This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

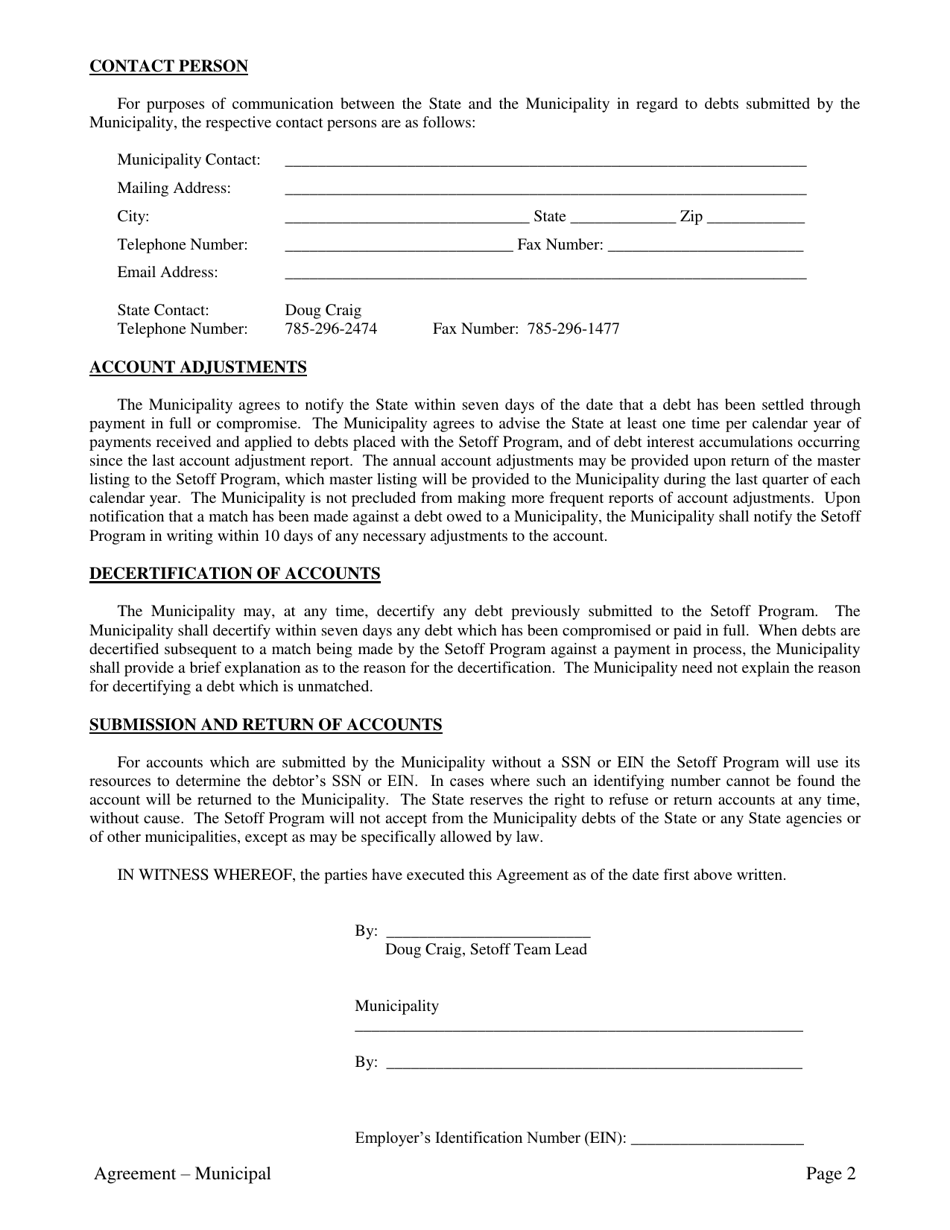

Agreement - Municipal - Accounts Receivable Setoff Program - Kansas

Agreement - Municipal - Accounts Receivable Setoff Program is a legal document that was released by the Kansas Department of Administration - a government authority operating within Kansas.

FAQ

Q: What is the Municipal Accounts Receivable Setoff Program in Kansas?

A: The Municipal Accounts Receivable Setoff Program in Kansas is an agreement that allows municipalities to collect outstanding debts by offsetting them against moneys owed to individuals or businesses by the state.

Q: How does the setoff program work?

A: The setoff program works by identifying individuals or businesses that owe money to a municipality and then deducting that amount from any money owed to them by the state, such as tax refunds or vendor payments.

Q: What types of debts can be collected through the program?

A: The program can be used to collect various types of debts, including unpaid utilities bills, court fines, and delinquent taxes.

Q: Who can participate in the Municipal Accounts Receivable Setoff Program?

A: Municipalities in Kansas can participate in the setoff program if they have outstanding debts owed to them and meet certain eligibility criteria.

Q: Are there any limitations on the amount of debt that can be collected through the program?

A: Yes, there are limitations on the amount of debt that can be collected. The maximum amount that can be offset in a single year is $3,000 per individual or business.

Form Details:

- Released on March 1, 2017;

- The latest edition currently provided by the Kansas Department of Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kansas Department of Administration.