This version of the form is not currently in use and is provided for reference only. Download this version of

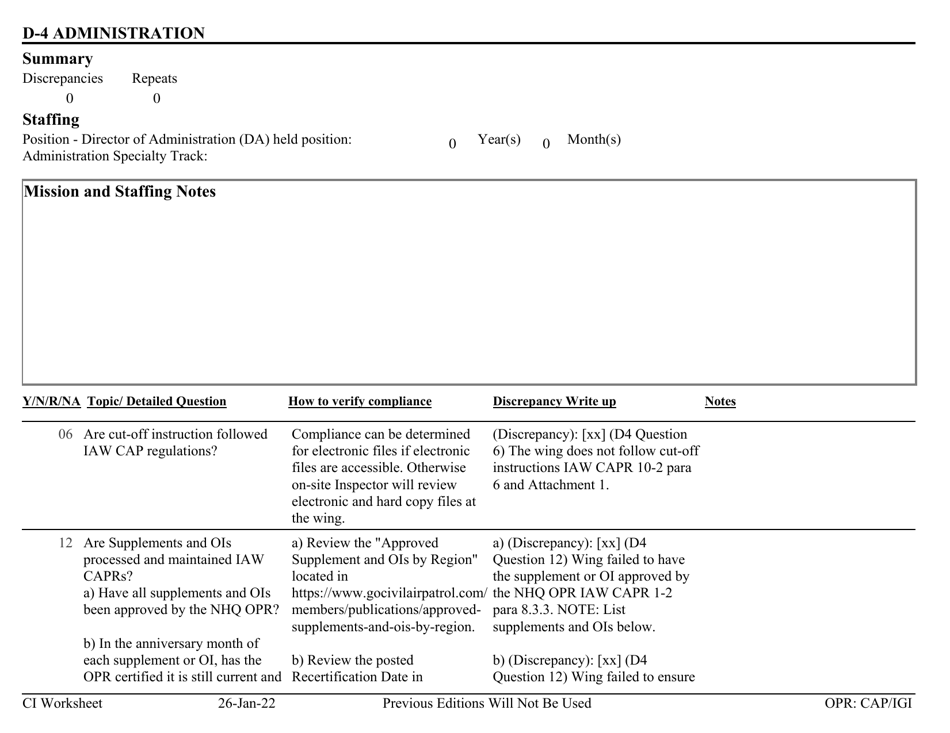

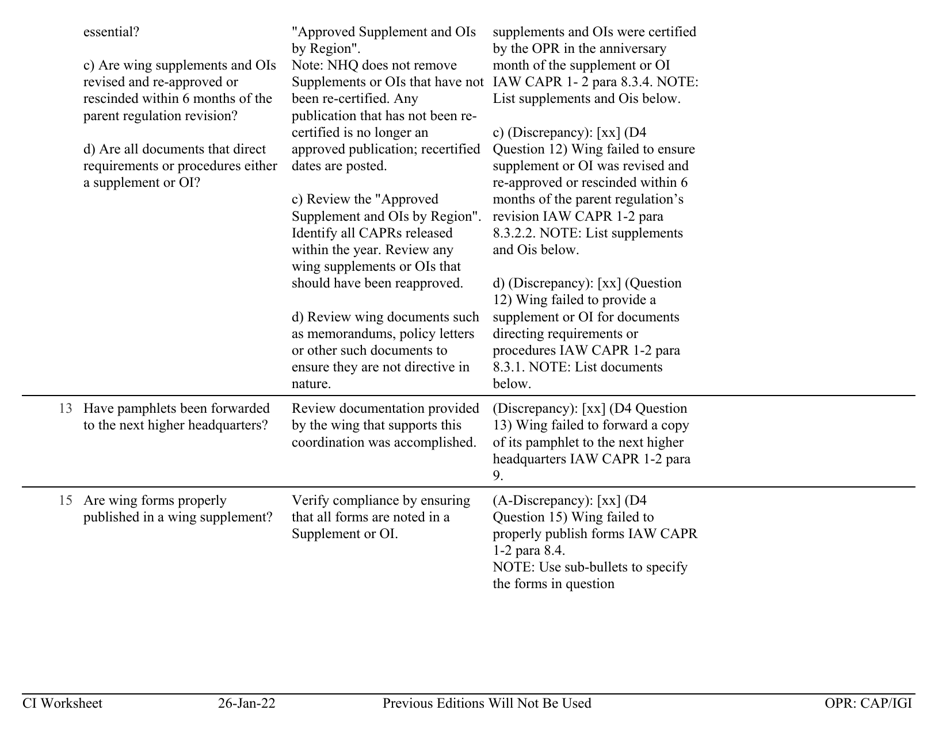

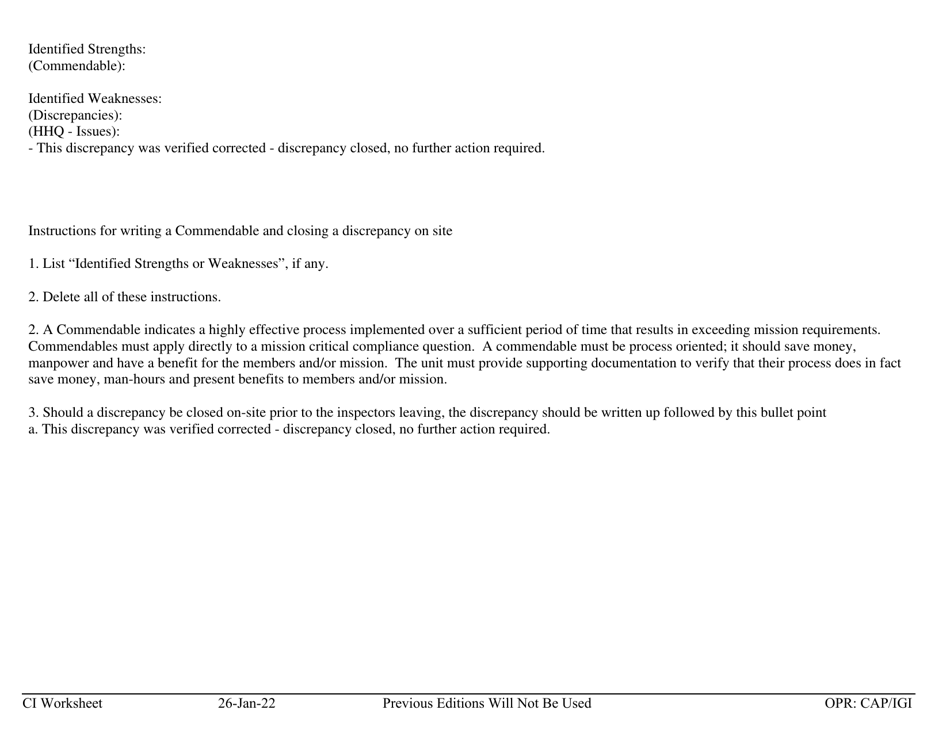

Form D-4

for the current year.

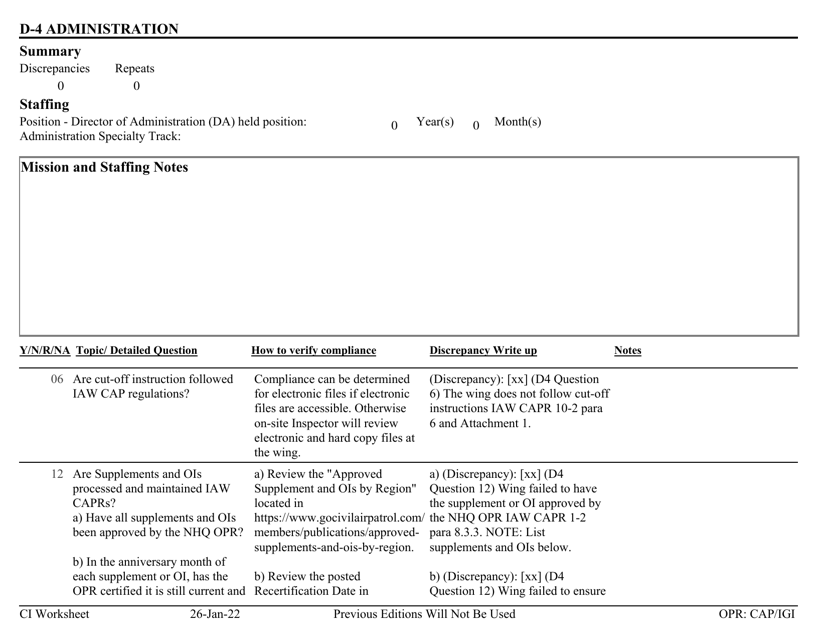

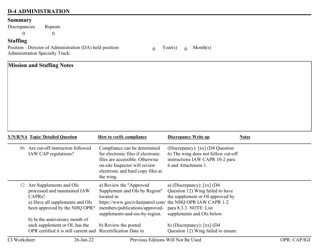

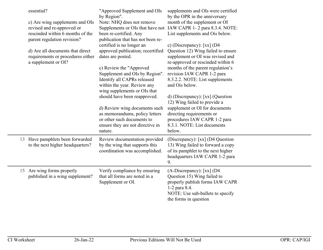

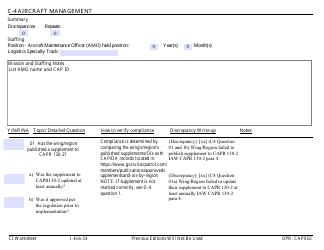

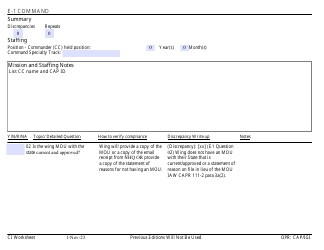

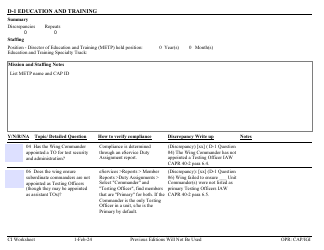

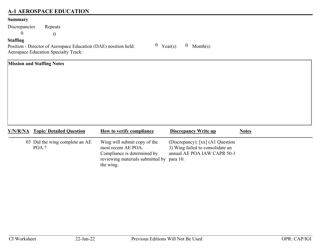

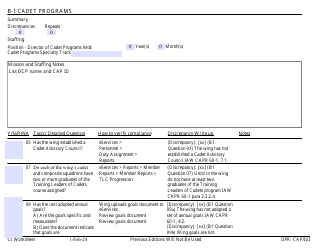

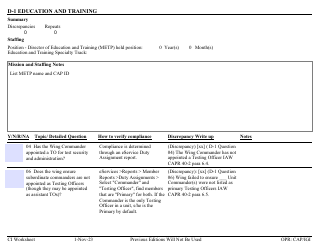

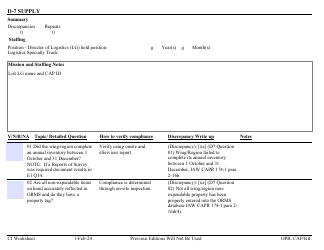

Form D-4 Ci Worksheet - Administration

What Is Form D-4?

This is a legal form that was released by the U.S. Air Force - Civil Air Patrol on January 26, 2022 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-4?

A: Form D-4 is a worksheet used for determining the amount of state income tax to be withheld from an employee's wages.

Q: What is a Ci Worksheet?

A: A Ci Worksheet is a specific type of worksheet used for calculating state income tax withholdings.

Q: What is the purpose of Form D-4 Ci Worksheet?

A: The purpose of Form D-4 Ci Worksheet is to help employers calculate the correct amount of state income tax to withhold from an employee's wages.

Q: Who needs to complete a Form D-4 Ci Worksheet?

A: Employers need to complete a Form D-4 Ci Worksheet for each employee in order to calculate the appropriate state income tax withholdings.

Form Details:

- Released on January 26, 2022;

- The latest available edition released by the U.S. Air Force - Civil Air Patrol;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-4 by clicking the link below or browse more documents and templates provided by the U.S. Air Force - Civil Air Patrol.