Louisiana, but certain types of payments may be subject to federal and state laws, such as the Fair Labor Standards Act (FLSA).

Q: What should I do if I have a dispute regarding supplemental pay?

A: If you have a dispute regarding supplemental pay, you should consult with an employment attorney or contact the Louisiana Workforce Commission for guidance.

Form Details:

- The latest edition currently provided by the Louisiana Department of Public Safety & Corrections;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Louisiana Department of Public Safety & Corrections.